How to budget, save and invest in a stress-free manner?

Use the superpower of the pay-yourself-first method to spend, save and invest.

Use the superpower of the pay-yourself-first method to spend, save and invest.

Pay-yourself-first is one of the golden rules of personal finance that builds up a habit of saving and investing. This concept is similar to a loan where the lender deducts the EMI automatically every month. There are penalties for missing a payment. We can use the same technique for savings and goal-based investing.

The main benefit of paying-yourself-first is that the money is moved out of reach before discretionary expenses start. It is like a salary that you are paying to your future self.

Expenses = Income - Investments, i.e. money is spent only after money is saved and invested.

Based on how your income is structured, either regular from salary or irregular from your profession, business or freelancing, you should

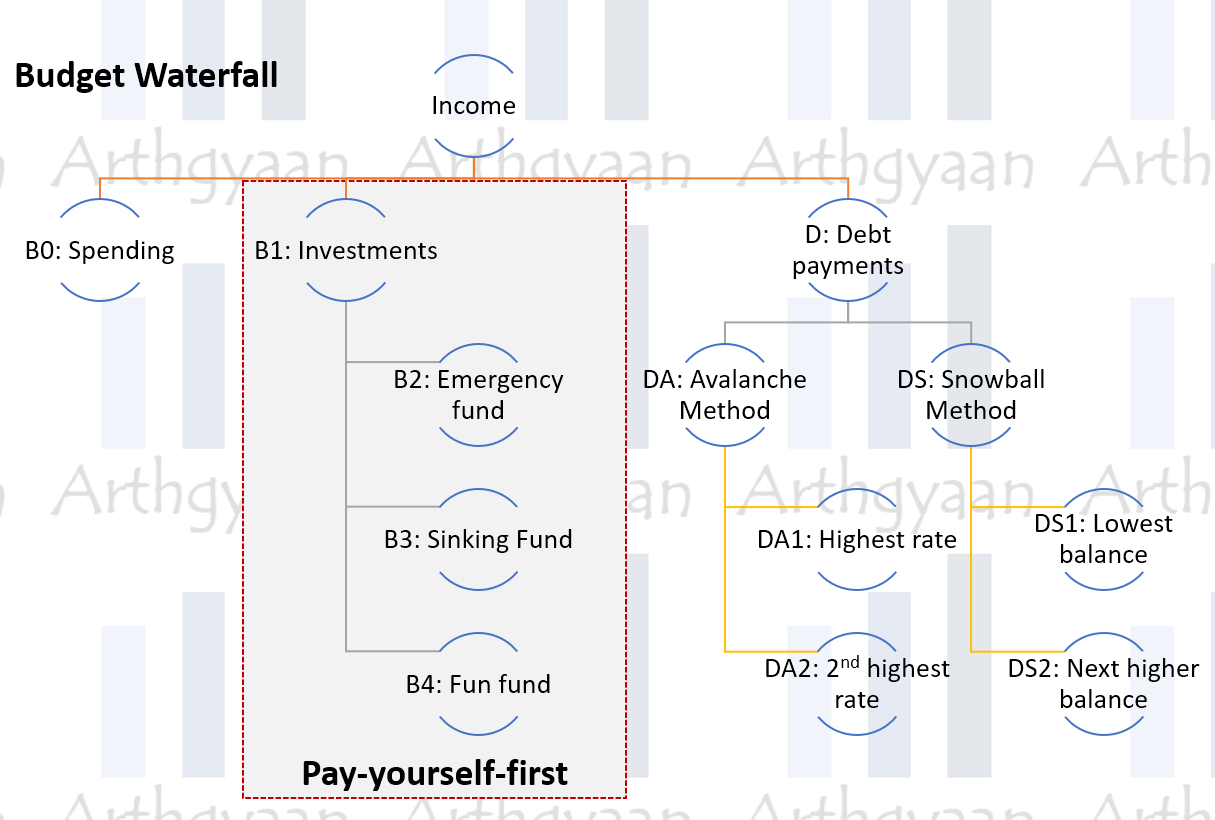

Use your income to fill expense buckets in this order:

For budgeting to be effective, you should track expenses via apps like Hello Expense, YNAB, or anything (even a spreadsheet or physical diary) that allows you to note down expenses as you make them. Use the Pareto principle (ensure that the biggest spends and recurring smaller spends are both captured). This way, it is not necessary to track every rupee spent. The target here is to be more or less accurate regarding your estimated and actual spending. For completeness’ sake, we will briefly touch upon debt payment. There are two methods for paying off multiple loans. Of the total amount of money being allocated for debt payments every month, call it D rupees per month:

Note of caution: Pay-yourself-first works only if you decide to aggressively implement the practice with a percentage contribution as high as possible, preferably via automated transfers. If you follow thumb rules that say “save %x of your income”, there will be two problems:

So instead of fully dependent on thumb rules, adjust the percentage figure of pay-yourself-first suitably for your financial condition. If you need an exact calculation, here are some posts that can help you:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to budget, save and invest in a stress-free manner? first appeared on 18 Jun 2021 at https://arthgyaan.com