What percentage of my salary should go towards retirement?

This post answers a common question asked by investors regarding investing for retirement.

This post answers a common question asked by investors regarding investing for retirement.

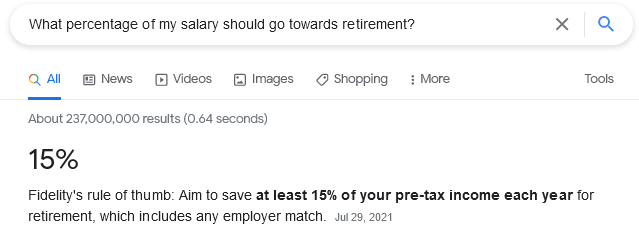

A common question for investors is the percentage of their monthly income they need to save for retirement. The in the US, a common thumb-rule is minimum 15% but that has a lot of assumptions that may not be applicable to Indian investors like retirement age, longevity, healthcare expenses and state pension.

If you have never used a goal-based investing calculator, which gives you the exact figure, this post will show you a quick way to calculate, starting with some simple assumptions. In the figure below, we have split the monthly post-tax income as:

We need to calculate three numbers:

How to read the tables:

You can use the table of contents below to jump to the age band you are interested in quickly.

The calculations in the tables below are not thumb rules. They are actual SIP figures for the current portfolio, expenses and income of the investor including an assumption of increasing the SIP amount every year. If you need a tailored result, please see

Assumptions for the model:

This table shows that a 30 year old who has not saved anything (row 1), needs to start saving 67% of their monthly salary for retirement to have the same lifestyle as they are having today.

| Retirement expenses > | 50 | 60 | 70 | 80 | 90 | 100 | 110 | 120 |

|---|---|---|---|---|---|---|---|---|

| 0x | 34 | 40 | 47 | 54 | 60 | 67 | 74 | 81 |

| 2x | 30 | 36 | 43 | 50 | 57 | 63 | 70 | 77 |

| 4x | 26 | 33 | 39 | 46 | 53 | 59 | 66 | 73 |

| 6x | 22 | 29 | 36 | 42 | 49 | 56 | 62 | 69 |

| 8x | 18 | 25 | 32 | 38 | 45 | 52 | 59 | 65 |

| 10x | 14 | 21 | 28 | 35 | 41 | 48 | 55 | 61 |

| 12x | 11 | 17 | 24 | 31 | 37 | 44 | 51 | 58 |

| 14x | 7 | 14 | 20 | 27 | 34 | 40 | 47 | 54 |

| 16x | 3 | 10 | 16 | 23 | 30 | 37 | 43 | 50 |

| 18x | 0 | 6 | 13 | 19 | 26 | 33 | 39 | 46 |

| 20x | 0 | 2 | 9 | 15 | 22 | 29 | 36 | 42 |

| 22x | 0 | 0 | 5 | 12 | 18 | 25 | 32 | 39 |

| 24x | 0 | 0 | 1 | 8 | 15 | 21 | 28 | 35 |

| 26x | 0 | 0 | 0 | 4 | 11 | 17 | 24 | 31 |

| 28x | 0 | 0 | 0 | 0 | 7 | 14 | 20 | 27 |

| 30x | 0 | 0 | 0 | 0 | 3 | 10 | 17 | 23 |

| 32x | 0 | 0 | 0 | 0 | 0 | 6 | 13 | 19 |

| 34x | 0 | 0 | 0 | 0 | 0 | 2 | 9 | 16 |

| 36x | 0 | 0 | 0 | 0 | 0 | 0 | 5 | 12 |

| 38x | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 8 |

| 40x | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4 |

This table shows that a 35 year old who has saved 10x their current yearly expenses (row 6) for retirement, needs to save 56% of their monthly salary for retirement to have the same lifestyle as they are having today.

| Retirement expenses > | 50 | 60 | 70 | 80 | 90 | 100 | 110 | 120 |

|---|---|---|---|---|---|---|---|---|

| 0x | 38 | 46 | 53 | 61 | 69 | 76 | 84 | 91 |

| 2x | 34 | 42 | 49 | 57 | 65 | 72 | 80 | 87 |

| 4x | 30 | 38 | 45 | 53 | 60 | 68 | 76 | 83 |

| 6x | 26 | 33 | 41 | 49 | 56 | 64 | 72 | 79 |

| 8x | 22 | 29 | 37 | 45 | 52 | 60 | 67 | 75 |

| 10x | 18 | 25 | 33 | 41 | 48 | 56 | 63 | 71 |

| 12x | 14 | 21 | 29 | 36 | 44 | 52 | 59 | 67 |

| 14x | 9 | 17 | 25 | 32 | 40 | 48 | 55 | 63 |

| 16x | 5 | 13 | 21 | 28 | 36 | 44 | 51 | 59 |

| 18x | 1 | 9 | 17 | 24 | 32 | 39 | 47 | 55 |

| 20x | 0 | 5 | 12 | 20 | 28 | 35 | 43 | 51 |

| 22x | 0 | 1 | 8 | 16 | 24 | 31 | 39 | 46 |

| 24x | 0 | 0 | 4 | 12 | 20 | 27 | 35 | 42 |

| 26x | 0 | 0 | 0 | 8 | 15 | 23 | 31 | 38 |

| 28x | 0 | 0 | 0 | 4 | 11 | 19 | 27 | 34 |

| 30x | 0 | 0 | 0 | 0 | 7 | 15 | 22 | 30 |

| 32x | 0 | 0 | 0 | 0 | 3 | 11 | 18 | 26 |

| 34x | 0 | 0 | 0 | 0 | 0 | 7 | 14 | 22 |

| 36x | 0 | 0 | 0 | 0 | 0 | 3 | 10 | 18 |

| 38x | 0 | 0 | 0 | 0 | 0 | 0 | 6 | 14 |

| 40x | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 10 |

This table shows that a 40 year old who has saved 20x their current yearly expenses (row 11) for retirement, needs to save 44% of their monthly salary for retirement to have the same lifestyle as they are having today.

| Retirement expenses > | 50 | 60 | 70 | 80 | 90 | 100 | 110 | 120 |

|---|---|---|---|---|---|---|---|---|

| 0x | 44 | 53 | 62 | 70 | 79 | 88 | 97 | 106 |

| 2x | 40 | 48 | 57 | 66 | 75 | 84 | 92 | 101 |

| 4x | 35 | 44 | 53 | 62 | 70 | 79 | 88 | 97 |

| 6x | 31 | 39 | 48 | 57 | 66 | 75 | 83 | 92 |

| 8x | 26 | 35 | 44 | 53 | 61 | 70 | 79 | 88 |

| 10x | 22 | 31 | 39 | 48 | 57 | 66 | 75 | 83 |

| 12x | 17 | 26 | 35 | 44 | 53 | 61 | 70 | 79 |

| 14x | 13 | 22 | 30 | 39 | 48 | 57 | 66 | 75 |

| 16x | 8 | 17 | 26 | 35 | 44 | 52 | 61 | 70 |

| 18x | 4 | 13 | 22 | 30 | 39 | 48 | 57 | 66 |

| 20x | 0 | 8 | 17 | 26 | 35 | 44 | 52 | 61 |

| 22x | 0 | 4 | 13 | 22 | 30 | 39 | 48 | 57 |

| 24x | 0 | 0 | 8 | 17 | 26 | 35 | 43 | 52 |

| 26x | 0 | 0 | 4 | 13 | 21 | 30 | 39 | 48 |

| 28x | 0 | 0 | 0 | 8 | 17 | 26 | 35 | 43 |

| 30x | 0 | 0 | 0 | 4 | 13 | 21 | 30 | 39 |

| 32x | 0 | 0 | 0 | 0 | 8 | 17 | 26 | 34 |

| 34x | 0 | 0 | 0 | 0 | 4 | 12 | 21 | 30 |

| 36x | 0 | 0 | 0 | 0 | 0 | 8 | 17 | 26 |

| 38x | 0 | 0 | 0 | 0 | 0 | 4 | 12 | 21 |

| 40x | 0 | 0 | 0 | 0 | 0 | 0 | 8 | 17 |

This table shows that a 45 year old who has saved 24x their current yearly expenses (row 13) for retirement, needs to save 45% of their monthly salary for retirement to have the same lifestyle as they are having today.

| Retirement expenses > | 50 | 60 | 70 | 80 | 90 | 100 | 110 | 120 |

|---|---|---|---|---|---|---|---|---|

| 0x | 52 | 63 | 73 | 83 | 94 | 104 | 115 | 125 |

| 2x | 47 | 58 | 68 | 78 | 89 | 99 | 110 | 120 |

| 4x | 42 | 53 | 63 | 74 | 84 | 94 | 105 | 115 |

| 6x | 37 | 48 | 58 | 69 | 79 | 89 | 100 | 110 |

| 8x | 32 | 43 | 53 | 64 | 74 | 84 | 95 | 105 |

| 10x | 27 | 38 | 48 | 59 | 69 | 80 | 90 | 100 |

| 12x | 22 | 33 | 43 | 54 | 64 | 75 | 85 | 95 |

| 14x | 17 | 28 | 38 | 49 | 59 | 70 | 80 | 90 |

| 16x | 13 | 23 | 33 | 44 | 54 | 65 | 75 | 86 |

| 18x | 8 | 18 | 28 | 39 | 49 | 60 | 70 | 81 |

| 20x | 3 | 13 | 23 | 34 | 44 | 55 | 65 | 76 |

| 22x | 0 | 8 | 19 | 29 | 39 | 50 | 60 | 71 |

| 24x | 0 | 3 | 14 | 24 | 34 | 45 | 55 | 66 |

| 26x | 0 | 0 | 9 | 19 | 29 | 40 | 50 | 61 |

| 28x | 0 | 0 | 4 | 14 | 25 | 35 | 45 | 56 |

| 30x | 0 | 0 | 0 | 9 | 20 | 30 | 40 | 51 |

| 32x | 0 | 0 | 0 | 4 | 15 | 25 | 35 | 46 |

| 34x | 0 | 0 | 0 | 0 | 10 | 20 | 31 | 41 |

| 36x | 0 | 0 | 0 | 0 | 5 | 15 | 26 | 36 |

| 38x | 0 | 0 | 0 | 0 | 0 | 10 | 21 | 31 |

| 40x | 0 | 0 | 0 | 0 | 0 | 5 | 16 | 26 |

This table shows that a 50 year old who has saved 30x their current yearly expenses (row 16) for retirement, needs to save 42% of their monthly salary for retirement to have the same lifestyle as they are having today.

| Retirement expenses > | 50 | 60 | 70 | 80 | 90 | 100 | 110 | 120 |

|---|---|---|---|---|---|---|---|---|

| 0x | 65 | 77 | 90 | 103 | 116 | 129 | 142 | 155 |

| 2x | 59 | 72 | 85 | 98 | 110 | 123 | 136 | 149 |

| 4x | 53 | 66 | 79 | 92 | 105 | 118 | 130 | 143 |

| 6x | 47 | 60 | 73 | 86 | 99 | 112 | 125 | 138 |

| 8x | 41 | 54 | 67 | 80 | 93 | 106 | 119 | 132 |

| 10x | 36 | 48 | 61 | 74 | 87 | 100 | 113 | 126 |

| 12x | 30 | 43 | 56 | 69 | 81 | 94 | 107 | 120 |

| 14x | 24 | 37 | 50 | 63 | 76 | 89 | 101 | 114 |

| 16x | 18 | 31 | 44 | 57 | 70 | 83 | 96 | 109 |

| 18x | 12 | 25 | 38 | 51 | 64 | 77 | 90 | 103 |

| 20x | 7 | 19 | 32 | 45 | 58 | 71 | 84 | 97 |

| 22x | 1 | 14 | 27 | 40 | 52 | 65 | 78 | 91 |

| 24x | 0 | 8 | 21 | 34 | 47 | 60 | 72 | 85 |

| 26x | 0 | 2 | 15 | 28 | 41 | 54 | 67 | 80 |

| 28x | 0 | 0 | 9 | 22 | 35 | 48 | 61 | 74 |

| 30x | 0 | 0 | 3 | 16 | 29 | 42 | 55 | 68 |

| 32x | 0 | 0 | 0 | 10 | 23 | 36 | 49 | 62 |

| 34x | 0 | 0 | 0 | 5 | 18 | 31 | 43 | 56 |

| 36x | 0 | 0 | 0 | 0 | 12 | 25 | 38 | 51 |

| 38x | 0 | 0 | 0 | 0 | 6 | 19 | 32 | 45 |

| 40x | 0 | 0 | 0 | 0 | 0 | 13 | 26 | 39 |

This table shows that a 55 year old who has saved 40x their current yearly expenses (row 16) for retirement, needs to save 22% of their monthly salary for retirement to have the same lifestyle as they are having today.

Note: The saved corpus starts at 10x of current expenses.

| Retirement expenses > | 50 | 60 | 70 | 80 | 90 | 100 | 110 | 120 |

|---|---|---|---|---|---|---|---|---|

| 10x | 51 | 69 | 88 | 106 | 124 | 143 | 161 | 179 |

| 12x | 43 | 61 | 80 | 98 | 116 | 135 | 153 | 171 |

| 14x | 35 | 53 | 72 | 90 | 108 | 127 | 145 | 163 |

| 16x | 27 | 45 | 64 | 82 | 100 | 118 | 137 | 155 |

| 18x | 19 | 37 | 56 | 74 | 92 | 110 | 129 | 147 |

| 20x | 11 | 29 | 47 | 66 | 84 | 102 | 121 | 139 |

| 22x | 3 | 21 | 39 | 58 | 76 | 94 | 113 | 131 |

| 24x | 0 | 13 | 31 | 50 | 68 | 86 | 105 | 123 |

| 26x | 0 | 5 | 23 | 42 | 60 | 78 | 96 | 115 |

| 28x | 0 | 0 | 15 | 34 | 52 | 70 | 88 | 107 |

| 30x | 0 | 0 | 7 | 25 | 44 | 62 | 80 | 99 |

| 32x | 0 | 0 | 0 | 17 | 36 | 54 | 72 | 91 |

| 34x | 0 | 0 | 0 | 9 | 28 | 46 | 64 | 83 |

| 36x | 0 | 0 | 0 | 1 | 20 | 38 | 56 | 74 |

| 38x | 0 | 0 | 0 | 0 | 12 | 30 | 48 | 66 |

| 40x | 0 | 0 | 0 | 0 | 3 | 22 | 40 | 58 |

| 42x | 0 | 0 | 0 | 0 | 0 | 14 | 32 | 50 |

| 44x | 0 | 0 | 0 | 0 | 0 | 6 | 24 | 42 |

| 46x | 0 | 0 | 0 | 0 | 0 | 0 | 16 | 34 |

| 48x | 0 | 0 | 0 | 0 | 0 | 0 | 8 | 26 |

| 50x | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 18 |

We will take the following example:

The table under the “Age is 40y, time left until retirement is 18y” section shows that the investor must be investing 44% of their monthly income for retirement. If you have already saved more money, say 30x of their current expenses, this requirement drops to just 21% of the monthly salary.

In the assumptions above, we have assumed that 50% is the total household expenses. Hence any investment figure above 50% in the tables indicates

To remedy you need to do some introspection as to what needs to be done

Any figure in the tables higher than 100% means that saving for retirement, as per current figures, will lead to a much lower corpus than needed.

At all times ensure that you have the following in place

Once you start investing,

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What percentage of my salary should go towards retirement? first appeared on 10 Sep 2021 at https://arthgyaan.com