Term life insurance: what, why, how much to get and from where?

Term insurance gives your dependents the necessary financial support in your absence.

Term insurance gives your dependents the necessary financial support in your absence.

Term insurance is a type of life insurance that pays a benefit to the named beneficiaries in the event of the insured person’s death, as long as the policy is active. The purpose of term insurance is to provide financial protection for the policyholder’s loved ones in the event of their unexpected death, helping to cover daily expenses, future goals such as children’s education, and loans like home loans.

It is a straightforward insurance product, similar to car insurance, in that it only pays out in the event of a specific occurrence (death) and does not have a savings component like other types of life insurance. The cost of a term insurance policy is extremely low compared to the potential benefit, and the recommended coverage amount is typically 20 times the policyholder’s annual after-tax income.

Every other insurance policy mixes a term plan with a savings component because it knows people cannot digest the “pays nothing if you don’t die” part, and also conveniently suppresses that the savings component is either paltry (you can get more from an FD or PPF) or market-linked/uncertain which you can simply get by investing outside the insurance plan.

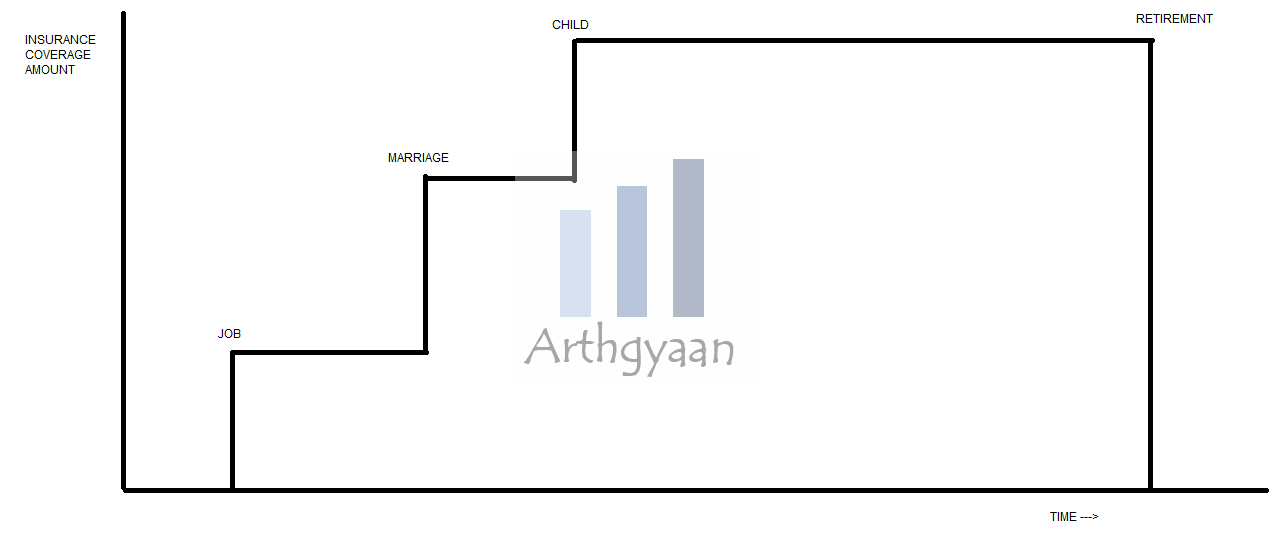

Insurance spreads financial risk across a large pool of policyholders, reducing individual financial burden. Since many people buy insurance, only some are expected to die within the policy’s coverage time. However, it should be present at least for all earning members of the family before retirement age. Term insurance is a critical part of everything you need to do before investing in your goals. Read more here: As someone who has heard about goal-based investing, how do I get started?.

Term insurance offers:

Term insurance protects income so that daily expenses and goals are not affected. It would be best if you only took term insurance as long as you have income, i.e. up to retirement (typically 58-60). This is because plans until age 70 or 80 are more expensive than plans up to age 60. If invested for 30-40 years, the difference can create a corpus higher than the sum assured of the term policy.

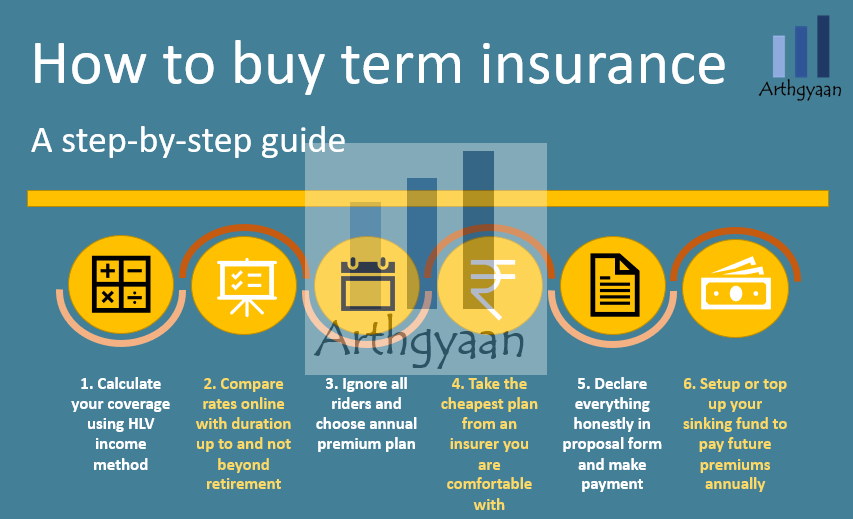

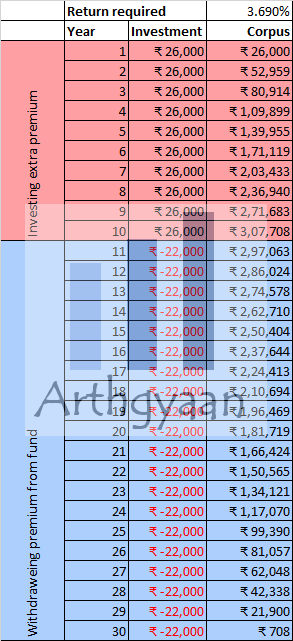

If you are planning to take an accelerated premium plan (either a single period or the typical ten years reduced period payment plan), please note that:

An example below to clarify the last point:

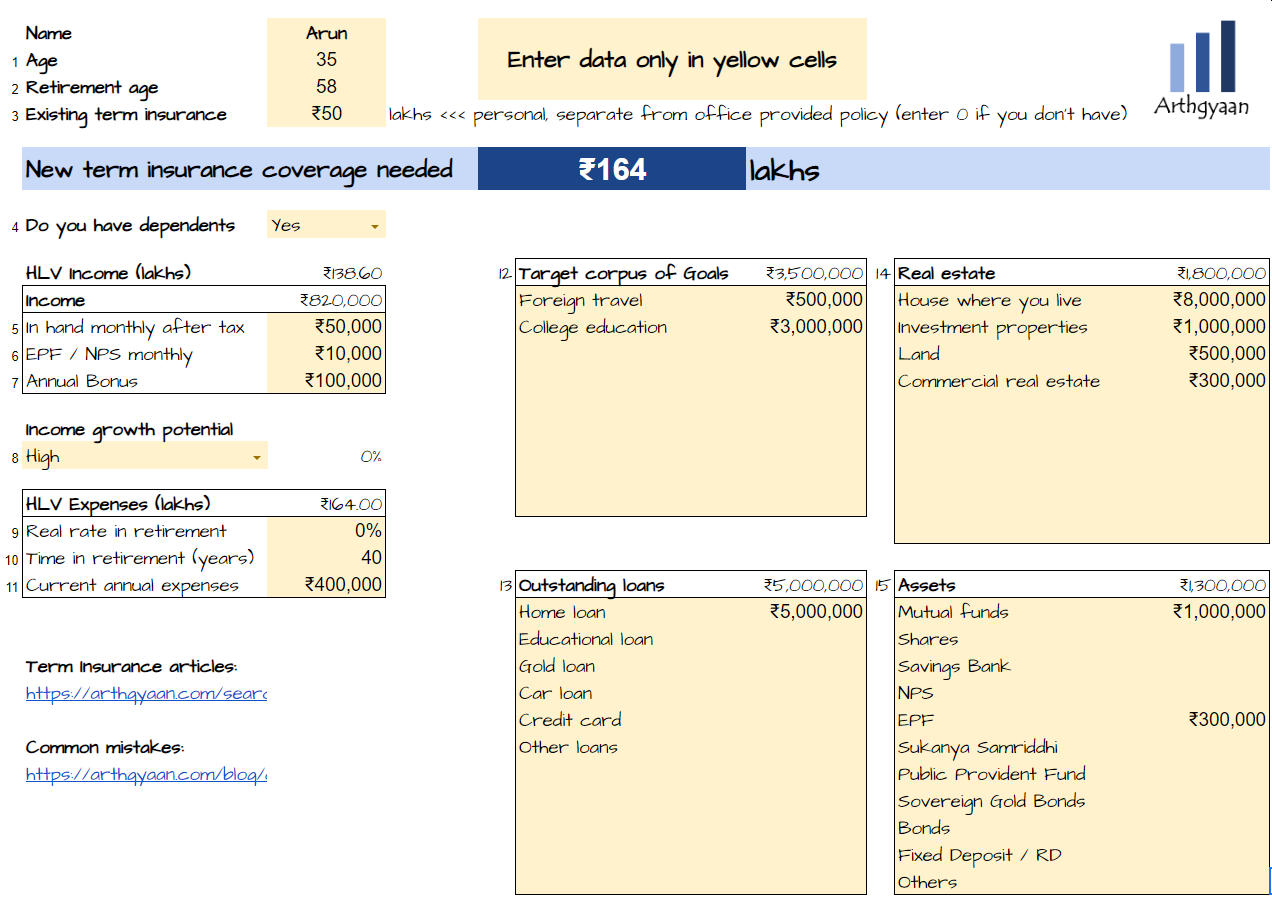

We will first cover two methods to calculate the term insurance coverage amount. We have explained the concept in detail here: How to calculate term insurance coverage amount?.

You can use a tool like Excel (free on office.com) or Google Sheets to calculate using the following formula:

Coverage needed = PV(RealRate,Years_to_retire,-AfterTaxAnnualIncome,0,1)

Coverage needed = PV(Real_Rate_In_Retirement,Years_In_Retirement,-Current_Annual_Expenses,0,1) + LoansOutstanding - Current_Investments - Existing_Term_Insurance

If you are using the Arthgyaan Google sheets-based goal planner then you will see the minimum term insurance you need to have based on:

We also have a simpler term insurance calculator built into the Arthgyaan Google sheets-based goal planner that can be used for free.

You can access the calculator and get instructions regarding how to use the calculator here: How to calculate term insurance coverage amount?.

If you are already having a policy from your company, you should still take a term policy of your own because:

Use the HLV method above to calculate how much you need. In both ways, a similar result came in the example (new 3cr policy required). However, the different methods require different assumptions (inflation, salary growth, time in retirement etc.). Therefore, the result is only good as the assumptions being made. You can choose whichever method you are comfortable estimating. If you select both, take the policy with higher calculated coverage since the premium difference will be small.

Related articles:

Riders make the claim process complicated, since you need to prove the cause of death as well, and may cause issues in claim processing by giving the insurance company more to investigate. You can take such riders as standalone policies, like personal accident insurance, from a general insurance company. You need to keep in mind that in general, rejection without or without litigation is cheaper than paying out the claim.

The annual premium is generally the cheapest compared to monthly/quarterly.

The duration of the policy should be no more or no less than the typical retirement age. The extra premium is wasted for longer durations since there is no income to protect. The money will earn more if invested as part of long-term goals.

Some policies offer shorter premium payment periods at much higher rates. This can be a single premium (which can be very high) or accelerated - a high premium for 7-8 years and nothing afterward. Choose this if and only if there is a chance of not paying all the premiums throughout the period. If regular income is available, the difference between accelerated and average premiums can be invested for long-term goals.

There are multiple insurers in India offering term insurance. The Life Insurance Corporation (LIC) is well known, and there are many more private insurers. The standard advice here is to

Some FAQs/myths on insurer choice and overall term insurance as a product are covered below.

You might be interested to read my personal experience with the LIC’s new Tech term online term plan here: My experience with the LIC Tech Term life insurance policy

Misrepresentation of facts at this stage may cause claim rejection later.

Warning: Do not sign a blank Medical Examination Report (MER) Form or any other blank form and give it to the insurance agent for submission. If a wrong entry gets made in the form, the premium may get hiked or the proposal rejected.

The annual premium is the cheapest compared to monthly/quarterly. If the annual premium is too high to be paid in a single month, use a sinking fund: see this detailed post to save the premium monthly and pay once a year.

Monthly/quarterly premium payments (apart from higher premiums) may lead to operational issues due to payment failures that can cause the policy to lapse.

A few of these myths and mistakes are discussed in detail here: Do not make these common mistakes while buying a term insurance policy

The Married Women’s Property Act 1874 (MWP Act) ensures that upon the husband’s death, the insurance proceeds only go to the wife/children (if the wife/children are nominees) and not to any creditor in case loans are outstanding in the husband’s name. A wife can also take a policy in her name and invoke the MWP option to ensure her children (if they are the nominee) get the proceeds instead of any creditors.

You must avail of the MWP option at the time of buying the policy, and it cannot be opted in once the policy has been issued. Opting into the MWP option does not change anything else in the policy terms.

Term plan has the cheapest premium for a given level of coverage. Any return of premium plan (or investment plan like endowment, whole life etc.) has a higher premium but low returns (comparable to FD at best). Instead, a combination of term plan and investment in PPF, stocks and debt mutual funds for long term goals is expected to beat the return offered by all return of premium or mixed plans.

Example:

Term plan for 30y for 1cr coverage is available for 15k while a return of premium plan costs 30k.

Option 1: Term plan for 15k and another 15k invested yearly at an average of 10% say grows to 27 lakhs (use any SIP calculator to check). Even if you invest that 15k using after-tax money (10,500/year after paying 30% tax and then pay 15% tax say investments after 30 years, the pre-tax amount of a 10.5k/year, 30y SIP at 10% average becomes 19 lakhs pre-tax and 16 lakhs post-tax.

Option 2: Term plan with return of premium for 30k over 30 years will give back 30k times 30, i.e. nine lakhs which is a lot lesser than the previous option.

So don’t believe for a second that there is a loss in taking a simple term plan. Another way of looking at a term plan is by comparing it with vehicle insurance. If there is no accident, the premium is “gone” if there is one, then you will be relieved that you had the insurance coverage.

Claim settlement ratio (CSR) is the percentage of life insurance claims an insurer has settled in a year vs the claims it receives in the period, including pending claims from last year. The definition of “settled” includes claims not paid out as well. So, in theory, a company can pay zero rupees in claims and still have 100% CSR.

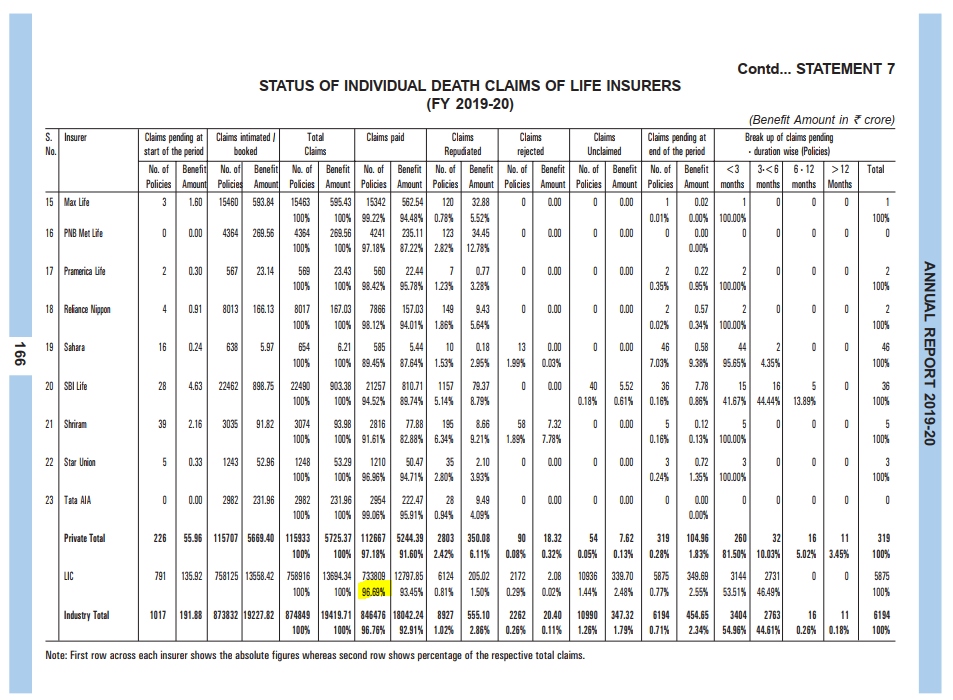

CSR data is surprising since LIC (supposed to be the best in claims) does not have the best CSR. CSR depends on the individual claim (whether disclosures were correctly made or not and many other factors). See this snippet from IRDA 2019-20 annual report where LIC has 96.69% CSR:

As per Section 45, Insurance laws of 2015 claims cannot be rejected past three years from the date of policy issuance. Also, as per regulations issued in 2017 all claims would need to be paid out in a maximum of 120 days. Please read both these documents in detail.

In such a case, the policy will be taken over by other insurance companies. The original company cannot simply shut down without a merger with another. As per IRDA laws, the insurer must have a solvency ratio of 1.5, i.e. they must keep 150 rupees of reserves for every 100 of coverage issued. Ultimately the choice of issuer depends on your comfort level with the company.

Someone with good savings or government pensions / stable passive income may consider term insurance unnecessary. However, please consider taking term insurance if at least one of the following is true:

This topic is discussed in more detail here:

You do not need term insurance if

The premium (including GST) that you pay for term insurance is eligible for deduction under Section 80C under the old tax regime thereby saving tax: How to plan tax deductions for salaried income?. If the premium is ₹15,000 with GST per year, you save around ₹4,500/year in taxes at the 30% tax bracket.

If you are buying the policy near the end of the financial year (FY) in March keep in mind that:

If you have a non-working spouse, you can use the expense method to calculate the coverage needed: typically use expenditures like home and childcare (if applicable). Some insurers may offer limited or single premium plans in such cases. This is often missed during financial planning for the family. There are nowadays joint term plans and “Saral Jeevan” plans that cover a non-working spouse.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Term life insurance: what, why, how much to get and from where? first appeared on 02 Jun 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.