My experience with the LIC Tech Term life insurance policy

This post chronicles my recent experience of applying for a LIC Tech Term life policy and why it will change your belief that LIC plans are more expensive than private insurers.

This post chronicles my recent experience of applying for a LIC Tech Term life policy and why it will change your belief that LIC plans are more expensive than private insurers.

Disclaimer: This article is not a recommendation to purchase the LIC Tech Term life insurance policy. It describes my personal experience with the LIC Tech term online plan application process in Feb-Mar 2022 so that the readers of this article get to know. I am not the policyholder for this policy. Readers should consult with their financial advisor if this plan is suitable for them or not.

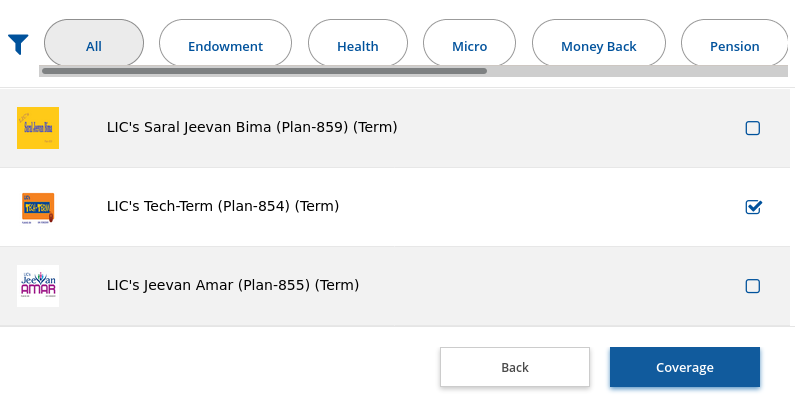

LIC’s Tech Term (Plan No. 854, UIN - 512N333V01) is a Non-Linked, Without Profit, Pure Protection “Online Term Assurance Policy” which provides financial protection to the insured’s family in case of his/her unfortunate demise. This plan will be available through online application process only and no intermediaries will be involved - LIC Website.

This post assumes that you are aware of the concept of a term insurance policy. If not i.e. if you wish to understand who should purchase a term insurance policy and why along with FAQs, please refer to this post: Term life insurance: what, why, how much to get and from where?.

This plan is a term insurance plan with the following features:

Here are the premiums for some selected combinations of age and coverage:

| Age | Coverage | Sex | Coverage period (y) | Yearly premium incl GST | Premium per crore |

|---|---|---|---|---|---|

| 30 | 1 crore | M | 30 | 11,007 | 11,007 |

| 30 | 2 crore | M | 30 | 20,013 | 10,007 |

| 35 | 2 crore | M | 25 | 25,276 | 12,638 |

| 35 | 3 crore | M | 25 | 37,913 | 12,638 |

| 40 | 3 crore | M | 20 | 46,038 | 15,346 |

| 40 | 4 crore | M | 20 | 61,384 | 15,346 |

| Age | Coverage | Sex | Coverage period (y) | Yearly premium incl GST | Premium per crore |

|---|---|---|---|---|---|

| 30 | 1 crore | F | 30 | 9,346 | 9,346 |

| 30 | 2 crore | F | 30 | 16,992 | 8,496 |

| 35 | 2 crore | F | 25 | 20,862 | 10,431 |

| 35 | 3 crore | F | 25 | 31,294 | 10,431 |

| 40 | 3 crore | F | 20 | 37,312 | 12,437 |

| 40 | 4 crore | F | 20 | 49,749 | 12,437 |

A Google search for “LIC Tech term policy” is the recommended route since the link to the page may change.

This is the current link to the policy page: https://licindia.in/Products/Insurance-Plan/LICsTECH-TERM

You will get the policy document and sales brochure here which you should read.

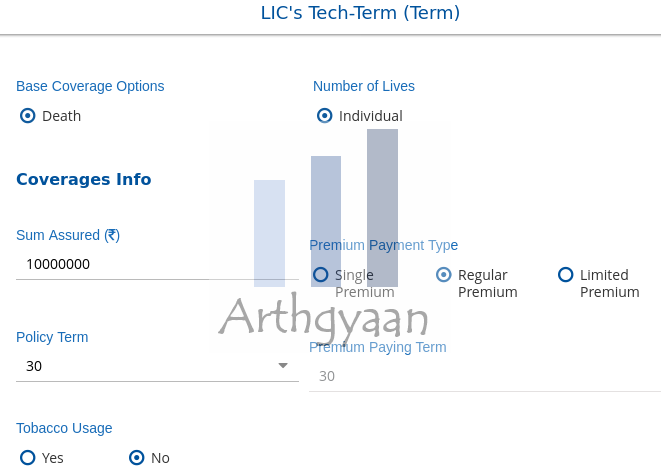

There is an online premium calculator on the right side of the page that will calculate the premium for your need.

You can start the online application process once the premium is calculated. This is the direct link: https://digisales.licindia.in/eSales/liconline

If this link does not work, Google “LIC Tech Term online purchase”.

The form that was filled required the following information:

There is nothing out of the ordinary here. The applicant should fill the form honestly with all information provided to the best of their knowledge.

The following documents were uploaded while filling out the application form

The email for medical tests came two days after the application date. The following tests were mentioned in the email:

The following is the complete timeline of events:

The amusing part here is the endless emails asking for the same documents repeatedly. Unfortunately, their website, where you upload the documents, works only after 9.30 am IST. Maybe someone comes to the office and switches on the webserver!

There are multiple theories as to why the premium, unlike previous term insurance plans offered by LIC, is so competitive. Here is some speculation I have come across:

Whatever be the reason, there is no apparent downside to having a low-premium policy. But, of course, consumers have the right to complain in both cases where the premium of LIC policies is either high or low.

I chose this policy due to the following reasons:

You choose to purchase this policy if and only if

This policy was relaunched in November 2022 as “New Tech Term” with substantially higher premiums. Here is a review of the new policy: A review of the LIC Tech Term plan in 2023.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled My experience with the LIC Tech Term life insurance policy first appeared on 01 May 2022 at https://arthgyaan.com