The agency problem in personal finance. What should you do?

This post discusses how various agents pitch financial products to investors and how many of these products may not suit the investors’ goals.

This post discusses how various agents pitch financial products to investors and how many of these products may not suit the investors’ goals.

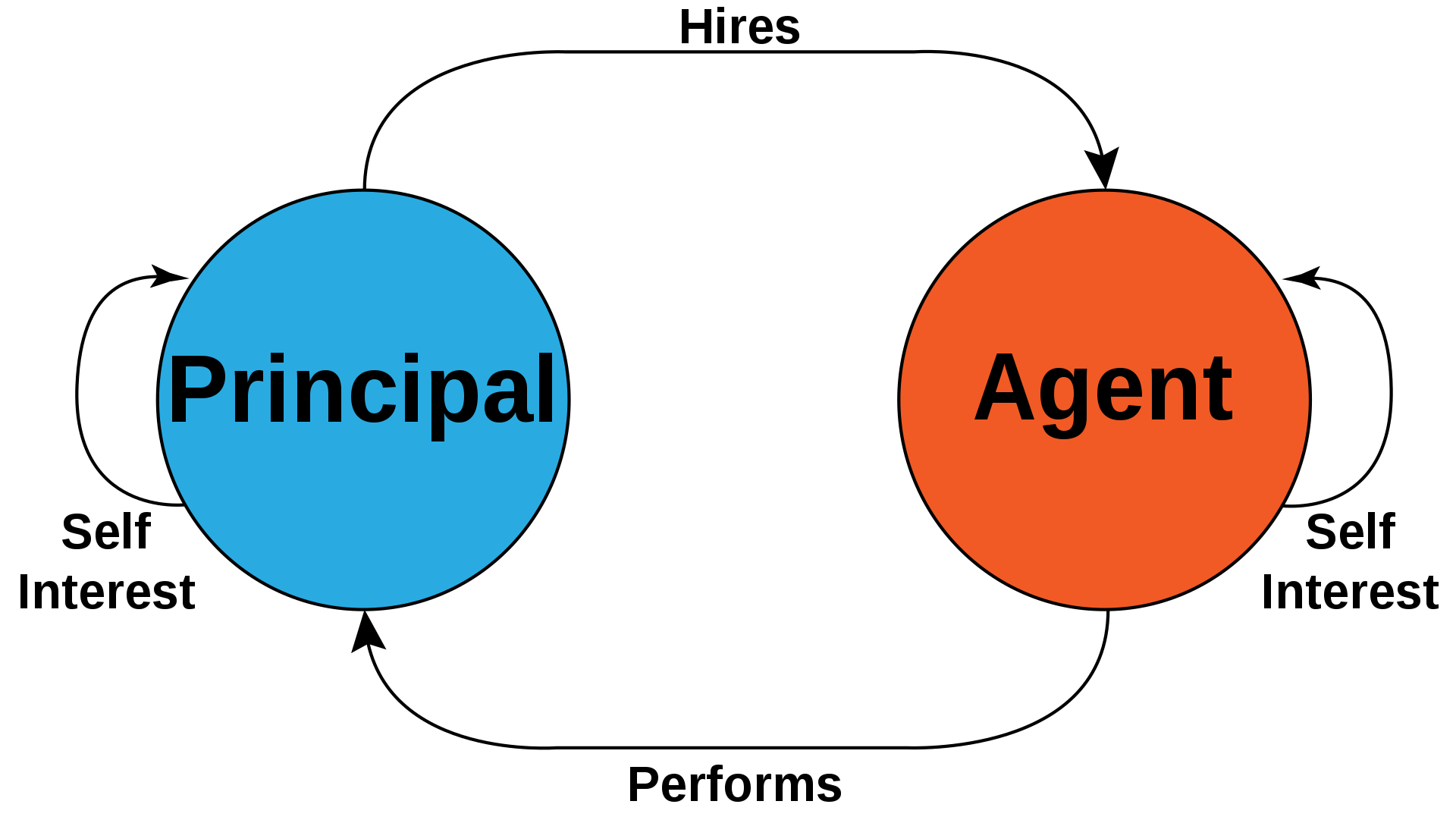

Source: Wikipedia

Source: Wikipedia

An agency problem is a conflict of interest inherent in any relationship where one party is expected to act in another’s best interests. - Investopedia

In personal finance, this conflict exists mainly because of the existence of commissions. The agent trusted by the investor to suggest the most suitable investment products turns out to be acting on their own interests instead of that of the investor.

You can identify the agency problem when you are pitched a product with a likely commission structure if at least one of the following is true:

In either case, the investor, i.e. the principal, will be pitched a product by the agent based on a single consideration: how much commission the agent makes on that sale. Commissions are universally paid out of the investor’s pocket and not out of the pocket of the investment management company, bank or insurance company.

While this is not necessarily bad per se, there are two problems:

This article will briefly cover the types of commissions, hidden or otherwise, their frequency of deduction, the impact on the investor’s returns, and how to identify a product with a high commission.

Upfront commissions are substantially better than the option of ongoing commissions, as we will show below. Typically insurance plans have a high upfront commission that tapers off in the later years. Suppose you cancel the policy in the first few years. You will not get back much of the premiums paid so far since the company has already paid the commission to the agent, and the money is already gone.

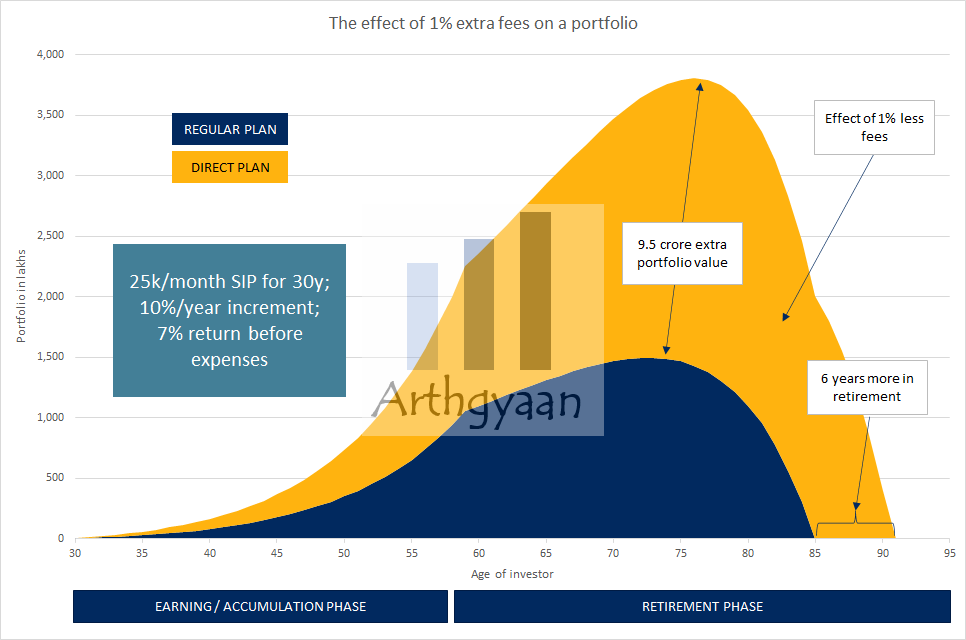

Unfortunately, ongoing commissions are worse since they reduce your rate of return. Since the nature of growth in any asset is exponential, using the principle of compounding, even a 1% lower rate of return leads to a 30% lower corpus in 30 years.

Corpus = Principal * (1 + Return) ^ Time

which means that the difference in corpus per 1% less return looks like this:

This example is from our article on why investors should never invest in regular mutual funds and must always choose direct funds. Here are the details: Do not make this mistake when investing in mutual funds

Unit-linked insurance plans, or ULIPs, have both of the above problems:

Many youngsters, especially when word gets around that they have joined their first job, receive a visit from a friendly neighbourhood insurance agent. Often well-meaning parents of the new joiner have a family friend who is an insurance agent who is brought over to make a pitch to the family.

The pitch revolves around having a life insurance policy with an investment component like endowment, whole life or ULIP. The policy will have benefits like tax savings under 80C on the premiums, life coverage and excellent customer service from the ever-helpful agent.

The agency problem occurs here if there is no mention of :

At this point, it is an excellent question to ask “high commissions, so what”? The following paragraph will clear this doubt.

These are the questions to ask, from a transparency perspective, if you are at the receiving end of this pitch:

A few suggestions to circumvent the usual emotional tricks that are played to ensure the sale happens:

However, at times it is better to focus on losing the battle to win the war. The premium of the insurance policy that the agent pitches is a small price to pay to get an agreement in place that the young earner is able to limit outside interference in their finances for goals that are decades away.

After all, and they should internalise this sooner than later, it is impossible to plan for any goal without investing in products, like equity, that can counter goal inflation. Of course, retirement can be possible with savings account returns, but few people will realistically reach the corpus for such a feat.

Here are some practical suggestions to circumvent the push:

A common argument in favour of choosing Regular funds offered by distributors goes like this. The distributor is supposed to advise which funds will perform better in the future in advance. The claim is that investing in “best performing” funds makes the TER difference between Regular and Direct funds (which is due to the distributor commission) immaterial. However, since the distributor makes this claim, the investor must examine the distributor’s track record of future prediction of finding such funds. Then there is the taxation cost of switching frequently. Direct funds give guaranteed extra returns over Regular without needing any attempt to predict the future.

Golden rule: do not approach your bank for investment products

There are sayings in multiple Indian languages that mean something along the lines of: “today the prey itself walked into the predator’s den”. If you approach a salesperson, you will have course be pitched a product that

A good product does not need to be sold.

The single most important criteria for evaluating if a product is suitable for investing is evaluating the sales channel used for obtaining the product:

Some common examples of investment products that should be considered (vs those that you should reconsider) are:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled The agency problem in personal finance. What should you do? first appeared on 27 Apr 2022 at https://arthgyaan.com