How to best use 80C deductions to plan your taxes?

This article talks about one of the most basic ways of saving tax and how to plan the deductions smartly.

This article talks about one of the most basic ways of saving tax and how to plan the deductions smartly.

Disclaimer: Taxation is a dynamic concept and the content of this article is valid on the date of publication and any subsequent updates. Always consult a professional tax advisor before doing anything that leads to taxes being due.

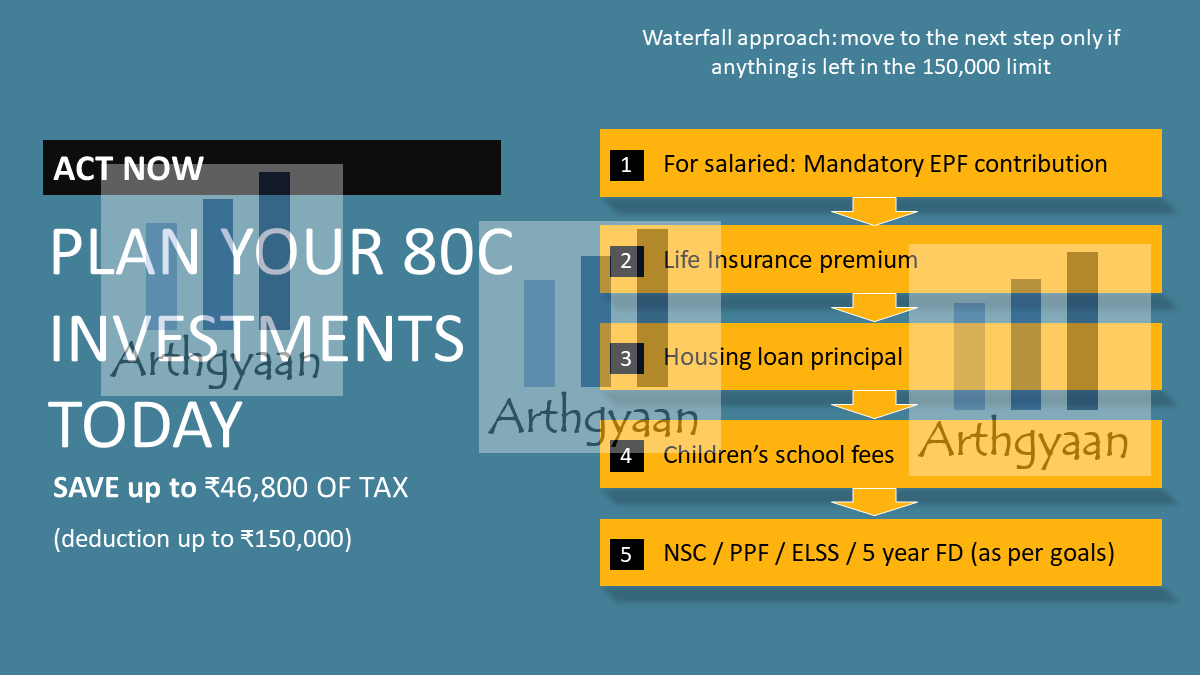

Section 80C of the Income Tax Act allows a deduction of up to ₹150,000 every financial year (Apr to Mar) for any taxpayer who opts for the “old tax regime”. This deduction means that your tax payable will come down by an amount as per your highest tax rate (plus applicable cess) like this:

You need to add cess to the tax saved, which is currently 4%. So ₹45,000 saving at 30% bracket becomes a saving of ₹46,800.

The deduction is available in two ways:

Many investors approach 80C from the “how to save most tax” angle, resulting in inappropriate investing or spending money to save tax. While the first problem is easy to rectify, the second, which is spending more to save tax, is an unfortunate and permanent loss of capital. For example, do not spend 100 to get 30 back. A deduction that is not suitable for your future financial goals is an effective wastage of 70 of capital since you get 30 back as reduced taxes only after spending that 100.

This article will cover the most efficient ways to claim the deduction so that:

The process for 80C investment should happen on the 1st of April and not as a part of a rush from December onwards. Many investors in March 2021 invested in the last week. However, due to a combination of bank holidays and the SEBI rule of unit allocation on the date of realisation of funds, they got their ELSS units allotted in the next financial year.

To claim the deduction:

The list of 80C deductions below is not comprehensive; however, it covers the most common ones.

Insurance premium payment is eligible for term insurance and traditional investment plans like whole life or endowment and ULIPs.

Our position on purchasing insurance is:

Combining a term plan plus mutual fund investments is the better alternative for all investment plans and ULIPs.

Read more: Term life insurance: what, why, how much to get and from where?

This provision exists for claiming a deduction for fees paid to a school, college or university as tuition fees (not an admission or other fees) for children.

If you have a home loan, then you can claim the principal component of the EMI under 80C. The home loan issuer will provide an interest certificate that will show the split of principal and interest for that financial year. For deduction purposes, the principal is eligible under 80C and the interest under a separate section called Section 24 (up to 2 lakhs/year). For joint loans, the deduction will be available for both borrowers. E.g. if husband and wife take a joint loan, up to 4 lakhs on interest and up to 3 lakhs on the principal can be deducted. Of course, there are complexities around when the loan was taken vs the status of the house being constructed; still, the overall idea of the deduction is as per the previous sentence.

At this point, it is essential to understand the effect of the tax deduction on principal and interest on the decision to buy a home. The two deductions effectively reduce the interest rate of the home loan. Imagine the EMI is ₹50,000, and the total interest paid is four lakhs, and the principal is ₹ two lakhs. Using the complete Sec 24 and 80C deductions leads to saving ₹60,000 and ₹45,000 less tax payment which can be interpreted as lowering the effective interest paid that year by ₹1.05 lakh (and a little more due to cess being saved), implying a lower interest rate on the loan. If the house is sold within five years, the deduction is reversed.

However, let us look at the purchase of the house holistically. The tax saving is ₹1 lakh/year. A few questions:

At the beginning of the career, a house purchase just for tax-saving may not be the most prudent use of capital. It will be better to check the numbers thoroughly before jumping into a house purchase solely to save tax. After all, the cost of delaying investing for long-term goals is prohibitive: What is the danger of starting investments late?. You should buy a house only if you are confident that you will live in it.

National Savings Certificates (VIIIth Issue) (NSC): This offers 6.8% compounded annually with a cumulative payout on maturity in 5 years. There is no limit on the investment amount, and the maturity amount is taxable.

Banks offer a five-year tax saving FD the same as a normal FD, except if you break it before five years, the tax deduction is reversed. Given the tax inefficiency of FDs, investors should carefully evaluate if FDs are right for them. Read more: Mutual Fund vs Fixed Deposit - where should you invest?

Salaried employees are eligible for Employee Provident Fund (EPF). The employer and employee both compulsorily invest 12% of the basic plus dearness allowance to EPF every month.

As a financial milestone, once you reach a certain salary bracket, your EPF contribution will exceed the 80C limit, and you will no longer have to submit proof for 80C deduction. The basic salary (plus DA) should exceed ₹12.5 lakhs/year to achieve this milestone.

PPF is a very common way to save tax and accumulate a tax-free corpus for long-term goals. The account matures after 15 years and can be extended by five years at a time. The maturity proceeds are tax-free.

A PPF account should be opened by every earning member of the family at the minimum, not for saving tax, but for long term goals. A PPF account requires just ₹500 yearly contributions to remain active. Hence you should open the account as soon as possible to start the 15-year clock. You should invest in PPF only if

If the above conditions are not true, invest only the minimum amount in PPF.

SSY can be opened in the name of a girl child younger than 10 years. The account matures in 21 years and you can withdraw some part of the corpus at the age of 18. Given how the product is structured, the maturity will align more with the child’s PG/PhD period than UG goals. SSY can be maxed out, just like PPF irrespective of the ₹1.5 lakh limit due to the guaranteed tax free return (though the rate varies) depending on the amount available for investing in long term goals. Many families may invest the full ₹1.5 lakhs in multiple PPF and SSY accounts (up to two girl children are allowed SSY to be opened) irrespective of the 80C limit solely for long term goals. The maturity proceeds are tax-free.

However, there are two important considerations for these products:

Purchase of annuity plans (any deferred annuity or specific annuity plans from LIC/mutual fund) is eligible under 80C as well. Annuities are not suitable for all investors, and it’s need should be carefully evaluated before purchase. Read more: Do you need a pension plan during retirement?

Investors over the age of 60 are eligible to invest up to ₹ 15 lakhs with a quarterly payout of interest (around 7.4% today) that is taxable. The scheme matures in 5 years, and the investment is eligible for an 80C tax deduction. You must invest within a month of receiving retirement benefits from the employer and is available from the post office and banks.

Equity Linked Savings Scheme (ELSS) funds are mutual funds that are eligible to get tax deductions under Section 80C. However, ELSS funds have a mandatory 3-year lock-in for every purchase. So, if you are investing in SIP form, then keep in mind that every SIP installment is locked for three years from the date of purchase.

Read more: How to choose the best ELSS funds?

NPS Tier 1 contributions are exempt up to ₹1.5 lakhs in 80C (specifically under 80CCD.1). A further ₹50,000 deduction, which is not very useful, is available under Section 80CCD.1B. NPS is a scheme that may not suit everyone due to the lock-in up to age 60. Read more here: What should be my mix of MF, Stocks, Gold, NPS, FD, PPF and ELSS if I want to invest 50k per month?.

Unit Linked Insurance Plans offer insurance and investment in a single product. A part of the yearly contribution is used as a premium for life coverage. The rest is invested in mutual funds after deduction of some additional charges.

ULIPs are notorious for high fees and poor performance vs a simple term insurance policy and a diversified portfolio of mutual funds. Therefore, most Investors will be better off avoiding ULIPs altogether.

We will use a waterfall approach to fill the 80C limit by moving to the next step only if anything is left within the 150,000 limit:

We will move to step 5 only if there is something left after completing the previous steps. At this point, we need to know the asset allocation and SIP amount for all of our goals and choose the most suitable option.

Retired Investors will have a modified waterfall since they will likely not have insurance premiums (do not pay term insurance premium if you do not have income), children’s fees and EPF. Therefore, based on how their retirement portfolio is structured, the appropriate options are SCSS, 5-year FD, ELSS and NSC. This article discusses how retirees can construct a portfolio: How to prepare a retirement portfolio using the bucket approach.

Detailed coverage of taxation for salaried taxpayers is present here:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to best use 80C deductions to plan your taxes? first appeared on 05 Jan 2022 at https://arthgyaan.com