What is the danger of starting investments late?

You pay a heavy price by waiting to start investments: this post shows the effects of every year of delay

You pay a heavy price by waiting to start investments: this post shows the effects of every year of delay

We have already covered

We will extend the concept developed while calculating for a traditional retirement goal and show what happens when investments are delayed. There may be many reasons for starting investments late like

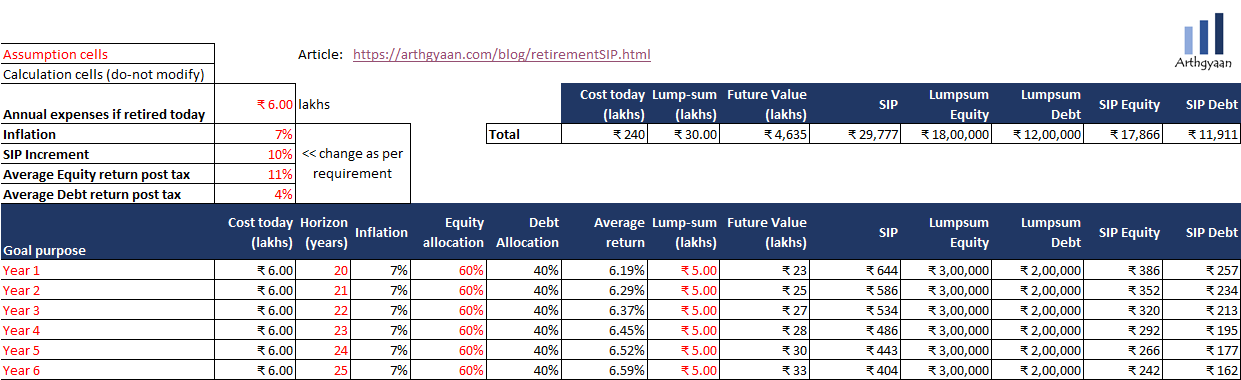

We will use the example from this post where a SIP value of ₹ 29,777 is found for retirement 20 years away and ₹ 30 lakhs of starting lump sum amount.

We will see what happens for each year of delaying investments for the next ten years. We assume that every year the starting expense of ₹ 6 lakhs increases at the same 7% inflation as in the example.

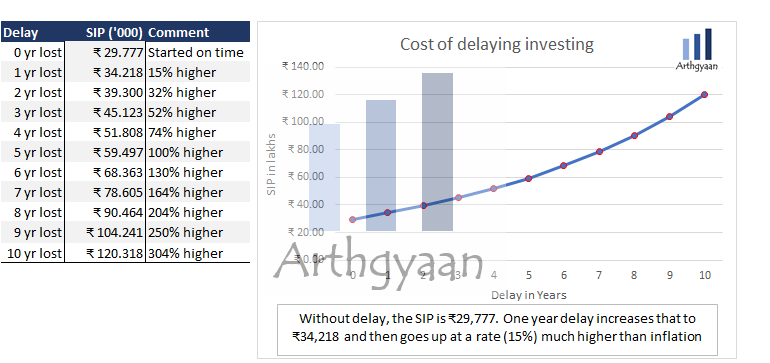

If there is one year of delay, the SIP requirement jumps by 15% to ₹ 34,218 and then to ₹ 39,300 (32% increase) if the delay is just 2 years. If the delay is 10 years, then the SIP amount jumps more than 4 times to ₹ 1.20 lakhs. This is the cost of starting late.

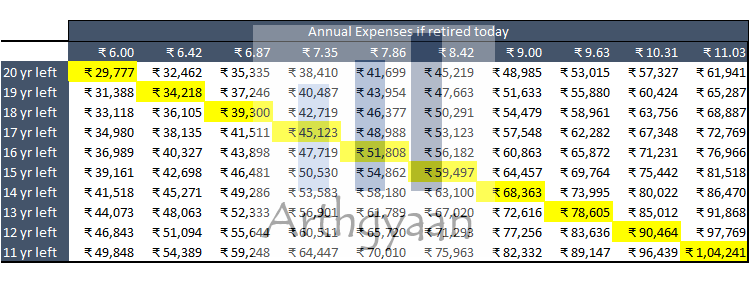

This table shows the different SIP amounts for every year of delay or increase in the amount required in the first year of investment (increasing at 7% a year). For example, if the starting investment is ₹ 9 lakhs and 14 years is left to retirement then the SIP amount will be more than ₹ 68,000.

This should convince every reader that there is a lot of benefit in starting investments as early as possible. It is easy to do as shown here:

We have two worked out examples for a 39-year old and 48-year old investor targeting retirement. We see that with the same asset base of ₹40 lakhs and the same monthly expenses of ₹45-50,000 in retirement

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the danger of starting investments late? first appeared on 27 Jun 2021 at https://arthgyaan.com