How do you get SIP amount for early retirement (RE): Part 4

Walk-through: Get SIP amount for early retirement (RE)

Walk-through: Get SIP amount for early retirement (RE)

We have already covered

We will extend the concept developed while calculating for traditional retirement (the usual at age 58-60 years) to develop a model for calculating how to save for early retirement.

There are a lot of literature out there that calculates a target corpus and finds out a way of drawing down that corpus (the safe withdrawal rate or SWR). We will sidestep that debate regarding how much SWR to assume by directly saving for each year of early retirement starting with the year before retirement first.

The model will have two parts:

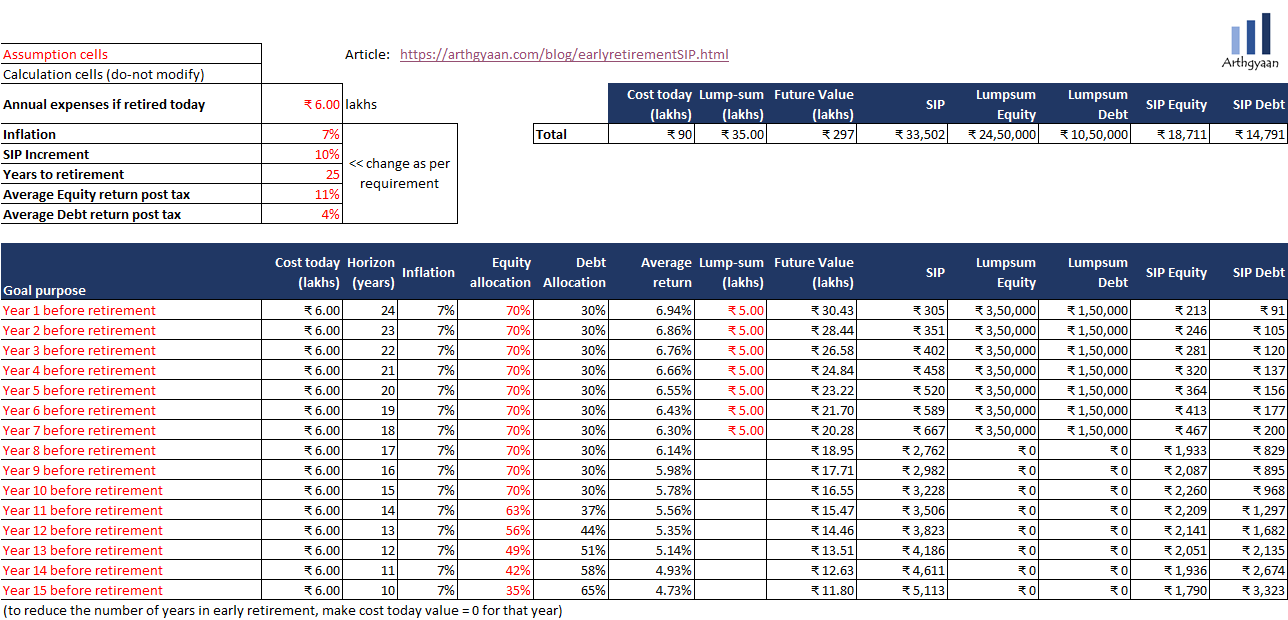

The model deals with a 33-year-old salaried individual with retirement at age 58 (25 years from now) who is also targeting retiring 15 years earlier. We will assume a figure for annual expenses if traditional retirement happened today (6 lakhs in the example), model it forward by 25 years of inflation (at 7%) and then use the figure to save for each year of early retirement. Estimation of the expenses in retirement is covered in more detail here.

One major assumption here is that the other goals like children’s education, travel, and house purchase are separate from the expenses in the RE period. If this is not possible then the RE goal will be delayed. A more aggressive asset allocation and conservative growth of SIP values are assumed to indicate the lower priority of this goal vs. traditional retirement.

Expenses i.e. the present value of target goal amounts will be

The model will start with saving ₹ 30.43 lakhs at a goal horizon of 25-1 = 24 years, ₹ 28.44 lakhs at a horizon of 23 years so on and so forth for 15 years.

There is also ₹ 35 lakhs of lump sum available for investment that must be allocated to the “First Year before Retirement” goal and then onwards to the next. At any point, the corpus value must be allocated to the oldest RE year since that is the highest priority goal (you can RE only in the last years before actual retirement).

These calculations are explained in this Google Sheets workbook.

As expected, RE requires significant monthly investment starting from the present day and requires careful balancing with the other goals, EMIs for house purchases and expenses/investments related to children’s education.

The following needs to be done in this order:

At all times ensure that you have the following in place

Please see below:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How do you get SIP amount for early retirement (RE): Part 4 first appeared on 06 Jun 2021 at https://arthgyaan.com