Does the 4% SWR rule work in India?

The article investigates if you can retire in India with only 25x your expenses saved as retirement corpus.

The article investigates if you can retire in India with only 25x your expenses saved as retirement corpus.

Originally published: 19-Jun-2022

Updated: 25-Feb-2024 - Updated for Jan 2024 market data; Used SENSEX TRI from 1996 instead of PRI

This article is a part of our detailed article series on Safe Withdrawal Rates. Ensure you have read the other parts here:

This article brings together the interrelationship between the size of the retirement corpus, inflation, asset returns, longevity and the amount you wish to spend in retirement.

This article shows how much you can withdraw from an equity mutual fund if you have a pension plan as well in retirement.

We examine the results of running a long-term SWP in index funds for retirement.

This article shows that if you decide to retire today, how long will the corpus last realistically based on real rates of return.

This article shows the maximum withdrawal in SWP form that you can take out from a retirement portfolio to make it last 30 years.

Retirement, like death and taxes, is inevitable. There are very few professions, like doctors or lawyers, where the retirement date is not well defined since these professionals can work for as long as they wish or can. However, for salaried employees, each offer letter has a well-defined retirement date known when the employee starts the job. Retirement, as we have argued before, is the one financial goal for which you cannot take a loan solely because you do not have any income to pay it back.

Hence, investing for retirement is an unavoidable financial goal for most of us, leading to the inevitable question: How much retirement corpus is enough?

This article will examine the popular SWR rule for determining whether a retirement corpus is enough in India. We will use historical data to simulate checking what possible SWR values are for India.

…the Trinity study is an informal name used to refer to an influential 1998 paper by three professors of finance at Trinity University. It is one of a category of studies that attempt to determine “safe withdrawal rates” from retirement portfolios that contain stocks and thus grow (or shrink) irregularly over time - Wikipedia.

The Trinity study said, using US historical stock and bond market data from 1925 to 1995, that:

Since X/25X = 4%, this is the origin of the name ‘4% rule’. Effectively a stock and bond corpus where you withdraw 4%, i.e. the Safe Withdrawal Rate or SWR, in the first year and keep increasing the withdrawal rate with inflation, and then the portfolio lasts 30 years.

The following points must be kept in mind before using the 4% rule:

The section below will examine how the 4% rule works for India.

Unlike the Trinity researchers who had access to data from 1925, we have a stock market index only since 1979, which means that we have just above 40 years of data, given that Sensex’s historical value goes back only to April 1979. Coupled with this, since we are running a 30-year simulation, we have a limited number of windows to run the simulation. We have 180 such windows from Apr-1979 to Mar-2009, May-1979 to Apr-2009 etc., until Jan-2024.

We use PPF data to proxy for debt fund returns and a standard 60/40 equity/debt asset allocation. We use realistic assumptions for taxes assuming a 10% loss due to tax on yearly rebalancing and 5% tax on selling monthly. We take inflation at 7%.

At the beginning of each window, we start with a one-crore portfolio. However, this starting amount does not really matter since we work in percentage terms, and any figure can be chosen without changing the result or conclusion. We keep 60% of the amount in equity (represented by Sensex TRI) and 40% in debt (using PPF returns). Every month we withdraw a small amount from the portfolio for monthly expenses. This monthly amount over the first twelve months is the SWR.

We will check three metrics:

The minimum value is the most critical metric since it tells us how close that case came to running out of money in 30 years.

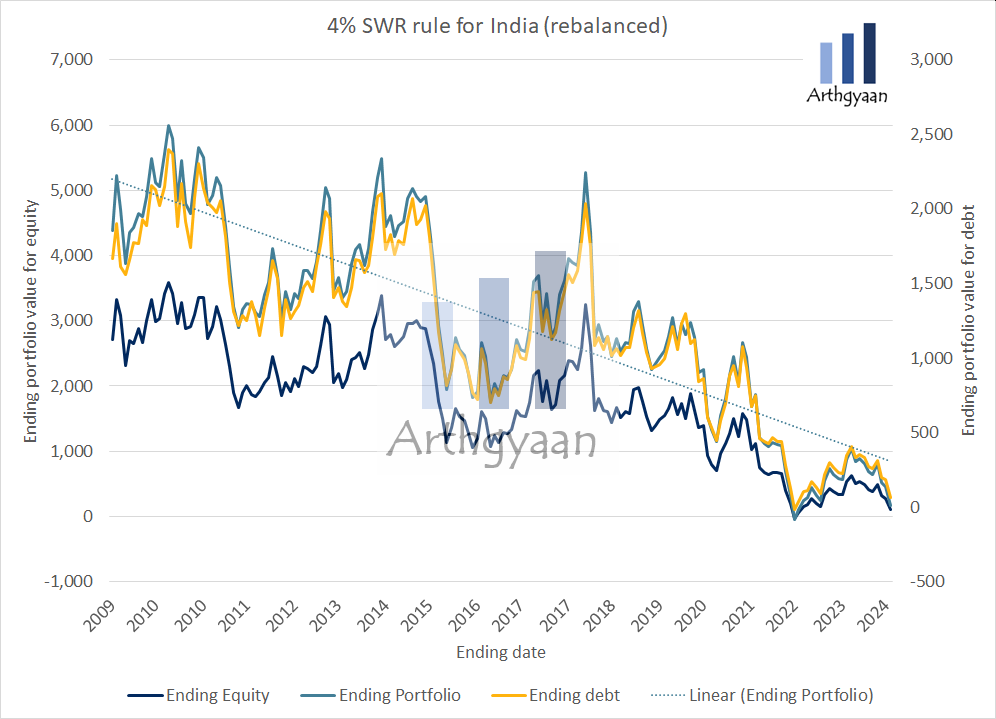

The following graph shows the portfolio ending values for the 4% rule applied to historical data with yearly rebalancing.

A few observations:

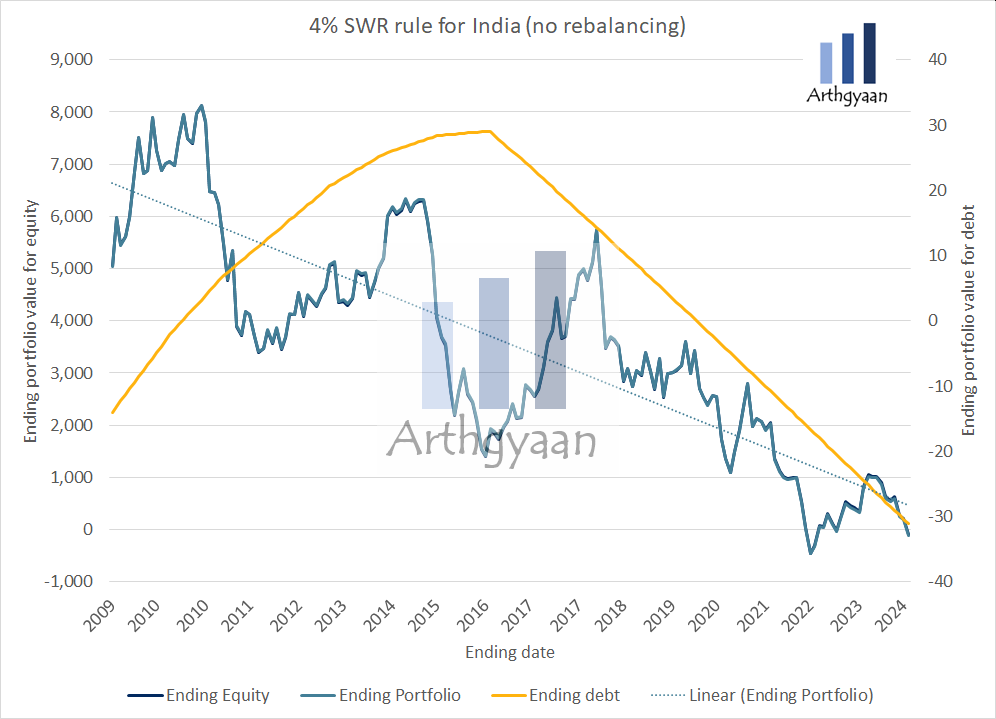

We will show a case where the portfolio is not rebalanced annually for curious readers. As evident, both the positive and negative ending values are more than the rebalanced case since the dampening effect of systematic rebalancing is absent.

This graph shows how rebalancing, even after taxes, reduces overall risk.

A few observations:

We now repeat the simulation with various SWRs from 4% (25x) to 2% (50x), both with and without rebalancing, and produce the results below:

The above table shows, without doubt, that for a 30-year retirement:

The 4% rule does not work in India

Other notable points are:

Under such a situation, the only alternative available to investors is to invest as much as possible using a calculator like goal-based investing retirement tool to create and review their retirement portfolio at least once a year.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Does the 4% SWR rule work in India? first appeared on 19 Jun 2022 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.