What happens if you do an SWP from an index fund in retirement?

We examine the results of running a long-term SWP in index funds for retirement.

We examine the results of running a long-term SWP in index funds for retirement.

This article is a part of our detailed article series on Safe Withdrawal Rates. Ensure you have read the other parts here:

This article brings together the interrelationship between the size of the retirement corpus, inflation, asset returns, longevity and the amount you wish to spend in retirement.

This article shows how much you can withdraw from an equity mutual fund if you have a pension plan as well in retirement.

This article shows that if you decide to retire today, how long will the corpus last realistically based on real rates of return.

This article shows the maximum withdrawal in SWP form that you can take out from a retirement portfolio to make it last 30 years.

The article investigates if you can retire in India with only 25x your expenses saved as retirement corpus.

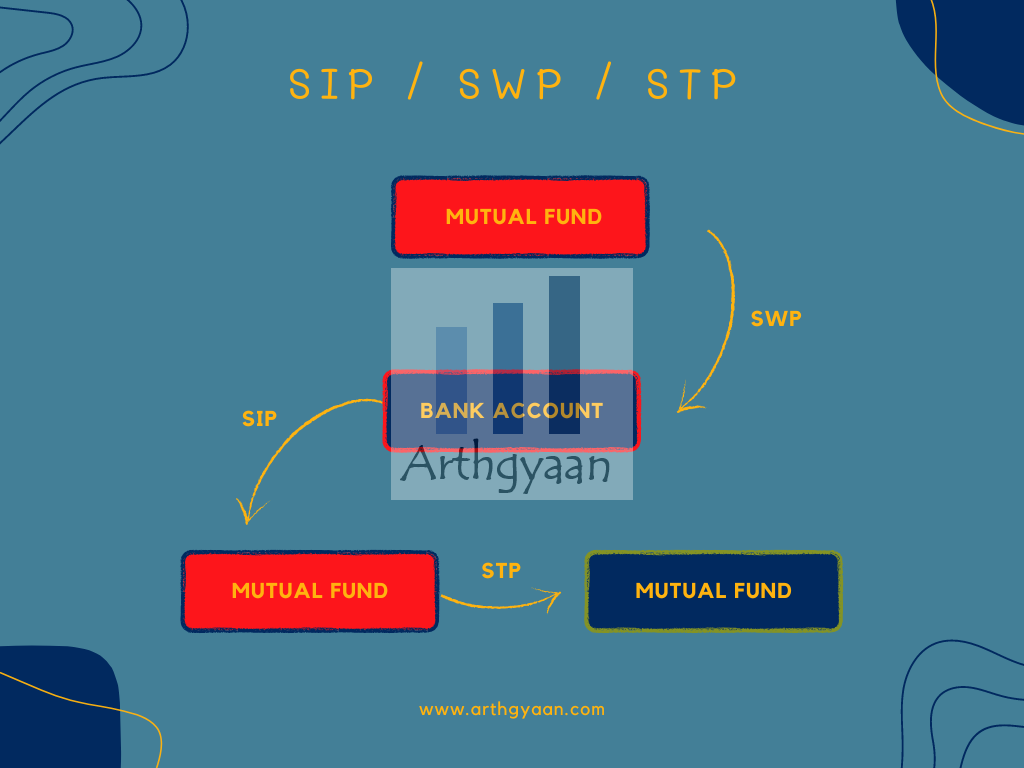

All of these are standing instructions that get executed as per a schedule you specify:

In this article, we will see if you can have an SWP during retirement to fund in-retirement expenses. Here the success criterion is:

There should be multiple other income sources in a retirement portfolio like a pension plan, SCSS, Post Office MIS, RBI bonds or bank FD.

In this article we will address a common question from investors:

Can I run a SWP from an equity mutual fund in retirement?

You can use this step-up SWP calculator to see how such a fixed-return SWP works in theory:

Total Withdrawal (₹):

Remaining Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

If you found this useful, check out the Arthgyaan step-up SIP calculator.We will add two conditions to our questions “_Can I run a SWP from an equity mutual fund in retirement?:

Due to the lack of data for the Indian market, we use Monte Carlo simulation using Nifty 50 Total returns index data since 1999 to model 1,000 retirement paths for SWR ranging from 1% to 5% at 0.5% intervals.

We will assume that the first year’s withdrawal to be a value between 1% and 5%. The withdrawal amount will be increased by inflation every year. As a practical example, we will take

| Start | ₹ 1,00,00,000 |

|---|---|

| Withdrawals ⬇️ | – |

| Year 1 | ₹ 2,50,000 |

| Year 2 | ₹ 2,67,500 |

| Year 3 | ₹ 2,86,225 |

| Year 4 | ₹ 3,06,261 |

| Year 5 | ₹ 3,27,699 |

We define “success” as ending with a non-zero portfolio, i.e. not running out of money, after a 30-year retirement with an SWR between 1% and 5%. As per the definition of SWR, the starting portfolio value is 1/SWR. So in terms of the first year’s expenses, a 4% SWR is 1/4% = 25x expenses.

This case leaves behind a ₹4 crores corpus for the heirs.

This case runs out of money around halfway into retirement.

We ran 1,000 such simulations for each of the SWRs (1-5%) and calculated the number of cases where there is a non-zero portfolio value after 30 years with a starting portfolio value of one crore.

Here the “Nearly failed” case is equal to an ending value less than or equal to one-fourth of the starting value. Since the starting portfolio is ₹1 crore, any ending value less than ₹25 lakhs is a near-miss. At 7% inflation, this ₹25 lakhs has lost its purchasing power to just ₹3.2 lakhs in 30 years and will, depending on the SWR, pay for only a few months to a year of retirement expense in the 31st year.

The conclusion is quite clear:

In a future article, we will cover the following two cases:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What happens if you do an SWP from an index fund in retirement? first appeared on 28 Sep 2022 at https://arthgyaan.com