How much can you save for a college education goal with a 10000/month SIP

A child’s education goal is the dream of every parent. We examine various return scenarios to see how much corpus you can create with a reasonable SIP amount.

A child’s education goal is the dream of every parent. We examine various return scenarios to see how much corpus you can create with a reasonable SIP amount.

A lot of parents who are investing in a child’s education goal for the first time have this common question:

How much money will I make if I start a SIP today?

We consider a hypothetical ₹10,000/month SIP and see how much corpus you can accumulate.

This SIP amount stays constant over the entire investment period.

This SIP amount is increased by 10% per year, as a step-up SIP, over the entire investment period:

| Start | ₹ 10,000 / month |

|---|---|

| Investment ⬇️ | – |

| Year 1 | ₹ 120,000 |

| Year 2 | ₹ 132,000 |

| Year 3 | ₹ 145,200 |

and so on.

As the tables above show, you can accumulate a drastically higher corpus over time if you increase your investments every year, even at just 10% a year.

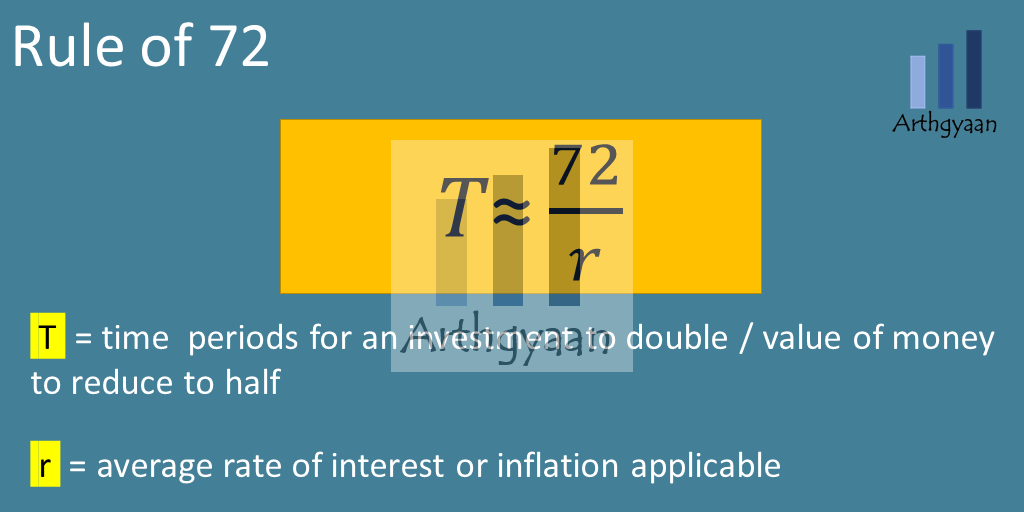

Inflation is an important input to goal-planning in an economy where prices are rising overall. We can use the rule of 72 as a convenient mental shortcut to understanding the impact of inflation.

The rule says: Rate of doubling * Time in years = 72

Educational inflation is one of the highest inflation rates in India currently with experts estimating the rate to be 10% per year. At 10% inflation, as the rule of 72 shows, the cost of a college degree doubles in 7 years and becomes four times in 14.

While the corpus created above in the top-up SIP case is adjusted using 10% inflation, we see that the corpus reduces substantially.

To read this table, a ₹60 lakhs corpus created in 15 years can only pay for a degree that costs around ₹15 lakhs today.

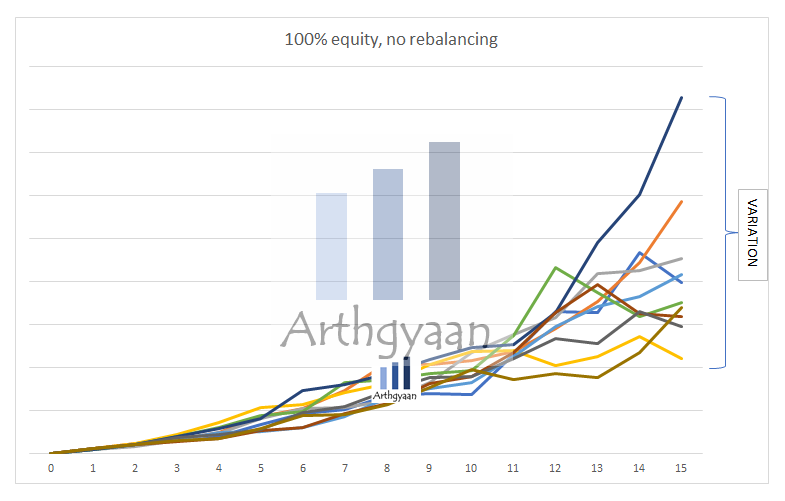

One major assumption in the tables and charts above has been that the return over the period is assumed to be fixed. In the real world, depending on what is there in the portfolio, especially with risky assets like equity, a SIP in equity looks like this:

Here is an example of a 15,000/month SIP run for 15 years. The SIP amount is increased by 10% every year. The chart shows ten different possibilities assuming the average equity return is 11% post-tax and a risk of 15%. The results are:

Given that the stock market does not behave like a fixed deposit, the end result is unpredictable and that is undesirable. The better alternative is to apply the principles of goal-based investing for children’s goals as explained in detail here: Goal-based investing: How to save for children’s future.

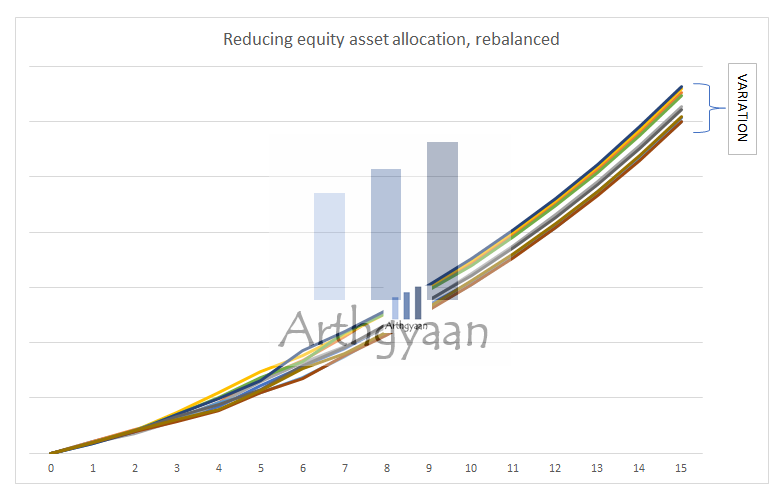

If you follow the guide, you can create a corpus for children’s education that lets you reach a target corpus over time as in the chart above.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much can you save for a college education goal with a 10000/month SIP first appeared on 02 Oct 2022 at https://arthgyaan.com