Does a step-up SIP provide a higher return than an ordinary SIP?

This article explains how the return and corpus created vary between a step-up SIP and an ordinary fixed SIP.

This article explains how the return and corpus created vary between a step-up SIP and an ordinary fixed SIP.

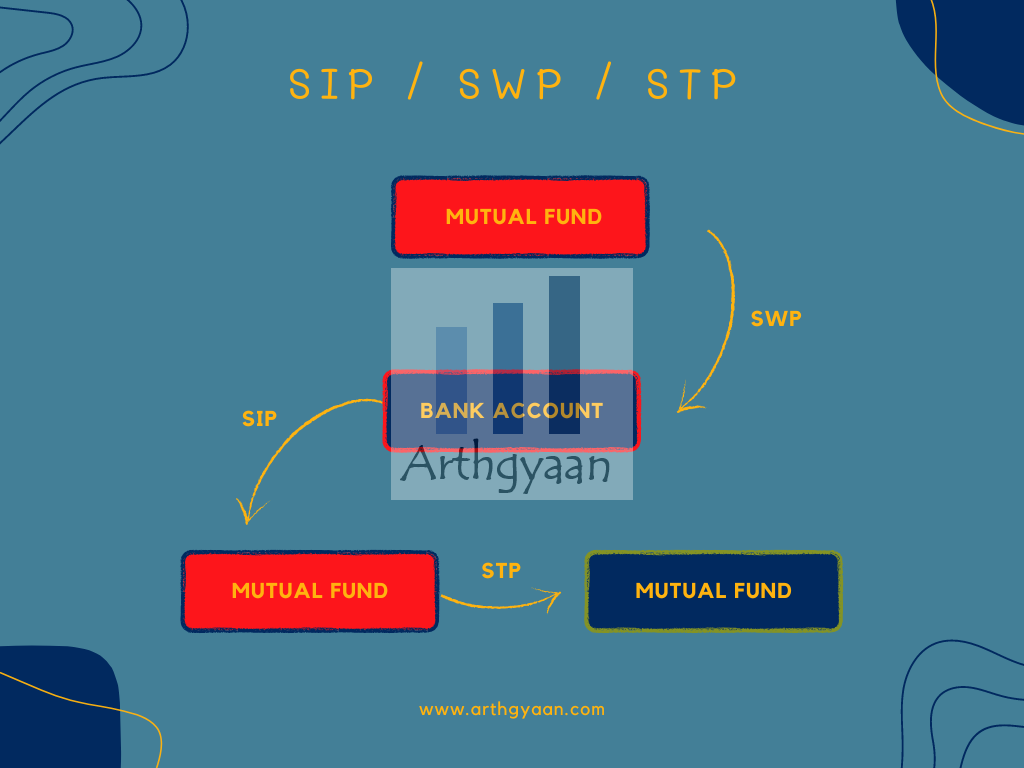

All of these are standing instructions that get executed as per a schedule you specify:

A SIP is an instruction to a mutual fund to deduct from your bank account, typically every month, to invest in a mutual fund. The amount invested stays the same every month.

A step-up SIP is one where the monthly amount invested increases, say by 5% or 10%, after a year every year until you stop the SIP.

You can see how the monthly amounts in a SIP and step-up SIP change like this:

| Year | SIP | 10% Step-up SIP |

|---|---|---|

| 1 | 1,000 | 1,000 |

| 2 | 1,000 | 1,100 |

| 3 | 1,000 | 1,210 |

| 4 | 1,000 | 1,331 |

| 5 | 1,000 | 1,464 |

We have covered the basics of a step-up SIP in detail in the link below:

You can use this calculator:

Total Investment (₹):

Total Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

If you found this useful, check out the Arthgyaan step-up SWP calculator.We have a data set for rolling returns: What are rolling returns of SIP and a lump sum of direct mutual funds?

Using that data set, in the table below, we show the median portfolio values for various equity mutual fund categories, for a 5 or 7-year SIP versus a 10% step-up SIP. The date range is January 2013 to June 2024.

| Category | Any 5y SIP | Any 5y SIP 10% step-up | Any 7y SIP | Any 7y SIP 10% step-up |

|---|---|---|---|---|

| Contra Fund | 690,724 | 1,122,015 | 942,211 | 2,044,404 |

| Dividend Yield Fund | 669,417 | 1,075,894 | 897,589 | 1,907,030 |

| ELSS | 682,739 | 1,077,367 | 904,398 | 1,895,113 |

| Flexi Cap Fund | 669,815 | 1,077,407 | 905,883 | 1,884,933 |

| Focused Fund | 692,468 | 1,079,890 | 907,854 | 1,902,881 |

| Large & Mid Cap Fund | 710,246 | 1,110,161 | 932,652 | 1,935,861 |

| Large Cap Fund | 646,426 | 1,024,039 | 858,869 | 1,783,235 |

| Mid Cap Fund | 751,573 | 1,175,645 | 989,243 | 2,097,582 |

| Multi Cap Fund | 732,906 | 1,189,131 | 1,002,543 | 2,155,172 |

| Sectoral/Thematic | 694,962 | 1,103,567 | 927,140 | 1,901,144 |

| Small Cap Fund | 853,889 | 1,379,051 | 1,173,391 | 2,316,132 |

| Value Fund | 689,919 | 1,086,240 | 908,994 | 1,870,727 |

Here, the SIP amount is ₹10,000 per month and increases, in the step-up case, by 10% a year.

In each of the cases, the portfolio with the step-up SIP is higher than the case with the fixed SIP.

Let’s look into a simple 10% step-up SIP like this:

| Year | SIP | 10% Step-up SIP |

|---|---|---|

| 1 | 1,000 | 1,000 |

| 2 | 1,000 | 1,100 |

| 3 | 1,000 | 1,210 |

| 4 | 1,000 | 1,331 |

| 5 | 1,000 | 1,464 |

Readers should recognize that this is a very simple combination of:

So there are two things to note:

The table below shows the step-up versus fixed SIP investment amount for a ₹10,000/month starting value. We have arranged the table in increasing order of invested amount.

| Type Of Investment | Total invested |

|---|---|

| 1y SIP | 120,000 |

| 1y SIP 10% step-up | 120,000 |

| 2y SIP | 240,000 |

| 2y SIP 10% step-up | 252,000 |

| 3y SIP | 360,000 |

| 3y SIP 10% step-up | 397,200 |

| 5y SIP | 480,000 |

| 7y SIP | 600,000 |

| 10y SIP | 720,000 |

| 5y SIP 10% step-up | 732,612 |

| 7y SIP 10% step-up | 1,138,461 |

| 10y SIP 10% step-up | 1,912,491 |

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Does a step-up SIP provide a higher return than an ordinary SIP? first appeared on 14 Jul 2024 at https://arthgyaan.com