Tata Nifty India Tourism Index Fund: should you invest?

This article discusses the NFO of the Tata Nifty India Tourism Index Fund which is the first fund tracking the Nifty Tourism Index.

This article discusses the NFO of the Tata Nifty India Tourism Index Fund which is the first fund tracking the Nifty Tourism Index.

Disclaimer: Image(s) from the Tata Mutual fund website is used for representational purposes only.

This article is a part of our detailed article series on new fund offerings (NFOs) in India. Ensure you have read the other parts here:

This article discusses a new offering by HSBC Mutual Fund focusing on companies in the Export sector.

This article discusses the NFO of the Bandhan Nifty Total Market Index Fund which is the second fund tracking the Nifty Total Market Index.

This article discusses the NFO of the Motilal Oswal Nifty Defence Index Fund which is the second fund tracking the Nifty Defence Index.

A new Fund of Fund wants to capture the alpha from innovative technology companies globally. Should you invest?

This post discusses new Real Estate feeder funds being launched in India and whether investors should invest in such funds.

This post discusses new Blockchain feeder funds being launched in India and whether investors should invest in such funds.

TATA Asset Management has launched an NFO for an index (passive) mutual fund tracking the Nifty Tourism Index in July 2024.

This fund is an index fund that passively tracks the Nifty Tourism Index. The Nifty Tourism Index is an index (like the SENSEX or Nifty 50) tracking the Tourism and Hospitality sectors in India.

The NFO period for this fund was from July 8 to July 19, 2024.

As per the index factsheet, the index details are as follows:

| Metric | Description |

|---|---|

| Methodology | Free float-Weighted |

| No. of Constituents | 17 |

| Launch Date | Jun 18, 2024 |

| Base Date | April 01, 2005 |

| Base Value | 1000 |

| Calculation Frequency | End of day |

| Index Rebalancing | Semi-Annually |

| Year | NSE Indices |

|---|---|

| 2013 | 36 |

| 2014 | 38 |

| 2015 | 48 |

| 2016 | 57 |

| 2017 | 69 |

| 2018 | 76 |

| 2019 | 78 |

| 2020 | 77 |

| 2021 | 87 |

| 2022 | 94 |

| 2023 | 104 |

| 2024 | 107 |

NSE makes money by creating indices and licensing that data to AMCs to launch index funds, ETFs, and other mutual funds tracking the index. It is such a great business that the number of indices published by NSE has increased three times from Jan-2013 to Jan-2024.

NSE has launched this index for investors to take advantage of the post-COVID boom in travel, tourism, hospitality and restaurant businesses.

If you look at the top 10 stocks in the Nifty Tourism Index, it is full of well-known travel and hospitality brands:

| Stock | Weightage % | Selected Brand(s) |

|---|---|---|

| InterGlobe Aviation Ltd. | 20.31 | Indigo |

| Indian Hotels Co. Ltd. | 19.26 | Taj |

| Indian Railway Catering And Tourism | 13.31 | IRCTC |

| GMR Airports Infrastructure Ltd. | 10.57 | DEL/HYD Airports |

| Jubilant Foodworks Ltd. | 9.54 | Dominos Pizza, Dunkin’ Donuts |

| EIH Ltd. | 4.04 | Oberoi, Trident |

| Lemon Tree Hotels Ltd. | 3.13 | Lemon Tree |

| Sapphire Foods India Ltd. | 3.01 | KFC, Pizza Hut, Taco Bell |

| Devyani International Ltd. | 2.90 | KFC, Pizza Hut, Taco Bell |

| Westlife Foodworld Ltd. | 2.49 | McDonald’s |

Warning: With 73% weightage to the Top 5 stocks and 88% weightage to the Top 10, this is not a diversified index. The performance impact of the Top 5, which are composed of well-known brands, will be the maximum.

As per the index factsheet, the stocks in Nifty Tourism Index are as follows

| Company Name | Industry | Symbol |

|---|---|---|

| BLS International Services Ltd. | Consumer Services | BLS |

| Chalet Hotels Ltd. | Consumer Services | CHALET |

| Devyani International Ltd. | Consumer Services | DEVYANI |

| EIH Ltd. | Consumer Services | EIHOTEL |

| Easy Trip Planners Ltd. | Consumer Services | EASEMYTRIP |

| GMR Airports Infrastructure Ltd. | Services | GMRINFRA |

| Indian Hotels Co. Ltd. | Consumer Services | INDHOTEL |

| Indian Railway Catering And Tourism Corp | Consumer Services | IRCTC |

| InterGlobe Aviation Ltd. | Services | INDIGO |

| Jubilant Foodworks Ltd. | Consumer Services | JUBLFOOD |

| Lemon Tree Hotels Ltd. | Consumer Services | LEMONTREE |

| Mahindra Holidays & Resorts India Ltd. | Consumer Services | MHRIL |

| Restaurant Brands Asia Ltd. | Consumer Services | RBA |

| Safari Industries (India) Ltd. | Consumer Durables | SAFARI |

| Sapphire Foods India Ltd. | Consumer Services | SAPPHIRE |

| V.I.P. Industries Ltd. | Consumer Durables | VIPIND |

| Westlife Foodworld Ltd. | Consumer Services | WESTLIFE |

The updated list is here: stocks.

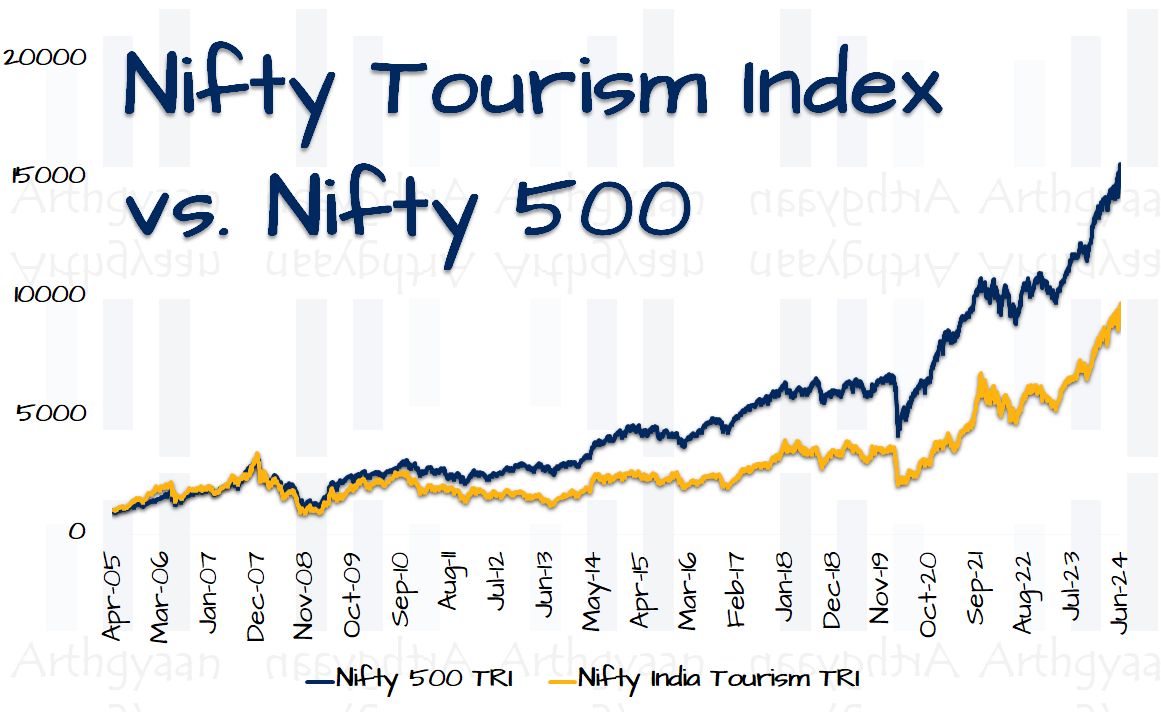

The Nifty Tourism Index was started with a base date of April 01, 2005 and a starting value of 1000. The performance chart below shows how this index has performed versus the broad market index Nifty 500 Total Return Index (total return = price changes plus reinvested dividends):

It is important to note the underperformance prior to 2021 vs. the Nifty 500. We will revisit this point in the rolling excess-return charts.

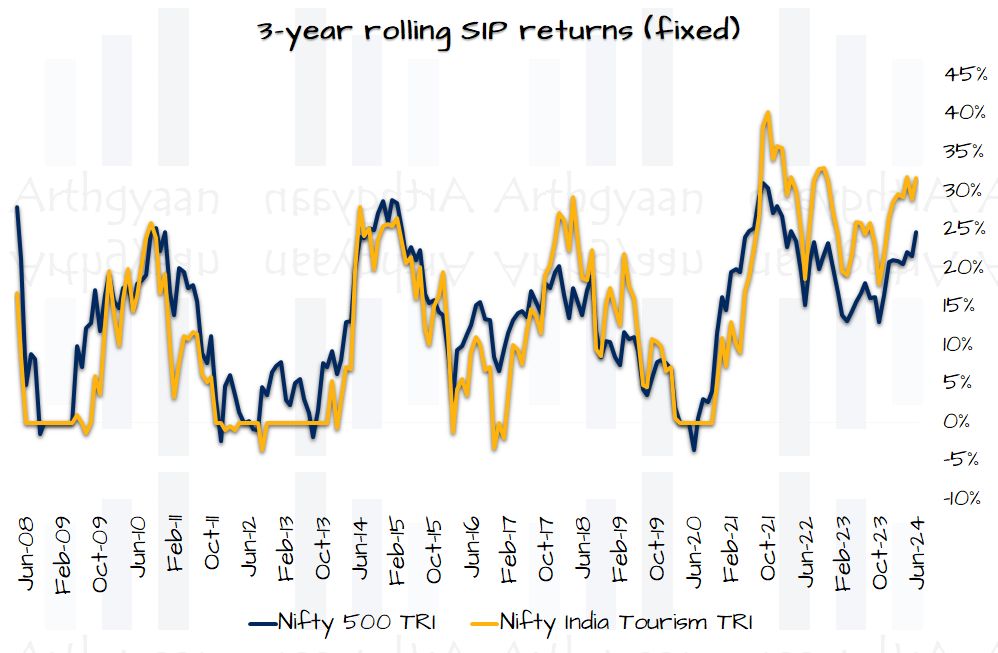

These rolling charts work on a window basis. Each point on the chart is calculated using a 3-year SIP like this:

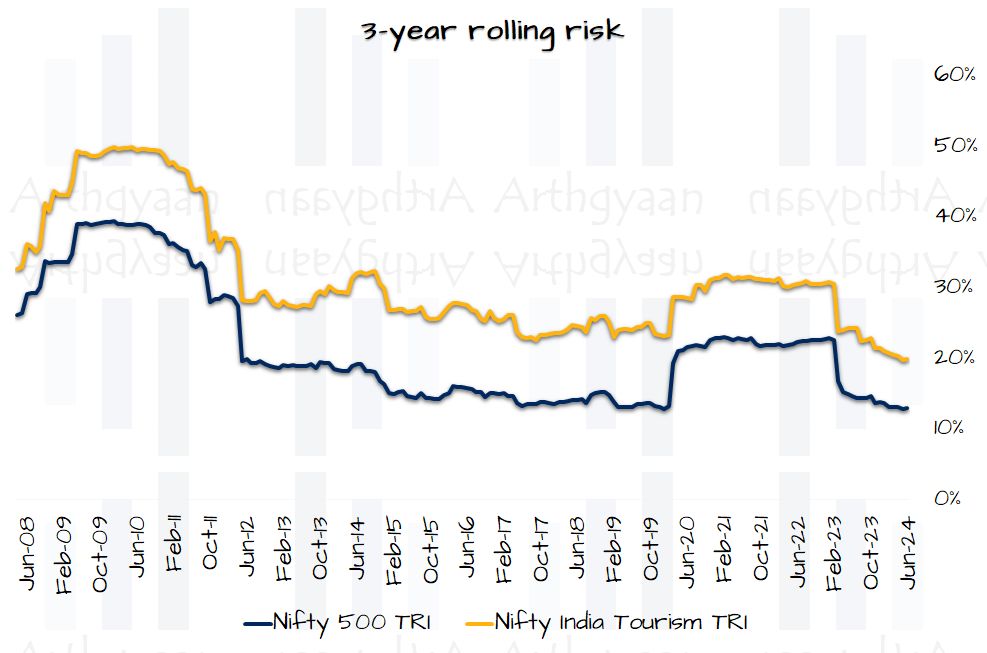

Here, using the same rolling window concept, we have calculated the standard deviation of the monthly returns using 36 months:

The rolling risk chart shows the inherent higher-than-parent volatile nature of the Nifty Tourism Index.

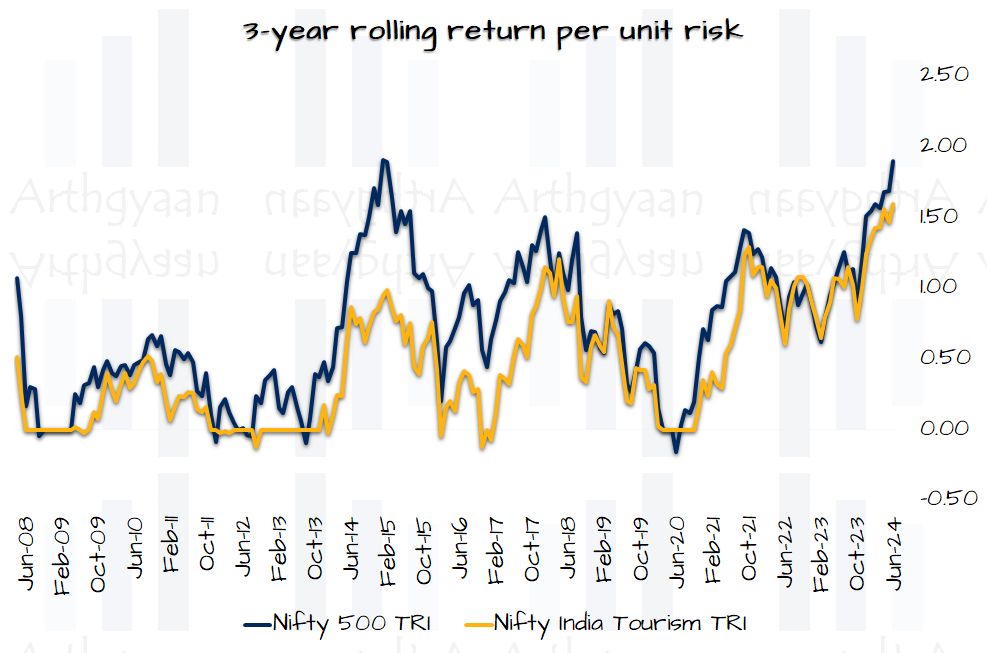

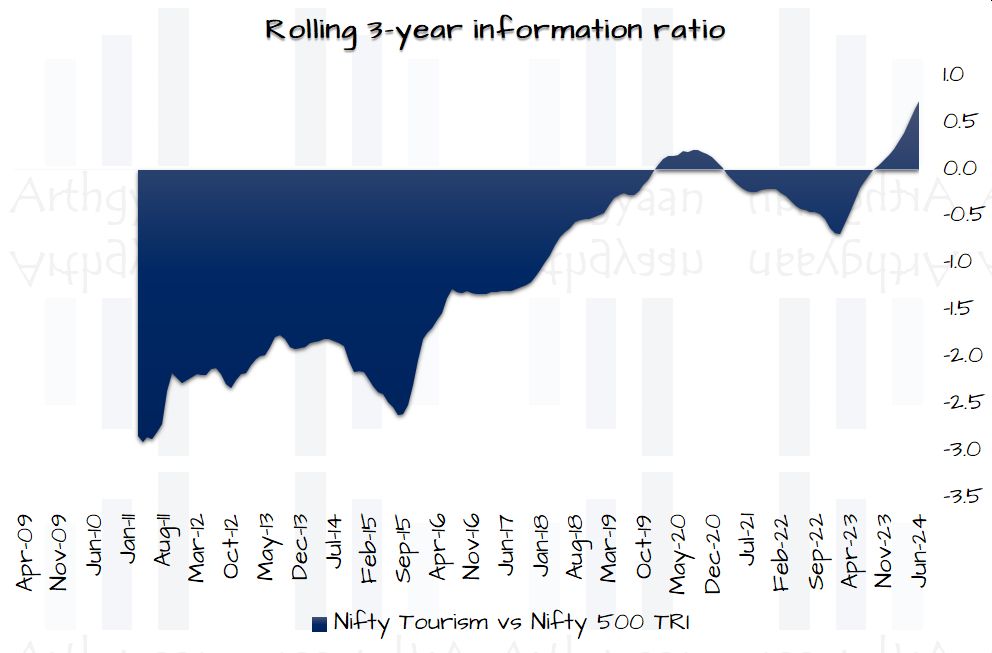

The risk-adjusted returns chart shows that for most of its life, the return per unit risk has been worse vs. the Nifty 500:

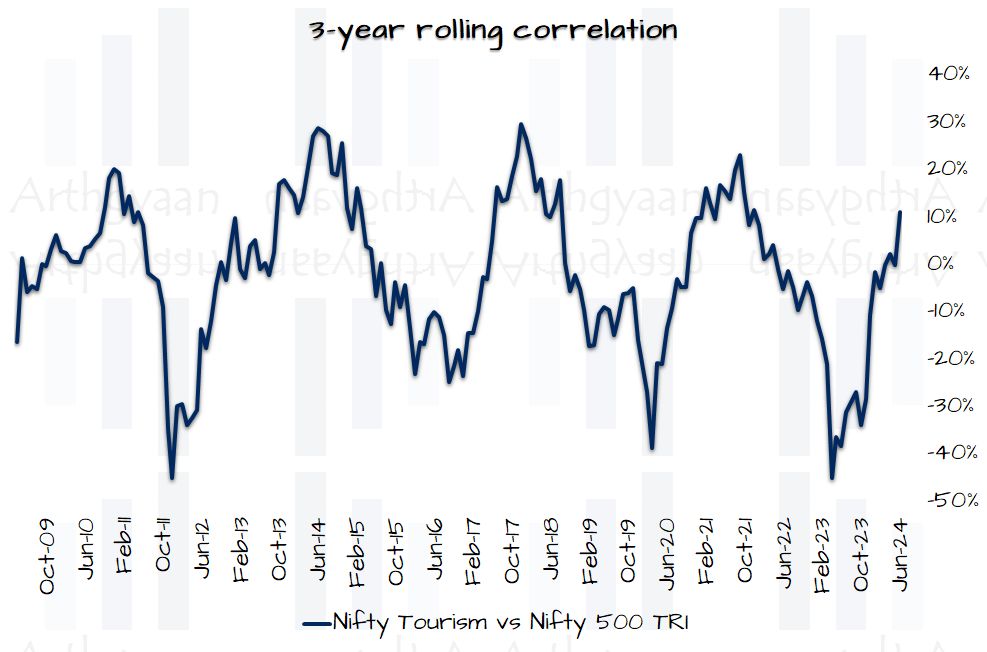

An interesting observation from the rolling correlation (which measures how much the indices are similar to each other) chart:

It was expected, as the rolling correlation chart shows, that these stocks do not move in tandem with the broad Nifty 500 Index.

To understand how to use data to understand if this NFO is good or not:

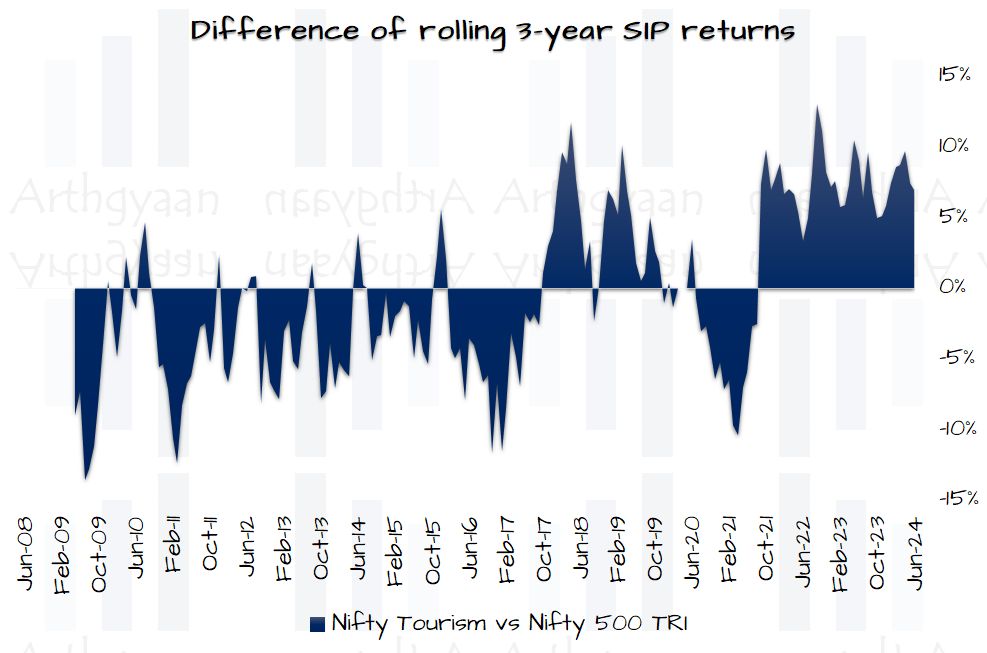

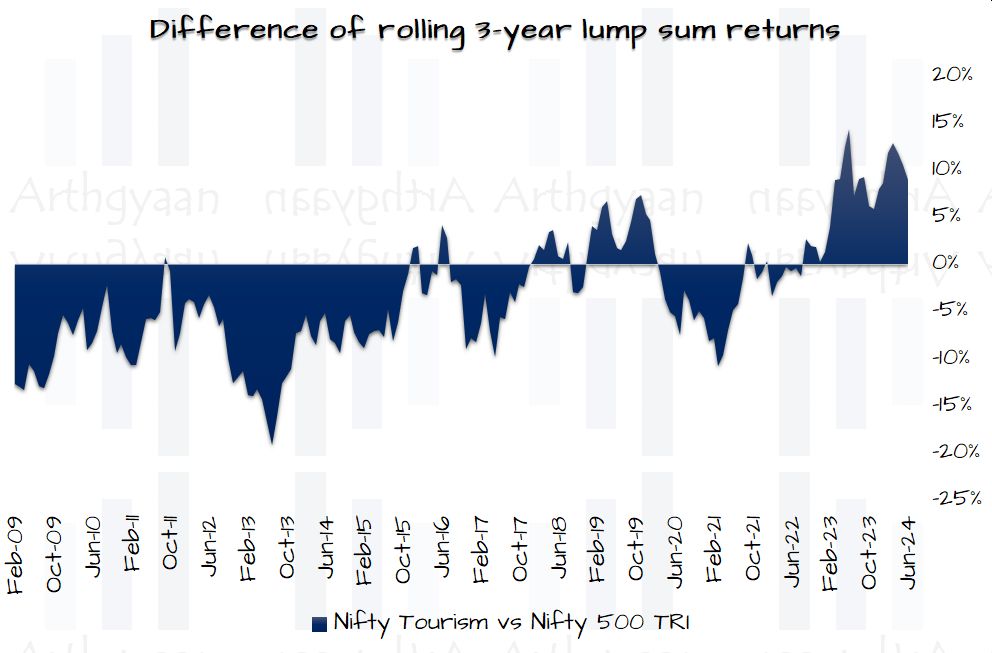

We will show these charts for excess returns of Nifty Tourism Index over the Nifty 500 for both SIP and lump sum as well a chart on information ratio.

These three charts shows the clear reason why this index and NFO have been launched now. After years of marked underperformance, the Tourism and related stocks are finally doing better than the index.

“Investors should remember that excitement and expenses are their enemies.” - Warren Buffett

The recent outperformance of the Nifty Tourism Index vs. the Nifty 500 can be an incentive for the AMC to launch such a fund. However, if you are looking to invest, you need to understand which concept is more appealing to you:

An investor who ticks one or more of the boxes below might consider investing:

☑ A keen follower of the Tourism and related sector news and companies

☑ Willing to invest a substantial portion of the portfolio (say 5% or more) as a satellite portfolio: What is a core-satellite portfolio and when can you use it?

☑ Would understand the inherent risks of theme-based investing

☑ Has research-based conviction on the entry and exit points for this theme

☑ Understands that thematic funds have tendencies of a sudden reversal that can wipe out all gains

An investor who ticks one or more of the boxes below should not invest:

☑ Interested in this theme now that the index (and funds) exist

☑ Attracted by the recent high returns of this theme

☑ Has not done due diligence beyond reading about this index and funds online

☑ Will be investing a very small amount or will start a small SIP. Both indicate a lack of conviction and lead to portfolio clutter: How to clean up your mutual fund portfolio?

☑ Disagrees with the Warren Buffett quotation above

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Tata Nifty India Tourism Index Fund: should you invest? first appeared on 10 Jul 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.