HSBC India Export Opportunities Fund: Should you invest?

This article discusses a new offering by HSBC Mutual Fund focusing on companies in the Export sector.

This article discusses a new offering by HSBC Mutual Fund focusing on companies in the Export sector.

This article is a part of our detailed article series on new fund offerings (NFOs) in India. Ensure you have read the other parts here:

This article discusses the NFO of the Tata Nifty India Tourism Index Fund which is the first fund tracking the Nifty Tourism Index.

This article discusses the NFO of the Bandhan Nifty Total Market Index Fund which is the second fund tracking the Nifty Total Market Index.

This article discusses the NFO of the Motilal Oswal Nifty Defence Index Fund which is the second fund tracking the Nifty Defence Index.

A new Fund of Fund wants to capture the alpha from innovative technology companies globally. Should you invest?

This post discusses new Real Estate feeder funds being launched in India and whether investors should invest in such funds.

This post discusses new Blockchain feeder funds being launched in India and whether investors should invest in such funds.

On 31st July 2024, HSBC Asset Management filed a draft application with SEBI for a mutual fund tracking export-oriented stocks in India. This is not a New Fund Offer (NFO) yet. Once SEBI approves it, the NFO will be launched by HSBC in due course. As per the draft filing, the fund is suitable for investors seeking:

Investment predominantly in equity and equity-related securities of companies engaged in or expected to benefit from the export of goods or services.

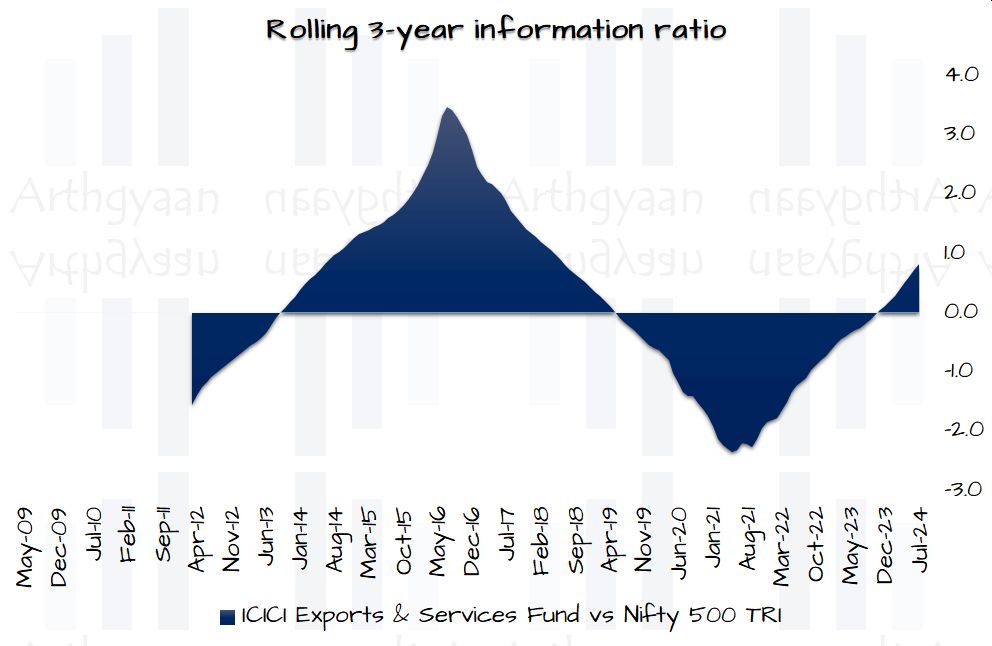

The fund benchmark is Nifty 500 TRI Index. There are limited funds in the market tracking this particular theme. Only ICICI has a similar offering called ICICI Export & Services Fund, which we will analyse versus the benchmark Nifty 500 TRI Index.

The investment objective of ICICI Export & Services Fund says:

To generate capital appreciation and income distribution to unit holders by investing predominantly in equity/equity-related securities of the companies belonging to the Exports and Services industry.

Source: https://www.icicipruamc.com/mutual-fund/equity-funds/icici-prudential-exports-and-services-fund/112

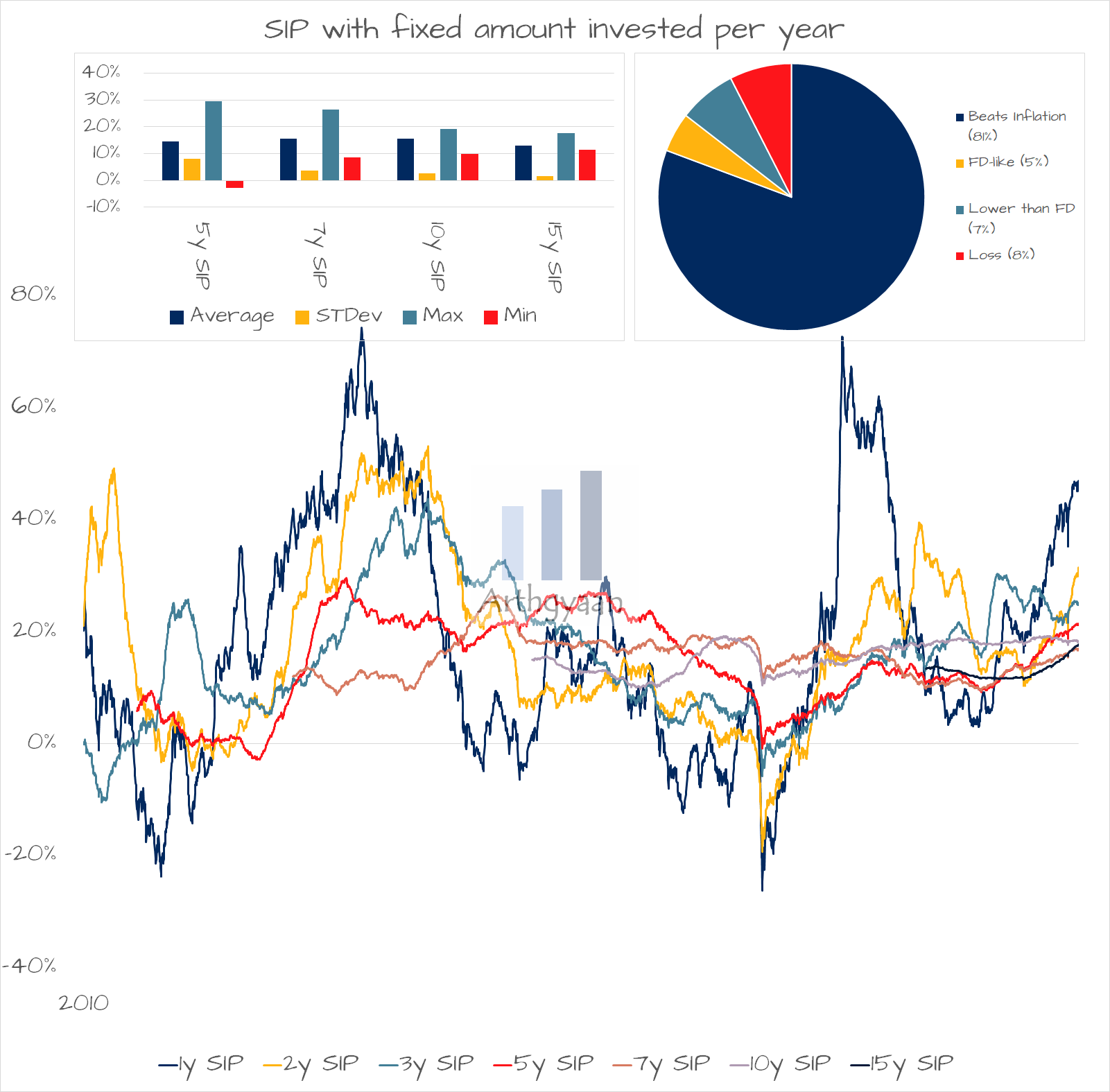

We have used data from AMFI to prepare a snapshot of the historical performance of ICICI Export & Services Fund.

To understand how to use data to determine if this fund is good or not:

We use the information ratio here to capture relative performance versus the benchmark in one convenient metric.

As the chart shows, there is a recent, albeit small, improvement in the information ratio, indicating that investors should look at this sector in more detail.

“Investors should remember that excitement and expenses are their enemies.” - Warren Buffett

The recent outperformance of the export theme (as per the ICICI Export & Services Fund fund) versus the Nifty 500 can be an incentive for the AMC to launch such a fund. However, if you are looking to invest in the HSBC India Export Opportunities Fund, it is too early since we don’t know the portfolio. Instead, ICICI Export & Services Fund is a more practical alternative to get exposure to the theme.

An investor who ticks one or more of the boxes below might consider investing:

☑ A keen follower of the export-oriented sector news and companies

☑ Willing to invest a substantial portion of the portfolio (say 5% or more) as a satellite portfolio: What is a core-satellite portfolio and when can you use it?

☑ Would understand the inherent risks of theme-based investing

☑ Has research-based conviction on the entry and exit points for this theme

☑ Understands that thematic funds have tendencies of a sudden reversal that can wipe out all gains

An investor who ticks one or more of the boxes below should not invest:

☑ Has not done due diligence beyond reading about this fund online

☑ Will be investing a minimal amount or will start a small SIP. Both indicate a lack of conviction and lead to portfolio clutter: How to clean up your mutual fund portfolio?

☑ Is an active NFO investor, which would mean dilution of the monthly investment surplus into many different funds

☑ Disagrees with the Warren Buffett quotation above

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled HSBC India Export Opportunities Fund: Should you invest? first appeared on 01 Aug 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.