What is a core-satellite portfolio and when can you use it?

A core-satellite portfolio combines two different portfolio styles to give the best of both worlds.

A core-satellite portfolio combines two different portfolio styles to give the best of both worlds.

A core-satellite portfolio (CSP henceforth) consists of a passive core of low cost, diversified index funds (70-100%) combined with an active satellite (0-30%) of concentrated and likely higher expense investments.

The CSP approach is unsuitable for all investors based on their risk profile. Therefore, only investors with the high risk-taking ability and willingness and generally high levels of investment knowledge/experience (not aggressiveness) should implement the satellite portfolio. The rest should stick to 100% core without any satellite component.

Depending on the risk profile, the following core to satellite proportion can be considered:

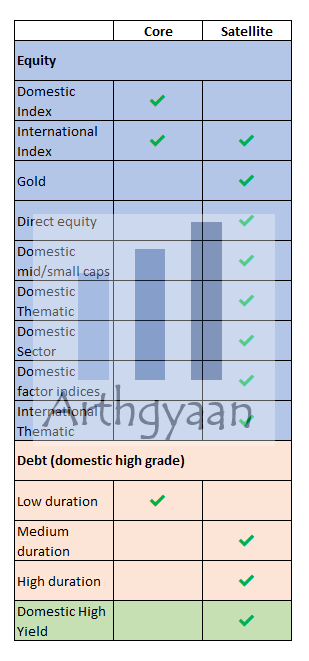

The premise of the core is low-cost diversification. For equity, domestic market-cap weighted index funds (tracking indices like the Nifty 50, Nifty Next 50 or the Nifty 500) and international index funds tracking the S&P500 or MSCI World indices are good candidates for inclusion here. For debt, high grade (AAA, A1+, SOV or Cash) and low duration (Duration <=1 year) domestic bond funds (see here) are suitable choices for this category. The composition of the core portfolio is mostly fixed (as per the strategic asset allocation) and maybe rebalanced using a calendar approach (once every six months or one year). While the core portfolio is not a fit-and-forget type portfolio, it requires less construction and maintenance effort than satellites. See this detailed post on constructing the core portfolio.

The satellite portfolio balances a desire to get higher risk-adjusted returns at reasonable costs. For equity, you can include domestic and international thematic and sectoral funds and factor indices (value, quality, momentum, low volatility, dividend). For debt, you can choose high-grade medium and high duration funds tracking bond indices (5 years or 10-year GSecs) or even domestic high yield (based on economic conditions). Exposure to commodities like gold can also be a part of the satellite portfolio. However, you must take care to keep the total expense ratio of the satellite portfolio at reasonable levels relative to the expected returns.

A close watch on the correlations of these assets with each other and the central core portfolio needs to be kept. Rebalancing will have to be frequent to take advantage of opportunities and within tight corridors. This will lead to higher transaction costs compared to the core portfolio.

An alternative reasoning as to why you should consider sectors or themes only as a part of the satellite portfolio is explained here: What does the 1983 World Cup win teach us about investing?

Satellite portfolios are best implemented if all the following conditions are true:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is a core-satellite portfolio and when can you use it? first appeared on 13 Jun 2021 at https://arthgyaan.com