What is the best way to invest in gold?

This post answers the question of how and whether investors should include gold in their portfolios.

This post answers the question of how and whether investors should include gold in their portfolios.

Whether for making jewellery, storing it as family wealth or as a part of an investment portfolio, Indians are amongst the world’s largest consumers of gold. Gold, while it has some industrial usage, has limited utility beyond making jewellery. A famous quotation by Warren Buffet regarding the utility of gold is this:

It gets dug out of the ground in Africa, or some place. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head. - Warren Buffet (1998)

Gold does not generate any income, unlike assets like stocks (via dividends), bonds (via coupons), real estate (via rent) or fixed deposits (via interest). Given how recurring cash flows like in the cases above are used to value assets like stocks, bonds and real estate, there is no way to value gold beyond hoping for a buyer to buy it at a higher price in the future. We will skip discussions on gold value and inflation in this post since we compare returns to a stock portfolio.

Inflation: the impact on your goals and how to choose assets that beat it

This post, apart from enumerating various options for buying gold in India, will answer the question of how much gold should be included in the investment portfolio, if at all. The time scale for this investment is in the scale of decades as a part of the goals like retirement, which can easily span 60+ years. Therefore, we will ignore short-term considerations like the outlook for gold in the next few months or years.

Depending on the purpose, gold is available for purchase in multiple forms.

SGB is a piece of paper issued (in digital form) by the Government of India with the following features. For every unit of SGB purchased, the investor will:

SGB issuance aims to reduce gold imports since the SGB is not backed by physical gold. Instead, the government gives two guarantees on SGB: payment of 2.5% interest and returning money as per the prevailing gold price at maturity. However, as evident from the description, the principal is not protected since gold prices can fall below the value at the time of issuance.

SGB is well-suited if

There is no guarantee that SGB as a product will exist in the future once the currently active issues mature. If the plan is to hold gold for decades, you need to find an alternative investment that tracks the price of gold if SGB is not available. If SGB is available once your investment matures and your purpose is served, then you can roll your investment into another series of SGB.

Tax on SGB is calculated like this:

Today, multiple channels are offering digital gold starting at ₹ 1. This gold is stored with a custodian who guarantees that the gold is owned and stored safely. Taxation depends on when the gold is sold, i.e. holding period, and 3% GST is payable on purchase. In addition, some platforms offer delivery of physical gold, for a fee, upon redemption. However, the gold is automatically redeemed after ten years, and a fee is payable for storage costs after five years.

SEBI does not regulate this mode of gold investing and recently (on 21-Oct-2021) banned registered investment advisers to deal in unregulated products like digital gold. This circular follows a ban in September 2021 on stockbrokers allowing investments in digital gold. Therefore, retail investors should perform adequate due diligence before investing in digital gold.

Jewellers and other entities sell physical gold bars, coins, and biscuits of varying quality. It is the investor’s prerogative to keep it safe until sold or converted into jewellery. If the objective is to buy jewellery at a future date, purchasing physical gold in small amounts is a viable alternative, provided you have a way to store it. You need to check the applicability of GST on the purchase value.

Paper gold is the name given to gold available as mutual funds and ETFs. Like stock/debt funds and ETFs, these are mutual funds that invest in gold instead of stocks or bonds. Typically these gold funds are fund-of-funds holding the ETFs of the same AMC. This implies that the expense ratio of these funds includes that of the ETF. However, most ETFs in India suffer from poor liquidity and significant variations of their price from the NAV. Therefore investors will be better off directly investing in the gold fund and not the ETF. A mutual fund, unlike the ETF, offers investment in SIP form and lumpsum investments of any amount without requiring a Demat account. Taxation depends on the holding period: at slab rates before 36 months or 20% rate with indexation beyond that.

The above discussion can be summarized as:

| Paper | Digital | SGB | Physical | |

|---|---|---|---|---|

| SEBI Regulations | Yes | No | N/A, sovereign guarantee | N/A |

| Ongoing cost | TER, Brokerage | Storage cost from 5th year | 2.5% interest benefit | None |

| Purchase cost | None | 3% GST | ₹50 online discount to gold price | 3% GST |

| Ticket size | Typically ₹1000 onwards | Any amount | 1gm to 4Kg equivalent | Any |

Gold is a USD denominated asset since India imports most of its gold. Hence the global price of gold in USD and the rupee-USD exchange rate drives the price of gold in India.

We have taken data from 1973 to date (October 2021) to show gold price movement vs US (MSCI US Index) and Indian stocks (Sensex since 1979) along with the USDINR exchange rate.

The table below shows the return and risk of gold, stocks and USDINR FX rate for the last 15 years.

The chart shows price performance from 1973. During this time, gold in USD has given a CAGR of 7%, while the rupee has depreciated on an average of 4.7%/year vs the USD. This has led to a 12% return in the gold price since 1973 in India. You should compare this to a 7.6% CAGR in US stocks and 16.1% in India for Sensex.

However, this return has come at the cost of significant drawdowns for both stocks and gold. Thus, the conclusion from these two charts should be that the returns of gold are comparatively less than the risk you take in price fluctuations.

We take rolling returns/risk (geometric mean divided by the standard deviation for 36 monthly returns) for major regions since 2002 (240 data points).

As the trends show

We examine the second conclusion (opposite return trend of gold vs stocks) in the following chart on correlation.

Correlation is a statistical measure used to check how two different assets, like stocks and gold, move together. Correlation, which is a number from -1 to 1, is used to construct a portfolio:

This chart of correlations of gold (in USD) vs stocks (US and India) in the top and rolling stock returns at the bottom shows a low correlation of gold vs stocks in all market conditions.

Risk reduction or downside protection is a crucial driver of diversifying stock portfolios by adding gold. The above conclusion of low correlations of gold with a stock portfolio implies that adding gold to a stock portfolio with regularly rebalancing has benefits of risk reduction that we will now examine.

Using data since 2000, we compare the result of running a 10-year SIP in Indian markets (represented by Sensex) and consider adding gold (in INR) with yearly rebalancing. The SIP is increased by 10% yearly as a step-up SIP. In addition, 2% is removed from the portfolio on every rebalancing event to simulate the impact of taxes. There are 142 such 10-year windows (each of 120 months) in this period.

We will plot four metrics:

A single case is shown below.

In this particular sequence of returns, the portfolio with 50:50 allocation to Indian stocks and gold has been underwater in only 13 out of 120 months. In addition, the portfolio has made money in these ten years with ending NAV above the starting value of 10.

The charts show three cases: a portfolio of only Indian stocks, only gold and a 50:50 mix of the two. Note that the USDINR exchange rate has impacted all the results. The impact of the exchange rate is unpredictable. This impact should be kept in mind when constructing a portfolio with gold in it.

We see that being underwater is high with both Indian stocks and gold when 100% is allocated, but adding gold to stocks reduces this probability. This implies that adding gold minimises the chance that the portfolio loses money over time.

We see that returns from gold have fallen over time vs stocks, with stocks giving higher returns in the recent past. However, a mixed portfolio has given intermediate returns throughout the period. Note that a mixed portfolio will incur taxes due to rebalancing that will significantly impact returns. However, the NAV chart shows a more robust trend that the mixed portfolio has underperformed both pure stock and gold portfolios.

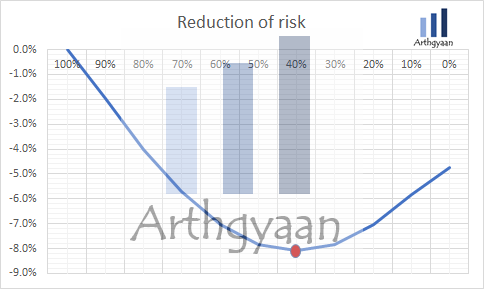

We see that both stocks and gold are volatile by themselves. Still, risk reduction by diversifying with gold is an unambiguous result. As the chart below shows, as the proportion of Indian stocks reduces in the portfolio, the overall portfolio risk reduces first and then increases beyond a threshold (40% stocks, 60% gold in this case).

The chart below summarises the result of adding gold (INR denominated) to a portfolio that tracks the Sensex. Each data point is an average of the results over 142 ten-year windows for each metric. NAV is on the right axis, while the rest is on the left axis for readability.

We see that adding gold reduces both the risk and return of the portfolio at first. Then the return (NAV and XIRR) progressively increase, and the risk reduces until 50% stock proportion is reached. Then the trend reverses. Does this mean that a 50:50 mix is optimal for stocks and gold?

To answer that, we will consider removing the effect of the rupee-dollar exchange rate and repeating the same calculation with gold in USD added to a portfolio of Sensex stocks. The result is shown below:

We now see a different result with only the trend of risk reduction with adding gold, up to a limit, being the same. The return metrics (underwater probability, NAV and XIRR) all deteriorate with the addition of gold. This result shows a dependency on the exchange rate. The results of adding gold to the portfolio will be heavily influenced by how the exchange rate behaves in the future.

We should keep in mind that these are trends that have been observed in historical data. The future may turn out to be entirely different from what these trends show. Therefore, the investor must keep a close eye on portfolio attributes like risk-adjusted return and rolling correlations to ensure that the portfolio does not deviate far from expectations.

Investors may consider adding gold to their portfolio of Indian stocks only if

As a percentage of the total equity portfolio, investors should choose the proportion allocated to gold as per the desired amount of risk reduction in this chart, repeated below for convenience.

Based on the discussion above, there are two options for investing as part of a portfolio: SGB and Gold Mutual funds since ETF, physical and digital gold are unsuitable alternatives. We will use the RRTTLLU framework for understanding these two options:

| Metric | SGB | Gold MF |

|---|---|---|

| Return | Very close to gold price; 2.5% coupon | Similar to gold price less TER |

| Risk | Similar to gold price movement | Mostly similar to gold price depending on TER |

| Time | Matures in 8y | Can be held as long as the fund exists |

| Taxes | No tax if held to maturity; taxable otherwise | Taxable based on holding period |

| Legal / Regulatory | Sovereign guarantee | SEBI regulated |

| Liquidity | Illiquid<8y; stock exchange liquidity is low>5y | Highly liquid |

| Unique situations | investment limited to 4Kg equivalent gold | No limits on investments |

Due to the point on liquidity, SGB is unsuitable if rebalancing is to be performed. The investor should choose an SGB and Gold MF ratio (like 50:50) to manage portfolio risk via rebalancing so that enough liquidity is present. This article talks about how to choose a gold mutual fund.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the best way to invest in gold? first appeared on 09 Nov 2021 at https://arthgyaan.com