How to accumulate gold for a child's wedding without buying SGB?

This article gives the solution for buying small amounts of gold over the years in case buying SGB is not an option.

This article gives the solution for buying small amounts of gold over the years in case buying SGB is not an option.

This article is a part of our detailed article series on accumulating gold over time for a child's wedding in the future. Ensure you have read the other parts here:

This article shows you how to buy gold in small amounts over years for a child’s wedding goal.

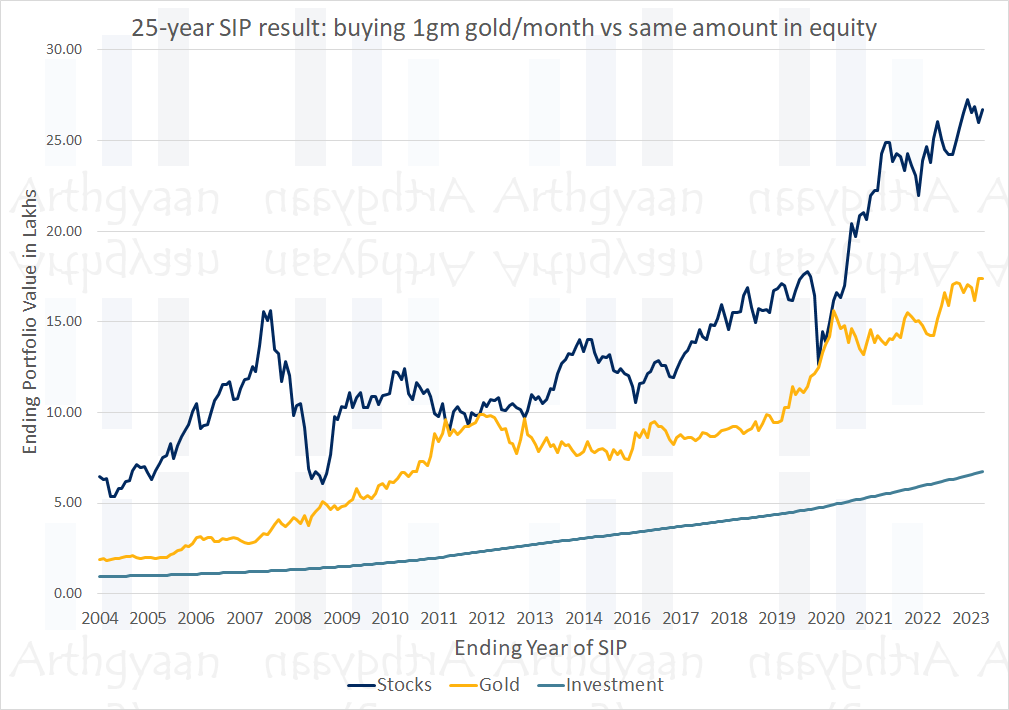

The article shows you if you there is a better alternative to buying gold over time for your child’s marriage goals.

This article is Part 2 of our post on purchasing gold over the years for a child’s wedding. You can read the previous part here: What is the best way to accumulate gold for your child’s wedding?.

We had concluded that SGB is a good option for this purpose. SGB gives the highest returns of all types of gold investment and is tax-free as we have discussed here: The Ultimate Guide to Which Type of Gold Gives the Best Returns. However, SGB has two main shortcomings that we need to overcome in our hybrid approach:

Also, NRIs are not allowed to invest in SGB. Therefore we need to discuss another solution here.

We will aim to have the highest amount of gold that we can get for our money by

There are 3 main options if you do not want to buy SGB:

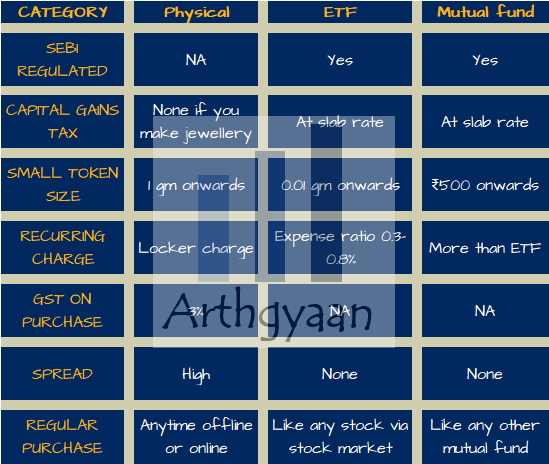

We will not discuss digital gold as a product since it is not SEBI regulated.

Depending on the monthly budget, you can setup a schedule for buying physical gold. Generally, smaller the purchase amount, the higher is the price per gram due to making charges. So if your target is to buy an average 2 grams/month, you will be better off, price-wise, so buy a 10-gram coin every 5 months than two 1-gram coins every month.

There will be 3% GST on each purchase and a spread above that (around 3% more) due to making charge. So if the price of gold is ₹6000/gram, then the price of a biscuit will be at least 6% more i.e. ₹6,300/gram. When you use this gold directly to make jewellery, then there is no tax.

You should know that when you sell gold, you will get that day’s gold price only. The making charge and GST is lost.

This calculator helps you determine the total cost of gold jewellery, including making charges and GST.

You should know that generally jewellery is not suitable for accumulation due to:

What is an ETF?

Here we are interested in ETFs that invest in physical gold bars and are available to purchase in NSE / BSE. The easiest way to buy Gold ETFs for a long-term investment is via a Stock SIP. You can read more on the concept of stock SIP here: What is a stock SIP? Should you have one?.

A gold mutual fund invests in bars of physical gold instead of stocks or bonds. Typical gold mutual funds in India invest in the ETF of the same AMC. Gold mutual funds have their own expense ratio on top of the ETF but are available for purchase at NAV unlike the ETF whose price, that you buy/sell for in the stock exchange, will be different, and usually lower, than the NAV.

We have a guide on choosing gold mutual funds here: How to choose a gold mutual fund?.

Just like SGB, physical gold does not have any tax if you make jewellery out of it. However, both Gold ETFs and mutual funds, though convenient to purchase, will have capital gains tax at slab rates for all units purchased after 1-Apr-2023. You can of course transfer the units to your child who can then sell it themselves and save tax if they are at a lower tax bracket, albeit unlikely, compared to the parent at the time of the wedding.

Therefore, compared to the other choices, buying physical gold for a wedding, over the years, is the better option compared to ETFs and mutual funds.

SGB (Sovereign Gold Bonds) are a good option for long-term goals due to higher returns and tax benefits. However, they have limitations like maturing in 8 years and being digital certificates that need conversion to physical gold.

Three main alternatives to SGB are Physical Gold (Purchasing gold bars, biscuits, or coins, but it may incur higher prices due to making charges), Gold Exchange Traded Funds or ETFs (Traded on stock exchanges, offering investment in physical gold bars) and Gold Mutual Funds (Investing in physical gold bars through mutual funds, subject to an expense ratio).

Depending on the budget, setting up a schedule for purchasing physical gold like bars, biscuits or coins is feasible. Smaller purchases may lead to higher prices per gram due to making charges. There's a GST of 3% on each purchase, plus an additional spread due to making charge.

When selling gold, you'll receive the prevailing day's gold price only, losing the making charge and GST. Jewelry is generally not suitable for accumulation due to lost making charges upon conversion and limitations in buying small amounts regularly.

ETFs are investment funds traded on stock exchanges and can include assets like physical gold bars. Purchasing Gold ETFs through a Stock SIP (Systematic Investment Plan) via your broker is recommended for long-term investment.

Gold mutual funds also invest in physical gold bars but have their own expense ratio on top of the ETF's cost. Unlike ETFs, mutual funds are available for purchase at NAV (Net Asset Value).

Physical gold doesn't have tax implications if used for jewelry. However, Gold ETFs and mutual funds are subject to capital gains tax at slab rates for units purchased after April 1, 2023. Transferring/gifting units to a child may help save tax if they are in a lower tax bracket during sale.

Buying physical gold for a wedding over the years seems a better option compared to ETFs and mutual funds due to tax benefits and potential savings when used for jewelry.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to accumulate gold for a child's wedding without buying SGB? first appeared on 03 Dec 2023 at https://arthgyaan.com