What is a stock SIP? Should you have one?

This article explains the concept of the stock SIP that allows you to buy shares automatically on a regular basis.

This article explains the concept of the stock SIP that allows you to buy shares automatically on a regular basis.

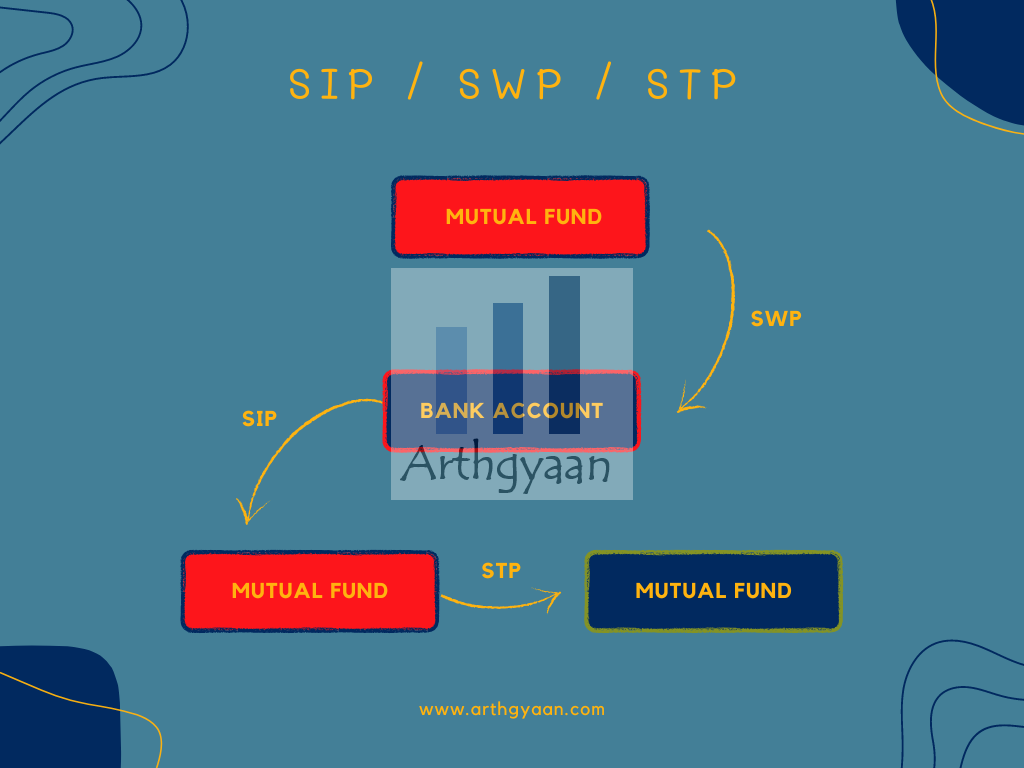

All of these are standing instructions that get executed as per a schedule you specify:

Note: You don’t invest in a SIP; you invest via one since a SIP is a standing instruction. You invest in a mutual fund, or basket of stocks, via a SIP.

In the image above, you can replace the mutual fund with a single or a basket of stocks that you choose and that will become a stock SIP.

A stock SIP gives the same benefits of a SIP in Mutual funds i.e. regular automated investment that ties in with the frequency of your income from salary. Unlike the usual sporadic investment pattern of stock investing, the concept of the stock SIP brings in discipline and regularity to direct equity investments.

A stock SIP should be used whenever you are accumulating a position in a core basket of stocks over time. For example, you are a direct equity investor who has a wish list of 10 “core” stocks to accumulate over time, a stock SIP can be useful here.

If you are buying ETFs for long-term goals, like those tracking Nifty or Gold, then also a stock SIP will act just like a regular mutual fund SIP and serve the same purpose.

Most major brokers in India have the stock SIP functionality. A simple Google search of “broker name stock SIP” will give you all details. Here is a tutorial from Zerodha’s website:

Image ©: Zerodha.com - https://support.zerodha.com/category/trading-and-markets/kite-web-and-mobile/articles/kite-sip-order

The broker website will also have detailed FAQs on this topic.

A stock SIP is a standing instruction to purchase stocks on a regular basis. These purchases are of two types:

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is a stock SIP? Should you have one? first appeared on 22 Nov 2023 at https://arthgyaan.com