Investing in Your 40s and 50s: Why Lump Sum Beats SIP for Mature Investors?

This article explains why seasoned investors with established careers and clear financial goals should consider a more dynamic approach over blindly running SIPs.

This article explains why seasoned investors with established careers and clear financial goals should consider a more dynamic approach over blindly running SIPs.

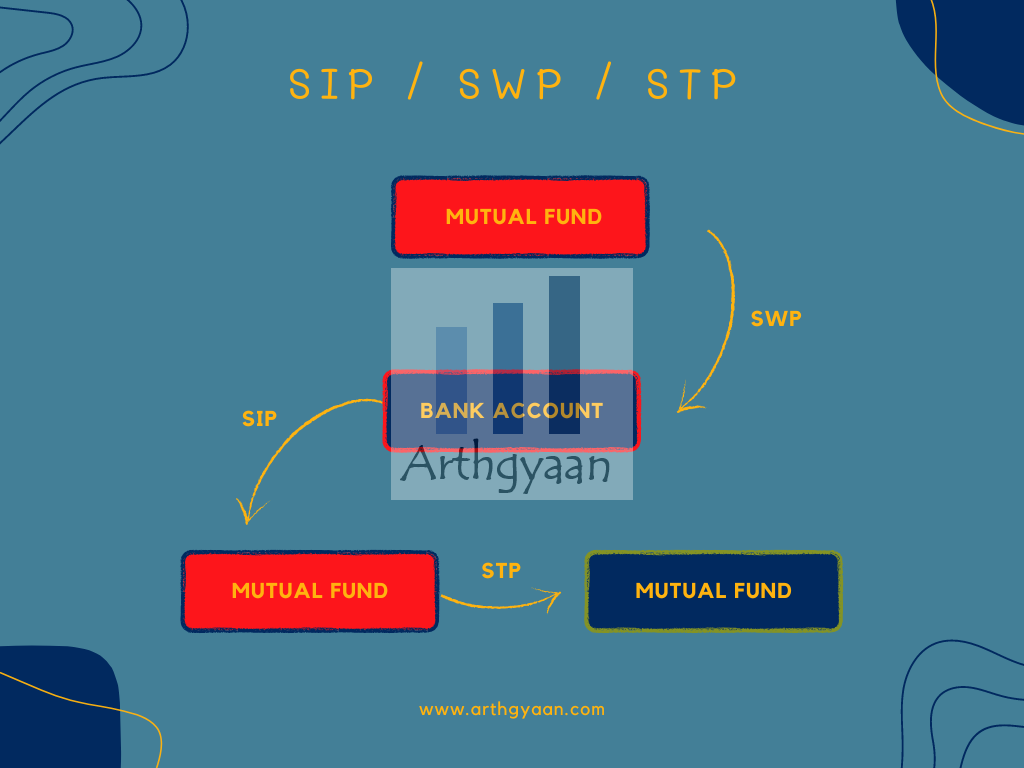

All of these are standing instructions that get executed as per a schedule you specify:

Note: You don’t invest in a SIP; you invest via one since a SIP is a standing instruction. You invest in a mutual fund, or basket of stocks, via a SIP.

There is enough content on both print and social media that implies that all you need to do is start a Systematic investment plan (SIP) in mutual funds. You will be, as per Edward Moore, “rich beyond the dreams of avarice” after 30-40-50 years with 10-20-50 crores.

The narrative of “SIP creates wealth” is so strong that many people believe that SIP itself is a form of investment and not a simple standing instruction from your bank account to purchase a fixed amount of mutual funds regularly.

In this article, we will turn this narrative around and explain how mature investors, those who have reached a certain level in their career and wealth will be better off investing a variable amount manually every month instead of a blind SIP.

There are three characteristics which an investor in their 40s and 50s that distinguish them from those who are younger:

If nothing else, these investors are extremely busy with family and career-related pursuits. Unlike their younger selves, they do not have the time and inclination to follow social media and financial influencers to find the best mutual funds and stocks.

So why should these investors not invest in SIP form?

There are three reasons why the Asset Management Company (AMC) and mutual fund distributors pitch investing in SIP form:

A SIP is by default a set-it-forget-it type of investment mode. If you think back about your SIP, when someone asks how you are investing, you will give a response like “Something is happening” or “my advisor is investing, they are doing something”.

This attitude of your money doing “something”, which you are earning after 15+ years of education and 20+ years of working is a disservice to your past, present and future selves.

A SIP supports the mentality of investors that all you need to do is start a SIP. Once you do that somehow, as long as you are investing in 10-15 best mutual funds, wealth will be automatically created.

Over time three things happen that impact your investments that are happening via SIP:

These events lead to confusion since the investor now wonders where the new amount should be invested:

The framework that we propose below will get rid of this confusion once and for and will allow you better control over the amounts you are investing.

Here we suggest using the weekend after your salary credit date. For those being paid at the beginning of the month, this will be the first weekend of the month. For the rest, it will be the last weekend of the month. At any rate, this weekend is fixed since your salary date is fixed.

We suggest not using any other date since if you are too far from your salary credit date, it will create confusion on the amount to be invested due to uncertainties in expenses over the rest of the month.

How much to invest a month is a question that creates confusion forever. For most people, the answer will be “every rupee that you can spare” unless their financial plan shows them that they are ahead of their major financial goals like financial freedom.

Our answer to this conundrum is simple:

Invest the money that is there in the salary account just before the salary gets credited.

Let us break this down:

You can log in to a portal like Mfcentral.com and invest in your choice of funds. Since you are doing this exercise manually, the propensity to invest in multiple funds which just create clutter will be less.

A lot of investors might get stuck at this point. The answer is simple:

We explain this concept below:

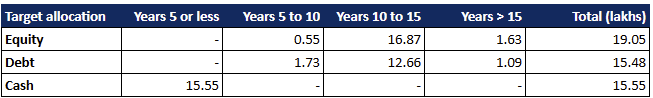

We need a method to divide your entire portfolio into these 12 categories (3 buckets: equity/debt/cash and 4 time-based groups) and allocate the correct amount of mutual funds to each.

The Arthgyaan goal-based investing calculator shows you how to do this by making it easy to see how much of your existing portfolio should go into each bucket and year-based cell as shown in the image above. The detailed concept is explained here: Which are the Best Mutual Fund Categories for every Investment Horizon?

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

This table is in the “goals” tab on the right.

Your investment this month will be in the bucket that does not have enough already invested in it.

This whole process will take no more than 10 minutes every month once you have set up the tool and linked your Mfcentral profile with a mandate to deduct your bank account automatically. Of course, you can pay for every investment via Netbanking as well.

Irrespective of the background, market experience and portfolio size of the investor, following this approach gives you peace of mind since:

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Investing in Your 40s and 50s: Why Lump Sum Beats SIP for Mature Investors? first appeared on 13 Oct 2024 at https://arthgyaan.com