SIP, SWP and STP - what do they mean, which one should you choose and when?

This article demystifies some common jargons of investing in mutual funds by explaining SIP, SWP and STP along with examples of which one to use and when.

This article demystifies some common jargons of investing in mutual funds by explaining SIP, SWP and STP along with examples of which one to use and when.

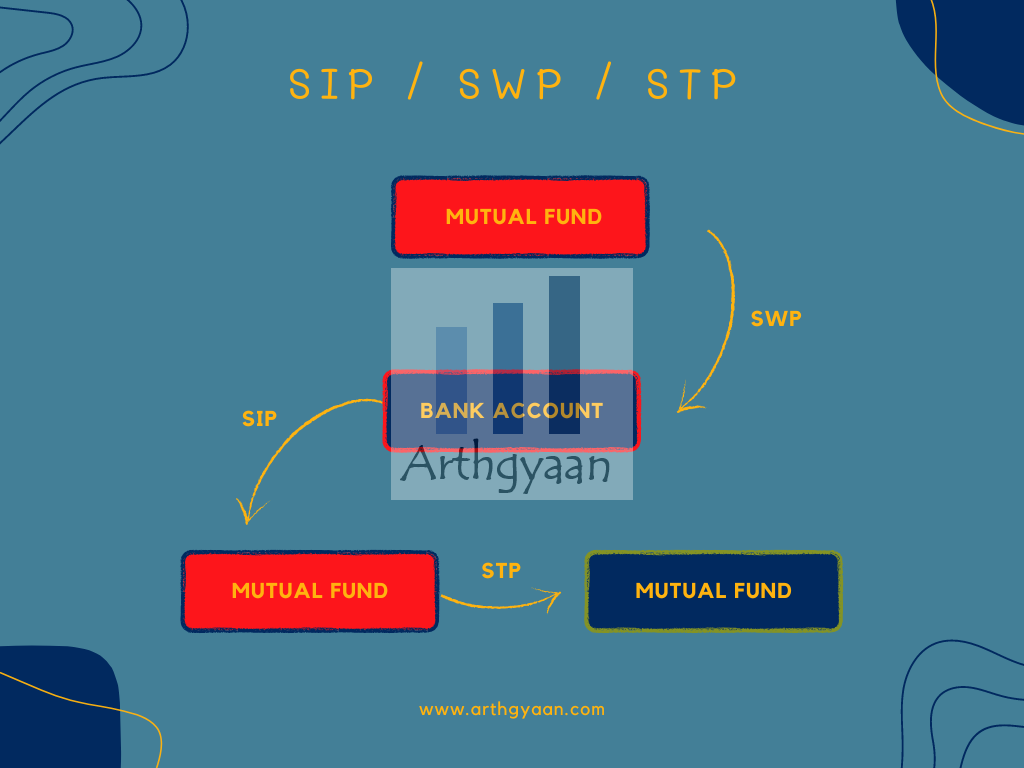

All of these are standing instructions that get executed as per a schedule you specify:

Note: You don’t invest in a SIP; you invest via one since a SIP is a standing instruction. You invest in a mutual fund, or basket of stocks, via a SIP.

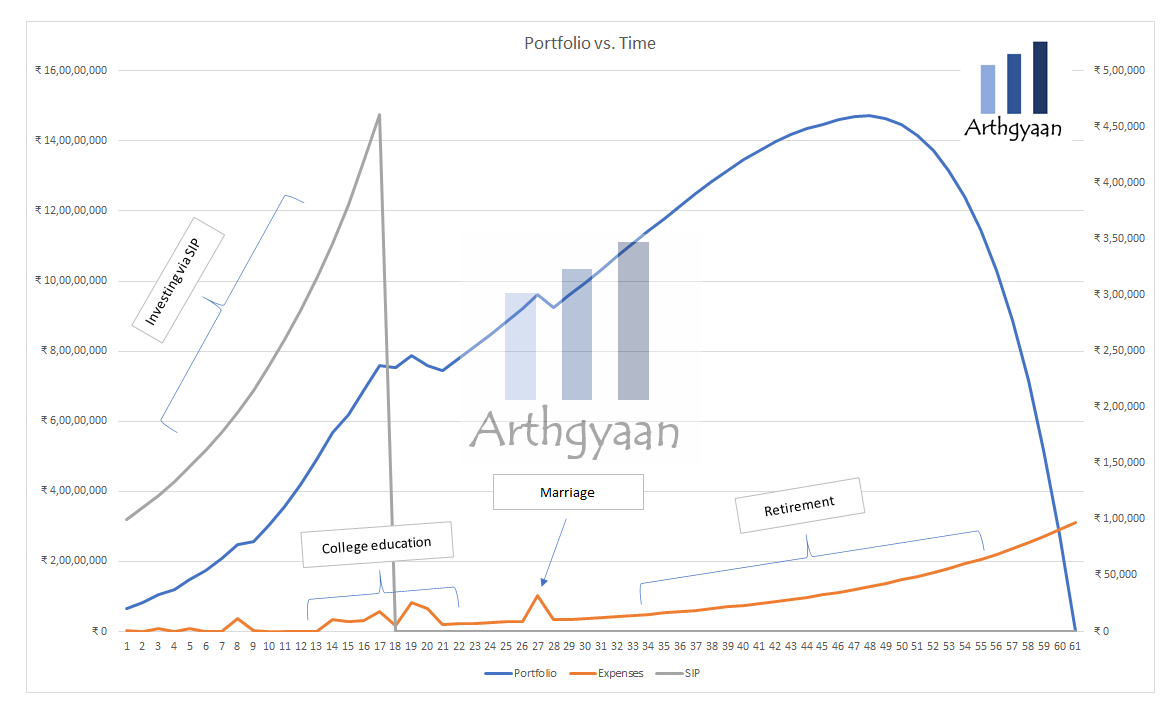

In the image above, SIP runs from years 1-17, and SWP takes over after that. However, STP may happen anytime in between for rebalancing purposes. We will explain the use cases below.

The asset management industry and every seller of mutual funds have one mantra that they want to drill into the head of the investor:

Start a SIP and never stop a SIP so that the SIP will create wealth

There is nothing inherently wrong with the statement above, so let us break it down.

Most people get paid once a month via salary, so it makes sense to match investing with money coming in

The concept of the SIP originates from the idea of dollar-cost-averaging (DCA). DCA allows you to:

You can use this calculator to see how a SIP can create wealth over time assuming fixed returns:

Total Investment (₹):

Total Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

If you found this useful, check out the Arthgyaan step-up SWP calculator.You need to keep a few things in mind since just having a SIP will not help you reach your goals or create wealth.

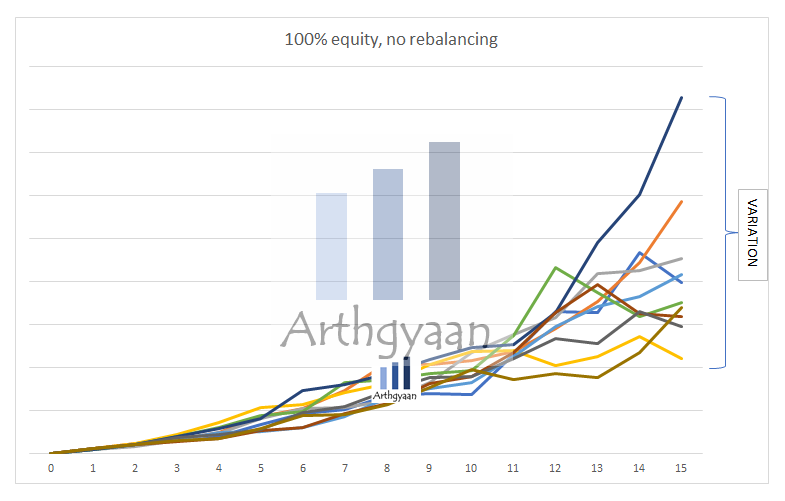

Since markets fluctuate unpredictably, you will not know the end value of the SIP after 5-10-20 years. Here is an example of a 15,000/month SIP run for 15 years. The SIP amount is increased by 5% every year. The chart shows ten possibilities assuming the average equity return is 11% post-tax and a risk of 15%. The results are:

You can tell that the “wealth” generated in these extreme cases is very different. The better alternative here is to apply the concept of goal-based investing instead of a simple SIP: I have started a 15k SIP. How much money will I have in 15 years?.

The STP is a way to transfer money from one mutual fund to another slowly. There is, of course, capital gains tax since the first leg of STP is selling mutual fund units. STP works very well in cases where behaviourally, you do not wish to take action due to inertia, tax implication or fear of market levels.

Many investors use STP to invest a large chunk of money, instead of a lump sum, via STP from a debt fund to an equity fund. For example, let us say you have 5 lakhs from a bonus much higher than the 50,000/month SIP. You invest the amount in a debt mutual fund and then start a 6-month STP to send the money into an equity fund.

There are many reasons why you would like to switch from one mutual fund to another: it is not performing well, being a typical example as part of a regular review process: Are you checking the performance of your funds regularly?. Having an STP in place allows you to overcome the inertia of not taking action.

Rebalancing allows you to systematically buy low and sell high

STP is an easy way to implement rebalancing since you can run a 3-6 month STP to exit from a mutual fund that has gone up in value into one that has not gone up that much.

An SWP instruction implements DCA in reverse to fund a recurring goal like college fees for your children or monthly expenses in retirement like this

Total Withdrawal (₹):

Remaining Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

If you found this useful, check out the Arthgyaan step-up SIP calculator.When these costs increase due to inflation, adjust the SWP amount.

Once you have a corpus for your child’s school or college education, you can create a quarterly or monthly SWP to get money into your account to pay the fees.

Related: Case study: how this double income single kid family can perform DIY goal-based investment planning

You can follow the principle of goal-based investing in creating a solid retirement corpus like this: Low-stress retirement planning calculations: worked out example.

When you retire, you can simulate a salary by starting an SWP from your cash bucket. Read more about buckets in retirement here: How to plan for retirement using the bucket approach?.

In this article, we cover the concept of funding retirement expenses via SWP: What happens if you do an SWP from an index fund in retirement?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled SIP, SWP and STP - what do they mean, which one should you choose and when? first appeared on 28 Aug 2022 at https://arthgyaan.com