The lie of enjoying financial freedom via SWP from mutual funds

This article will show how starting an SWP once you are retired (early or otherwise) does not always guarantee a comfortable lifestyle in retirement.

This article will show how starting an SWP once you are retired (early or otherwise) does not always guarantee a comfortable lifestyle in retirement.

🎉 This is post number 500 in this blog

Every media outlet and offline channel from bank relationship managers and distributors, print, television, video (YouTube) and social media (X, Instagram, Facebook and LinkedIn) is now full of how starting a Systematic Withdrawal Plan (SWP) from your mutual fund corpus will help you have a comfortable lifestyle in retirement.

This article is the opposite side of the coin of our viral article covering SIP: The Truth About SIPs: Why They Don’t Always Lead to Wealth Creation

What is SWP in Retirement, and What Are Its Risks?

A Systematic Withdrawal Plan (SWP) in retirement allows investors to withdraw a fixed amount from their mutual fund investments regularly, providing a steady income. However, it carries risks, such as the sequence of return risk, where withdrawing during market downturns can deplete the portfolio early. Using a 3-bucket portfolio strategy can help mitigate these risks and ensure sustainable withdrawals.

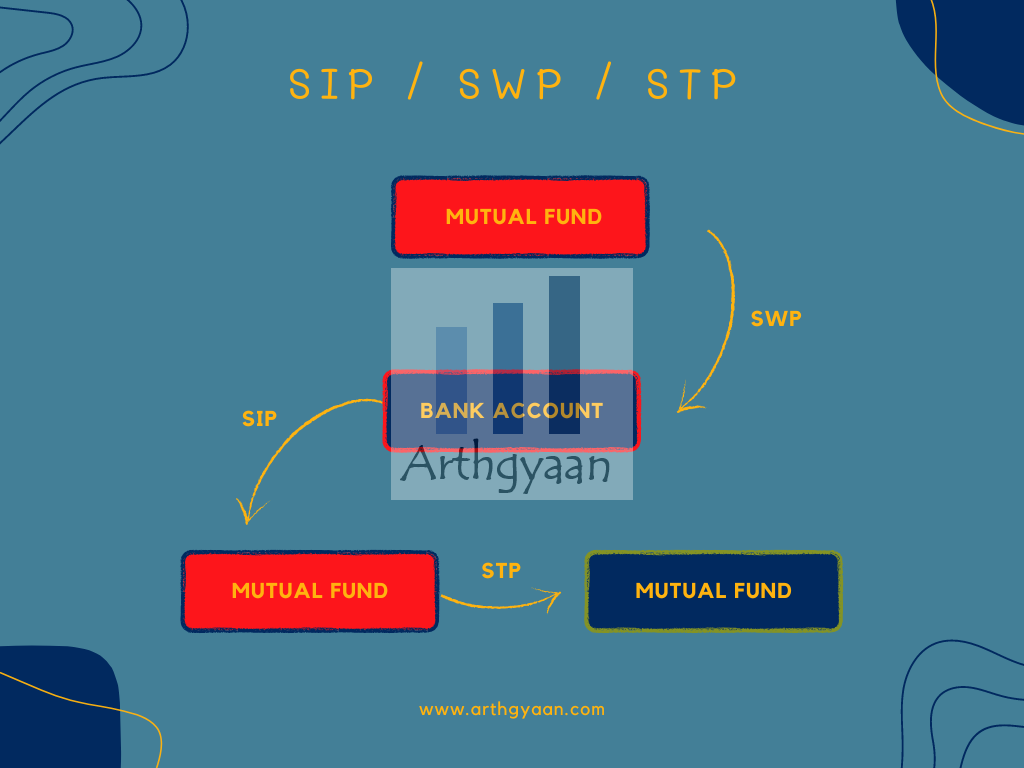

All of these are standing instructions that get executed as per a schedule you specify:

The mutual fund industry, and similarly the stock advisory business, makes money when distributors and wealth managers manage more and more of their clients’ money via commissions. This is the just start SIP narrative which goes something like this:

Start an SIP today. You will then have enough money for financial freedom, a comfortable retirement and everything else.

Automatically, the next step of the advice is to answer the question of what to do once the crores of corpus are reached and the time for withdrawal starts. A Systematic Withdrawal Plan which is a convenient instruction to your mutual fund to regularly sell your units and give you money in your bank account becomes the obvious next step:

You can use this step-up SWP calculator to see how such a fixed-return SWP works in theory:

Total Withdrawal (₹):

Remaining Value (₹):

Inflation-Adjusted Value (₹):

Uncertainty-Adjusted Range (₹):

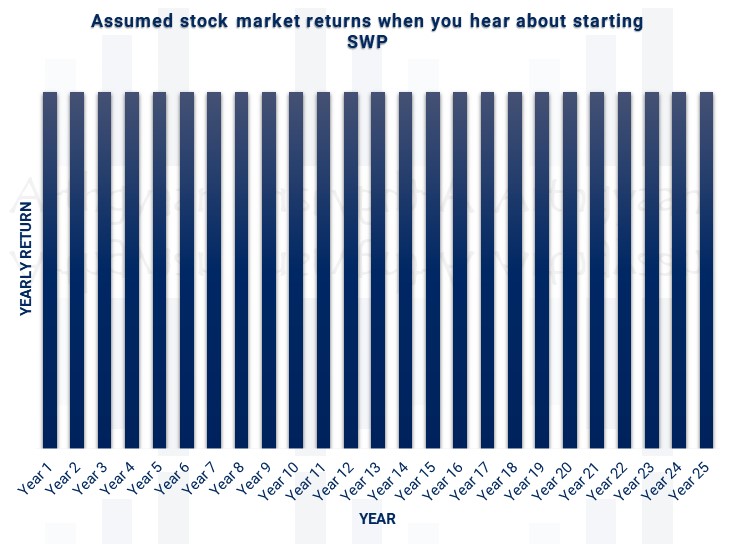

If you found this useful, check out the Arthgyaan step-up SIP calculator.In real life, stock markets do not behave as simply as implied by the “Start SWP when retired” mantra which implicitly assumes that the stock market does this:

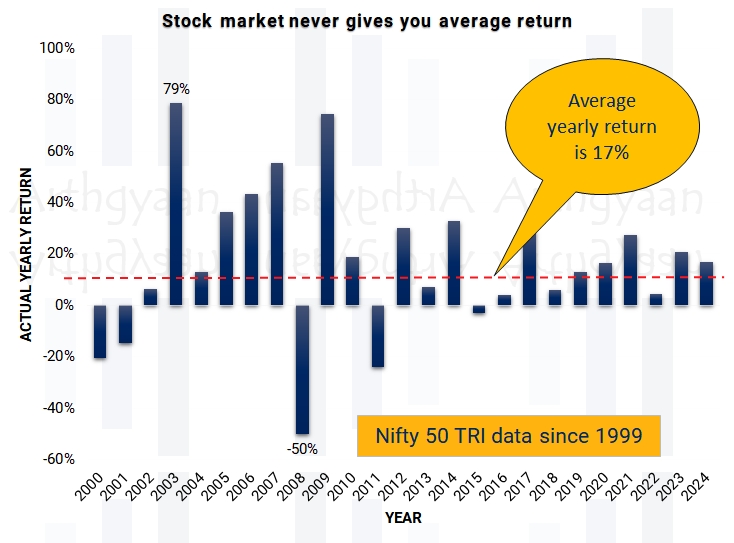

But the actual stock market returns look like this:

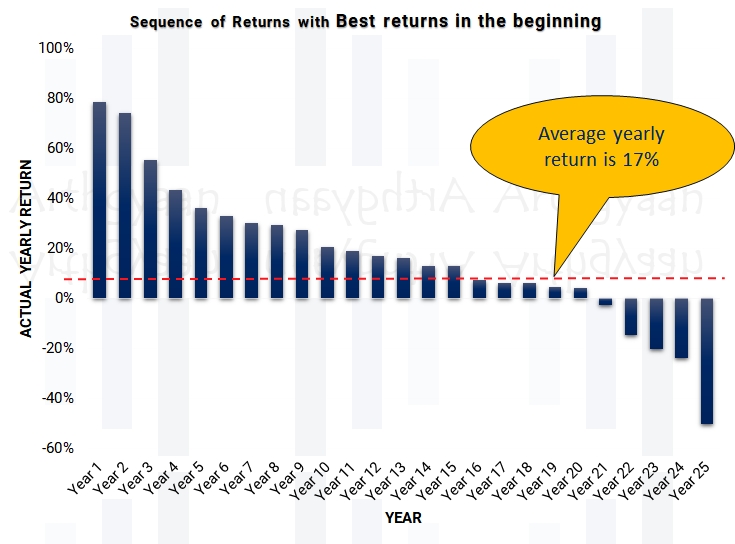

Here the average return is 17% of the Nifty 50 index with dividends reinvested, but never in this period the return was that average value. Here lies the problem. If you withdraw too much when the markets are down, especially at the beginning of retirement when the portfolio is small, then you will likely never recover. This is the concept of Sequence of Return Risk (SRR).

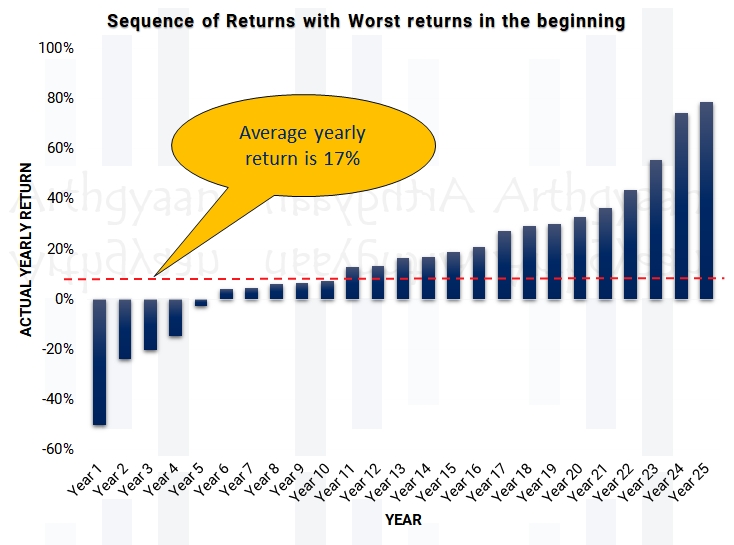

Let’s take the case of a hypothetical retiree who gets the same returns as in the image above but in the worst possible order from the beginning of retirement:

Starting a SWP in such a market condition will lead to running out of money around halfway into retirement.

We will now look at the opposite extreme case with the best returns happening in the beginning of retirement like this:

This case leaves a substantial inheritance to the heirs since there is now more than enough money even after the required withdrawals.

Therefore, since actual life will be between these two opposite extremes, and will not be known in advance, it comes down to how much you are planning to withdraw in retirement.

SWR = the percentage of your portfolio that you withdraw in Year 1 of retirement and then increase that amount by inflation every year

The concept of Safe Withdrawal Rate (SWR) is used to put numbers around the percentage of the portfolio to be withdrawn in retirement every year.

“nastiest, hardest problem in finance.” - William Sharpe, Nobel Prize winner, regarding the withdrawal stage of retirement

Therefore, it all comes down to the amount you are planning to withdraw every year. There are already a lot of assumptions in a retiree’s portfolio namely:

In such cases, high withdrawal rates or SWRs, implied by simplistic versions of the “just start SWP” advice is dangerous. We show some simulation results below, given that Indian equity market data starts from only 1979 after the launch of the SENSEX as explained in detail here: Risks and Benefits of SWP from Index Funds in Retirement

We ran 1,000 such simulations for each of the SWRs (1-5%) and calculated the number of cases where there is a non-zero portfolio value after 30 years with a starting portfolio value of one crore.

Here the “Nearly failed” case is equal to an ending value less than or equal to one-fourth of the starting value. Since the starting portfolio is ₹1 crore, any ending value less than ₹25 lakhs is a near-miss. At 7% inflation, this ₹25 lakhs has lost its purchasing power to just ₹3.2 lakhs in 30 years and will, depending on the SWR, pay for only a few months to a year of retirement expense in the 31st year.

The conclusion is quite clear:

Therefore, if your advisor is projecting or implying a withdrawal rate of more than the numbers in the chart above, then you need another source of advice.

The first and foremost thing to keep in mind for retirement is that while you will have fixed and regular expenses in retirement, e.g. groceries and utilities, a lot of the big-ticket expenses like travel and lifestyle expenses will come at irregular intervals. Therefore, the retirement portfolio will not actually need to give you a replacement for your fixed salary income.

That is why we will implement a 3-bucket portfolio using the Arthgyaan Goal-based investing calculator.

Learn How to Build a Risk-Free Retirement Portfolio Using the 3-Bucket Method.

Watch this video to learn about safe withdrawal strategies for retirement using the 3-bucket approach:

We use the Arthgyaan Goal-based investing calculator to formulate the investment model with all the above assumptions and goals. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Once you get your sheet, you can access video tutorials in the howto tab.

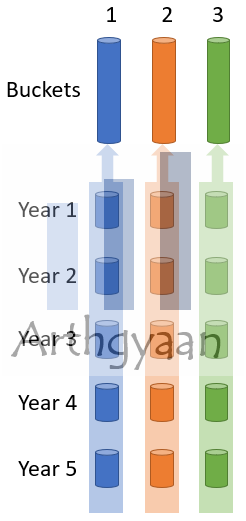

The concept of the 3-bucket retirement portfolio creates three risk-based asset pools or buckets out of the retirement portfolio:

Instead of regular SWP-like withdrawals, the bucket portfolio moves money from the risky buckets when markets are performing well, via rebalancing, while deferring forced withdrawals from risky assets during bad patches in the market.

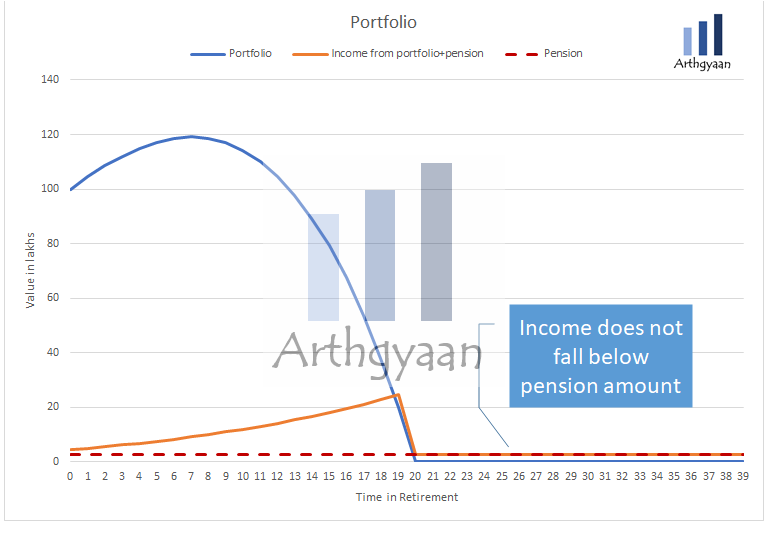

If you have a sufficient corpus, you can implement a pension plan as well into your portfolio: Do Retirees with a Pension Still Need Equity Mutual Funds?.

SWP, or Systematic Withdrawal Plan, allows investors to withdraw a fixed amount from their mutual fund investments at regular intervals, providing a steady income during retirement.

SWP is often recommended as a way to generate regular income in retirement by systematically selling mutual fund units and transferring the money to the retiree's bank account.

Sequence of return risk refers to the danger of depleting your retirement portfolio early if you withdraw money during market downturns, especially in the initial years of retirement.

If the market experiences poor returns in the early years of retirement, SWP withdrawals can rapidly reduce the portfolio's value, making it difficult to sustain income throughout retirement.

SWR is the percentage of your portfolio you withdraw in the first year of retirement, adjusted annually for inflation. It aims to minimize the risk of running out of money.

Key assumptions include expected returns from assets, inflation, lifestyle and medical expenses, tax changes, and life expectancy.

A 3-bucket portfolio helps manage retirement expenses by separating funds into short-term cash, stable debt assets, and long-term growth assets, reducing reliance on risky assets during market downturns.

The 3 buckets include: (1) cash for short-term expenses and emergencies, (2) debt for stability and income, and (3) equity for long-term growth.

Yes, retirees with a pension can include equity mutual funds to combat inflation and grow their portfolio for future expenses or inheritance purposes.

Retirees can avoid this risk by using a 3-bucket portfolio and rebalancing it periodically, ensuring withdrawals are made from safer assets during market downturns.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled The lie of enjoying financial freedom via SWP from mutual funds first appeared on 10 Dec 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.