Do Retirees with a Pension Still Need Equity Mutual Funds?

This article explores whether retirees can manage without risky equity investments if they already have a pension plan for their retirement.

This article explores whether retirees can manage without risky equity investments if they already have a pension plan for their retirement.

Watch this article as a video on Youtube:

Pension plus other investments

We will cover those cases where there is a generous pension plan applicable to the retiree along with other assets. We will use the Arthgyaan goal-based investing planner to explore whether risky assets like equity are needed in the retirement portfolio instead of safer options like fixed deposits (FD).

Inflation. That is why.

Rule of 72 shows us that the value of money halves every 10 years at a modest 7% inflation.

The rule says: Rate of doubling * Time in years = 72

Therefore, if you are getting ₹50,000/month pension today, what you need to afford the same lifestyle 10 years later will be ₹100,000/month. In 20 years, it will be ₹2 lakhs a month and so on.

Therefore, you need an allocation to risky assets like equity to beat inflation. The way we will approach this problem is by figuring out the minimum portfolio size needed to get by using FD only. If the portfolio is smaller than that, we will need to explore riskier options.

We will take the example of a retiree with a ₹50,000/month (₹6 lakhs/year) pension and a current expense in retirement of ₹75,000/month. We will assume a longevity of 30 years for the younger spouse. This portfolio will have to support ₹75,000/month (₹9 lakhs/year), increasing at 7% inflation for the next 30 years. The pension is assumed fixed.

The cash flows will look like this:

| Year | Total expense | From Pension | From portfolio |

|---|---|---|---|

| 1 | 9 lakhs | 6 lakhs | 3.00 lakhs |

| 2 | 9.63 lakhs | 6 lakhs | 3.63 lakhs |

| 3 | 10.30 lakhs | 6 lakhs | 4.30 lakhs |

| 4 | 11.03 lakhs | 6 lakhs | 5.03 lakhs |

| 5 | 11.80 lakhs | 6 lakhs | 5.80 lakhs |

| 6 | 12.62 lakhs | 6 lakhs | 6.62 lakhs |

| 7 | 13.51 lakhs | 6 lakhs | 7.51 lakhs |

| 8 | 14.45 lakhs | 6 lakhs | 8.45 lakhs |

| 9 | 15.46 lakhs | 6 lakhs | 9.46 lakhs |

| 10 | 16.55 lakhs | 6 lakhs | 10.55 lakhs |

We will now see how much we need to fund the entire From Portfolio numbers from safe options like FD.

We use the Arthgyaan Goal-based investing calculator to formulate the investment model with all the above assumptions and goals. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Once you get your sheet, you can access video tutorials in the howto tab.

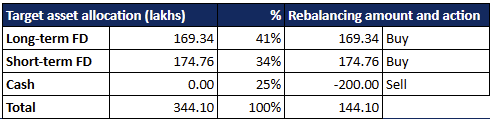

We have assumed a 4% post-tax return from FDs. We will examine a little later if this assumption is practical.

As the example shows, the retiree needs an additional ₹3.44 crore to be invested in FD to last for 30 years over and above the pension.

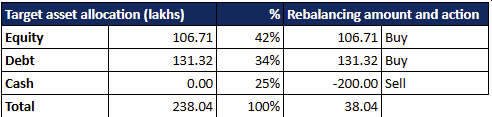

If we had invested in equity and debt mutual funds instead of FD, a much smaller amount, as expected with an 11% assumed return from equity mutual fund and the same-as-FD 4% return from debt mutual funds.

Here we need only ₹2.38 crore instead of ₹3.44 crore since we are now investing in a mix of equity and debt mutual funds.

While neither equity nor debt mutual funds do not guarantee returns, it is the only option for retirees who do not have adequate corpus for investing only in FDs. The following table consolidates the results for 30, 35 and 40 years of retirement.

| Years | FD only | Mutual funds | % lower with MF |

|---|---|---|---|

| 30 | 3.44 | 2.38 | -31% |

| 35 | 4.52 | 2.79 | -38% |

| 40 | 5.77 | 3.18 | -45% |

To understand how to create such a plan for yourself:

The reality of FD investment, apart from the larger corpus requirement, is that:

These three points make FDs an impractical solution for long-term retiree portfolios. Debt funds, based on risk profile, are a more suitable option: Which are the Best Mutual Fund Categories for every Investment Horizon?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Do Retirees with a Pension Still Need Equity Mutual Funds? first appeared on 24 Nov 2024 at https://arthgyaan.com