Mutual Fund vs Fixed Deposit - where should you invest?

This post shows investors in which situations they should invest in FD vs other products like mutual funds.

This post shows investors in which situations they should invest in FD vs other products like mutual funds.

A common set of questions asked by investors are:

The underlying question is that fixed deposits (FD) offer familiarity, safety and known returns under most circumstances while mutual funds do not.

As discussed in our post on choosing investments using the RRTTLLU framework, we will evaluate Fixed Deposits and Mutual funds using the following seven criteria: Return (R), Risk (R), Time horizon (T), Taxes (T), Legal / regulatory (L), Liquidity (L), and Unique situations (U).

Most of the points made here regarding FD apply to recurring deposits as well.

At the time of opening, fixed deposits will tell you precisely the maturity value and any interest payments over time. If the FD is held with a bank, the principal is protected and the return is guaranteed.

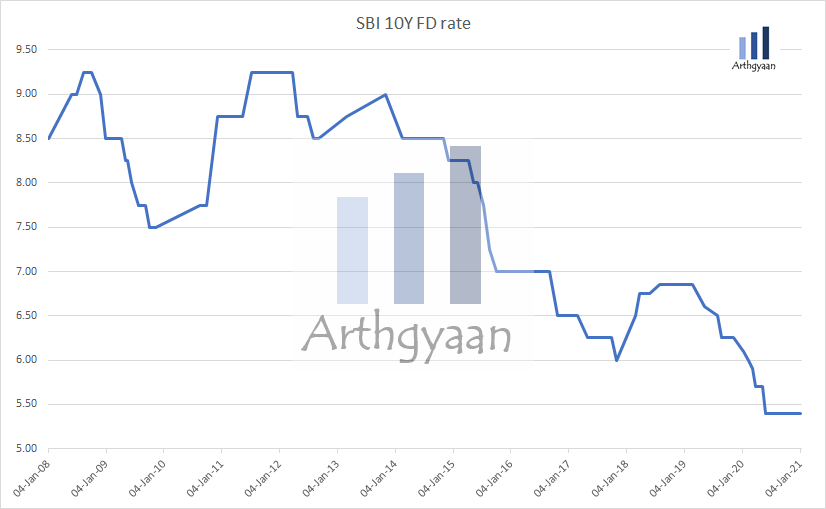

Mutual funds do not provide any return guarantees. Only overnight and liquid debt funds, depending on their portfolio, offer the some predictability of returns. In addition, mutual funds do not provide any interest. Therefore, investors invest with the expectation that over time, they can sell their mutual fund units at a higher price than their purchase price. There are 30+ categories of mutual funds in India. Historically, some varieties have given higher and the rest lower returns than FD rates over the same period, as shown below.

As the chart shows, there is a lot of variability of returns of FD vs the best and worst mutual funds of that year. This variability is the reason why there is potential for higher returns with mutual funds compared to FDs. Therefore, based on their goal, investors make a conscious choice regarding investing in different types of mutual funds. This topic is covered in detail in this post on asset allocation.

Mutual funds are not the only way to get exposure to the stock, bond, real estate and commodity markets. However, they offer convenience, flexible ticket sizes, and liquidity, making the investment, tracking, and withdrawal easier than alternatives.

If you know exactly how much money you will need and cannot afford the slightest deviation in maturity value, FDs offer a good investment option. However, if the variation is something you can handle, then only you should consider mutual funds.

For a humourous take on a common mutual fund vs. FD sales pitch, you can refer to this article: Do the worst performing equity mutual funds beat FD?.

We will discuss four types of risk:

Deposits (and cash) held in banks fall under the purview of DICGC insurance up to five lakhs per bank. While this does not mean you will get that money immediately in case the bank fails, but still, the principal will eventually come back (up to five lakhs).

Corporate and NBFC, i.e. non-bank FDs (also called NCD), offer an indicative yield. They do not provide any guarantee of principal and interest beyond the guidance provided by their credit ratings. The higher the indicative yield, the riskier is the FD and vice versa. Most investors should avoid such FDs given track record of defaults in cases like DHFL. If you need security of FDs, then chasing yield in corporate FDs is the wrong approach. The reason such FDs promise a higher return than a bank FD is the indication of higher risk.

FDs in banks are a good investment option where safety (and also liquidity) is paramount, like saving the emergency fund. You need the availability of the entire amount at a moment’s notice. Only bank FDs offer this facility without limits on the amount.

FDs are also suitable if capital protection and not returns are the primary criterion for investing, like retirees with a low corpus amount.

While they do not “fail” like a bank, mutual funds do not guarantee that the invested amount will return to the investor. Depending on the category of funds, the credit risk increases in this order:

Interest rate risk affects debt mutual funds and other mutual funds with debt holding and other asset classes like hybrid funds.

Consider an existing bond offering a 7% coupon rate versus a new bond with a 6% coupon. The current bond is more desirable, and the NAV of the debt fund holding it will be higher since the 7% bond is more valuable due to the higher coupon. Similarly, the reverse happens, i.e. debt fund NAVs fall if interest rates rise in the economy. The metric for measuring interest rate risk is Modified Duration. It is available for all debt funds (higher the average portfolio maturity). It measures the portfolio NAV rate of change due to changes in interest rates.

FDs do not have interest rate risk since the rate is known when making the FD.

Due to inflation, the returns from a portfolio has to reach the future target corpus. For example, imagine a goal for a college education for 20 lakhs in 15 years with an inflation of 10%. This goal will be more than 80 lakhs after 15 years (20 * 1.1^15 = 84). So with a starting corpus of 5 lakhs, say, the rest of the target has to come from investments over the next 15 years.

As the FD rates show a decreasing trend, it is unlikely that you can reach the goal via FD investments unless the monthly investments are very high. Mutual funds investing in debt and equity funds over the same period are expected to provide higher returns.

Inflation: the impact on your goals and how to choose assets that beat it

Since banks generally do not offer FDs beyond ten years, you need to reinvest the maturity amount into another FD if the goal is more than ten years away. Similarly, suppose you invest in closed-ended or target-date mutual funds. In that case, once they mature, you need to reinvest the proceeds if the goal is further away. Again, this risk is due to the uncertainty of future interest rates if the goal maturity and the fund/FD maturity do not align. Investing in low duration open-ended mutual funds minimizes this risk since the portfolio reacts adjusts to rate changes. Then, whenever you need the money, you can redeem the units. This article talks more in detail regarding when you should sell mutual funds.

You need to choose an instrument whose maturity ideally aligns with the date you need to spend the money. For example, if the date is within ten years, you can use FD. Alternatively, you can use open-ended mutual funds for any goal duration from days to decades. When the goal horizon is unknown, like when you have parked money for some time (a few months to a few years), you can use either FD or debt MF.

Equity mutual funds should not be used if the horizon is unknown since their returns can be negative over shorter holding periods, as the graph above shows.

FD returns are taxed at the marginal tax of the investor. Therefore, investors would need to pay their taxes due every year in the FD interest, using the accrual method, reducing the overall return. Accordingly, investors in the highest tax brackets should re-evaluate investing in FDs beyond a three-year horizon.

As per the amendment to the Finance Act 2023, on 24th March 2023, debt mutual funds purchased after 1st Apr 2023 will be taxable at slab rates just like FDs: What should debt mutual fund investors do now that these funds are taxable at slab rate?.

Debt mutual funds, unlike FDs, still offer deferment of capital gains to the time of sale instead of yearly tax on accrual basis which reduces FD returns. Also, debt funds can be sold for any amount where the whole FD needs to be broken with penalties. Unless an absolute certainty of return is needed, and this is again need-based and not tax-based, FD should not be chosen over debt mutual funds.

FDs are available to both resident Indians and non-residents. In contrast, residents of other countries have restrictions on investing in mutual funds in India. The taxation on residents and non-residents varies in the case of both FD and mutual funds.

Know your customer (KYC) norms vary for FDs and mutual funds, along with the requirement for disclosures like FATCA for MFs.

Liquidity refers to how fast you can convert the investment to cash. The order as per liquidity is

Both FDs and MFs may charge a penalty for early withdrawal. FDs generally charge 1% of the principal as a premature withdrawal penalty. MFs may charge similar a penalty if withdrawn before one year of investment. The penalty period and amount varies from fund to fund. As a special case, you cannot redeem from ELSS mutual funds before three years for every investment.

In cases like people with a windfall or sudden changes in life (like a job loss or death in the family) are well suited for the safety of FDs in a bank like SBI, HDFC and ICICI. These three banks are on RBI’s Systematically Important (SIFI) list and are considered very safe.

Some quick thumb rules for choosing MF vs FD are presented below.

Invest the money in SIFI banks: SBI, HDFC, ICICI for maximum safety and liquidity.

A specific use case, where the investor wants to get higher returns than FD at “low” risk, is discussed in this article:Can you get higher than FD returns with low risk?

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Mutual Fund vs Fixed Deposit - where should you invest? first appeared on 28 Oct 2021 at https://arthgyaan.com