How to update your KYC to continue investing in mutual funds from 1st April 2024?

This article shows you the easy steps to update your KYC so that you can continue your mutual fund investments without any hassles.

This article shows you the easy steps to update your KYC so that you can continue your mutual fund investments without any hassles.

As per SEBI guidelines, the Know Your Customer (KYC) rules have been tweaked slightly from 1st April 2024.

The main change is that Aadhaar is now the most important and only acceptable identity proof for mutual fund KYC. Given that all PAN cards are linked to Aadhaar, and Aadhaar has both demographic and contact information, linking all mutual fund KYC to Aadhaar is logical. Whether this practice is right or not is beyond the scope of this article.

If your KYC is correct as per Aadhaar as per these new KYC rules:

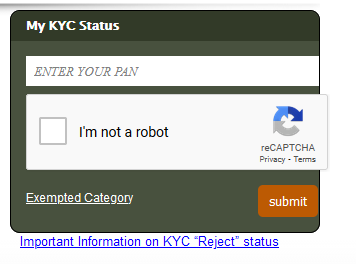

The easiest way to check your KYC status is the CAMS KRA website: direct link and Google search result.

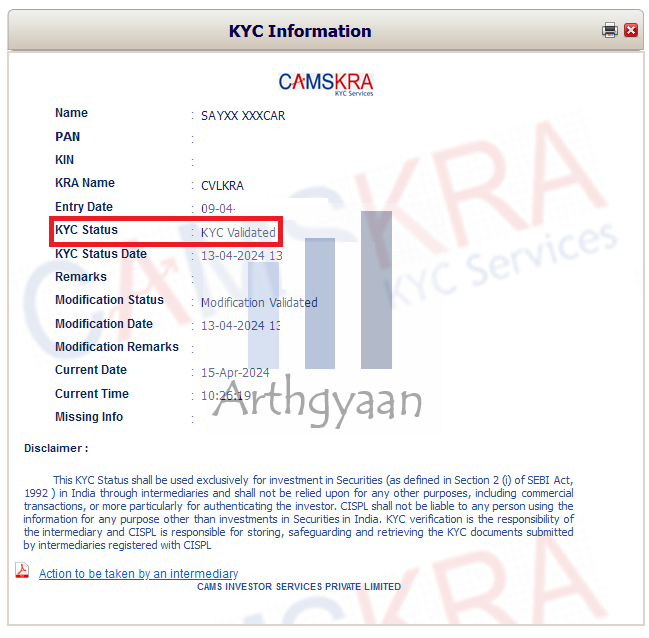

You will have to enter your PAN in the above box, click the Captcha and wait for the result. If you see “KYC Validated” under KYC Status then your KYC is Aadhaar-based and you don’t have to do anything else. Here is a new article for you to read: These are India’s worst performing mutual funds: are you invested in these funds?.

Apart from CAMs KRA, the other KRAs you can use are NDML, CVL, CAMs and Karvy.

If the result shows anything other than “KYC Validated” under KYC Status, you must move to the next step.

Any document, like a bank statement that is not in the RBI list above, is no longer valid for KYC.

If you already invest in mutual funds and you have used any other OVD, except Aadhaar which was validated via OTP and a photo of your face, you will likely see the status as “KYC Registered”. This status will likely allow you to continue your existing funds. Only when you try to invest with a new AMC, then you need to submit your Aadhaar.

The KRA record can show other values like “On Hold” with multiple issues due to choice of OVD, validation of contact details etc.

The solution here is an online KYC update using Aadhaar. This process takes 5-10 minutes and is completely online. Of course, offline KYC with your Aadhaar card, Aadhaar XML copy, PAN card etc. by visiting your nearest CAMS / Karvy office is always an option.

My KRA record was also showing “KYC Registered” so I decided to act immediately. I don’t remember what documents I used in 2007 when I did my first KYC, must have been my PAN and Passport, since Aadhaar did not exist at that time.

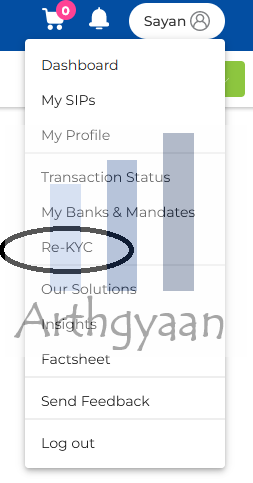

The trick here is to use an AMC website which:

I used Edelweiss AMC since I already have invested in their funds. You can try other sites (or even Edelweiss directly - if it works for KYC update then why not try once?). I was not charged any money for the KYC update.

Is Edelweiss the only site that is allowing re-kyc?

A reader has confirmed that UTI AMC website has the same facilty.

NRIs are not required to have Aadhaar. Therefore NRIs should contact their Mutual Fund Distributor or Bank Relationship manager for guidance on the next steps.

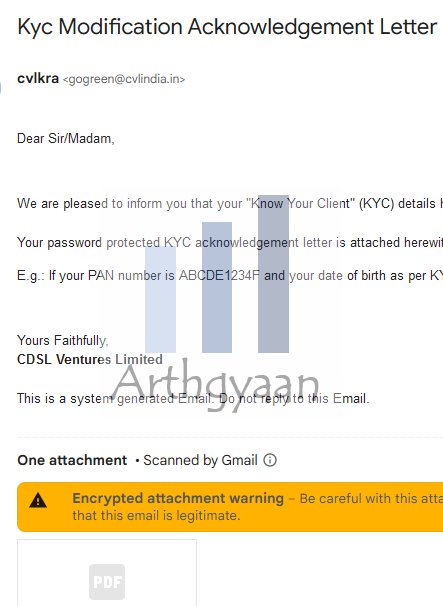

I did the Re-KYC process at around 6.45 am on Fri 12-Apr-2024 and on Mon 15-Apr-2024 at 8.24 pm got this email:

I rechecked on CAMS KRA and got this:

Mission accomplished!

A quick update:

We have updated your address under folio XXXXXXXX, based on the feed received from KRA. For more details, call us at…

The actual update that took place was my address since my Aadhaar address has a few extra characters (addition of post-office name) which my original address-proof did not have. On the morning of Tue 16-Apr-2024, I got a bunch of emails and SMSes (one sample above) from the AMCs where I have invested.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to update your KYC to continue investing in mutual funds from 1st April 2024? first appeared on 16 Apr 2024 at https://arthgyaan.com