Which mistakes in tax-proof submission can make you lose your HRA exemption?

This article tells you the common mistakes to avoid while giving your HRA exemption proof to your company.

This article tells you the common mistakes to avoid while giving your HRA exemption proof to your company.

This article is a part of our detailed article series on the issues tax-payers are facing due to not having PAN-Aadhaar linkage. Ensure you have read the other parts here:

This article considers one risk on TDS payment due to an inoperative seller PAN card where the buyers ends up with an income tax notice to pay the remaining tax.

This article shows the solution in case NRIs suddenly find their PAN number has become inoperative after 30th June 2023.

Before we discuss HRA exemption, you need to note that HRA is no longer an allowed tax deduction in the new tax regime. You should always check first if you will save more tax in the new tax regime: Which is the best tax regime to choose from April?.

Assuming you have found out that old tax regime is better, or you already chose the old regime and you cannot switch until you file your tax return, you need to collate HRA exemption proofs. These proofs have to be submitted to your company. HRA exemption does not exist for self-employed people.

It is important to note that irrespective of your company accepting your proof or rejecting it:

You can provide rent receipts and rent agreement proofs in case you get a tax notice later.

It is mandatory to obtain your landlord’s PAN number for HRA exemption. Your company will reject your exemption proof if you do not have the PAN number. The company will submit the PAN details as part of Form 24Q in the TDS return it send to the income tax authorities every quarter.

After pushing back the deadline multiple times, the central government has started marking inoperative PAN numbers that are not linked to Aadhaar. This action was taken after the latest PAN-Aadhaar linkage deadline expired on 30th June 2023. HRA exemption is not allowed if the PAN is inactive due to either lack of Aadhaar linkage or any other reason.

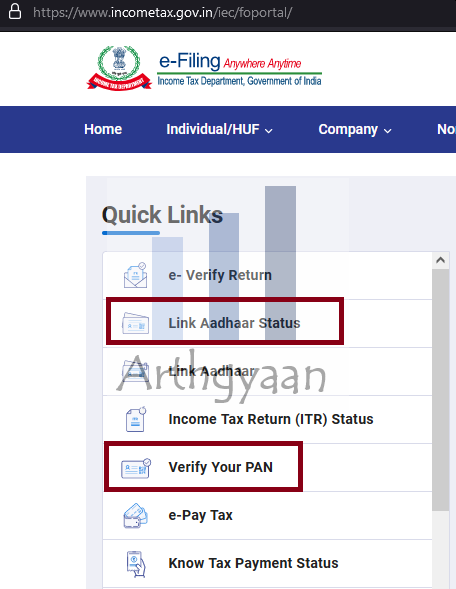

There is an easy-to-use facility on the income-tax filing portal to check PAN validity and PAN-Aadhaar linkage status. You can ask the landlord for their Aadhaar number to check this yourself (since no OTP is needed) or ask the landlord to provide screenshot proof from the portal that their PAN/Aadhaar are linked.

Rent receipts with revenue stamp and the landlord’s signature are proof of the rent actually paid. The income tax authorities have the right to reject the HRA exemption in the absence of rent receipts even when the rent agreement is provided. Whether the company will accept proof of HRA exemption without rent receipt or only with rent receipt and no rent agreement generally depends on company to company.

Linkage of HRA submission with Landlord’s PAN implies that this HRA exemption will show up in the Landlord’s Annual Information Statement (AIS). The Landlord, seeing discrepancy in the rent received vs. claimed in HRA has the option of rectifying their own AIS since they will have to pay excess tax otherwise. Once the AIS is rectified, the employee who put in an inflated rent amount will get an income-tax notice.

This list is not comprehensive and does not talk about one of the major issues with HRA proof submission namely false rents. However, as a list of common mistaktes, it will suffice for most people.

If you’re paying rent above ₹50,000/month and haven’t deducted TDS, you could face penalties and must act soon. This article explains the problem and shows you what needs to be done: What to do if you have received an email from the Income Tax department regarding HRA and TDS on rent?

If you do not have the landlord's PAN number, then you can only submit HRA exemption up to ₹1 lakh/year which implies a rent of up to ₹8333/month.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which mistakes in tax-proof submission can make you lose your HRA exemption? first appeared on 24 Dec 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.