What is a hidden risk about TDS what buyers must consider before property purchase?

This article considers one risk on TDS payment due to an inoperative seller PAN card where the buyers ends up with an income tax notice to pay the remaining tax.

This article considers one risk on TDS payment due to an inoperative seller PAN card where the buyers ends up with an income tax notice to pay the remaining tax.

This article is a part of our detailed article series on the issues tax-payers are facing due to not having PAN-Aadhaar linkage. Ensure you have read the other parts here:

This article tells you the common mistakes to avoid while giving your HRA exemption proof to your company.

This article shows the solution in case NRIs suddenly find their PAN number has become inoperative after 30th June 2023.

To track the buying and selling of residential property, TDS must be deducted by the buyer and deposited in the Income Tax portal.

We have discussed the topic of TDS on property purchase in more detail here: TDS on Property Purchase: A Step-by-Step Guide.

One risk that on TDS payment for the buyer happens when:

The property buyer is responsible for paying TDS at the correct rate, 1% or 20%, as per income tax laws.

For example:

We have covered the process of paying TDS on property purchase in detail here: How to file TDS for Property Purchase: A Step-by-Step Guide.

If the seller’s PAN is inactive, then

The danger here is that the buyer did not know that the seller’s PAN was inactive and paid ₹99 lakhs to the seller and deposited only ₹1 lakh as TDS. Now, the buyer will get an income tax notice for the remaining ₹19 lakhs. There is no option for the buyer but to pay this ₹19 lakhs. Whether the seller will entertain the buyer and return ₹19 lakhs is another story.

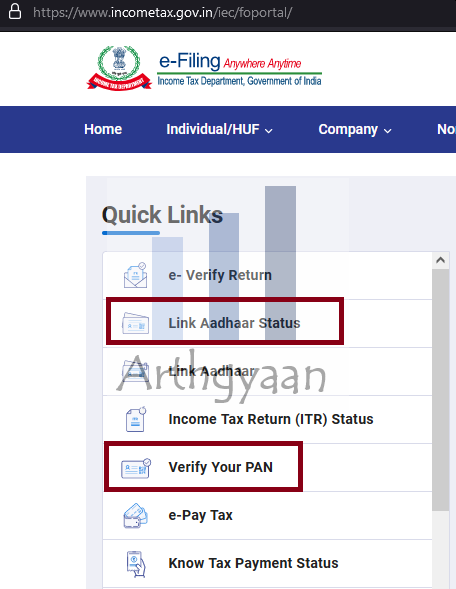

There is an easy-to-use facility on the income-tax filing portal to check PAN validity and PAN-Aadhaar linkage status. The buyer must use this facility to ensure the seller’s PAN is valid before purchasing the property.

Even NRIs, who do not have to link their PAN with Aadhaar, might have inoperative PAN cards since their KYC may not be updated: What should NRIs do if your PAN has become inoperative?.

The buyer, at the end of the day, has to pay the remaining TDS. They should immediately get in touch with a competent Chartered Accountant to understand the next steps.

In a best-case scenario, they can contact the seller to get the remaining 19% returned to pay the required TDS. If there is a long delay since the TDS due date, there will be a penalty interest on the buyer of 1.5% per month.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is a hidden risk about TDS what buyers must consider before property purchase? first appeared on 20 Dec 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.