How to file TDS for Property Purchase: A Step-by-Step Guide

This article explains the steps for paying TDS on purchasing property in an easy step-by-step manner.

This article explains the steps for paying TDS on purchasing property in an easy step-by-step manner.

This article continues the concept of TDS on property purchases and shows you how to file and deposit the TDS. You should read the previous part here to understand the concept of TDS on property purchase in detail: TDS on Property Purchase: A Step-by-Step Guide.

Here are the steps we will cover below for TDS filing. Each step is required every time you pay the seller, either from your own funds, funds from a bank loan or both.

You need to keep handy:

If the property agreement date is in the future, the TDS will still be calculated as per the date you paid the seller. Payment could be from the seller’s own funds, a bank loan or a combination of both.

TDS is to be paid whenever payment is made to the seller. The buyer must deposit the TDS amount by the last date of the following month after the payment.

If, for example, the buyer makes the payment on 15th July, the TDS must be deposited by 30th August. Please deposit the TDS by this date to avoid a penalty of 1% per month if the TDS is not filed. In case of a TDS payment default, the property will not get registered.

There is no relationship between the property registration date, builder-buyer-agreement date or any date other than the payment date for TDS calculation.

The same logic of payment date is applied when payment is in instalments, like in the case of an under-construction property.

The buyer has to deposit the TDS in the Income Tax website, generate Form 26QB and provide Form 16 (16B to resident seller, 16A to NRI seller) to the seller that records the TDS.

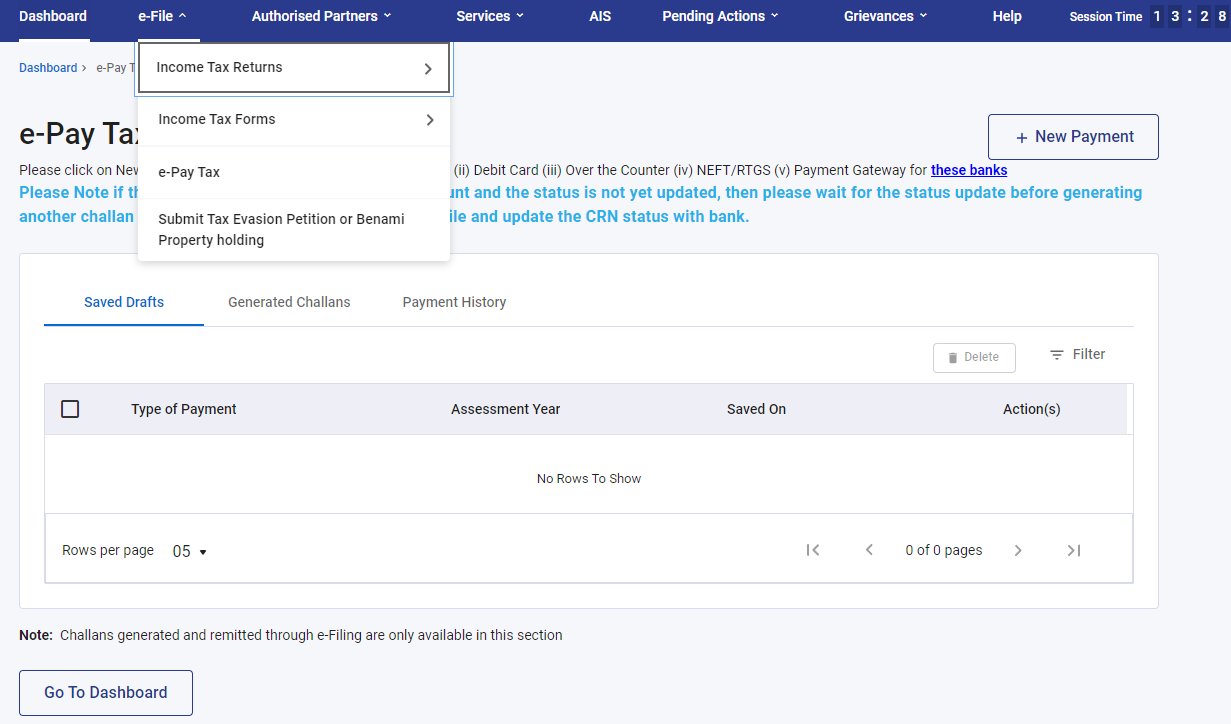

You need to log in to the Income Tax website in the usual way and click the e-Pay tax option in the main menu under e-File.

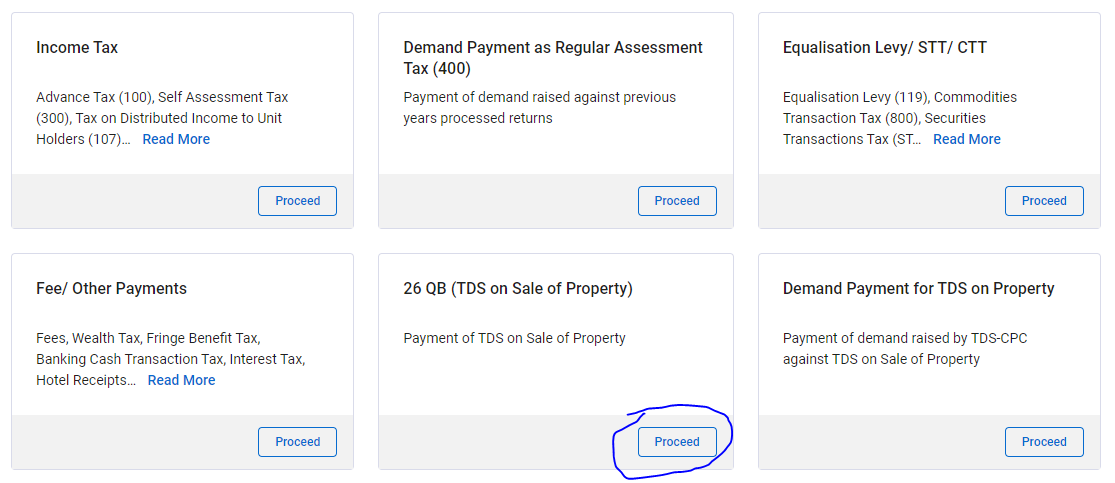

You can now choose the Form 26QB option here and proceed with the rest of the filing.

If there is more than one buyer, you must repeat the same process as above for the other buyer(s). A helpful reminder will be at the bottom: “Please fill another Form 26QB for co-buyer share”.

Once you fill in the details, you will be prompted to pay the TDS amount online via NetBanking.

TDS must be paid from the buyer’s own bank account.

Once paid, the Form 26QB will be generated, which you should save.

You must note the acknowledgement number at this step.

You need that number to locate the Form 26QB in the future.

Provisions pertaining to Tax Deduction and Collection Account Number, i.e., section 203A, shall not apply to a person deducting tax at source under Section 194-IA.

Important: It is no longer mandatory for resident Indian buyers to register for TAN for TDS purposes while buying property from an NRI as per the above quote from the Income Tax website.

The next step is registering with your PAN number on the TRACES website. TAN is no longer necessary. You need the acknowledgement number from the previous step under Option 3 of the registration form.

Around a week after registering, you can again log in to TRACES and will have the option of downloading the Form 16 (A/B):

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to file TDS for Property Purchase: A Step-by-Step Guide first appeared on 03 Sep 2023 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.