Which are the important points to keep in mind when buying a house from an NRI seller?

The article lists out the important points and steps that a resident Indian buyer should keep in mind when purchasing property from an NRI seller.

The article lists out the important points and steps that a resident Indian buyer should keep in mind when purchasing property from an NRI seller.

This article is a part of our detailed article series on property deals between an NRI seller and a resident Indian buyer. Ensure you have read the other parts here:

This article simplifies the process of selling land in India for NRIs, offering clear insights on how to manage TDS deductions, understand the differences between urban and rural agricultural land, and calculate capital gains tax.

This article lists out the processes and frequently asked questions for NRIs looking to create a Power of Attorney for selling their house in India.

The article lists out the important points and steps an NRI property seller must keep in mind while selling property in India.

This article lists out the processes and frequently asked questions for NRIs looking to fill Form 13 for applying for Lower Deduction Certificate.

We will cover the following points:

Tax Deducted at Source (TDS) is the income tax deducted before the money is paid.

All property deals by NRI sellers, without exception, fall under the TDS rules specified in Section 195 of the Income Tax Act. The TDS and payment rules are:

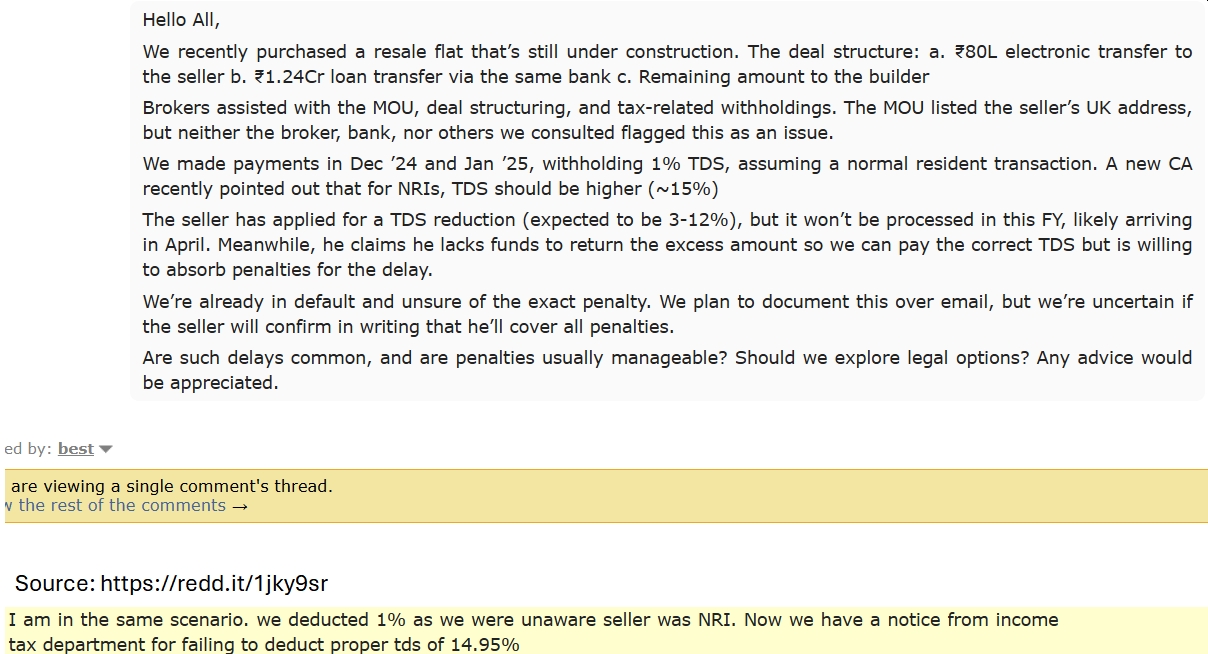

Warning: TDS payment is not optional for the buyer and will 100% result in an income tax notice if not paid on time (interest gets added) or not paid at the current rate (the seller will not refund the amount and you will pay extra from your pocket).

Here is one example:

TDS must be deducted for every instalment paid to the seller and then deposited via the IncomeTax website by the 7th of the following month.

The buyer needs to apply for a Tax Deduction and Collection Account Number (TAN) from the TRACES website for TDS payments.

TDS is supposed to be calculated on the capital gains of the sale if you have the documents to prove the purchase price/cost like registered deed. Otherwise it will be on the complete sale value.

TDS rates depend on how long the property is held before selling:

There will be surcharge and cess on the TDS amount. Union Budget 2024 has removed indexation benefit for NRIs for calculating the TDS eligible amount if the earlier purchase price is known.

Effective TDS Rate = Base TDS Rate * (1 + Surcharge %) * (1 + Cess %)

where Base TDS Rate = 12.5% (long-term), Cess = 4%, Surcharge = 0, 10% or 15% (for property sold after 2 years of purchase)

and where Base TDS Rate = 30% (short-term), Cess = 4%, Surcharge = 0, 10% or 15% (for property sold before 2 years of purchase)

Note: Union Budget 2024 reduced the TDS on land/property sales by NRIs from 20% to 12.5% under Section 195

Please see page 117 of Finance Bill 2024 for details of changing the TDS for property sales by NRIS from 20% to 12.5% under Section 195.

This effective TDS rate applies to the registration value of the property:

Warning: For NRI sellers, their PAN must be marked as NRI (to get around the Aadhaar-PAN linkage rule). Otherwise TDS will not get refunded even after Income tax return filing.

For deals after 23-Jul-2024 (as per Union Budget 2024)

Here are some sample TDS numbers for various sale values for deals after 23-July-2024 (using base TDS rate of 12.5% for properties held for more than 2 years)

| Registration value | TDS Rate with surcharge/cess | Buyer Pays to IT | Buyer Pays to Seller | Seller gets in NRO |

|---|---|---|---|---|

| ₹25 lakhs | 13.00% | ₹3.25 lakhs | ₹21.75 lakhs | ₹21.75 lakhs |

| ₹50 lakhs | 13.00% | ₹6.50 lakhs | ₹43.50 lakhs | ₹43.50 lakhs |

| ₹75 lakhs | 13.00% | ₹9.75 lakhs | ₹65.25 lakhs | ₹65.25 lakhs |

| ₹1 crore | 14.30% | ₹14.30 lakhs | ₹85.70 lakhs | ₹85.70 lakhs |

| ₹1.5 crores | 14.95% | ₹22.43 lakhs | ₹127.58 lakhs | ₹127.58 lakhs |

| ₹2 crores | 14.95% | ₹29.90 lakhs | ₹170.10 lakhs | ₹170.10 lakhs |

| ₹3.5 crores | 16.25% | ₹56.88 lakhs | ₹293.13 lakhs | ₹293.13 lakhs |

| ₹5 crores | 17.81% | ₹89.05 lakhs | ₹410.95 lakhs | ₹410.95 lakhs |

For deals before 23-Jul-2024

Here are some sample TDS numbers for various sale values for deals prior to 23-July-2024 (using base TDS rate of 20%)

| Registration value | TDS Rate with surcharge/cess | Buyer Pays to IT | Buyer Pays to Seller | Seller gets in NRO |

|---|---|---|---|---|

| ₹25 lakhs | 20.80% | ₹5.20 lakhs | ₹19.80 lakhs | ₹19.80 lakhs |

| ₹50 lakhs | 22.88% | ₹11.44 lakhs | ₹38.56 lakhs | ₹38.56 lakhs |

| ₹75 lakhs | 22.88% | ₹17.16 lakhs | ₹57.84 lakhs | ₹57.84 lakhs |

| ₹1 crore | 23.92% | ₹23.92 lakhs | ₹76.08 lakhs | ₹76.08 lakhs |

| ₹1.25 crores | 23.92% | ₹29.90 lakhs | ₹95.10 lakhs | ₹95.10 lakhs |

| ₹1.50 crores | 23.92% | ₹35.88 lakhs | ₹114.12 lakhs | ₹114.12 lakhs |

| ₹1.75 crores | 23.92% | ₹41.86 lakhs | ₹133.14 lakhs | ₹133.14 lakhs |

| ₹2 crores | 23.92% | ₹47.84 lakhs | ₹152.16 lakhs | ₹152.16 lakhs |

Note: If the buyer is applying for a home loan, the bank will not fund the TDS portion of the loan. That has to be a part of the buyer’s own funds. If the bank funds up to 75% of the non-TDS portion, the down-payment amount will be:

| Registration value | TDS Rate with surcharge/cess | TDS Amount | Loan Eligible Amount | Maximum loan | Downpayment | Downpayment % |

|---|---|---|---|---|---|---|

| ₹25 lakhs | 13.00% | ₹ 3.25 | ₹ 21.75 | ₹ 16.31 | ₹ 8.69 | 34.75% |

| ₹50 lakhs | 13.00% | ₹ 6.50 | ₹ 43.50 | ₹ 32.63 | ₹ 17.38 | 34.75% |

| ₹75 lakhs | 13.00% | ₹ 9.75 | ₹ 65.25 | ₹ 48.94 | ₹ 26.06 | 34.75% |

| ₹1 crore | 14.30% | ₹ 14.30 | ₹ 85.70 | ₹ 64.28 | ₹ 35.73 | 35.73% |

| ₹1.5 crores | 14.95% | ₹ 22.43 | ₹ 127.58 | ₹ 95.68 | ₹ 54.32 | 36.21% |

| ₹2 crores | 14.95% | ₹ 29.90 | ₹ 170.10 | ₹ 127.58 | ₹ 72.43 | 36.21% |

| ₹3.5 crores | 16.25% | ₹ 56.88 | ₹ 293.13 | ₹ 219.84 | ₹ 130.16 | 37.19% |

| ₹5 crores | 17.81% | ₹ 89.05 | ₹ 410.95 | ₹ 308.21 | ₹ 191.79 | 38.36% |

Many potential buyers might face challenges in arranging such a large down payment amount.

The buyer should deduct TDS at a lower rate only if they receive the LDC from the seller.

The NRI seller has the option of applying for a Lower Deduction Certificate (LDC) to lower the TDS amount. Depending on the competency of the CA engaged by the seller and the quality of the documentation provided, LDC might take two months or more to get approved.

Again, the buyer needs to safeguard themselves properly in the case of TDS by using the lower TDS rate as per the LDC only if they have the actual LDC with them.

Here are some thumb rules to follow in case the NRI seller is utilising a Power of Attorney (PoA):

To understand the steps to purchase a property from an NRI:

This section applies only to buyers looking for a home loan.

Banks generally do not offer home loan funding for the TDS since that amount does not get paid to the seller. LTV for NRI seller deals is therefore much lower.

Loan to Value (LTV) = Value of Home Loan Approved / Registration Value of House

The down payment amount varies based on different LTV rates offered by banks, as shown in the table below:

| Registration value | TDS Rate with surcharge/cess | 60% LTV | 75% LTV | 90% LTV | 90% LTV |

|---|---|---|---|---|---|

| ₹25 lakhs | 13.00% | 47.80% | 34.75% | 30.40% | 21.70% |

| ₹50 lakhs | 13.00% | 47.80% | 34.75% | 30.40% | 21.70% |

| ₹75 lakhs | 13.00% | 47.80% | 34.75% | 30.40% | 21.70% |

| ₹1 crore | 14.30% | 48.58% | 35.73% | 31.44% | 22.87% |

| ₹1.5 crores | 14.95% | 48.97% | 36.21% | 31.96% | 23.46% |

| ₹2 crores | 14.95% | 48.97% | 36.21% | 31.96% | 23.46% |

| ₹3.5 crores | 16.25% | 49.75% | 37.19% | 33.00% | 24.63% |

| ₹5 crores | 17.81% | 50.69% | 38.36% | 34.25% | 26.03% |

Depending on the value of the house and the bank’s Loan-to-Value (LTV) policy, your down payment requirement may vary between 30% and 55%.

As a buyer, you can fund the higher down payment in many ways.

If you have time on your side, you can always save for it: SMART goals: investing step-by-step for buying your dream home.

However, likely, you have already shortlisted a property and the seller is incidentally an NRI. Thankfully at this point, you can sell your shares and mutual funds (long-term holdings only) to take advantage of Section 54F and not pay any capital gains tax. This way, you can get the money for the down payment without paying any tax on the shares/MF sold: Sec 54F: a hack that can save lakhs in taxes when you buy a house.

Of course, if you are selling one property to buy another, then Section 54 applies and the capital gains tax on the previous property can be made tax-free. Personal and gold loans can also be an option.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which are the important points to keep in mind when buying a house from an NRI seller? first appeared on 11 Aug 2024 at https://arthgyaan.com