SMART goals: investing step-by-step for buying your dream home

This article offers the steps for identifying, quantifying and investing for buying your dream house.

This article offers the steps for identifying, quantifying and investing for buying your dream house.

We have covered why we need to set goals before investing in this post: Set a goal before looking for what to invest in

This post uses the S.M.A.R.T framework to ensure that goals are set in the right way so that you can move on to the next steps of goal-based investing: I am now ready to do goal-based investing. What now?

The S.M.A.R.T framework has the following five components. We will discuss one by one:

If the goal is missing one or more of these attributes, you cannot invest for it meaningfully. In this post, we will apply the S.M.A.R.T framework to save for the downpayment of a home using the Arthgyaan goal-based investing calculator.

The benefit of using the S.M.A.R.T framework is that it will unambiguously show you if you can afford the house or not. We will now walk through the framework to arrive at the result. The process can be iterative since you might have to go back to a previous step to adjust your assumptions.

You wish to buy a house. You would have some idea in your mind as to what type of house it would be: flat, stand-alone or plot (with later construction). Maybe you have a target city/location, size (2/3/4 BHK etc.) and amenities (pool, gym etc.) you would like to have.

You should sit down with your family at this stage to brainstorm on these points. It is not that important to perfectly narrow down the exact type of house as long as you have some idea in mind.

Once you know the type of house, location, size and amenities, it is time to find out how much they cost today. Some sources are

Once you have a figure, which will be a range, the next step is deciding the down payment amount. A good plan is to have a down payment of at least 20% of the total closing cost.

Closing cost = Cost of house + brokerage + registration

Let us say this is the house that you have shortlisted:

.

.

Source: 99acres.com site

If we add brokerage, stamp-duty, parking, shifting and interiors, the total closing cost could be ₹1 crore. We will take 20% of this value as the target before inflation adjustment.

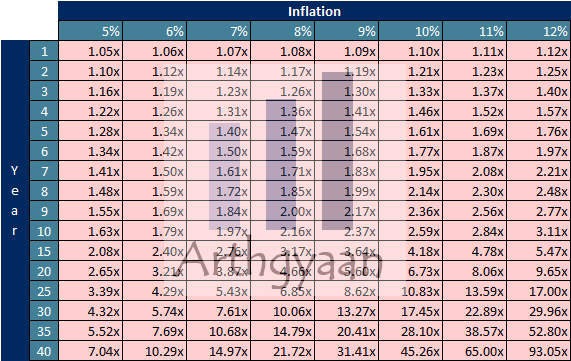

Cost after N years = Cost today * (1+Inflation) ^ Time

Here is a table that applies the above rule:

For example, at a reasonable 5% inflation for the house, the goal, say five years away will increase by 1.28 times. If the cost today is ₹1 crore, and the down payment is 20%, then the inflation-adjusted target for the goal is

20% * 100 * 1.28 ~= 26 lakhs

Therefore our target corpus in 5 years is 26 lakhs. This amount might look very large today but with disciplined investment, you can reach it.

Related article: Why you should chase your target goal corpus instead of returns?

If you start a SIP of ₹36,000, using the calculator here assuming no starting lump sum investment, and increase the amount you are investing by 5% every year, you should come close to the ₹26 lakhs target for the down payment. This corpus will pay for the down payment while you will pay for the loan from your monthly salary.

If your salary increases by more than 5% a year, you can invest more to reach your goal faster.

The next aspect here is to invest this money in a way which maximises the chances of reaching the target. Given the horizon of the goal, five years, we need to invest in a way that there is a minimal amount of risk.

Being realistic about your goal means if you can

Once you decide how much you need to save, this article will show you where to save: Where to save for the downpayment of a home?

Goals do not exist in isolation. At the very least, retirement is a default goal for most people, since, after all, you cannot take a loan for retirement. If you are investing only for this goal, and not for others, then you are putting those other goals in jeopardy.

Therefore you need to carefully consider all your goals together and then start investing. Here are some case studies to help you do that:

This article uses the Arthgyaan goal-based investing calculator to understand how much corpus is needed to have a comfortable lifestyle in India.

This article shows how a single-income middle-aged couple with two small children reach their retirement and children’s goals.

This article shows how a double-income couple with a 2-year old reach their FIRE dream at the age of 50.

This article shows how a double-income couple with a newborn child can invest for their future goals of FIRE and real-estate investment.

This article shows how a young just-married couple can invest for future goals using the Arthgyaan goal-based investing tool.

Did you welcome a bundle of joy in your 40s? This article will discuss ways of planning the child’s (and your’s financial future)

This article shows how a very typical salaried couple with one child can invest for future goals using the Arthgyaan goal-based investing tool.

We have chosen the year in which the goal is due, i.e. the time horizon, to be five years from now. Two things happen when the horizon changes:

Is the timing flexible is the next important question. Goals could be classified as must have, should have and could have. If you are unable to reach this amount within the target horizon, you can consider either buying a cheaper house or investing a bit longer.

| Question | Answer |

|---|---|

| Specific: Why do you need the money? | To buy a house |

| Measurable: How much money do you need? | ₹26 lakhs - 5% inflation, ₹1 crore total cost, 20% down-payment |

| Achievable: Can you do it? Do you need help? | Be able to invest ₹36,000/month; increase that amount by 5%/year |

| Realistic: Can you reach this target based on where you are? | Other goals are not impacted; able to invest in the correct investments |

| Time-bound: When do you need the money? Is the timing flexible? | Five year horizon and flexible |

You can create a Single Date Fund to save for this goal. Please follow the detailed instructions here: How to invest for a single goal using Target Date Funds in India?.

This article has the plan you can follow in such cases: How to Buy Your Dream Home Without Any Savings: A Step-by-Step Guide

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled SMART goals: investing step-by-step for buying your dream home first appeared on 07 Sep 2022 at https://arthgyaan.com