Should you withdraw from your EPF to buy a house?

This article explains what happens if you withdraw from your EPF to buy a house and who should or shouldn’t withdraw from EPF for this reason.

This article explains what happens if you withdraw from your EPF to buy a house and who should or shouldn’t withdraw from EPF for this reason.

Employees’ Provident Fund (EPF) is a mandatory retirement investment applicable to all salaried investors. However, you can withdraw from your EPF to purchase or build a residential property.

EPF offers a guaranteed and mostly tax-free 8.25%/year while home loans have a higher interest rate. Prepaying a home loan, or not withdrawing from higher return equity corpus when buying a house can be a good reason for liquidation of EPF.

A somewhat extreme example, to understand how the interest rate dynamics work, is the rationale that you must pay off higher interest rate loans before investing. For example, a credit card balance, at 42%, requires you to pay more than 40,000/year for ₹1 lakh outstanding balance. If you have ₹1 lakh with you today, then there is no other investment that can give you higher returns than that consistently year after year. So you must pay off the credit card loan.

The same logic applies here. Home loans have a higher interest rate than EPF. Also, you can have other investments that are currently giving good returns that you don’t want to touch. An EPF withdrawal, which is allowed only under special circumstances, can be a good option.

EPF withdrawal, under the conditions above, can be used to pay off a home loan, in part or in full. Please do not withdraw more from your EPF than what is needed for the home loan payoff.

EPF withdrawal is also allowed to pay your home loan EMI periodically in part or full.

Our easy-to-use calculator will give you the answer.

Enter the details to calculate your admissible EPF withdrawal amount.

50,0000

65.00 Lakh

80.00 Lakh

EPF being a retirement investment, should be withdrawn only if you really need the money. Or you understand the exact impact on your portfolio due to the withdrawal. To make a robust case for EPF withdrawal, we will

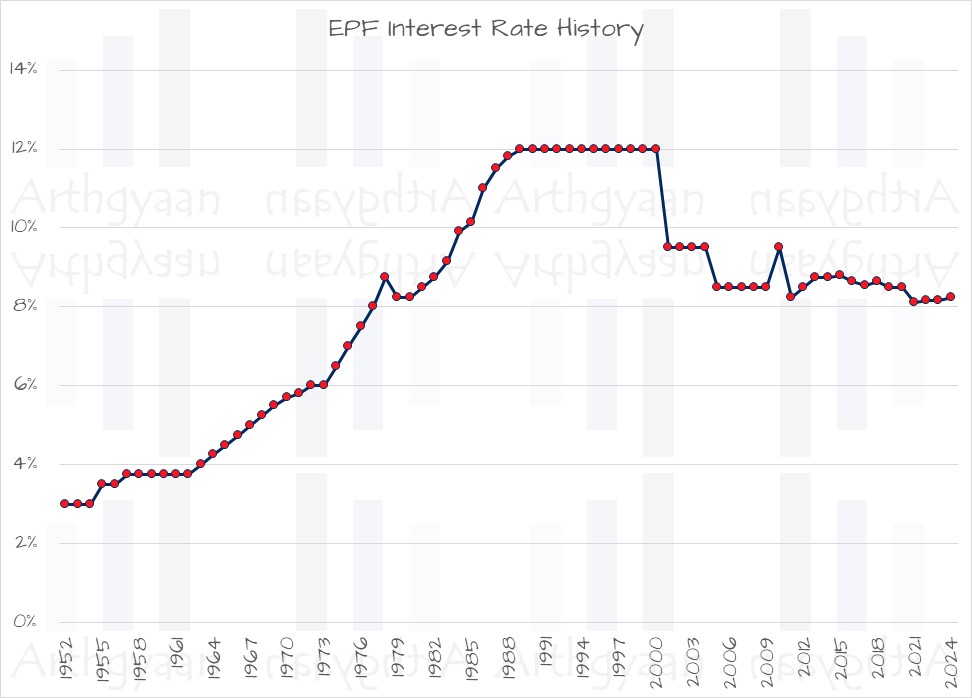

Using data from the EPF India website, we plot the historical interest rates of EPF since 1952.

Some observations:

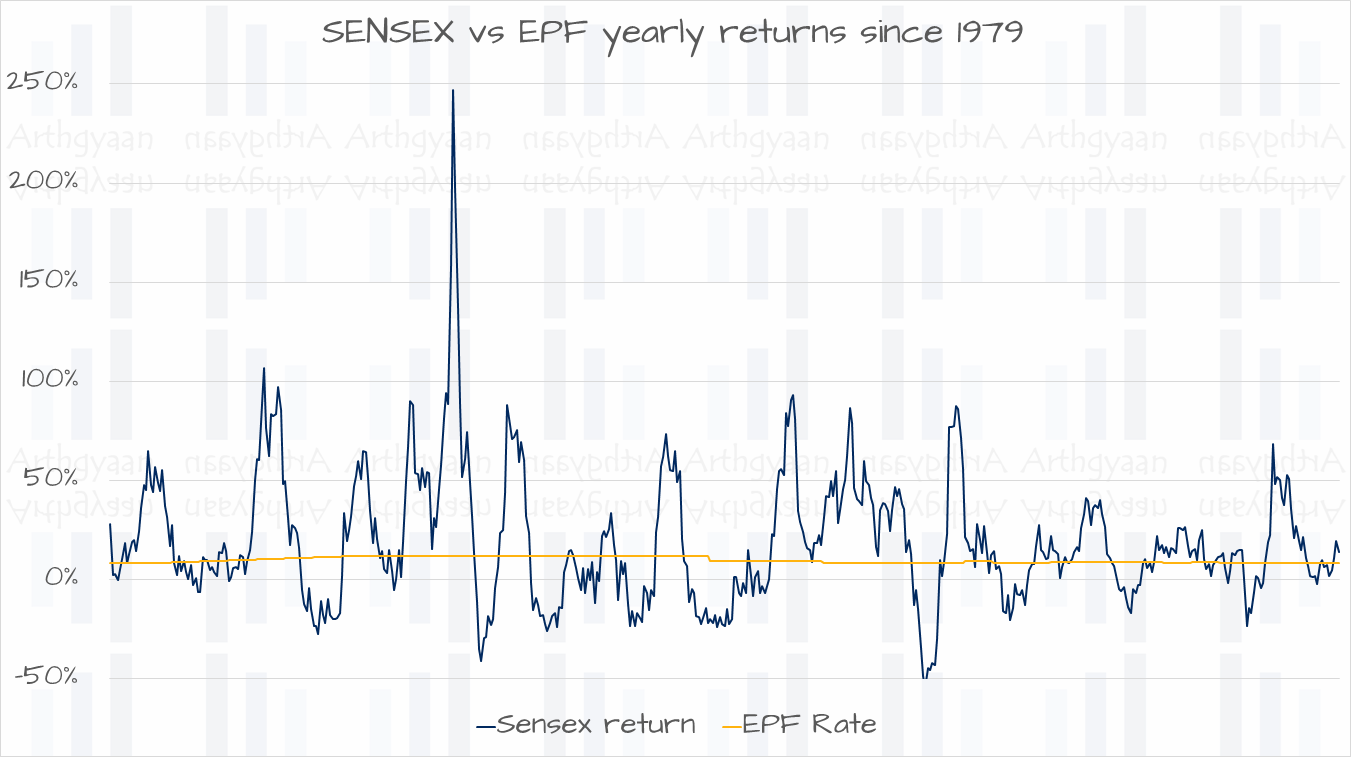

Yearly SENSEX returns have been quite volatile but EPF, but even with regular changes, the EPF rate has been quite stable.

We are following the same methodology as our previous article on PPF vs mutual funds here: PPF vs. mutual funds: which is better?. The key difference between PPF and EPF is that while PPF is an optional investment open to all investors whether salaried or not, the EPF is open only to salaried employees but is mandatory for most salaried employees:

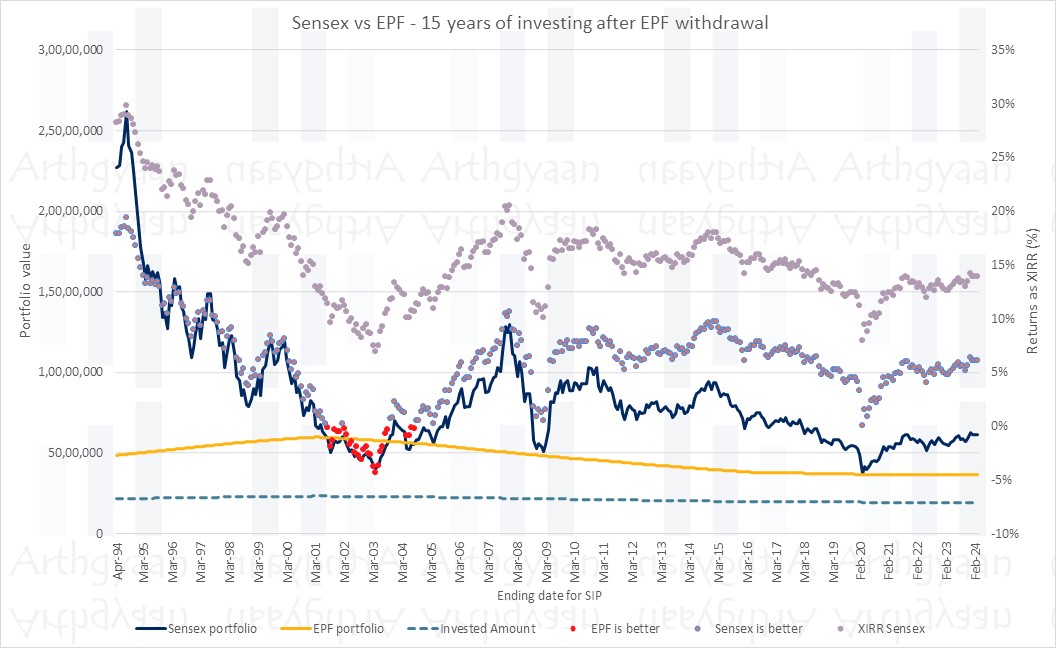

These are all rolling-returns and show a strong trend that can help you make a decision.

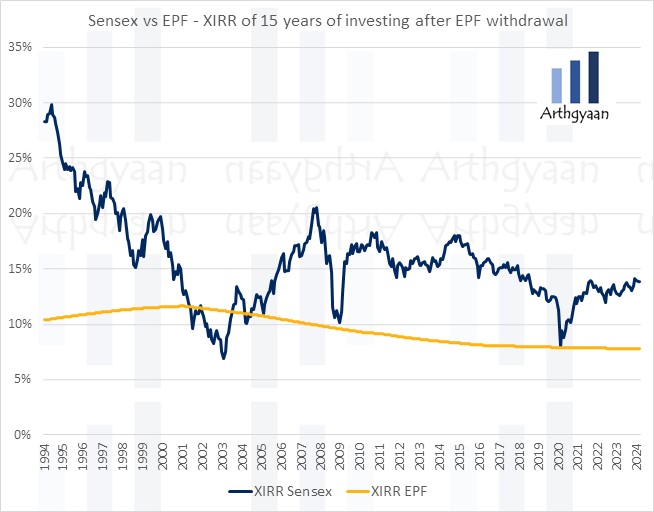

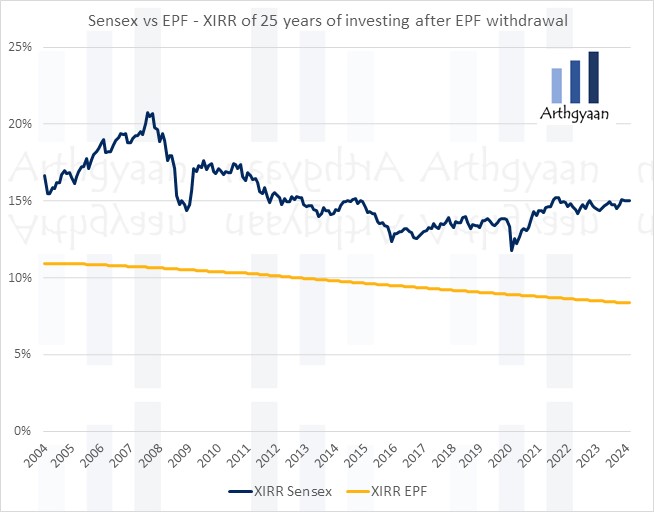

Only during post 2000 market fall has EPF withdrawal been a bad option. For all other periods, withdrawal has been a better option. The XIRR chart below shows the same result.

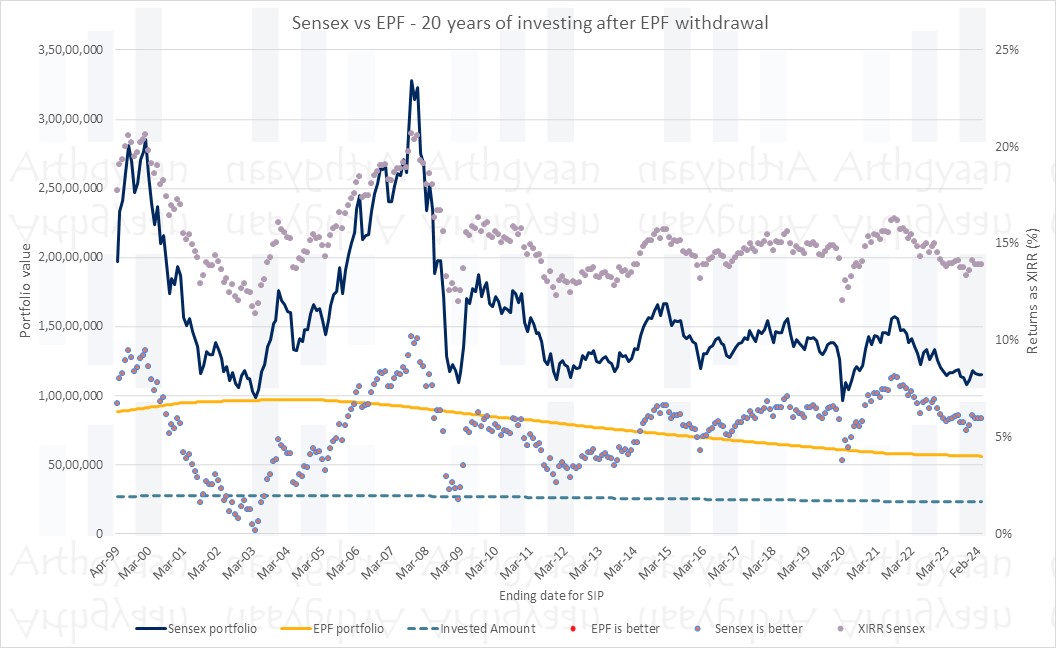

We see that in all situations, the mutual fund portolio has given better results.

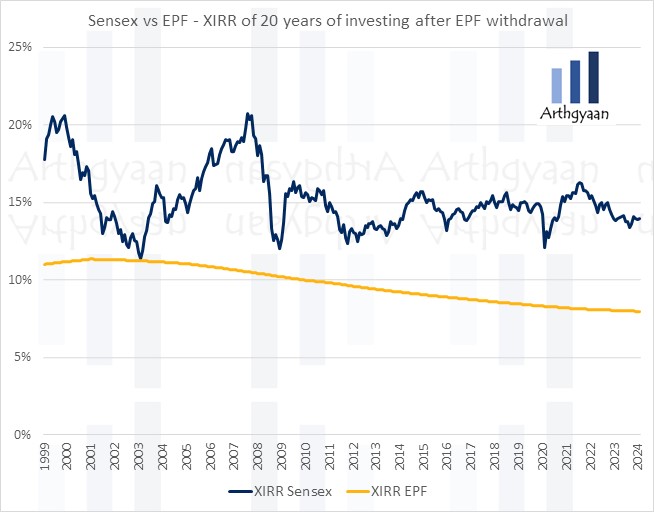

As the time period increases, the trend is now stronger in favour of EPF withdrawal.

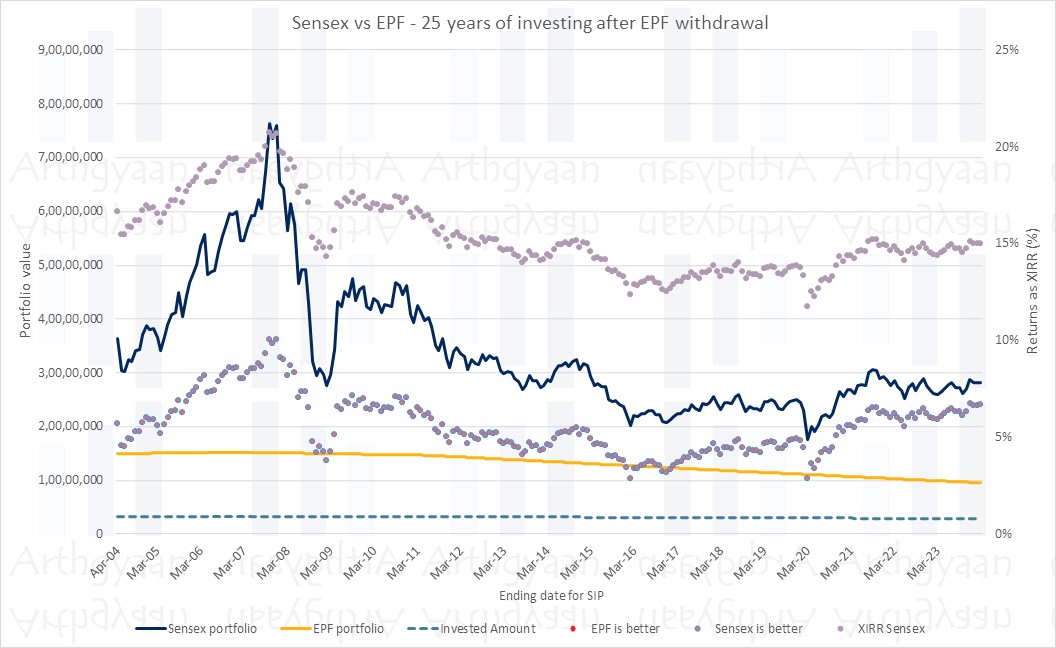

These results show, quite unambiguously, that a SIP in SENSEX, using the home loan EMI saved by EPF withdrawal, has worked out well in the past, especially for long time horizons.

We will lay down some thumb rules to understand if EPF withdrawal is the right thing for your situation:

To understand if EPF withdrawal is the right decision for you:

EPF withdrawal for house purchase does not make sense if:

If your home loan rate dips below the EPF rate, which was the case for floating-rate loans before COVID-19-related interest rate hikes, the benefit reverses. Since you cannot put a large sum of money back into EPF, you will be in a net loss situation.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Should you withdraw from your EPF to buy a house? first appeared on 21 Apr 2024 at https://arthgyaan.com