EPF vs. mutual funds: which is better?

The article presents a historical analysis of investing in stocks vs. EPF since 1979.

The article presents a historical analysis of investing in stocks vs. EPF since 1979.

Many investors wonder which is a better option for long-term investment: Employee Provident Fund or investing in the stock market via mutual funds.

Originally published: 2-Jul-2023

Updated: 29-Mar-2024 - Updated for closing Sensex for March 2024

Updated: 19-Feb-2024 - EPF rate updated to 8.25%

We run a simulation using historical data to check which option has been better. The simulation takes the case of two individuals

We are following the same methodology as our previous article on PPF vs mutual funds here: PPF vs. mutual funds: which is better?. The key difference between PPF and EPF is that while PPF is an optional investment open to all investors whether salaried or not, the EPF is open only to salaried employees but is mandatory for most salaried employees.

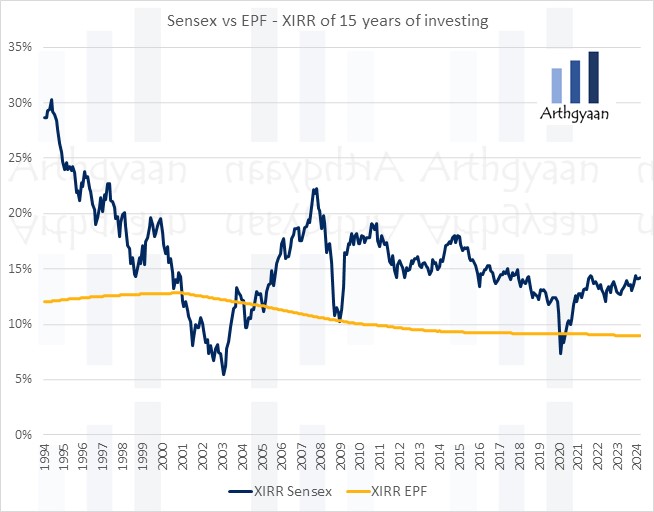

In this article, we will show the results of running a 15-year investment in EPF vs the Sensex (to represent stock investing via mutual funds) in this way:

We did not have mutual funds in 1979, but we have today, and not having mutual funds in the 1970s does not invalidate the conclusions below.

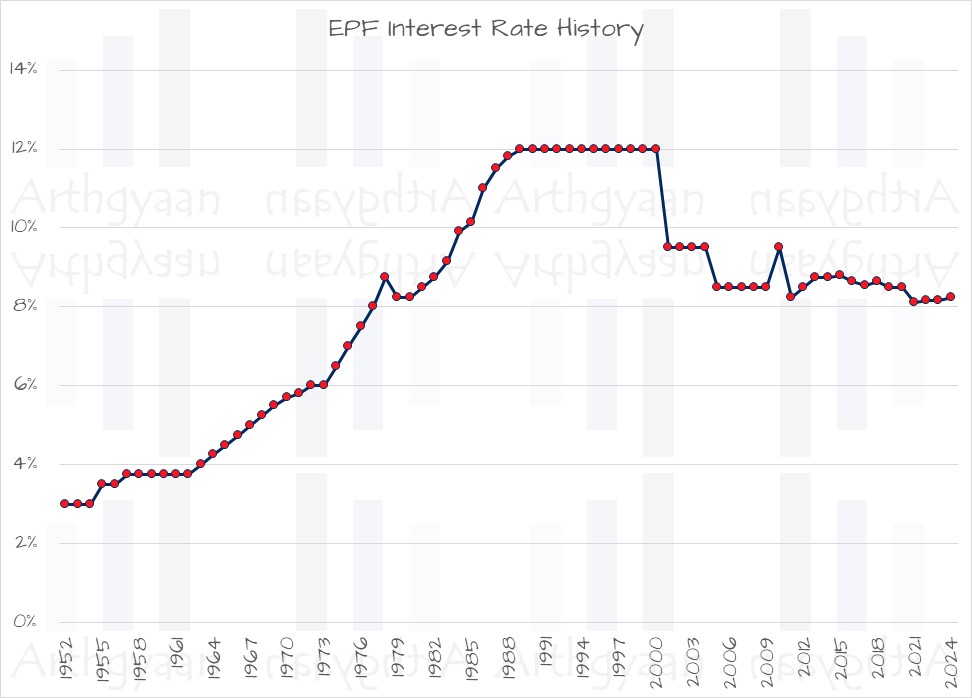

Using data from the EPF India website, we plot the historical interest rates of EPF since 1952.

Some observations:

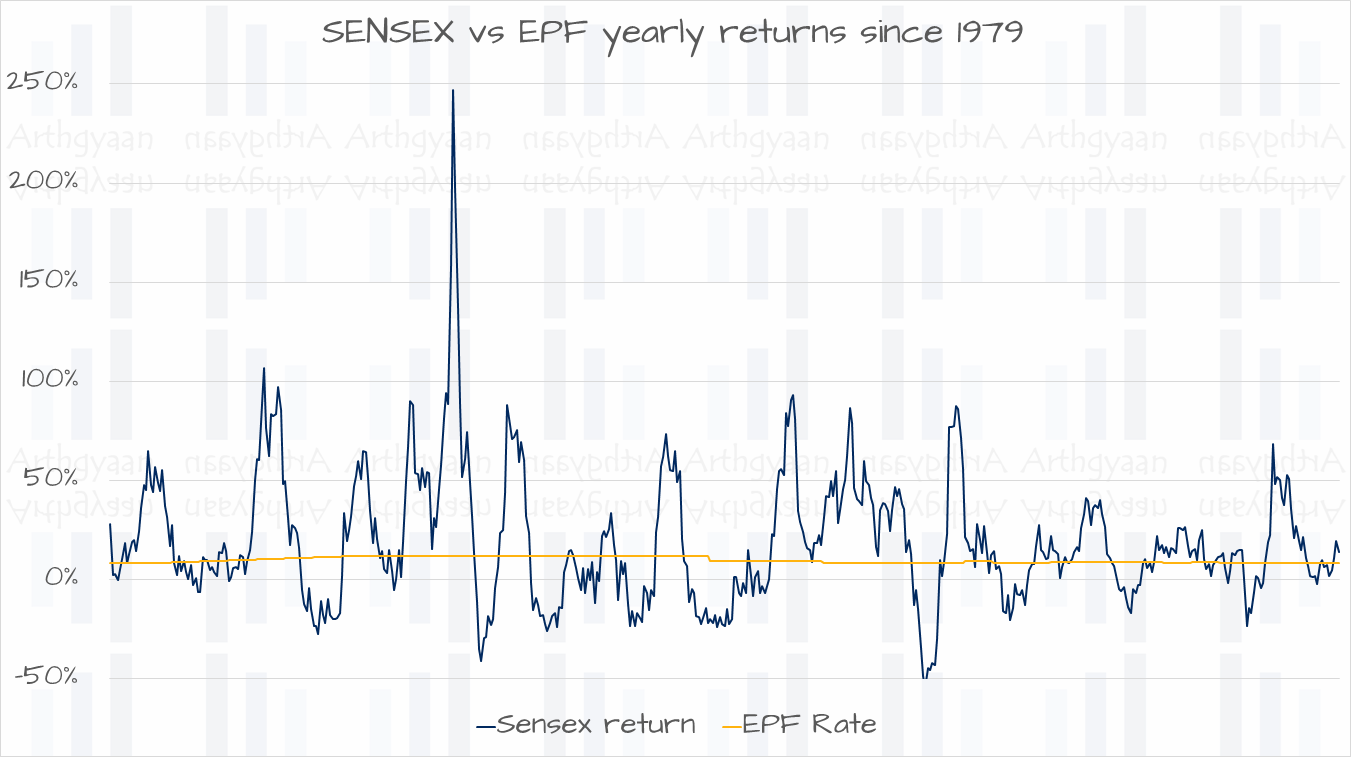

Yearly SENSEX returns have been quite volatile but EPF, but even with regular changes, the EPF rate has been quite stable.

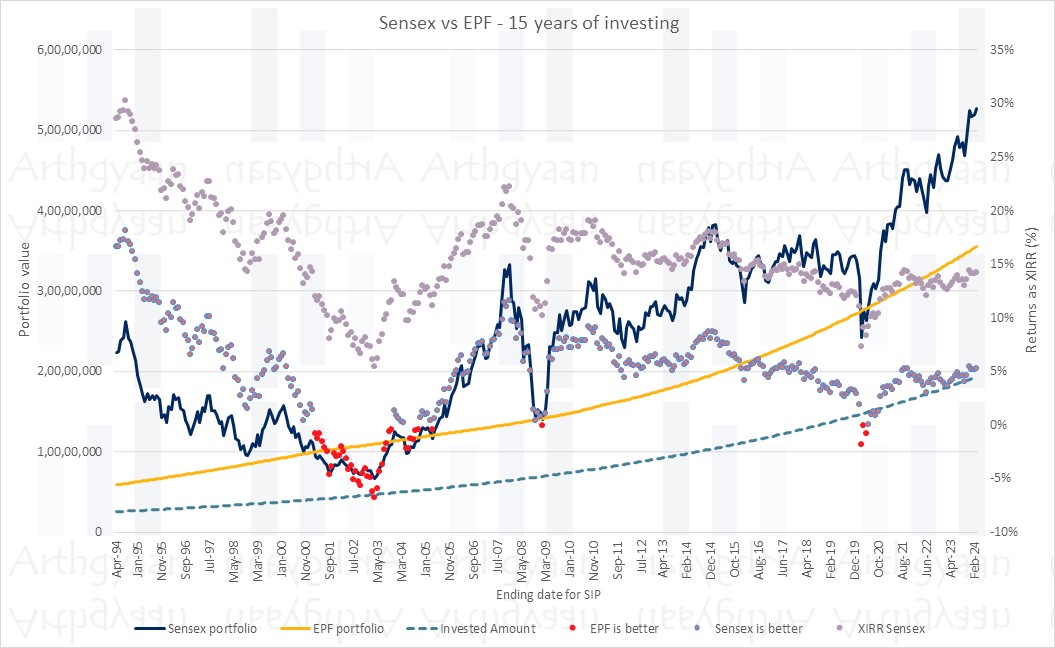

We will invest the same amount at the beginning of the month in EPF or Sensex. The amount is 1/12th of one lakh but since EPF is tied to salary (basic plus dearness allowance), we have assumed a hike of 10% of the investment amount per year. The interest rate taken is the actual EPF rate in that period. We also use the actual Sensex returns for the final portfolio value over the period.

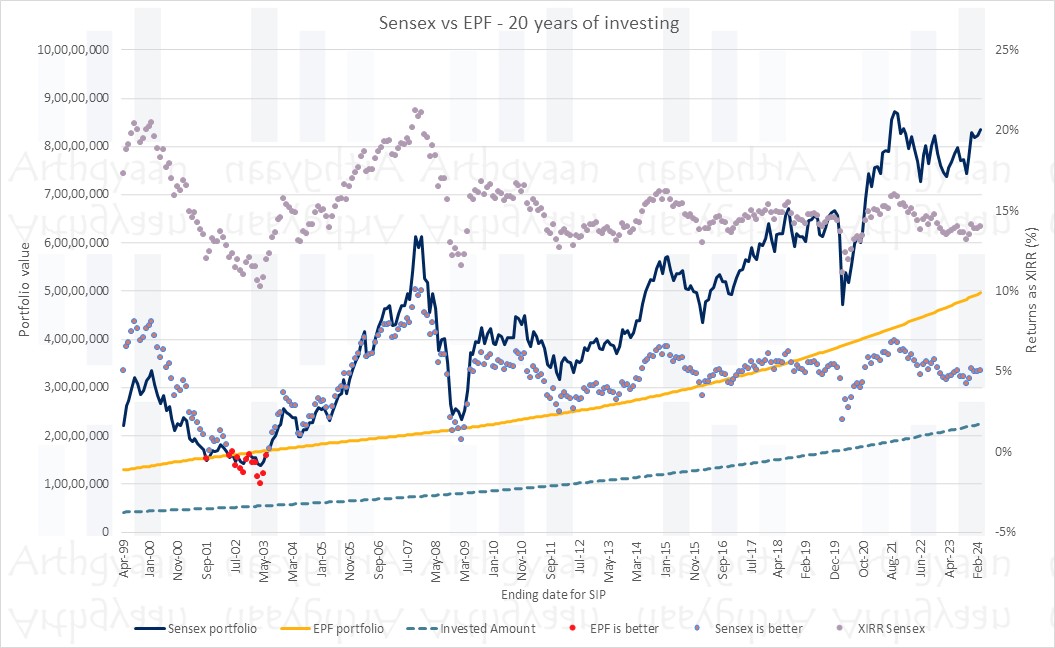

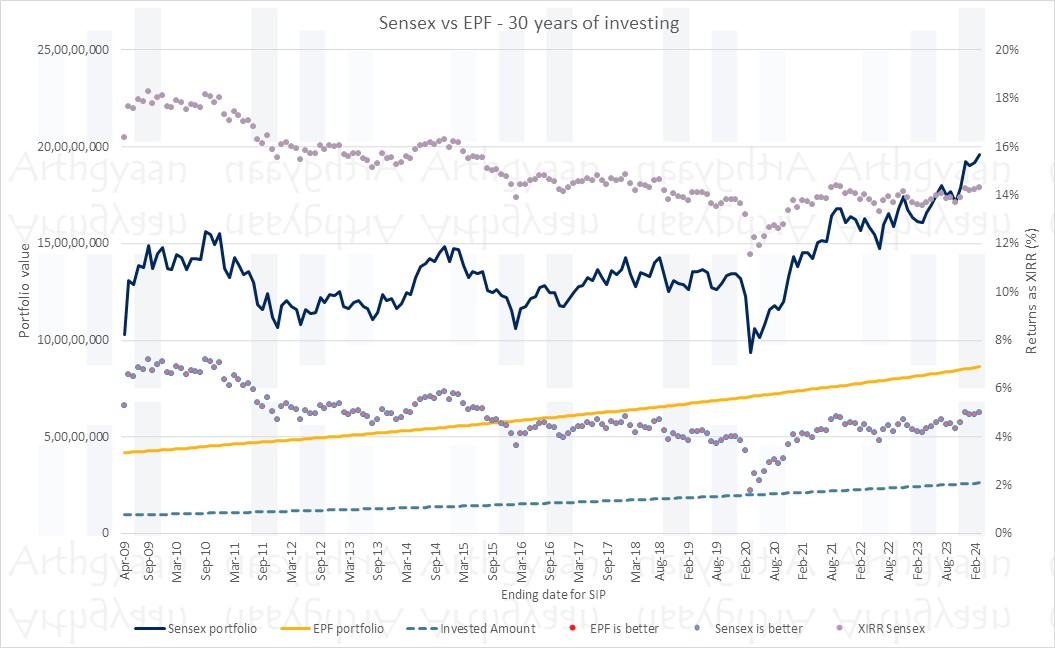

The result shows that in most of the 300+ cases in this simulation, Mr S, the stock investor, comes out ahead. Only in some extreme market events, like the post-Harshad Mehta years, the 2008 global financial crisis or the 2020 COVID-19 crash, did the EPF portfolio do better in 13% cases.

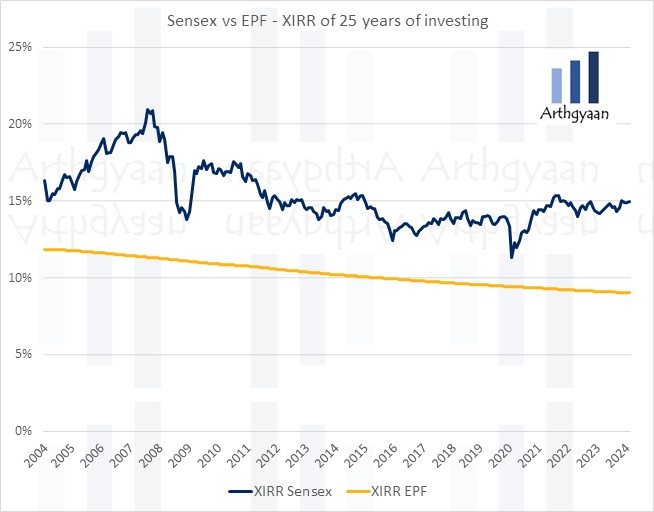

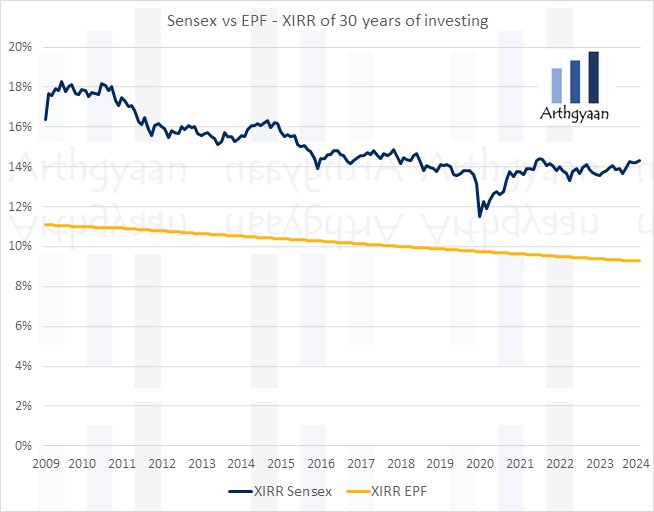

In this chart, we see how the returns of the EPF investment have risen and later fallen with EPF rates while that of the Sensex investment has been unpredictable.

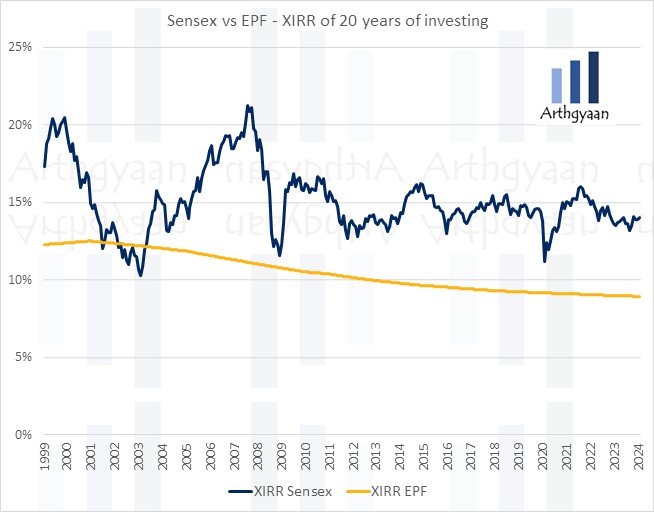

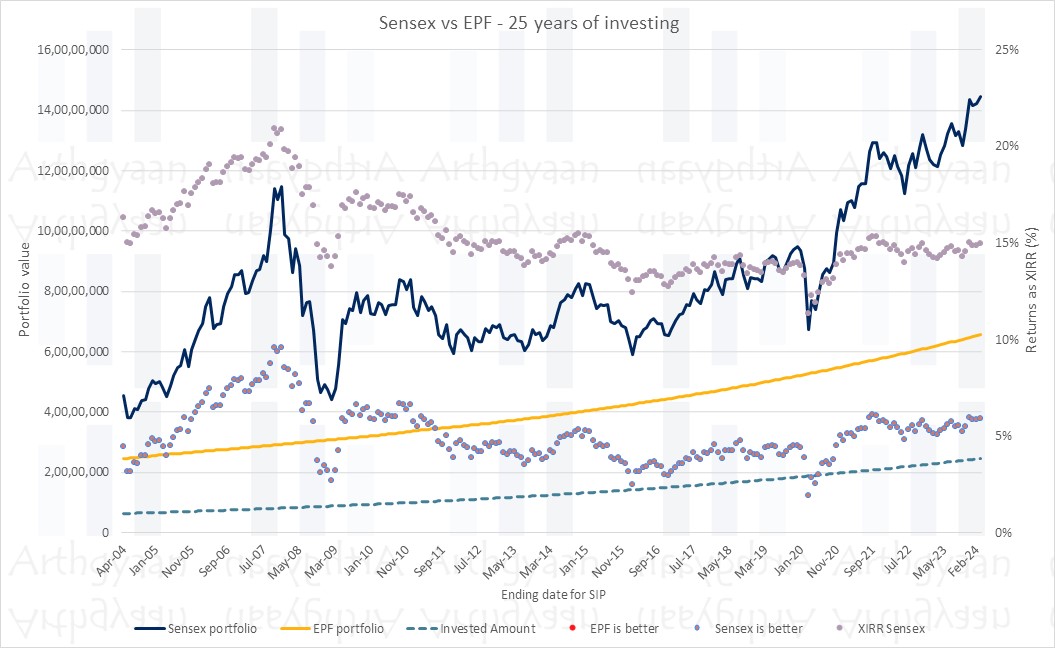

Since EPF is a longer term investment, we will now compare EPF with mutual funds for 20,25 and 30 year holding periods with the same analysis methodology.

The clear conclusion here is that for longer holding periods, investment in mutual funds has beaten EPF in all cases where data is available.

We should keep in mind the following points while concluding anything from this analysis:

Can we use this data to say that “stocks are usually better than EPF”? That is mostly true. However, EPF has some benefits like guaranteed tax-free returns that stocks do not have.

There is another point that we need to keep in mind. From 2015 onwards, the EPFO is allowed to invest from 5-15% of its corpus (starting with fresh inflows) into the stock market via exchange traded funds. Therefore the fixed return of the EPF is somewhat contradictory given that the EPF portfolio now holds both bonds and stocks.

We should not construct a portfolio for long-term goals only with stocks since we have shown before that the end result of such a portfolio is unknown. The better option is to create a portfolio with both debt and equity as asset classes and rebalance between the two per an appropriate glide path.

Given that the EPF is mandatory for salaried employees, it cannot be avoided. However, as per the results of this article, extra investments via the VPF for those who are salaried may be avoided. We will cover the alternative to EPF/VPF in a future article.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled EPF vs. mutual funds: which is better? first appeared on 02 Jul 2023 at https://arthgyaan.com