How to plan tax deductions for salaried income?

This post targets explicitly new investors who are getting started with investing. We cover the most common, i.e. 80C, 80D, HRA, home loan and educational loan interest deductions.

This post targets explicitly new investors who are getting started with investing. We cover the most common, i.e. 80C, 80D, HRA, home loan and educational loan interest deductions.

Originally published: 18-Jan-2022

Updated: 02-Feb-2022 - post Union budget 2022

Updated: 02-Feb-2023 - post Union budget 2023

Updated: 01-Feb-2024 - no changes in direct/indirect taxes in interim budget 2024

Updated: 23-Jul-2024 - tweaks in new tax regime slabs and NPS deductions in Union Budget 2024

Disclaimer: Taxation is a dynamic concept, and the content of this article is valid on the date of publication and any subsequent updates. Always consult a professional tax advisor before doing anything that leads to taxes being due.

In this world nothing can be said to be certain, except death and taxes. - Benjamin Franklin

Paying income tax is one of the inevitabilities that everyone with income has to deal with sooner or later. However, new investors are typically shocked to see how much taxes they are paying on their salary slips for the first time.

The most basic tax calculation is:

Tax is due on net income, i.e. gross income minus deductions. Deductions allow you to save tax. Tax in India is based on slabs. As the income increases, taxes are levied at higher rates on the additional income above thresholds. This means that the highest tax slab is applied only to the income above the value over which 30% is applicable, not to the entire income. There is a surcharge on the total tax only if the taxable income exceeds ₹50 lakhs.

This article only covers the most common tax deductions available to salaried employees. There are more available on the Income Tax website, but the applicability is less due to conditions that are not for every taxpayer.

Many investors approach tax planning from the “how to save most tax” angle, resulting in inappropriate investing or spending money to save tax. While the first problem is easy to rectify, the second is spending more to save tax, which is an unfortunate and permanent loss of capital. For example, do not spend 100 to get 30 back. A deduction that is not suitable for your future financial goals is an effective wastage of 70 of capital since you get 30 back as reduced taxes only after spending that 100.

Before we start, we should keep in mind the key difference in attempts to pay less tax, i.e. planning vs avoidance.

Tax planning uses legal tax-saving provisions to pay a lesser amount of tax. A typical example is section 80C which allows the reduction of taxable salary up to ₹1.5 lakhs/year under allowable deductions. This article will focus on some usual tax planning provisions.

Tax avoidance uses loopholes in tax laws to reduce tax payable. Therefore, it operates in a legal and moral grey area. Tax evasion is illegally not paying due taxes.

All tax deductions claimed must have adequate proof that should be submitted to the employer and retained as records in case of any future audit from Income Tax authorities.

Tax planning starts in April and not in December/March: How should you plan your investments and taxes in April?

If you are using a CA to file your tax return, ensure that you have added them to the Income Tax portal in the right way: Do not share login and password of the Income Tax portal with your CA. Here is what you should do instead..

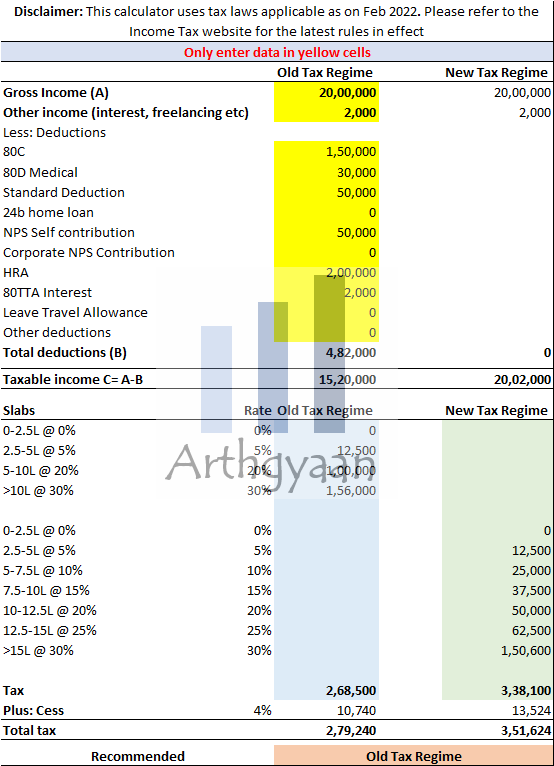

The new tax regime, introduced in Budget 2020 as Section 115BAC, is a more straightforward taxation system that forgoes a few regular deductions (like 80C, HRA etc.) in return for lower tax slabs. Every taxpayer must check, based on their investments and expenses like a house on rent, life insurance premiums and investments like EPF etc., whether the new tax regime is applicable to them or not, and if not, they should choose the old tax regime. Generally, if your taxable income is more than ₹15 lakhs and you have deductions like 80C and HRA, then you should take the old tax regime.

As per Budget 2023 (1st Feb 2023), the new tax regime will be the default option from 1st April 2023 onwards. We have an easy-to-use calculator here: Which is the best tax regime to choose from April?

An amount of ₹50,000 deduction is available for salaried taxpayers that replaces the previous deductions on transport allowance and medical bills. Some companies offer mobile/internet bill reimbursements as well as food coupons that are tax-free.

Budget 2024 (July 2024) has increased the deduction to ₹75,000 for the new tax regime.

LTA allows you to claim tax deduction on the actual journey cost by air/rail/bus inside India for self and family. The deduction is available twice in a block of four calendar years. The current block year is 2022-25, and the next one will be 2026-29.

Under 80C, you can claim a deduction of ₹1.5 lakhs/year. At the 30% tax bracket, you can save ₹45,000 (plus cess) as taxes.

We will use a waterfall approach to fill the 80C limit by moving to the next step only if anything is left within the 150,000 limits:

Read more about 80C deductions here: How to best use 80C deductions to plan your taxes?

If you are paying health insurance premiums, and you must before starting investing, you can claim a deduction on the premium and GST on the premium. The deduction is:

₹5,000 is available as a separate deduction for preventive health check-ups. If you have spent money on medical treatment for dependents, then under 80DDB, you can get up to ₹40,000 as a deduction. For senior citizens, this deduction is up to ₹1 lakh. For disability of self and dependents, there are Section 80U and Section 80DD.

If you have an educational loan, you can claim the entire interest amount without any limit as a deduction. For example, if you have paid ₹3 lakhs as total EMI on your educational loan in the financial year and of that ₹1 lakh is interest, then your taxable income reduces by ₹1 lakh.

There has been an argument given by taxpayers that an educational loan should be allowed to continue since there is tax benefit on the interest. This is an example of the spend-100-to-save-30 fallacy since you are paying ₹1 lakh as interest and saving ₹30,000 on tax. However, you are still paying a net ₹70,000 to the bank as interest.

Prepaying a loan depends on how you are investing. If you are investing enough for long-term goals in equity mutual funds or stocks and the loan interest rate is low, you can only then consider prepaying the loan. Of course, if you decide to be loan-free since that gives you the feeling of freedom, please go ahead and prepay the loan.

Section 24 exists to allow deduction of up to ₹200,000 on interest payable on a home loan. First-time home buyers also have an option of saving an extra ₹50,000 deduction (Section 80EE) on the interest paid under certain conditions. There are a lot of conditions associated with both these deductions and should be carefully researched before going for the loan.

If you are salaried and live in a rented house, you can deduct a part of your taxable income under the HRA head. The deduction amount is the minimum of:

You can pay rent to your parents or family members as long as they own the house. If you declare HRA to your company, you need the landlord’s PAN card, which will show up in the landlord’s own Annual Information Statement (AIS). This last step has been brought in to prevent fake rent receipts from being submitted and to ensure the landlord pays taxes on rental income. If HRA is not given by the company, Section 80GG can help to claim a deduction.

It is our view that young investors should not invest in NPS at all due to blocking the amount until age 60 and compulsory ann

uity purchase requirement for 40% of the corpus. We will cover the details here.

If you still must invest in NPS, restrict the amount to get the ₹50,000 deduction under Section 80CCD, which does not really give much benefit if your retirement is far away, and to get any employer match under the corporate NPS scheme since that is a part of CTC. Up to 10% of salary can go to NPS (limit of ₹7.5L) under corporate NPS as company’s contribution, just like EPF. Under the new tax regime, this limit has been increased to 14% in Budget 2024 (23-Jul-2024).

There is a tax deduction available on donations that are made under section 80G. You will get a receipt post donation that has the PAN of the charity/organisation. Depending on the type of charity, there is a 50% or 100% deduction on the amount donated.

Section 80TTA allows for a deduction of interest from the savings account in any bank or post office up to ₹10,000 per year. Your taxable income is therefore reduced by a maximum of ₹10,000 leading to tax savings. If the total interest exceeds ₹10,000, you need to pay tax at slab rates on the amount above ₹10,000.

This section is only for savings bank interest and not for Fixed Deposit interest. Since bank accounts are linked to PAN, not disclosing this interest in the income tax return might lead to a tax notice. 80TTA, like all other tax deductions, is not available under the New Tax Regime.

To claim the deduction, you need to fill numbers in two places in the income tax return form:

The form will calculate the deduction accordingly.

Companies generally ask for proofs starting December. You need to retain the original receipts and only send the scanned copy as proof. If you miss a deduction or the company did not accept it, it can be claimed while filing taxes. If the company has deducted more tax, you can ask for a refund while filing.

The general way to submit these proofs is:

If you are submitting proofs in Dec-Jan and the expenses happen after that, like ELSS SIP deduction, insurance payments, rent for Feb-Mar etc., then you can handle it like this:

A salaried person has limited options to save tax. Once those options are exhausted, there is no point in thinking more about taxation. As your salary increases, you will pay around ₹34,500 as taxes in the higher slabs per lakh of additional income. It is your wish if you want to anguish over the ₹34,500 tax paid or spend and invest the ₹65,500 income. Overall, tax planning is a subset of investment planning. Invest as per goals and optimise tax deductions so that you can meet the goals with a minimum amount of taxes paid.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to plan tax deductions for salaried income? first appeared on 18 Jan 2022 at https://arthgyaan.com