Which tax regime is better if you want to invest in PPF or ELSS or have a home loan?

This article allows you to calculate the best tax regime to choose based on your investments and salary structure.

This article allows you to calculate the best tax regime to choose based on your investments and salary structure.

Typically, we invest in multiple tax-saving investments like ELSS mutual funds, PPF, NPS or look for exemptions for expenses like life insurance premiums or home loan investments for saving tax. There are multiple sections like 80C, 80D and others that have been historically popular for saving tax.

But Budget 2020 introduced the New Tax Regime (NTR) with the premise of lower overall taxes on income as long as these tax deductions like 80C, 80D, HRA etc., are foregone by the investor. In contrast, the Old Tax Regime (OTR) allows all of these deductions but with a higher tax on the post-deduction income. The latest tax slabs are

Old tax Regime slabs for post-deduction income are:

New tax Regime slabs for post-deduction income are:

Note: The new tax regime slabs are as of Union Budget 2025 announced on 1-Feb-2025. Standard deduction is at ₹75,000 (same as Budget 2024) for income from salary and pension. Please keep in mind that offset of capital gains say under Section 111A, 112 etc (stocks and mutual funds) will not be available in the amounts above the threshold 4L no-tax threshold.

This means that income up to ₹12.75L (including the standard deduction) will be tax-free but if you have say ₹3 lakhs of equity long-term capital gains, it will still be taxable at 12.5% above 1.25L. Though taxable income starts after 4 lakhs as per the slabs, there is no tax until ₹12.75lakhs (₹12 lakhs for non-salaried) due to marginal relief.

There is also a concept of marginal relief, under Section 87A, up to ₹71,250 so that some one with ₹12,75,001 income is not hit with ₹71,250 tax just because of being over the threshold by ₹1. In Budget 2025, 87A relief has been raised to ₹60,000 for income up to ₹12 lakhs. 87A rebate is not available for NRIs.

Previous to Union Budget 2025, the new regime slab rates were:

Given how these slabs are structured, there is a break-even point based on the total amount of deductions you usually take so that one of the tax regimes leads to lower taxes. Now that NTR is the default option, it is essential to correctly choose the tax regime, as many companies will open up the choice in April.

This answer is very simple. The best tax regime is the one that allows us to save the most taxes. You can read the complete guide here along with an easy-to-use calculator: Which is the best tax regime to choose from April?

There is a caveat though on choosing the deductions which go into the tax-regime calculation. If there is no incentive for tax saving, what do we do with investments like PPF, ELSS or expenses like insurance payments?

In this section, we will talk about investments like the Public Provident Fund (PPF), Sukanya Samriddhi Yojana (SSY), Employee Provident Fund (EPF), National Savings Certificate (NSC), Equity Linked Saving Scheme (ELSS) mutual funds, Unit Linked insurance plan (ULIP) and 5-year tax saving FDs amongst others.

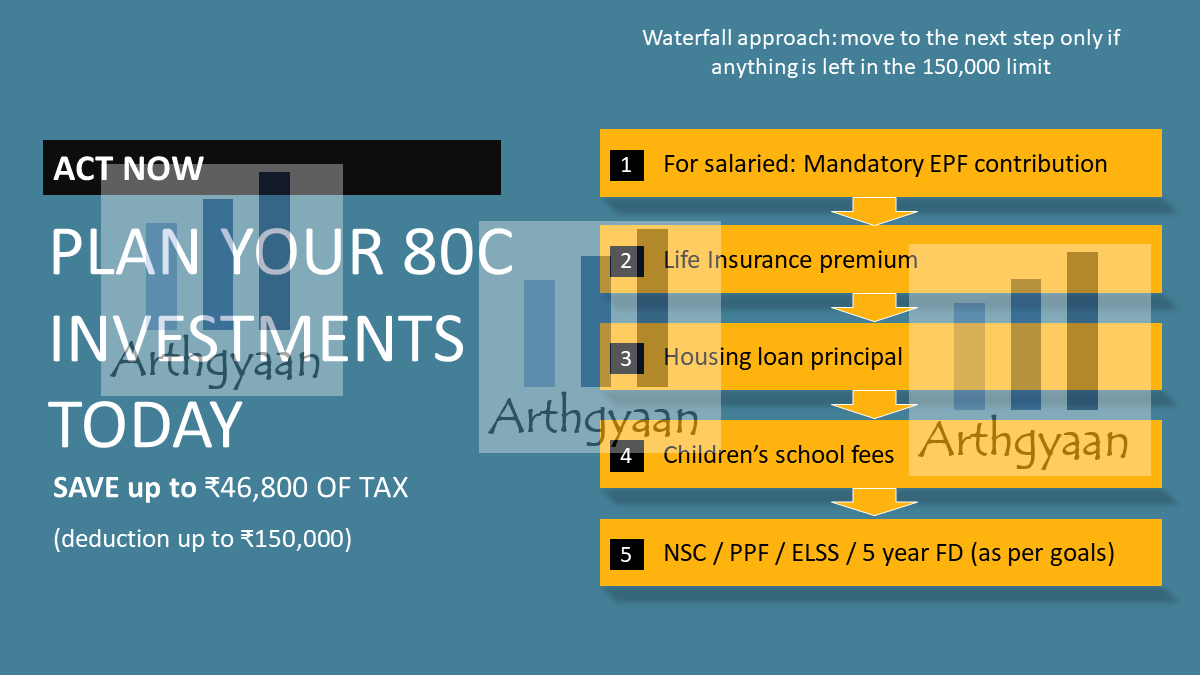

Just because these investments allow you to save tax does not mean that you should choose only them or at all irrespective of the tax regime. For salaried people, there will be EPF. Apart from EPF, at best, ELSS mutual funds might be chosen. Investments in ELSS funds should be only to fill any remaining 80C limit and should be as per the equity allocation of your goals. This post shows you how to select an ELSS fund: What are best tax-saving ELSS Mutual Funds?.

Here is a complete guide on choosing 80C investments correctly: How should you plan your investments and taxes in April?.

Expenses like insurance premium payments (80C), home loan interest (24A), home loan principal and registration cost (80C), medical insurance premiums (80D), school fees (80C) etc are expenses that no longer enjoy any deduction in the new tax regime.

Now it should be obvious that just because the tax deduction is not there in the new regime, you should stop paying your insurance premiums, home loans and child school fees. That would be inadvisable for obvious reasons.

Do not throw good money after bad in these insurance plans

Of course, if you were mis-sold any non-term endowment, whole-life, ULIP, child plan or some other plan in the name of tax savings, please do not waste further premiums and consider exiting. You can always go to the nearest insurance company branch to understand your exit options.

Apart from these, HRA, LTA, savings account interest exemption (80TTA) and other exemptions are not there in the new regime. Still, if you check by using the calculator, you might save more tax in the new regime.

Here is a small list of tax deductions that are still valid in the new tax regime:

Salaried individuals without business income can choose whichever tax regime they want, based on what saves the most tax, at the time of tax filing.

All of these options, including employee contributions to NPS do not have any tax deductions under the new regime. If you are using our calculator to check which tax regime is best for you, please do not forcibly add these items except EPF and Employer NPS Contribution under 80CCD(2).

However, if you need them for whatever reason, you should continue to invest in the new regime:

PPF investment: PPF is good if you want safe but limited returns for a goal but bad if you are planning to create wealth

EPF investment: We can extrapolate the same logic to EPF (and then to VPF): EPF vs. mutual funds: which is better?

NPS investment: We are not fans of NPS in its current form due to restrictions on withdrawals before 60 and then the compulsory annuity purchase clause. If you have Employer NPS Contribution under 80CCD(2), take that but do not invest any more in NPS: Is NPS the right option for your retirement planning?

ELSS investment: There is no need to invest in ELSS unless both the following conditions are true:

In such a case, please check out the latest ELSS funds here: Which are the best tax-saving ELSS Mutual Funds?.

If you have an existing home loan, please use this calculator to enter the total home loan interest to be paid over the next year into the calculator:

Interest paid last year = As per interest certificate from the bank

Estimated interest to be paid next year = Home loan balance * Loan Interest Rate

(this will be an approximate estimate only)

Please enter these values in the calculator for an accurate choice of tax regime.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Which tax regime is better if you want to invest in PPF or ELSS or have a home loan? first appeared on 31 Mar 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.