How should you plan your investments and taxes in April?

This article shows what steps investors should take in April at the beginning of the financial year.

This article shows what steps investors should take in April at the beginning of the financial year.

April marks the beginning of the financial year. We need to perform some tasks to ensure both investments and taxes are appropriately planned for the entire year. This article will focus on some of the most common items.

Disclaimer: Taxation is a dynamic concept and the content of this article is valid on the date of publication and any subsequent updates. Always consult a professional tax advisor before doing anything that leads to taxes being due.

Don’t spend 100 rupees to save 30 rupees tax - Author

A lot of investors focus on taxes first while planning their investments. While saving taxes is essential, an investment plan that focuses on saving tax and not investing as per goals is a recipe for future disaster. Capital is scarce for most investors which means you need to be able to formulate your goals with a proper investment plan to know if your investments are happening correctly. Based on your age, you may not have a lot of time to course correct.

For example, if you are 35 and do not have a corpus of 13x your current annual expenses saved for retirement, you are already behind. You can check this concept here: Goal-based investing will show you how much you should have saved at 30,40,50 and retirement.

Before focusing on tax deductions, ensure that:

A few common mistakes that investors make:

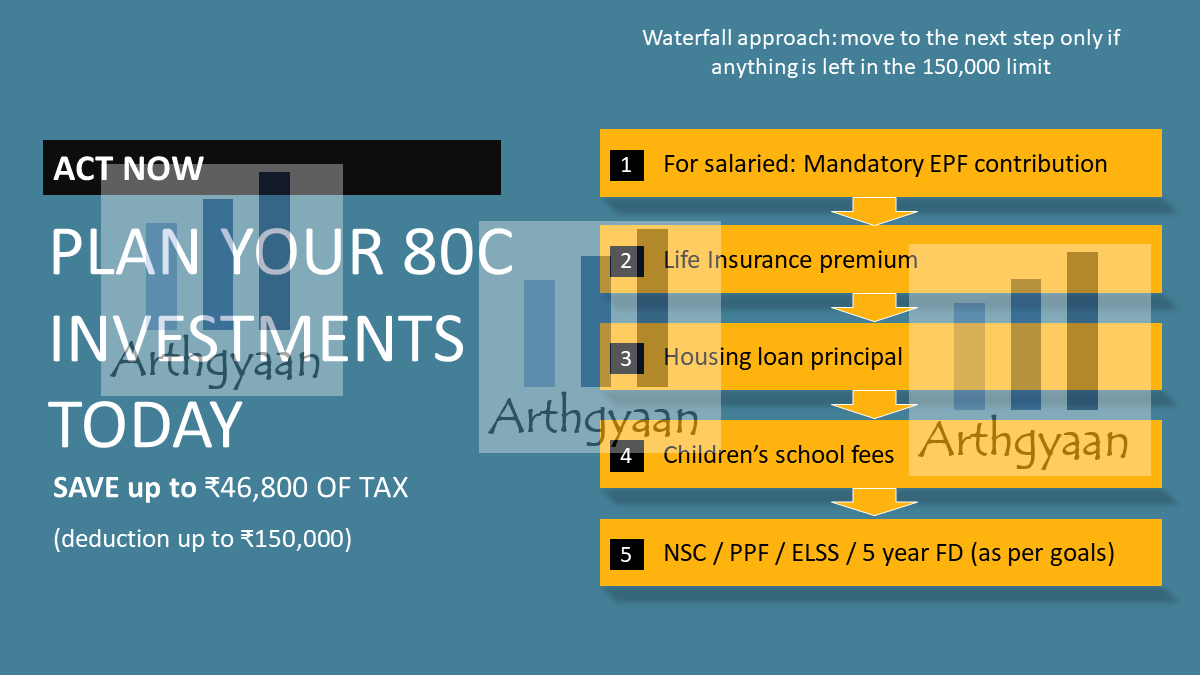

Under 80C, you can claim a deduction of ₹1.5 lakhs/year. At the 30% tax bracket, you can save ₹45,000 (plus cess) as taxes.

We will use a waterfall approach to fill the 80C limit by moving to the next step only if anything is left within the 150,000 limits:

Read more about 80C deductions here: How to best use 80C deductions to plan your taxes?

Apart from term insurance, do not buy other life insurance like whole life, endowment and ULIP. These products are just a term plan with an investment component. They are traps for insurance agents and banks to make money off unsuspecting investors.

Use this guide to purchase term insurance: Term life insurance: what, why, how much to get and from where?

NPS offers a ₹50,000 deduction under Section 80CCD and is, therefore, a hot favourite amongst those who wish to save ₹15,000 in tax every year. Two major problems with NPS are:

Our position on NPS investment is:

ELSS funds are mutual funds with a mandatory 3-year lock-in for every purchase and offer a tax deduction under section 80C. If you are investing in the SIP form, then keep in mind that every installment is locked for three years from purchase.

All ELSS funds are currently available only as active funds. Only having active funds leads to “which is the best ELSS fund” confusion amongst investors. The thumb rule to choose active funds is

Many investors use the 1-lakh equity LTCG tax exemption to roll their ELSS funds every year. This form of tax harvesting involves selling the oldest (>3y) ELSS units and reinvesting them immediately in the same or another fund.

If you plan to invest in ELSS, start a SIP in April instead of waiting until December or later when your company asks for investment proofs. Investments in ELSS funds should be only to fill any remaining 80C limit and should be as per the equity allocation of your goals. This post shows you how to select an ELSS fund: What are the best tax-saving ELSS Mutual Funds?.

Debt allocation for any portfolio has three parts:

PPF allows you to invest ₹1.5 lakhs/year in every family member’s PPF account (grandparents, parents, children) and allows ₹1.5 lakhs exemption/year under 80C per investor who is investing. So a family with goals that are far away can invest 1.5 lakhs/year for multiple family members as long as their asset allocation allows it. The interest rate for PPF is 7.10% today and is expected to fall with time. The money is locked until maturity for 15 years.

If you are wondering when to invest in PPF keep this in mind: since the balance of the PPF account does not reduce, you need to invest as much as you can or need to as early as possible. The interest for PPF is calculated based on the balance on 5th April, then on 5th May and so on and then credited on 31st of March next year: Which is the best month to invest in PPF to get the highest interest?.

These are retirement schemes (currently offering 8.25%/year) with the following main differences

VPF, like PPF, should be considered if the asset allocation allows it and not because of the interest rate.

SSY is allowed only for girl children and has a ₹1.5 lakhs/year limit. It offers a deduction under 80C and has a 8.20% interest rate as of today. The amount is locked in until 21 years from account opening and allows partial withdrawal once the child is 18. It is recommended that SSY is used mainly for goals like post-graduation degree and marriage due to the lengthy lock-in if your asset allocation allows it. However, if your monthly investment amount is high enough, SSY can also be used for retirement planning.

It is expected that over time, as the economy matures, these debt instrument returns will go down. Invest in them only if

Just like PPF, the interest on SSY is calculated on the 10th of the month and so you should invest as much as possible or need to by that date.

This is a common question regarding investments in PPF, VPF and SSY. On one hand, we have the allure of the “government-backed secured returns”. On the other hand, we need to beat inflation for 30-40 years in retirement, which can be done by equity and is impossible via debt investments.

Our position on PPF, VPF and SSY investments is this: follow a step-by-step process:

Once you have these three corpus figures, you can use one of these calculators to know your monthly SIP amount and asset allocation between debt and equity using this comprehensive Goal-based Investing Excel planner for all goals together.

Your debt proportion should go into EPF, PPF, VPF and SSY (if you have a girl child) only up to the limit allowed by the debt SIP amount. If you do not have a large exposure to equity already, your debt allocation will possibly come lower than your current debt investments. In such a case, your entire monthly SIP should only be in equity. You can choose equity funds from here: Which index funds to invest in and why?

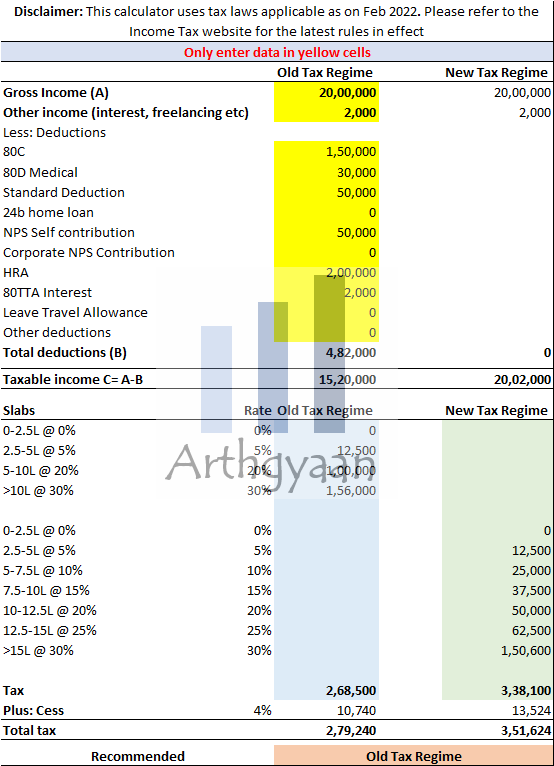

Most salaried employees have to choose their tax regime (old vs. new) along with 80C and other deductions in April. A quick way, if you have not thought about where you plan to invest under 80C is to declare ₹1.5L in PPF since you can always edit this later. The same concept applies to health insurance (80D) and HRA.

The new tax regime, introduced in Budget 2020 as Section 115BAC, is a more straightforward taxation system that forgoes a few regular deductions (like 80C, HRA etc) in return for lower tax slabs. Every taxpayer must check, based on their investments and expenses like a house on rent, life insurance premiums and investments like EPF etc, whether the new tax regime is applicable to them or not, and if not they should choose the old tax regime. Generally, if your taxable income is more than ₹15 lakhs and you have deductions like 80C and HRA, then you should take the old tax regime.

Read the complete guide here along with an easy-to-use calculator: Which is the best tax regime to choose from April?

You should submit 15H or 15G forms for avoiding TDS on dividends from companies and bank fixed deposits if you are below the 30% tax bracket. If you are already in the 30% tax bracket, though, there is no need to submit these forms since you will anyway pay tax at 30% on this income.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How should you plan your investments and taxes in April? first appeared on 01 Apr 2022 at https://arthgyaan.com