How to pay for an IIT Engineering degree with only PPF investment?

PPF is a great safe and guaranteed investment that can be used for investing enough to pay for a 4-year IIT engineering degree.

PPF is a great safe and guaranteed investment that can be used for investing enough to pay for a 4-year IIT engineering degree.

Disclaimer: This article does not propose that an IIT undergraduate degree is the best option for every child. Parents should be conscious of the stress that children go through while preparing for the entrance examination which unfortunately continues in many cases during the 4 years at IIT. This is a personal finance blog and the focus is only on investing suitably for a college degree.

Public Provident Fund (PPF) offers a guaranteed, safe and tax-free return that many people find comforting for using for a child’s college education goal. There is nothing wrong with the approach of using safe investment for the college goal but parents should be aware of the complete pros and cons.

Many people might want a way to ensure that the money for the college education goal is locked away so that it cannot get spent on frivolous things.

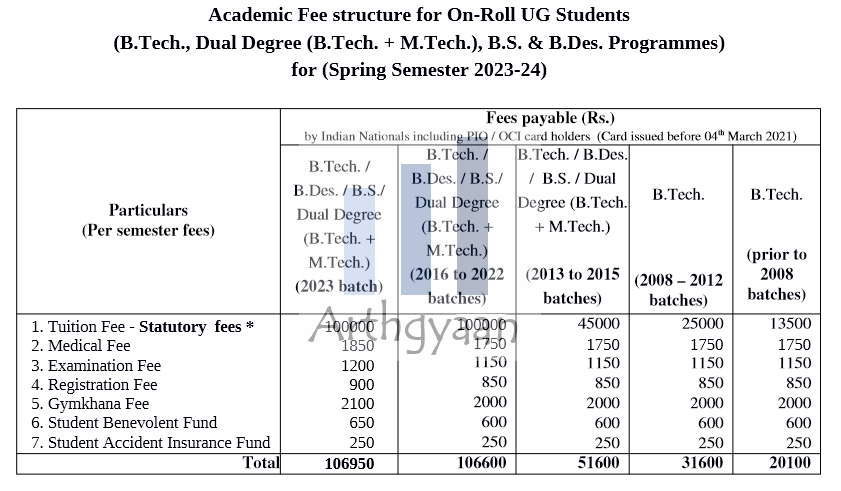

Here we will follow the simple method of using the website of IIT Bombay to estimate the various costs related to a 4-year engineering degree at IIT. The numbers are accurate as of February 2024.

| Year | Cost in lakhs | Cost after 15y |

|---|---|---|

| 1 | 3.14 | 8.66 |

| 2 | 2.14 | 5.90 |

| 3 | 2.14 | 5.90 |

| 4 | 2.14 | 5.90 |

| Total | 9.56 | 26.38 |

For admission and other setup costs (laptop etc.) we have assumed ₹1 lakh extra in the first year. We have assumed 7% inflation in fees for the next 15 years:

Cost after 15 years = 1.07 ^ 15 times cost today

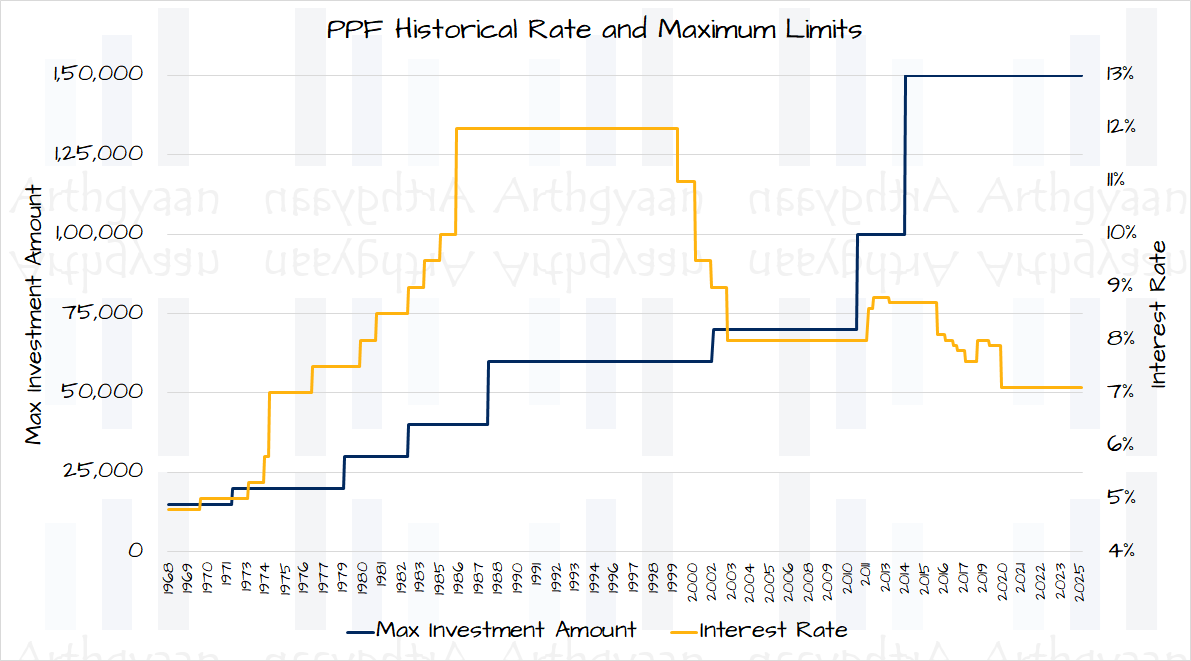

PPF is not always the best instrument for college goals since it can create a corpus only up to a certain limit based on the interest rate it offers (which changes over time) and the amount of investment per year is also fixed.

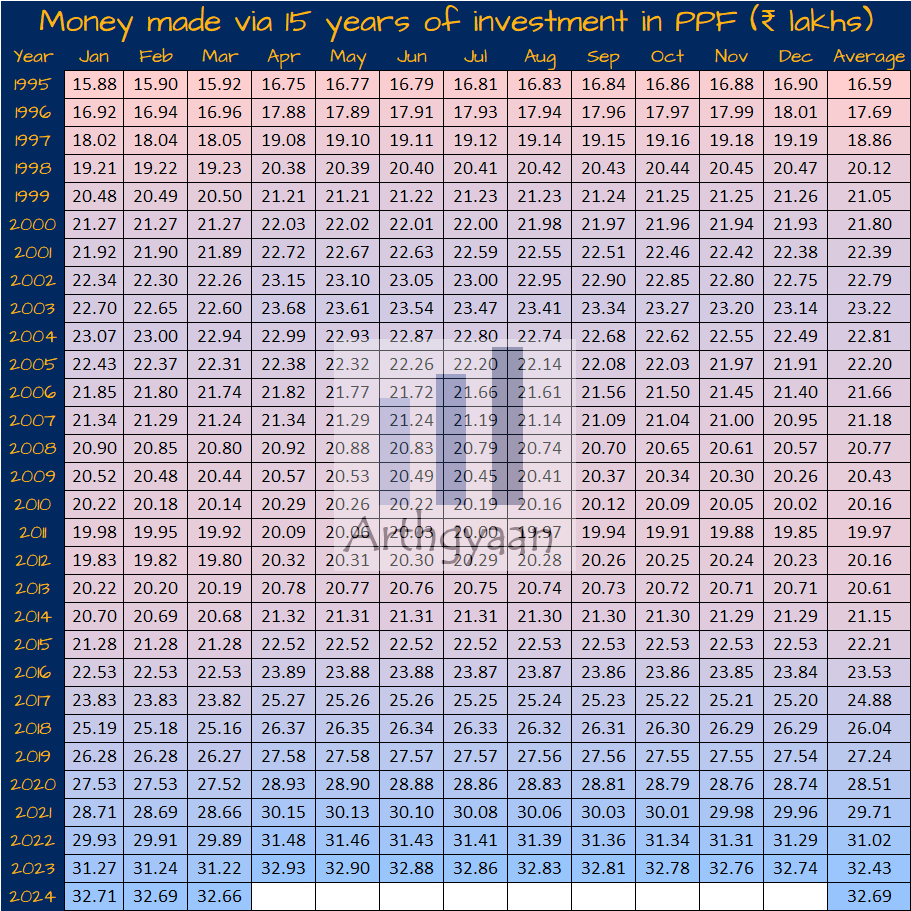

If the college cost is more than what is there in the PPF account, you will have to arrange funds from other sources or take an educational loan. If the PPF interest rate of 7.10% continues and if you invest the maximum allowed ₹1.5 lakhs/year, you will make around ₹40 lakhs: How much money has been made by investing in the Public Provident Fund (PPF)?

So to reach the total corpus of fees of ₹27 lakhs in 15 years in PPF, you should invest ₹8,500/month. Ideally you should invest more than that, preferably up to the current limit of ₹12,500 since:

There are two things that you have to keep in mind:

As per the ₹1.5 lakhs limit, a parent cannot invest more than ₹1.5 lakhs/year in their own plus child’s PPF combined. So there is no difference in whose PPF account it is.

Paperwork will be easier if that parent simply opens a PPF account in their own name for this purpose if they don’t have one already. Most banks offer online PPF account opening.

Other parents might want to keep the finances of their child separate and open a new PPF account.

Since IIT starts at age 18 of the child, you need to plan the account maturity (which is always on 1st April) to happen before the admission fees are due.

| Age | Event |

|---|---|

| 16 | IIT Coaching Year 1 |

| 17 | IIT Coaching Year 2 |

| 18 | Admission + Year 1 in IIT |

| 19 | Year 2 in IIT |

| 20 | Year 3 in IIT |

| 21 | Year 4 in IIT |

Some thumb rules can be:

You can even use the money received for the Rice Ceremony as a lump sum to kick-off the PPF account in the child’s name.

You get the most interest by investing the entire ₹1.5/lakh for the year before 5th April. However, the final corpus, if you invest ₹12,500 every month (12,500 * 12 = 1.5 lakhs) is not very different: How to get the most interest when investing in PPF?.

Please do not make the common mistake of investing ₹12,500/month in an RD to invest ₹1.5 lakhs in PPF next April. That actually reduces returns since the RD interest rate, especially after tax, is much lower than the PPF rate.

You should keep the amount in multiple FDs that mature every 6 months as per the IIT fee payment schedule.

| Date | Event |

|---|---|

| Apr 2026 or earlier year | PPF maturity |

| Jun 2026 | FD maturity for admission fees |

| Dec of 2026 | FD maturity for semester 2 |

| Jun of 2027 | FD maturity for semester 3 |

| Dec of 2027 | FD maturity for semester 4 |

| Jun of 2028 | FD maturity for semester 5 |

| Dec of 2028 | FD maturity for semester 6 |

| Jun of 2029 | FD maturity for semester 7 |

| Dec of 2029 | FD maturity for semester 8 |

Fees are due for every semester and there are 2 semesters per year. You can check PPF maturity dates here: When does a PPF account mature?

Banks like SBI and Canara Bank (which were there on campus the day I took admission to IIT Bombay) and many others offer loans at reasonable rates to IIT students. Most of the time, they will have a branch outside the campus gate and a kiosk or stall beside the admission office at the time of admission.

SBI offers an excellent product called SBI Scholar Loan that you can explore.

If your PPF account is maturing after the admission fees are due, simply pay the fees now from educational loan and once you get the PPF maturity in April, pay off the loan with the PPF. The rest of the PPF amount goes into FD.

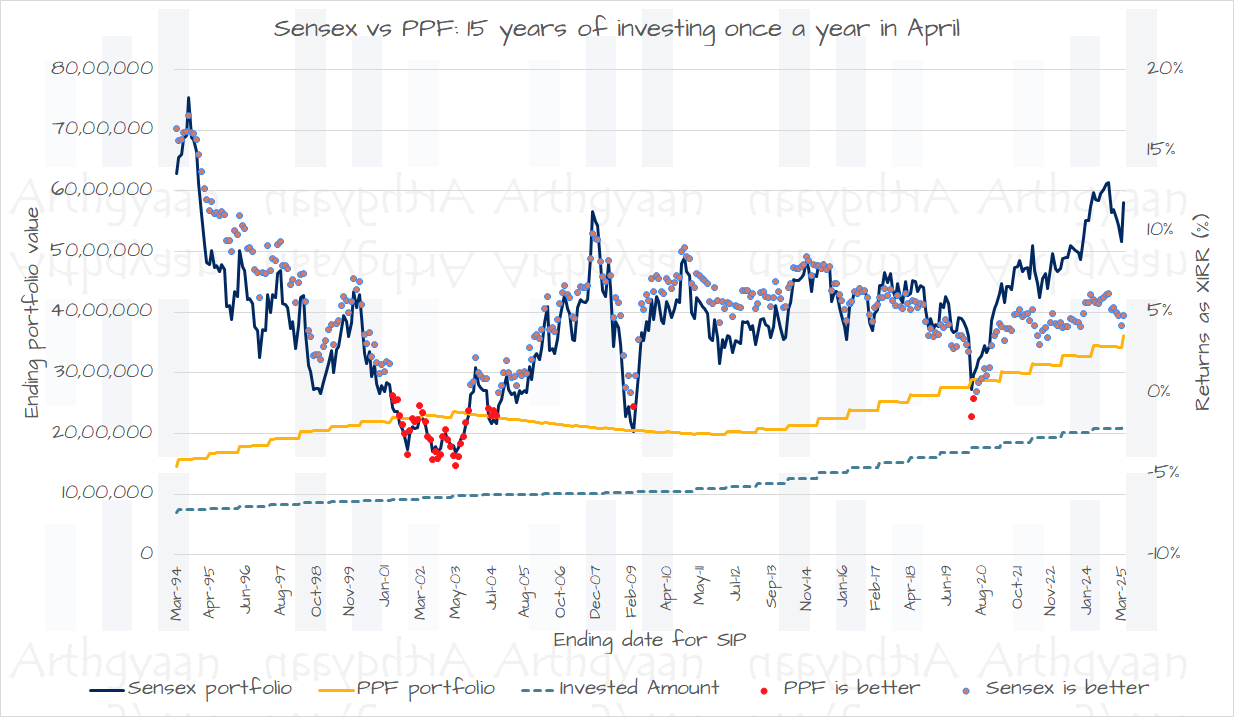

PPF creates a much lower corpus compared to mutual funds and that is the cost of choosing safety.

We have already shown that PPF has not beaten risky assets like equity in less than 10% of cases since 1979: The latest result of PPF vs. SENSEX.

You can follow the complete goal-based investing process as explained:

Your child’s school and other regular expenses will come from monthly income. But you need to plan for bigger expenses in advance:

Which of these are you saving for:

To understand how to create a child’s education plan:

You need to ensure that an untimely death will not prevent your child from going to their future dream college. Term insurance is the right product here. Every earning member of the family must have adequate term insurance.

The whole family, i.e. child and parents should also have sufficient health insurance. This step prevents loss of income or a setback to investment goals due to illness.

Children’s education and other goals do not exist in isolation. They are a part of the comprehensive goal-based planning that parents need to do for their own retirement and everything else. The process is explained best with these examples:

There are more case studies here: Case Studies.

We have proven that the goal-based investing process works in most market conditions in this article: What is the best way to invest for your child’s college education?.

As time passes, things change:

Therefore the plan created in Step 3 has to be reviewed and rebalanced to check if you are still on track: Are your investments on track for your goals?.

To implement all of the above steps in one easy-to-follow bundle, we have Arthgyaan Child Education goal packages. Choose the year closest to your desired college admission year to get started:

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to pay for an IIT Engineering degree with only PPF investment? first appeared on 25 Feb 2024 at https://arthgyaan.com