How much money has been made by investing in the Public Provident Fund (PPF)?

This article shows the maturity amount of investing in the Public Provident Fund (PPF) for 15 years as per historical interest rates.

This article shows the maturity amount of investing in the Public Provident Fund (PPF) for 15 years as per historical interest rates.

As per Wikipedia, the Public Provident Fund (PPF) is a savings-cum-tax-saving instrument in India introduced by the National Savings Institute of the Ministry of Finance in 1968. PPF allows you to save small sums of money, and offers a guaranteed interest rate and tax benefits that make it attractive for many conservative investors.

PPF is a fantastic debt instrument which has guaranteed return (though it has fallen over time) but it is still higher than the market rate in other options. Since there is a 15 years lock-in (which can be extended in blocks of 5 years) and to keep the account active you need only ₹500/year, open it and keep it active. Later when you need to invest more amount in long-term debt investments, both the maturity of PPF will be closer and you will have many options like debt mutual funds. You can open PPF in your own name plus in the name of your parents if they don’t have one already. When you get married and have children, you repeat this for your spouse and children.

PPF is an EEE-class instrument which means that it is exempt from tax on investment up to 1.5 lakhs/year under 80C, exempt from taxation during growth and there is a full exemption on taxes at maturity.

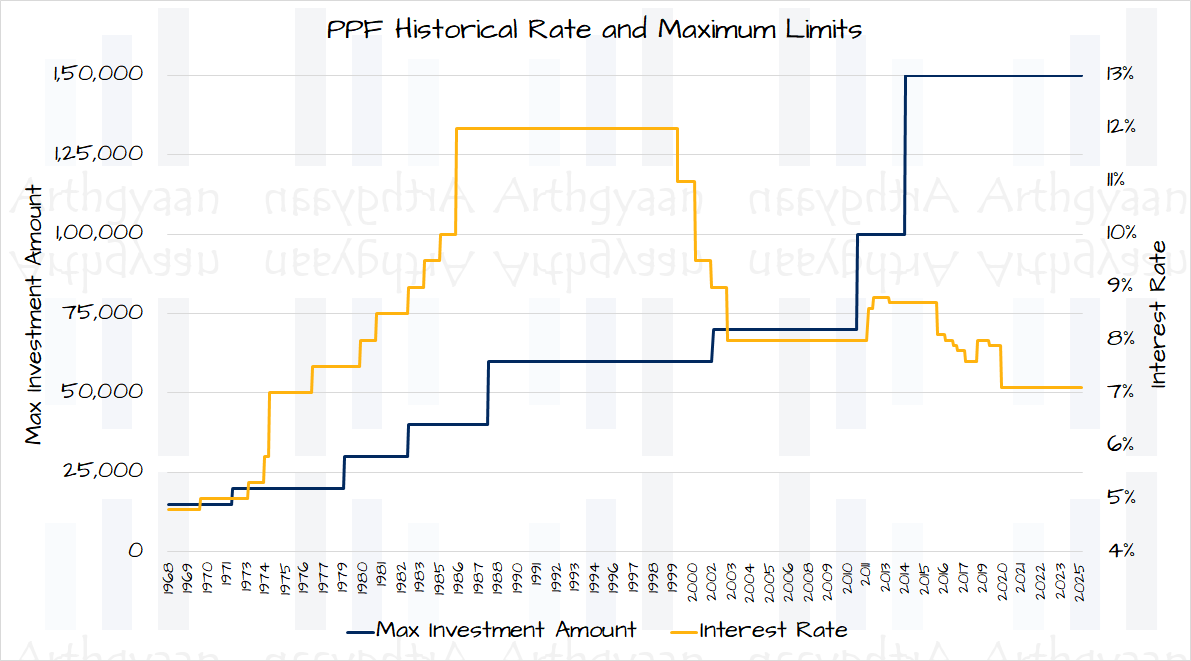

The latest PPF rate is 7.10%

However, the interest rate, as well as the limits of investment has varied over the years like this:

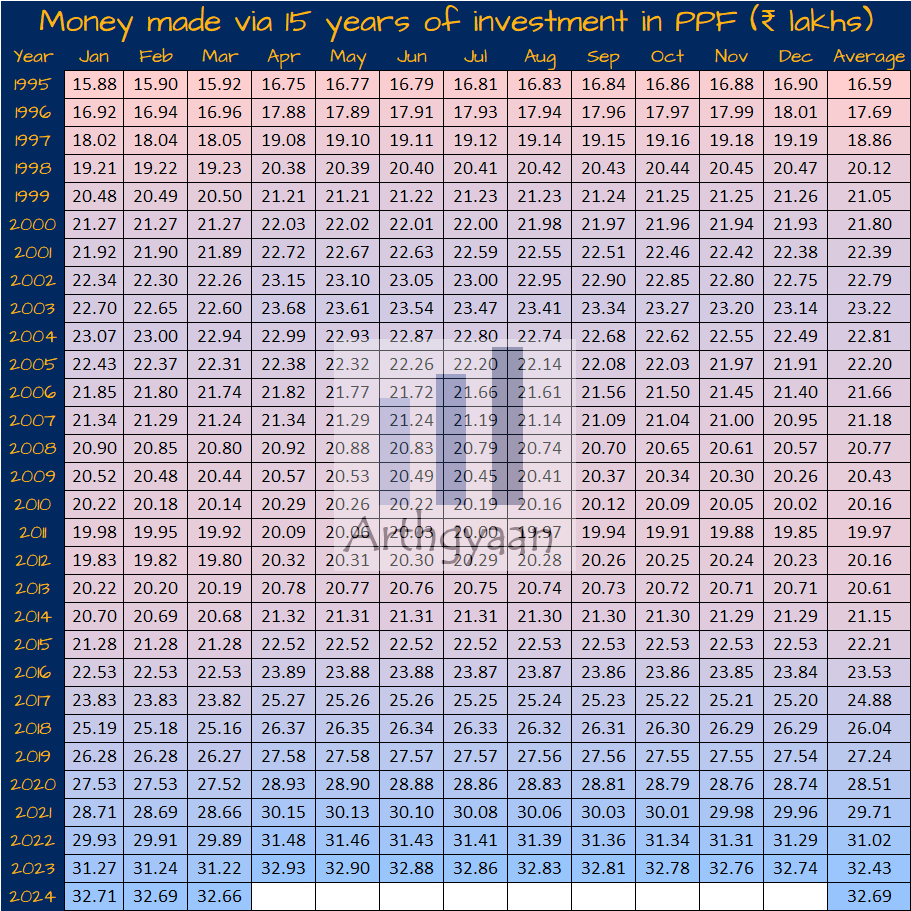

We have calculated how much anyone could have got by investing the maximum allowed amount per year as per historical interest rates and created this table:

Each value in the table is for a 15 year investment in PPF ending on the 1st of that month. Please note that in actual life, PPF is not an exact 15 year investment as the account can be opened anytime but the maturity happens on 1st April as explained here: When does a PPF account mature?.

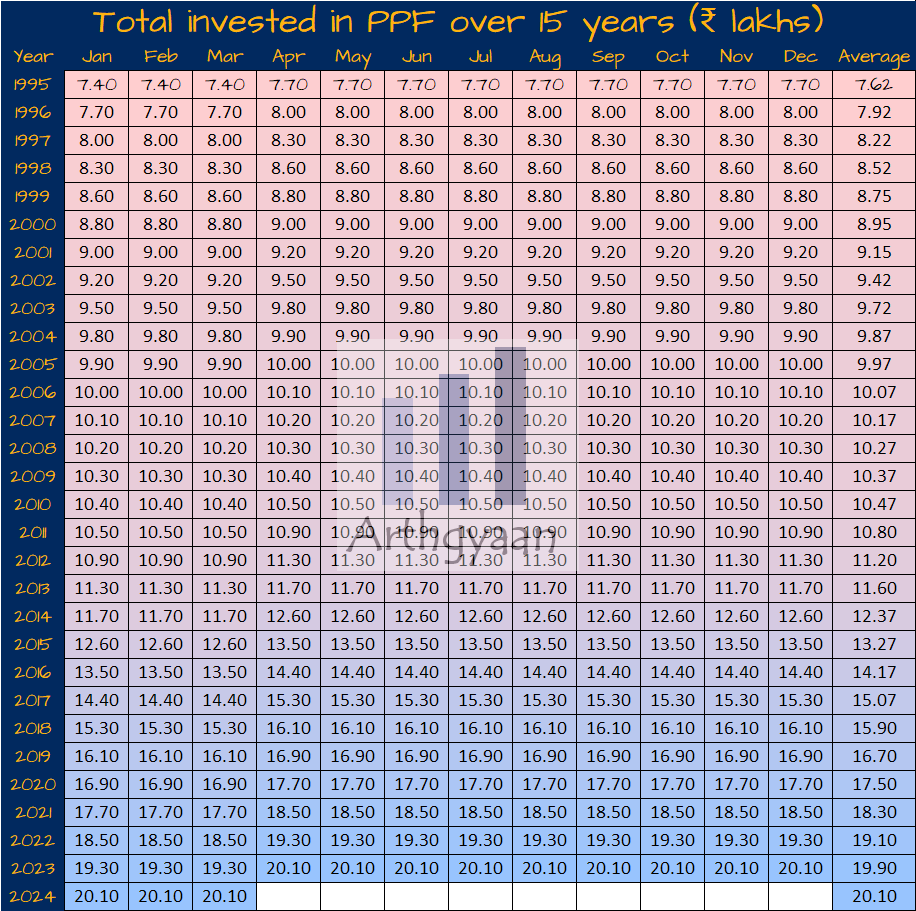

Using the same logic, we have also plotted the maximum amount that was allowed to be invested over the years in PPF:

You can see that over time, limits of investment in PPF has been steadily increased.

This article is a part of our detailed article series on Public Provident Fund (PPF). Ensure you have read the other parts here:

Many investors wonder which is a better option for long-term investment: Public Provident Fund or investing in the stock market via mutual funds. Given that PPF returns more the earlier you make the investment, many investors also try to target investing the maximum in PPF as early as possible, preferably in April.

This article compares how the PPF has performed against the SENSEX since 1979 to help investors decide if they should invest a lump sum in PPF in April 2024.

This article explains how PPF interest calculation works so that you can invest in the best month to get the maximum interest.

This article compares the various ways of investing in PPF to show which gives the most interest.

This article compares how the PPF has performed against the SENSEX since 1979 to help investors decide if they should invest a lump sum in PPF in April 2023.

This article gives you the current and historical interest rates for PPF so that you can decide if investing in PPF is the right option for your portfolio.

This article shows you a quick way to know when your PPF account will mature depending on the date you opened the account.

This article compiles an exhaustive list of FAQs on the Public Provident fund (PPF).

The article presents a historical analysis of investing in stocks vs. PPF since 1979.

A Step-by-step guide for PPF account holders approaching maturity in April. This post shows how to decide between extension vs. withdrawal.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much money has been made by investing in the Public Provident Fund (PPF)? first appeared on 22 Oct 2023 at https://arthgyaan.com