What is the latest PPF rate? What are the historical rates for PPF?

This article gives you the current and historical interest rates for PPF so that you can decide if investing in PPF is the right option for your portfolio.

This article gives you the current and historical interest rates for PPF so that you can decide if investing in PPF is the right option for your portfolio.

This article is a part of our detailed article series on Public Provident Fund (PPF). Ensure you have read the other parts here:

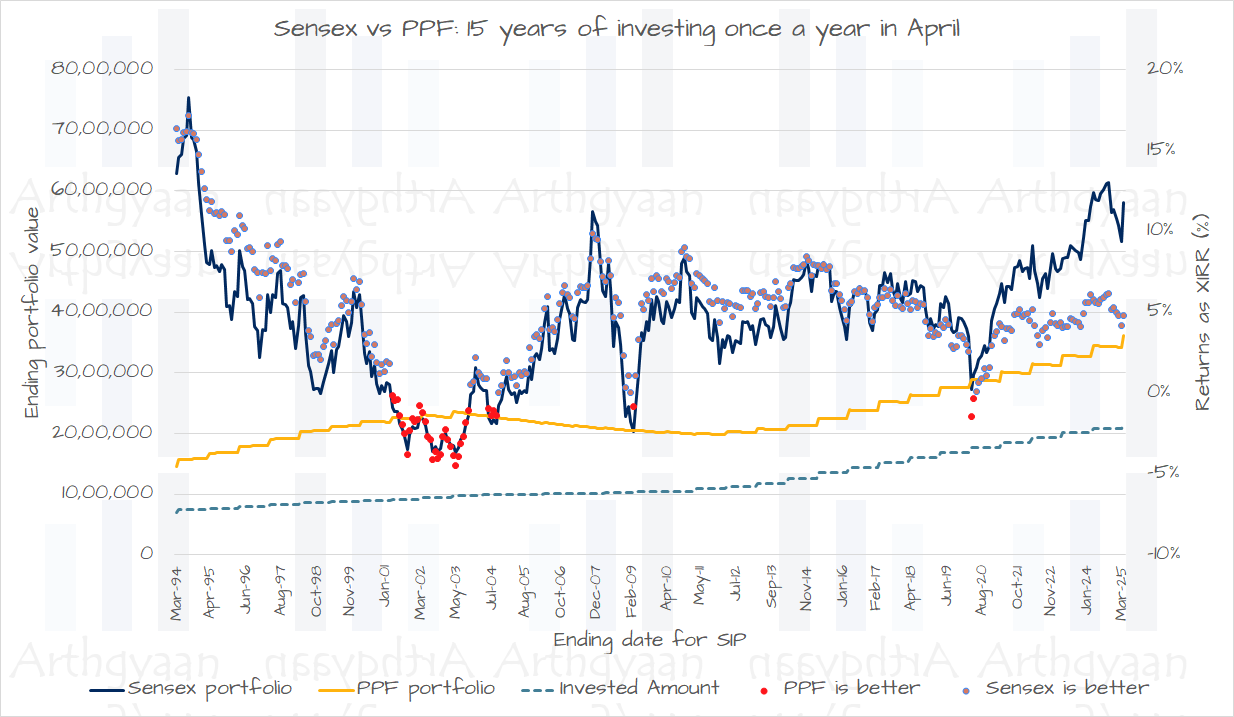

Many investors wonder which is a better option for long-term investment: Public Provident Fund or investing in the stock market via mutual funds. Given that PPF returns more the earlier you make the investment, many investors also try to target investing the maximum in PPF as early as possible, preferably in April.

This article compares how the PPF has performed against the SENSEX since 1979 to help investors decide if they should invest a lump sum in PPF in April 2024.

This article shows the maturity amount of investing in the Public Provident Fund (PPF) for 15 years as per historical interest rates.

This article explains how PPF interest calculation works so that you can invest in the best month to get the maximum interest.

This article compares the various ways of investing in PPF to show which gives the most interest.

This article compares how the PPF has performed against the SENSEX since 1979 to help investors decide if they should invest a lump sum in PPF in April 2023.

This article shows you a quick way to know when your PPF account will mature depending on the date you opened the account.

This article compiles an exhaustive list of FAQs on the Public Provident fund (PPF).

The article presents a historical analysis of investing in stocks vs. PPF since 1979.

A Step-by-step guide for PPF account holders approaching maturity in April. This post shows how to decide between extension vs. withdrawal.

As per Wikipedia, the Public Provident Fund (PPF) is a savings-cum-tax-saving instrument in India introduced by the National Savings Institute of the Ministry of Finance in 1968. PPF allows you to save small sums of money, and offers a guaranteed interest rate and tax benefits that make it attractive for many conservative investors.

PPF is a fantastic debt instrument which has guaranteed return (though it has fallen over time) but it is still higher than the market rate in other options. Since there is a 15 years lock-in (which can be extended in blocks of 5 years) and to keep the account active you need only ₹500/year, open it and keep it active. Later when you need to invest more amount in long-term debt investments, both the maturity of PPF will be closer and you will have many options like debt mutual funds. You can open PPF in your own name plus in the name of your parents if they don’t have one already. When you get married and have children, you repeat this for your spouse and children.

PPF is an EEE-class instrument which means that it is exempt from tax on investment up to 1.5 lakhs/year under 80C, exempt from taxation during growth and there is a full exemption on taxes at maturity.

The latest PPF rate is 7.10%

The latest PPF rate has been updated on 30-Sep-2025.

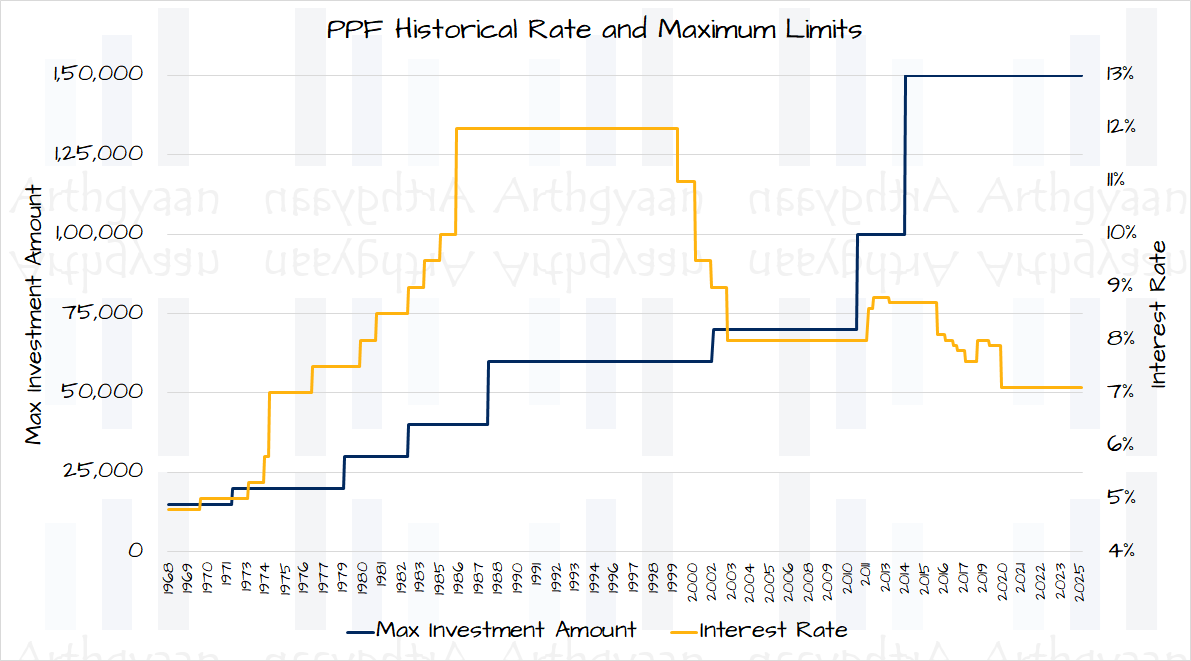

Using data from the National Savings Institute, we plot the historical interest rates and limits of PPF investment since 1968.

Some observations:

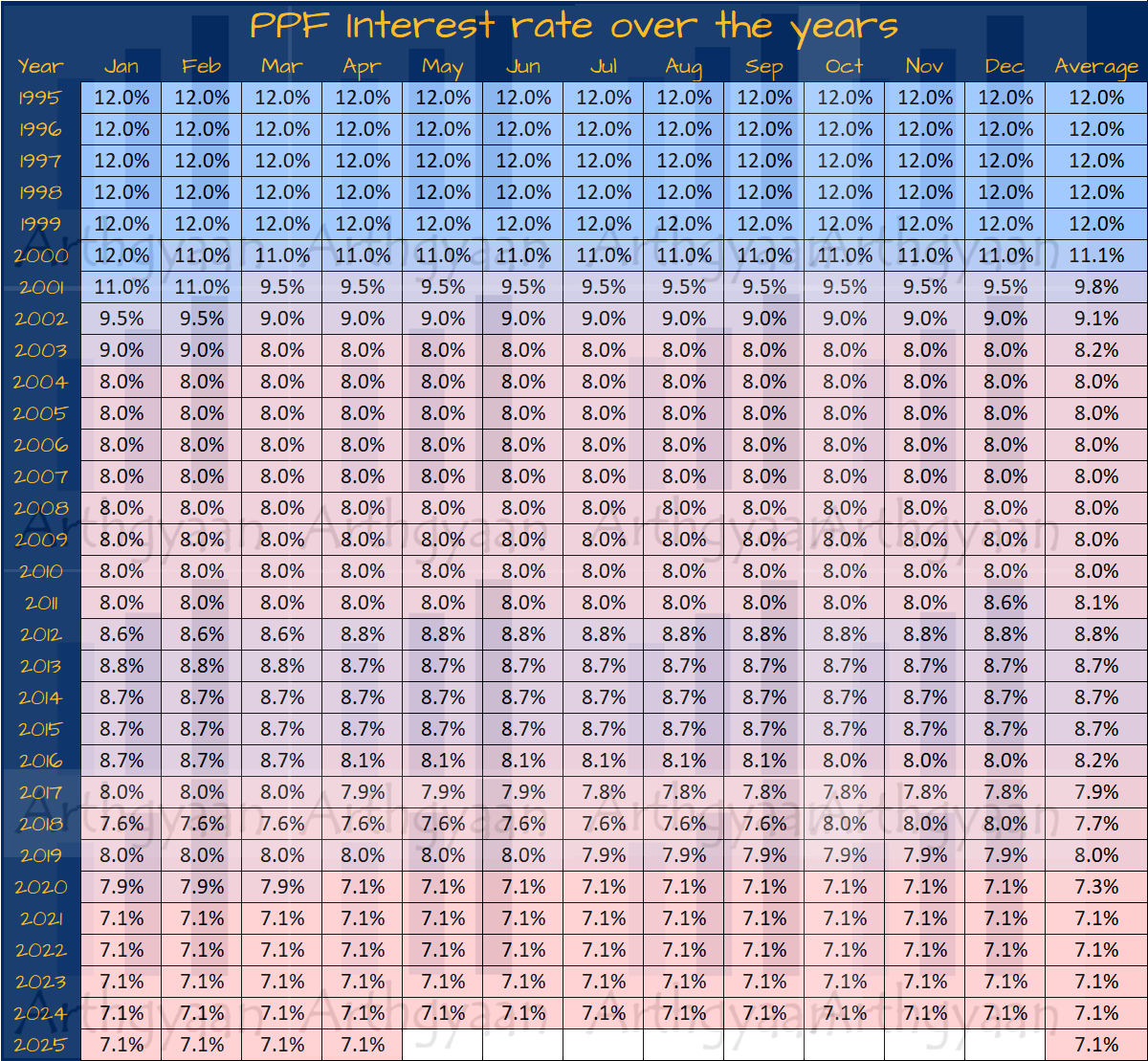

Here is another view of the same data but for every month since 1995:

In the sections below we will cover a few commonly asked questions on PPF.

Our analysis using SENSEX data from 1979 shows that stock investing in SIP form over a 15-year horizon has given better returns than investing in PPF.

Read more: PPF vs. mutual funds: which is better?

If your college admission date is 15 years or more away, then a PPF account can be used. However, the returns from PPF are below the usual college fee inflation of 10% (or more), you need equity mutual funds as well to ensure that you meet your goal.

Read more: What is the best way to invest for your child’s college education?

For long-term goals, PPF is a good option. For goals that are more than 15 years away, the typical asset allocation, i.e. mix of equity and debt in the portfolio, should be around 60:40. This means that your monthly investment should also follow the same 60:40 rule. As long as you are investing at least enough in equity as per the asset allocation, the rest can be in PPF and other debt investment options.

Read more: What should be my mix of MF, Stocks, Gold, NPS, FD, PPF and ELSS if I want to invest 50k per month?

We have an extensive list of questions on PPF here: Frequently asked questions on Public Provident fund (PPF): the complete guide.

PPF is a part of the Small Savings Schemes whose interest rates are periodically announced by the government. The latest rates are here: What are the latest Small Savings Scheme rates?.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the latest PPF rate? What are the historical rates for PPF? first appeared on 30 Jan 2023 at https://arthgyaan.com