What are the best target maturity debt funds in 2023?

This article gives you the latest view on target maturity debt funds for investors in 2023.

This article gives you the latest view on target maturity debt funds for investors in 2023.

Originally published: 1-Feb-2023

Updated: 16-Apr-2023 - latest funds and YTMs added

Target maturity debt fund (TMDF) is a debt mutual fund that matures, like an FD, on a particular date. The portfolio of these funds, based on the fund mandate, is a mix of one or more of the following types of bonds:

In most cases, the funds are benchmarked against a bond index launched by an index provider like Crisil, NSE or others and are run in a passive fashion. These funds are launched in three formats:

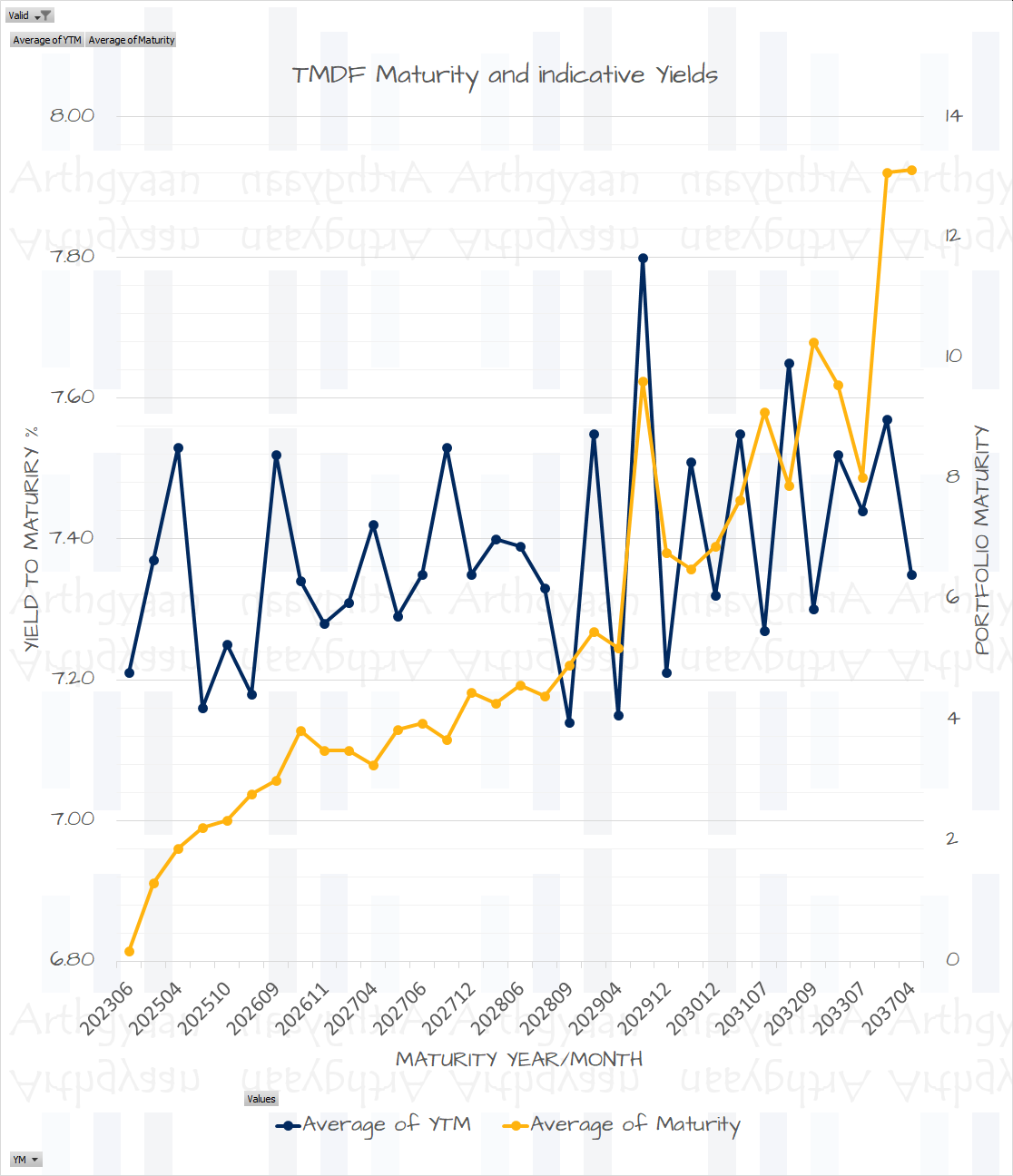

Using data from Valueresearchonline and AMC websites, we see that the average maturity of the bonds in the portfolio is very close to the residual time to maturity of the bonds. This is by design since the TMDF buys bonds that mature just before the fund’s maturity date. Therefore, this portfolio structure clarifies the actual yield (measured by Yield To Maturity or YTM minus the expenses TER) the investor is expected to get for every investment made in the fund, given that the bonds are held until maturity.

Using the SMART framework for goal-setting when we need to spend money is one of the essential inputs to the investment process. The output is the goal horizon. For example, suppose you are in January 2023, and the horizon is 5 years. In that case, you need to spend the money in January 2028.

Once you know the date, look at the table below and choose a fund that matures just before, say 1-3 months of the goal maturity. In this case, we can see that there is a fund maturing in December 2027.

The Yield To Maturity (YTM) of the fund indicates the expected returns for the investment you are making today. This point is essential. The return will differ if you invest the next month since the YTM changes daily. But for today’s investment, a good predictor of the return over the entire holding period will be:

Adjusted Yield = Yield to Maturity - Fund Expenses

The Adjusted Yield is the last column of the table or can be seen in the chart below:

Investors should check the suitability profile in the section below. These funds are not FD replacements.

These funds are suitable for investors under certain conditions and investors need to be extremely clear on their requirements and expectations.

A general primer on choosing debt mutual funds is provided here: How to choose a debt mutual fund?.

Investors should invest if:

Investors should not invest if:

As per the new tax law change, units purchased in these funds, along with several other categories of non-Indian-equity funds, after 1st-Apr-2023 are no longer eligible for 20%-post-indexation benefit. You can read more here: What should debt, international and gold mutual fund investors do now that these funds are taxable at slab rate?.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What are the best target maturity debt funds in 2023? first appeared on 01 Feb 2023 at https://arthgyaan.com