Mutual fund report card: Edelweiss BHARAT Bond FoF - April 2023

This article shows the performance of the BHARAT Bond April 2023 mutual fund/ETF since inception and compares it against investing in FD.

This article shows the performance of the BHARAT Bond April 2023 mutual fund/ETF since inception and compares it against investing in FD.

Originally published: 16-Apr-2023

Updated: 19-Apr-2023 - updated with 18-Apr-2023 NAV for maturity

BHARAT Bond - April 2023 was a mutual fund and ETF launched by Edelweiss AMC in December 2019 with maturity in April 2023. This fund, a Fund of Fund (FoF), invested in the BHARAT Bond - April 2023 ETF, which invested in Central and State Government bonds maturing in April 2023.

This fund is an example of a Target Maturity Debt Fund (TMDF) and is the first such fund launched in India.

Related: What are the best target maturity debt funds?

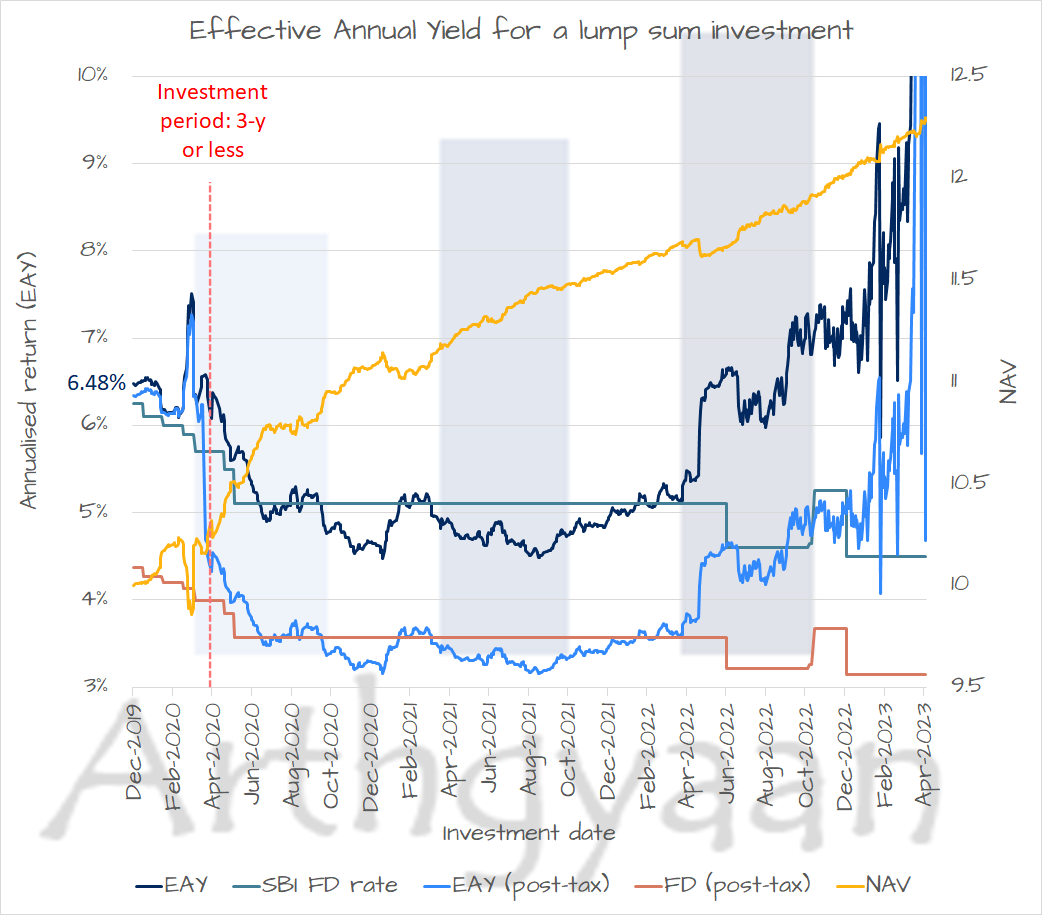

Head line performance since inception: 6.48% pre-tax, 6.34% post-tax vs. 4.38% (post-tax) in SBI FD

We have used the NAV of the FoF in all calculations below since investors will buy into the ETF at market price instead of NAV. It is difficult to ascertain an “average” investment price for ETF investors. For FoF investors, all transactions happen at NAV. The chart shows the NAV and pre and post-tax returns in the FoF and SBI FD (of the same holding period as the fund) from inception onwards, with maturity on 18-Apr-2023.

We use Effective Annual Yield (EAY) for the return from a single lump sum investment in the fund.

EAY = (MV/BV) ^ (365/t) - 1

where MV = exit NAV, BV = entry NAV, t = holding period in days (actual/365d year). This EAY value is pre-tax.

The fund was launched at an indicative yield of 6.83%.

The fund earned 6.48% pre-tax for a lump sum investment during NFO based on the 12.3105 closing NAV on 18-Apr-2013. Post-tax, after 20% tax on indexed profits, the EAY comes to 6.34% which effortlessly beat the SBI FD of the same duration.

The difference between the projected and actual yield is attributable to the fund’s expense ratio and tracking error.

The chart shows that the fund’s pre-tax return started well compared to an SBI FD of the same holding period. However, the return rapidly fell due to large fluctuations in interest rates as rates rose overall due to the COVID-19 crisis in March 2020. For the next two years, the fund return mostly stayed below FD returns.

Chart: Arthgyaan • Source: RBI • Get the data

Fund returns exceeded FD returns as NAVs started falling when repo rates increased from May 2022 onwards.

We take the example of an investor in the 30% tax bracket and compare the returns post-tax for the FoF and an equivalent duration FD in SBI.

Before 18-Apr-2020, the holding period for any investor is more than 3 years. Using a CII of 289 for FY-2019-20, we calculate tax for exit in April 2023 using the 20%-post-indexation rule since the capital gains are classified as long-term. Post 18-Apr-2020, the holding period is less than 3 years, and the capital gains are short-term and, therefore, taxable at the slab rate of 30%.

For FD, the tax is a flat 30% for all holding periods. We can see the FoF vs FD post-tax returns in the chart above.

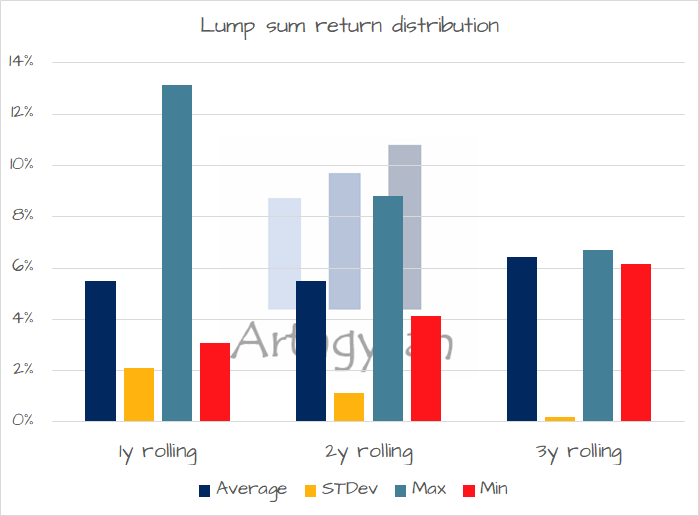

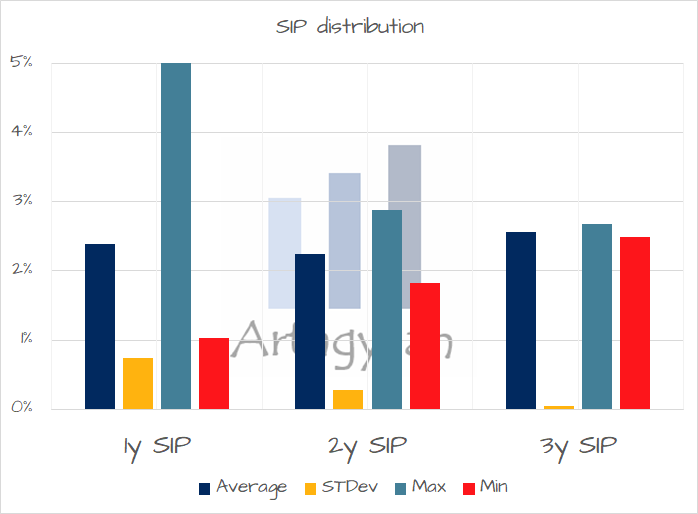

In the charts below, we show lump sum and SIP rolling returns. The returns are simple profit figures (end value/invested value - 1), not XIRR. The charts show average, standard deviation (higher means riskier), and max/min returns within the period.

An investment in an FD from SBI has no risk of return or principal and interest for all practical purposes.

However, as the NAV and EAY charts show, there is considerable fluctuation in the realised returns for the FoF due to changes in interest rates, first during the COVID-19 market disruption in March 2020 and then again due to interest rate hikes from May 2022 onwards.

Therefore conservative investors or those who need absolute predictability of returns should avoid investing in this fund with an expectation of getting stable FD-like returns.

These funds are suitable for investors under certain conditions and investors need to be extremely clear on their requirements and expectations.

A general primer on choosing debt mutual funds is provided here: How to choose a debt mutual fund?.

Investors should invest if:

Investors should not invest if:

As per the new tax law change, units purchased in these funds, along with several other categories of non-Indian-equity funds, after 1st-Apr-2023 are no longer eligible for 20%-post-indexation benefit. You can read more here: What should debt, international and gold mutual fund investors do now that these funds are taxable at slab rate?.

Investors invested in the Edelweiss BHARAT Bond FoF - April 2023 since inception in December 2019 got a return of 6.48% pre-tax which translates to 6.34% post-tax. In the same period, SBI FD gave a return of 4.38% post-tax at 30% tax-slab.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Mutual fund report card: Edelweiss BHARAT Bond FoF - April 2023 first appeared on 16 Apr 2023 at https://arthgyaan.com