What is the impact of 20% TCS rule on all LRS investments from 1st July 2023?

This article shows the impact of the new 20% TCS rule on all investments under the Liberalised Remittance Scheme from 1st July 2023 onwards.

This article shows the impact of the new 20% TCS rule on all investments under the Liberalised Remittance Scheme from 1st July 2023 onwards.

Originally published: 19-Apr-2023

Updated: 29-Jun-2023 - post LRS 20% postponed to 1st Oct 2023

Updated: 01-Sep-2024 - LRS rules updated post Budget 2024

Updated: 31-Mar-2025 - LRS rules updated post Budget 2025

The Liberalised Remittance Scheme (LRS) allows you to remit up to $250,000 per financial year for foreign travel, education in foreign colleges and the purchase of stocks, ETFs and mutual funds in foreign stock exchanges. LRS allows resident Indian investors to invest directly in ETFs tracking the S&P500 or global market indices (like VWRA) or hyped stocks like Tesla and Apple.

In Budget 2023, a new rule has been introduced that all LRS investments for investing and foreign travel must undergo 20% TCS, which will set off against future tax liabilities.

Before Budget 2023, this TCS amount was 5% over ₹7 lakhs a year. As per the latest press release on 28-Jun-2023, TCS is applicable at 5% till ₹7 lakhs and 20% above ₹7 lakhs/year. The updated rules are here: How the government has provided relief to travellers and international investors by tweaking the LRS and TCS rules from 1st Oct 2023?.

The TCS rules keep changing every year. The latest ones are here:

TCS rates from 1st April 2025 onwards:

| Purpose of Remittance | TCS Rate | Threshold |

|---|---|---|

| LRS for education purpose from education loan |

NIL | Any Amount |

| LRS for the purpose of education, other than above, or for medical treatment |

Up to ₹10 Lakh: NIL Above ₹10 Lakh: 5%, 10% if sender PAN is inoperative |

₹10 Lakh per FY |

| Any other purpose under LRS (including overseas tour packages or investing in foreign stocks/ETFs) |

Up to ₹10 Lakh: NIL Above ₹10 Lakh: 20% |

₹10 Lakh per FY |

TCS = Tax Collected at Source

TCS is not TDS which is Tax Deducted at Source. In the case of TDS, a bank paying interest, for example, deducts a part of the interest payment as tax. You must pay the rest of the tax, as per the tax bracket, at the time of tax filing. You can read more here: Frequently asked questions on Tax Deducted at Source (TDS): the complete guide.

TCS is a tax collected in advance for the sole purpose of tracking an expenditure. It will be adjusted against advance tax or during the filing of tax returns.

The TCS amount is over and above the LRS amount you send out.

| Due date | Advance tax payable |

|---|---|

| 15th June | 15% |

| 15th September | 45% |

| 15th December | 75% |

| 15th March | 100% |

In each of the above cases, you need to subtract the advance tax already paid.

All taxpayers with more than ₹10,000/year tax liability must pay advance tax as per the schedule above. Since income tax from salary is deducted and paid by the employer, this advance tax must be paid on other sources of income like rent, interest from FD, dividends from stocks and mutual funds, capital gains on the sale of stocks, mutual funds or house etc.

You can adjust the TCS amount on LRS against this advance tax. However, if you do not have advance tax due, you must wait for tax filing time and then claim a refund.

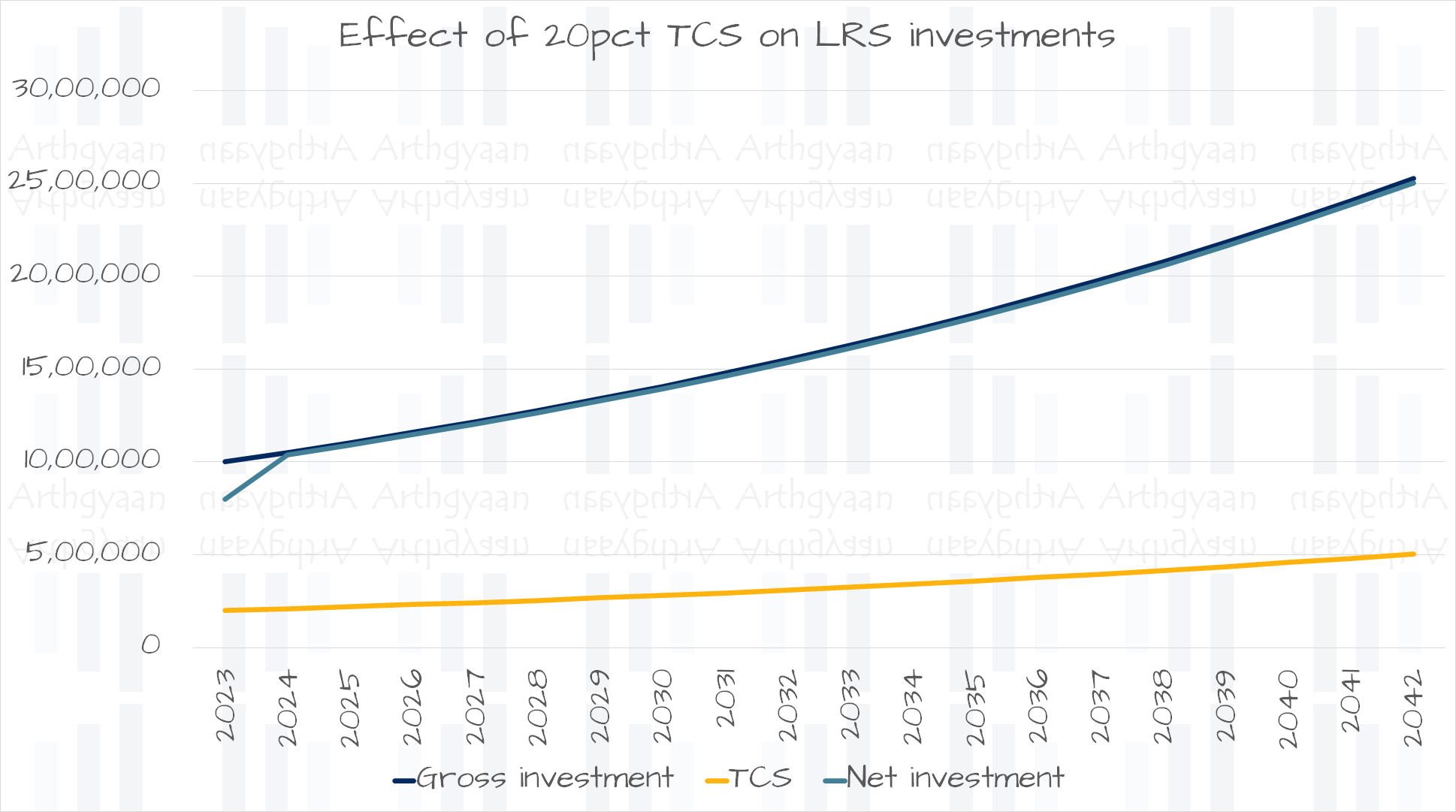

In the chart, we show the impact of ₹10 lakhs investment, growing at 5% a year, made on 15-Aug every year. In the first year, the TCS is ₹2 lakhs which is refunded the next August after the tax return is filed in July.

The following year ₹10.5 lakhs investment is made (5% increase) while the effective TCS (₹2.1lakhs for this year minus the ₹2 lakhs refund from last year) is only ₹10,000.

| Year | Gross Investment | TCS (after refund) | Net investment |

|---|---|---|---|

| 2025 | 10,00,000 | 2,00,000 | 8,00,000 |

| 2026 | 10,50,000 | 2,10,000 | 10,40,000 |

| 2027 | 11,02,500 | 2,20,500 | 10,92,000 |

| 2028 | 11,57,625 | 2,31,525 | 11,46,600 |

| 2029 | 12,15,506 | 2,43,101 | 12,03,930 |

| 2030 | 12,76,282 | 2,55,256 | 12,64,127 |

| 2031 | 13,40,096 | 2,68,019 | 13,27,333 |

| 2032 | 14,07,100 | 2,81,420 | 13,93,699 |

| 2033 | 14,77,455 | 2,95,491 | 14,63,384 |

| 2034 | 15,51,328 | 3,10,266 | 15,36,554 |

| 2035 | 16,28,895 | 3,25,779 | 16,13,381 |

| 2036 | 17,10,339 | 3,42,068 | 16,94,050 |

| 2037 | 17,95,856 | 3,59,171 | 17,78,753 |

| 2038 | 18,85,649 | 3,77,130 | 18,67,691 |

| 2039 | 19,79,932 | 3,95,986 | 19,61,075 |

| 2040 | 20,78,928 | 4,15,786 | 20,59,129 |

| 2041 | 21,82,875 | 4,36,575 | 21,62,085 |

| 2042 | 22,92,018 | 4,58,404 | 22,70,190 |

| 2043 | 24,06,619 | 4,81,324 | 23,83,699 |

| 2044 | 25,26,950 | 5,05,390 | 25,02,884 |

We have deliberately timed the investment so that the tax refund is obtained around the same time to offset the TDS. You invest once you receive the TCS refund.

This way, the impact of the 20% TCS is only for the first year. From the next year onwards, there is a minimal impact.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What is the impact of 20% TCS rule on all LRS investments from 1st July 2023? first appeared on 19 Apr 2023 at https://arthgyaan.com