How to check your income tax refund status?

This article shows you how to know the status of your income tax refund from Income Tax India website.

This article shows you how to know the status of your income tax refund from Income Tax India website.

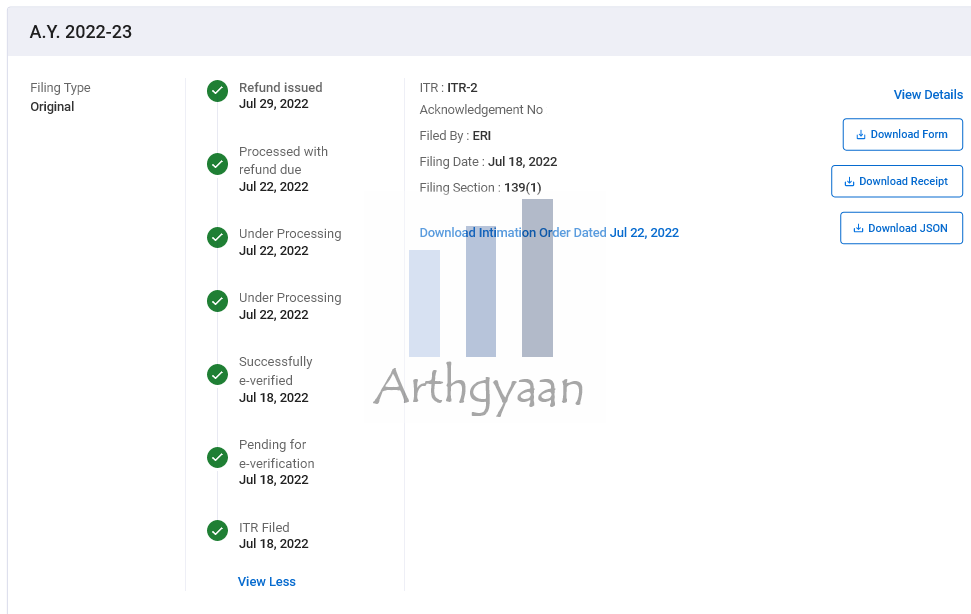

Income tax refunds, in recent times, are being processed fully electronically. The sequence of events looks something like this with the major steps being filing > verification > processing > demand / refund. This is the sequence of steps from my own tax filing for AY 2022-23.

Therefore, a refund will only be issued once the processing is complete.

💡 Tip: Pay a little extra tax

When you are filing your return, pay a little extra tax of around Rs. 1,000 as Self-Assessment Tax. This way if there is a little extra tax that is to be paid as per the final calculation during ITR processing, that will be adjusted against this small amount of Rs. 1,000.

You do not need to do anything at this point except wait for the refund.

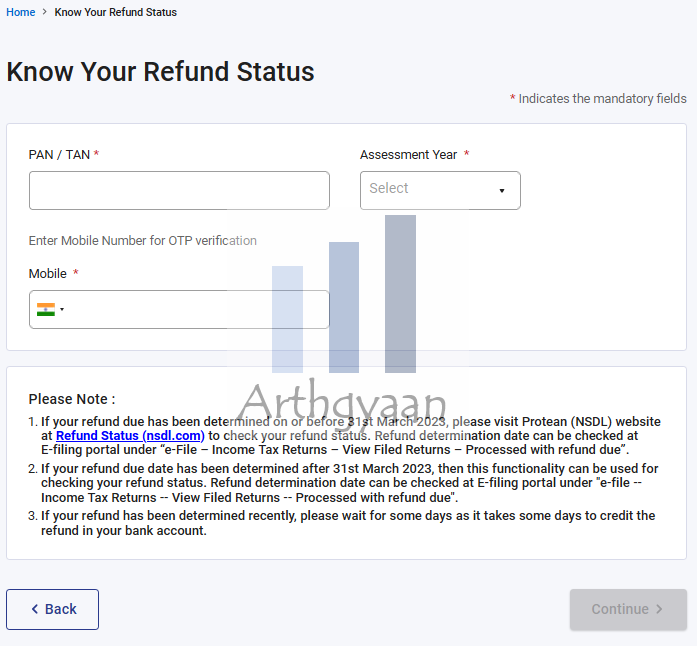

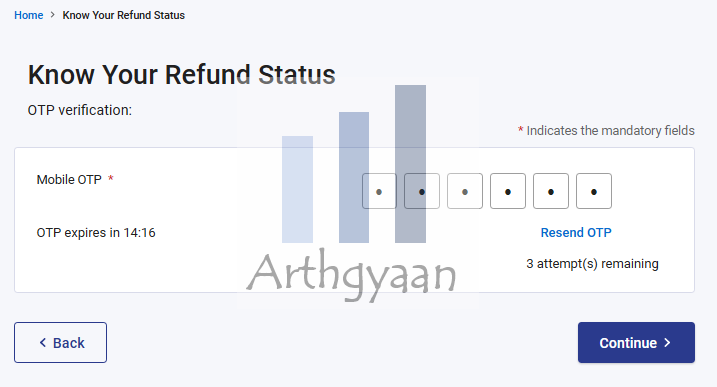

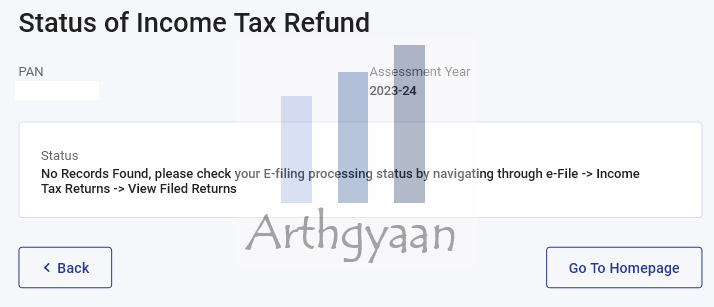

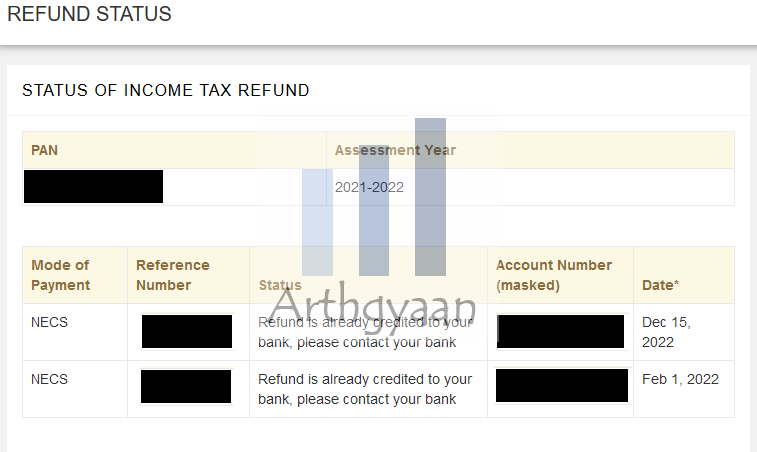

Income tax website has come up with a facility to check your refund. This is how the know your refund page looks like.

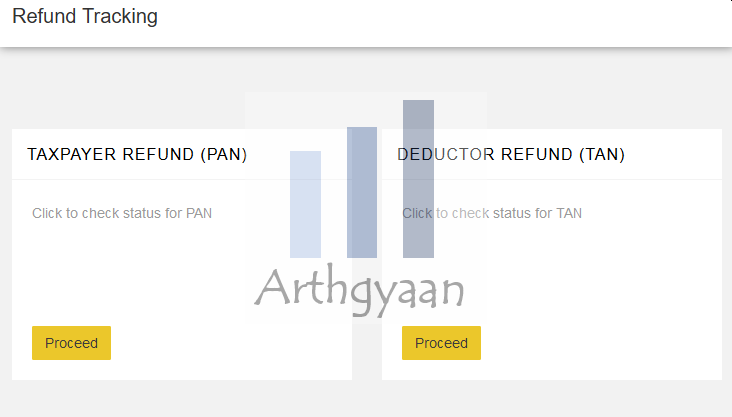

Here are the steps to check your refund status.

Choose assessment year as:

and so on. You will get the OTP for the next step in the mobile number.

As per the Income tax website,

Please note that the refund will be credited only to the PAN linked Bank Account. Please ensure the same.

This is the link to the refund status site: here.

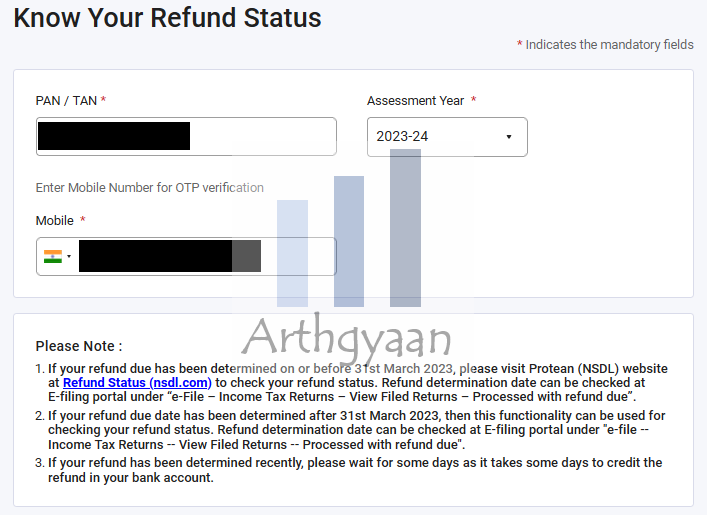

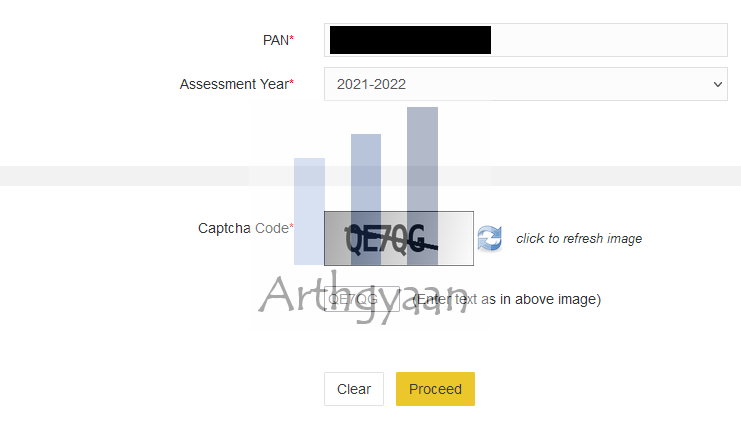

Choose assessment year as:

and so on.

In this case, the refund was already received in my bank account.

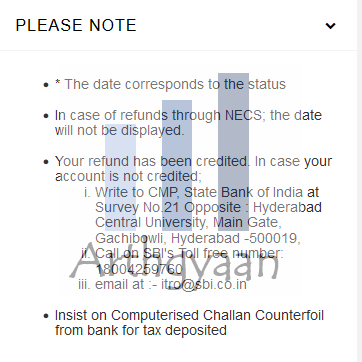

The site also provides some explanation of the refund status:

If your return was determined before 31-Mar-2023, then click this link instead to check the status: here.

If the refund amount is fairly large, you can follow this guide regarding how to invest it: Maximizing Your Finances: Smart Moves for Your Tax Refund Windfall in India.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to check your income tax refund status? first appeared on 23 Jul 2023 at https://arthgyaan.com