Maximizing Your Finances: Smart Moves for Your Tax Refund Windfall in India

Expert tips for maximizing your tax refund so that you can do the best thing to do for your portfolio in India.

Expert tips for maximizing your tax refund so that you can do the best thing to do for your portfolio in India.

An income tax refund is issued once you file your yearly income tax refund and you have somehow paid extra tax. The return that you have filed is scrutinised, approved and then either a demand is produced, if tax is due or a refund is issued if you have paid excess tax.

There are many reasons why a refund might be due. A few examples are:

etc.

Whenever you get some extra money, a few basic health checks should be made regarding your financial life:

If any of these are incomplete, please complete them before moving on to the next step. Consider if there is some small expense that you want to make, as a white goods purchase or a vacation, then allocate that money now. You will be investing the remainder as per goals in the same asset allocation as specified in your goal-based investing plan.

Suddenly having a bit extra money makes it easier to spend it. We are not against spending an extra ₹50,000 for a new phone, trip or white goods. However, just because you have some money now does not mean that you get swayed by your bank relationship manager or insurance agent to buy an ULIP, pension, endowment plan or something similar. You can read more on this point here: The agency problem in personal finance. What should you do?.

We insist that all investors should invest after creating a financial plan. Without a financial plan there are a lot of avoidable mistakes that tend to get made: 12 mistakes that interrupt compounding: what to do instead.

If you don't have a financial plan as of now, you can follow these case studies to create your own:

This article uses the Arthgyaan goal-based investing calculator to understand how much corpus is needed to have a comfortable lifestyle in India.

This article shows how a single-income middle-aged couple with two small children reach their retirement and children’s goals.

This article shows how a double-income couple with a 2-year old reach their FIRE dream at the age of 50.

This article shows how a double-income couple with a newborn child can invest for their future goals of FIRE and real-estate investment.

This article shows how a young just-married couple can invest for future goals using the Arthgyaan goal-based investing tool.

Did you welcome a bundle of joy in your 40s? This article will discuss ways of planning the child’s (and your’s financial future)

This article shows how a very typical salaried couple with one child can invest for future goals using the Arthgyaan goal-based investing tool.

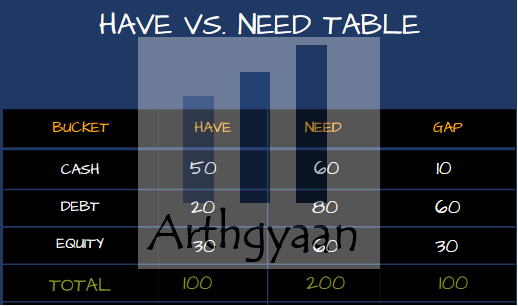

Since your bank account now has more money, you can add this to your cash bucket and then use the Arthgyaan Have-vs-Need framework to reallocate this extra money into your other goals: How to invest a lump sum amount for your goals?.

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Maximizing Your Finances: Smart Moves for Your Tax Refund Windfall in India first appeared on 13 Sep 2023 at https://arthgyaan.com