12 mistakes that interrupt compounding: what to do instead

This post is about how to avoid common mistakes that interrupt compounding.

This post is about how to avoid common mistakes that interrupt compounding.

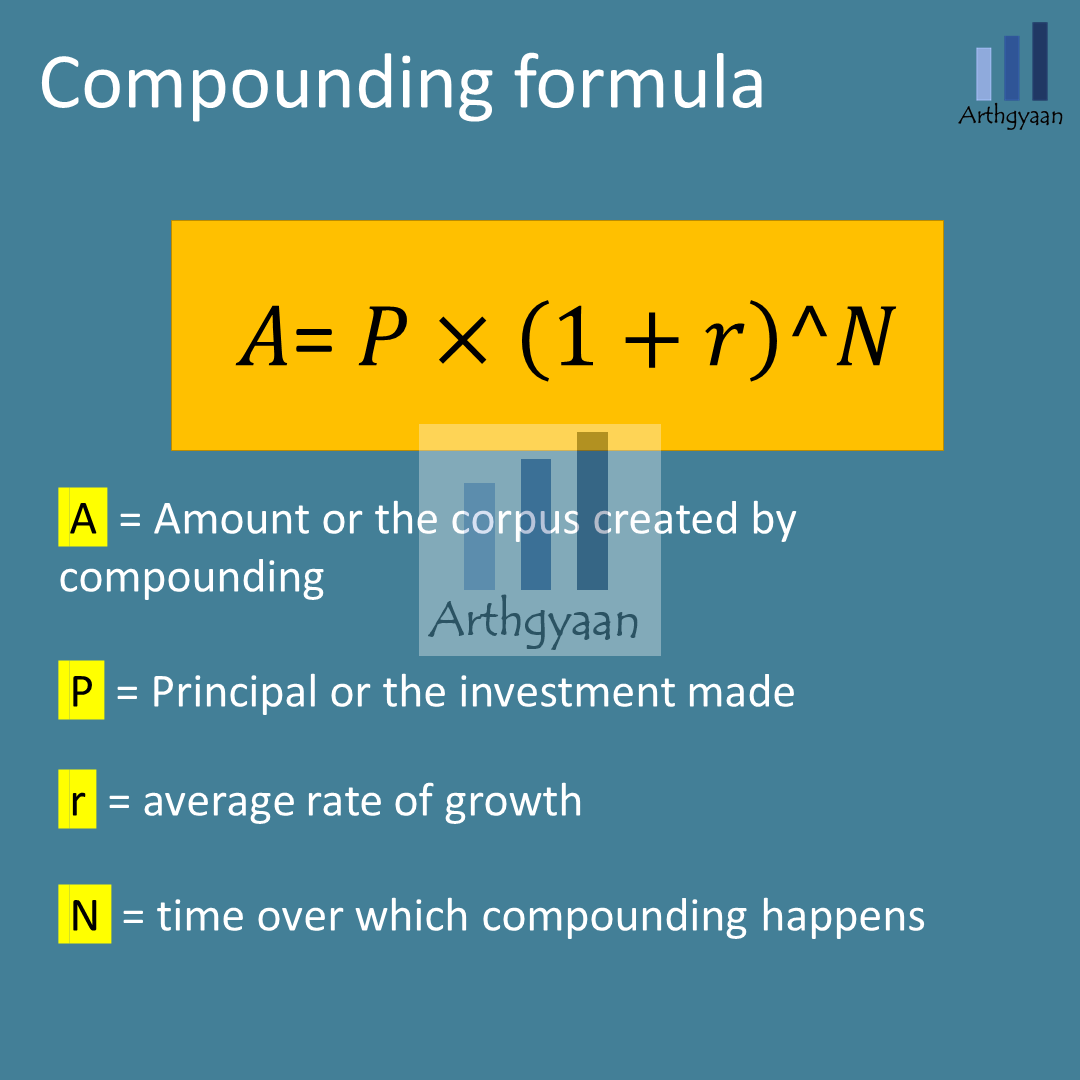

Compounding is called the eighth wonder of the world for a good reason. ₹1 lakh invested at 10% over 30 years becomes (1+10%)^30 = ₹ 17.44 lakhs. More remarkably, in 5 more years, this becomes ₹ 28.10 lakhs.

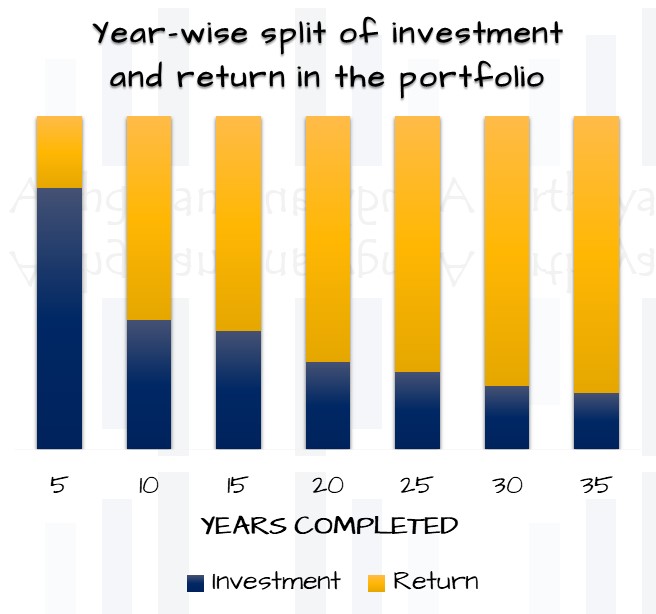

To get from 1 lakh to 17 lakh, you needed 30 years. However, to reach from 17 to 28, you need just five years more. There have been cases of investments where people forgot about it for decades have checked and found lakhs/crores in the account. The majority of compounding happens in the later years when there is a significant corpus already accumulated.

We will now discuss common mistakes that investors make which prevent them from benefiting from compounding and explain what to do instead. Most of the examples related to market movement apply to stocks or equity mutual funds. The general principle of compounding applies to all asset classes.

This formula is an example of an exponential curve where the current period growth happens on the entire corpus from the previous period. A good example is simple vs compound interest:

This interest-upon-interest feature is the reason compounding grows so fast as we see in the chart above. This feature is the premise of this quote:

My life has been a product of compound interest” - Warren Buffett.

This factor is 100% under our control. How much we invest monthly and what we withdraw has a substantial impact on the final corpus. Some examples of mistakes investors make:

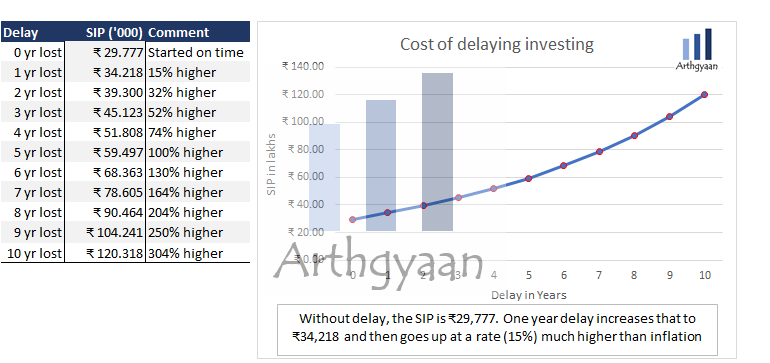

We pay a heavy price by waiting to start investments since the amount of investment needed to reach the same goal rises faster than inflation.

Inflation: the impact on your goals and how to choose assets that beat it

This issue happens when investors have not calculated the target corpus for their goals. Due to this issue, investors believe that a small SIP is sufficient for reaching their goals. They keep the rest of their investments in the bank, which does not beat inflation.

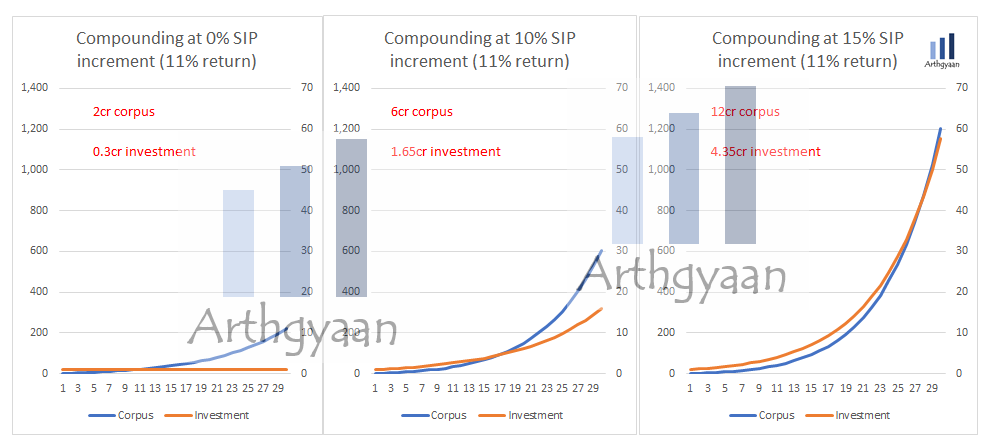

A SIP should also be increased every year as a step-up SIP as salary/income increases as part of the yearly goal review process. Assuming a 30 year investment period and average 11% returns,

Investors can plan for their goals and figure out how much they need to invest using this Excel template. Investors can invest more and more amounts by increasing their income by enhancing their human capital. Read more on this concept here: Your human capital, not investment returns, is your biggest wealth creator.

So examples of this behaviour are:

This particular mistake happens if investments are not tagged to a goal or lack a purpose: Why your Investment goals must be SMART?

What you can do instead:

Imagine that everything is going well. Suddenly you are hit with a medical emergency that leads to a ₹ 5 lakh out-of-pocket expense. There is no health insurance coverage.

Alternatively, the primary earning member dies without having term insurance. You get a ₹ 10 lakh coverage amount from an endowment plan. That money will get exhausted in 1-2 years.

All future goals go for a toss and require a fire-sale from the equity corpus to meet expenses.

Only sell equity assets from a position of strength. A defined asset allocation and rebalancing plan make that possible. Along with that, there needs to be a defensive barrier around your portfolio. Ensure that you have the following in place:

If you invest in direct equity instead of mutual funds, then every sale transaction for rebalancing the portfolio leads to capital gains taxes.

Income-producing assets in the accumulation stage mean you are sacrificing return since that income is taxable at marginal rates. Examples are dividend-paying stocks/mutual funds or rental income. Instead, income-producing assets are better suited to the withdrawal or the retirement stage.

Trading frequently in stocks or mutual funds requires paying a sizeable amount in capital gains taxes that lower return.

Investing in regular mutual funds or holding high TER mutual funds or other investments with high fees (like ULIPs) reduce the return. The alternative to high cost active mutual funds is low-cost index funds. See this article to know how to choose one.

He who understands it, earns it; he who doesn’t, pays it - Albert Einstein

Paying the minimum amount on high interest-rate debt like credit cards while making discretionary expenses is an example of this situation. The family should treat debt as a personal finance emergency and make every effort to pay it off soon. The investor should cut down discretionary purchases like entertainment, trips and similar expenses while the debt exists.

Investors tend to take some action if they look at their portfolio values too often. This habit leads to acting due to either greed or fear that hurts compounding:

Investors should exit equity markets as per their glide-path, that is, when they want to as per their investment plan and preferably near a market top.

An excellent way to get that signal is when your rebalancing plan has defined corridors that get hit due to a market movement. For example, if the target allocation is 60:40 for equity and debt with a 5% corridor, then rebalance when equity hits either 65% or 55%.

All financial goals require discussion with the entire family to get their buy-in. Some items of discussion are large ticket items like

Without family members being on board with these goals will lead to:

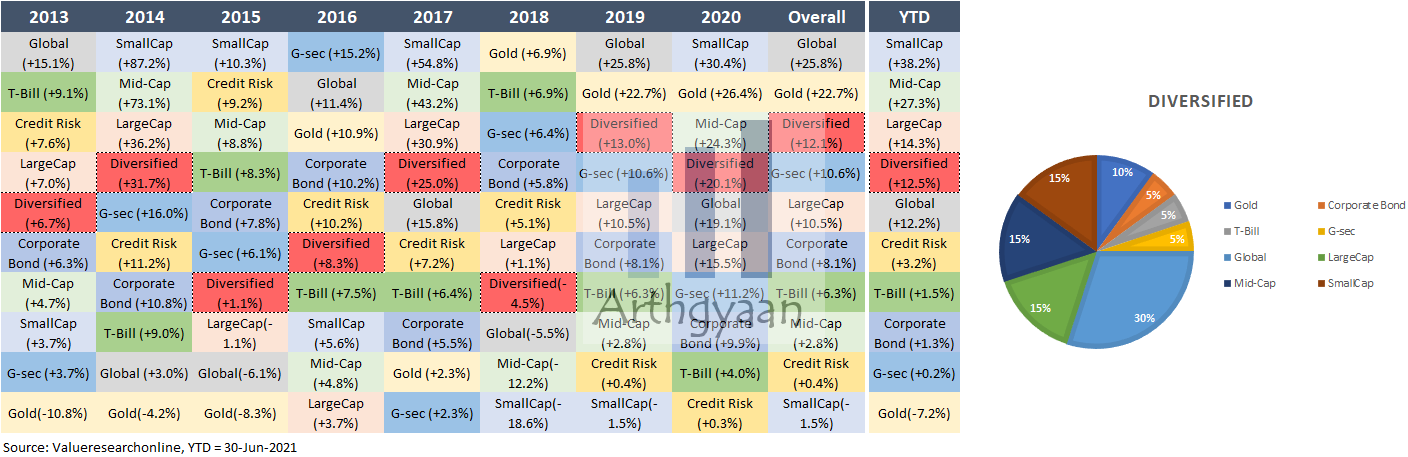

Unfortunately, most people are focused on improving the return from the portfolio at the cost of the first two factors. Market returns can be assumed but you will get what you Mr. Market gives you. This investor behaviour leads to

Investors investing in yesterday’s winning stocks, mutual funds or sectors often get sub-par returns. Investors should choose active funds based on the fund manager’s consistency in delivering index-beating returns. Alternatively, investors can eliminate human (both self and fund manager) risk by switching to index funds.

Investors need to understand how to evaluate an asset for purchase or sale. Learning this requires skill and knowledge that takes a long time to master and there are no shortcuts.

However, it is easy to outsource investing conviction

Lack of conviction leads to

Many investors believe that once their investible surplus increases, they need newer, more complex or exclusive investments. Some examples are:

Given that today index funds exist and goal-based calculators are easy to come by, it is easy to avoid these behavioural mistakes that impact compounding.

Follow this article series to set your goals: start here

This post deals with combining all goals into one easy to use Excel template.

The only certainties in investing are

This post shows how to choose investments suitable for goals at low cost.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled 12 mistakes that interrupt compounding: what to do instead first appeared on 10 Aug 2021 at https://arthgyaan.com