How to plan for FIRE using the bucket approach?

This post shows how to use the bucket theory of asset allocation to create your FIRE portfolio.

This post shows how to use the bucket theory of asset allocation to create your FIRE portfolio.

We expand on the concept of the bucket theory of portfolio creation to create a 3-bucket portfolio for Financial Independence, Retiring Early (FIRE). Unlike the Safe Withdrawal Rate (SWR) approach, which cannot be demonstrated to work for India due to lack of data, this method plans for each year in retirement as a separate goal and sums up to create 3 buckets holding cash, income assets and growth assets. Since each year in FIRE is modelled separately we get a much higher amount of FIRE corpus which is as expected. The SWR approach creates a unified portfolio whose size is smaller and correspondingly has higher risk. As described in this post on the quickest way to FIRE, the sustainable savings rate is the key to reaching FIRE.

This example uses the same framework developed here. Review that post first to understand the concept. Please note that at all times, there should be adequate emergency fund and health insurance over and above the retirement portfolio. Ensure that the yearly budget includes health insurance premium.

The amounts allocated to each bucket is calculated on the basis of appropriate asset allocation for each year of retirement and each year has its own glide-path and plan for rebalancing. The aggregate view for each year for cash, income and growth assets is summed up to create the buckets. Once the buckets have been created then periodic review and rebalance must be done to ensure that risk is being managed. The Rebalance column in the Excel calculator will show how rebalancing is to be done. See this detailed post on how and when to do rebalancing.

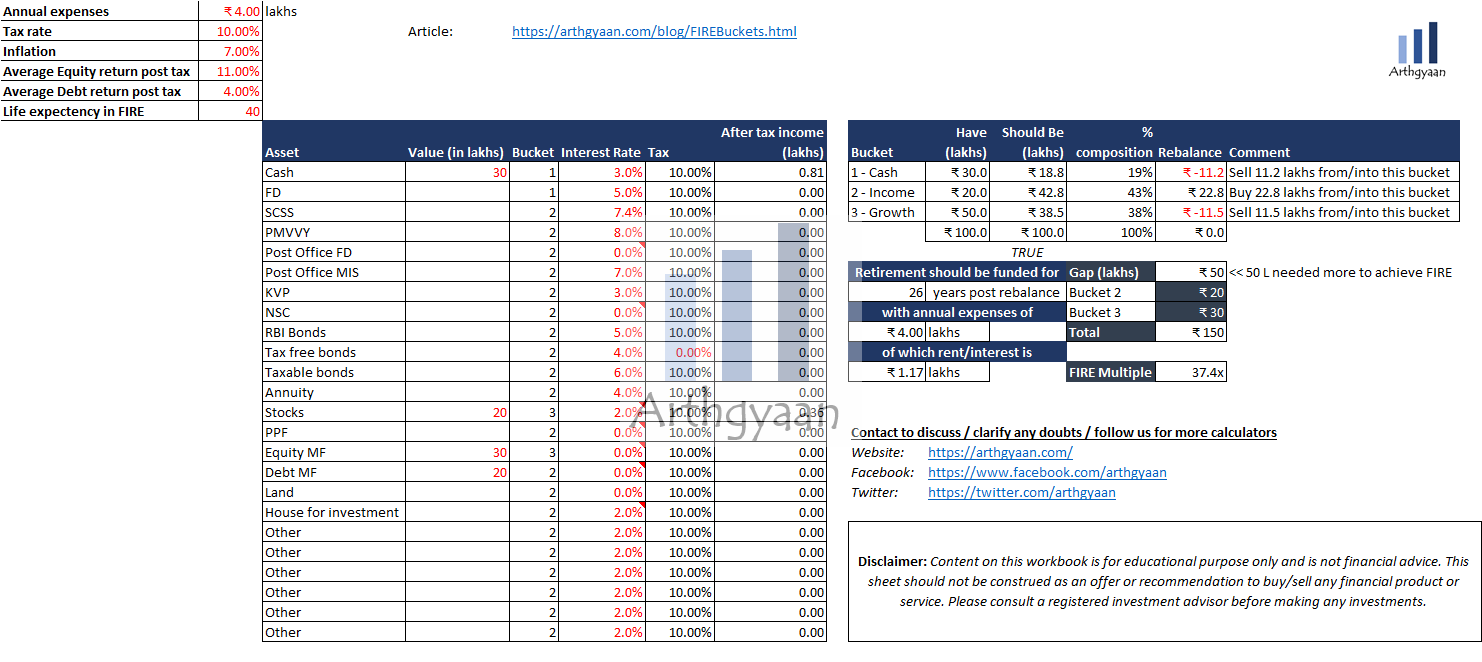

Use the Excel sheet to enter your desired number of years in FIRE, returns from debt and equity, inflation in FIRE period, tax rate and annual post tax expenses. The last number is the biggest driver of the number of years you can spend in FIRE.

Here all the existing assets (total 1 crore) are entered along with their market value, interest rate and applicable tax rate. Please note that

This shows the current value in each of the three buckets (Have column). The “Should Be” column shows the value which should be as per the right asset allocation. The Rebalance column shows the amounts to be moved in and out of each bucket to maintain the correct asset allocation. After that, the “Retirement Should be Funded for” value shows how many years the corpus is expected to last. Bucket 1 contains the emergency fund as well.

The section below shows that how long the corpus will last if FIRE happens immediately (in this case 26 years) and shows the investment gap needed to reach the desired 40 years (50 lakhs) and the investments needed in Bucket 2 (20 lakhs) and Bucket 3 (30 lakhs).

The FIRE multiple comes to be 37x which means that FIRE will be possible once the corpus reaches 37 times the expenses.

Excel sheet for this article: link

If time is left to FIRE, then the objective will be to reduce the Gap figure (currently 50 lakhs) to 0 by having a as high sustainable savings rate as possible. As new investments are being made, make them first in the bucket with the bigger gap. If there is significant gap between the desired and possible years in FIRE (40 years vs. 26 years), then FIRE should not be attempted at this time.

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to plan for FIRE using the bucket approach? first appeared on 22 Jun 2021 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.