How to plan for retirement/FIRE using dividend income?

How to get inflation-indexed income in retirement using dividends.

How to get inflation-indexed income in retirement using dividends.

Stock dividends can be used to get regular income during retirement. For retirement, dividends are essential in two ways. First, there is limited income potential from bonds without taking credit risk due to falling bond yields. Additionally, rising inflation makes income from bonds not sustainable for getting inflation-indexed returns. Dividend payouts have the potential to address these problems.

This article is a part of our detailed article series on Dividend investing. Ensure you have read the other parts here:

This article shows how to combine dividends from an equity portfolio with pension plans to get guaranteed income for life.

This article explains the concept of dividends and shows which option is better for dividend income: stocks or mutual funds.

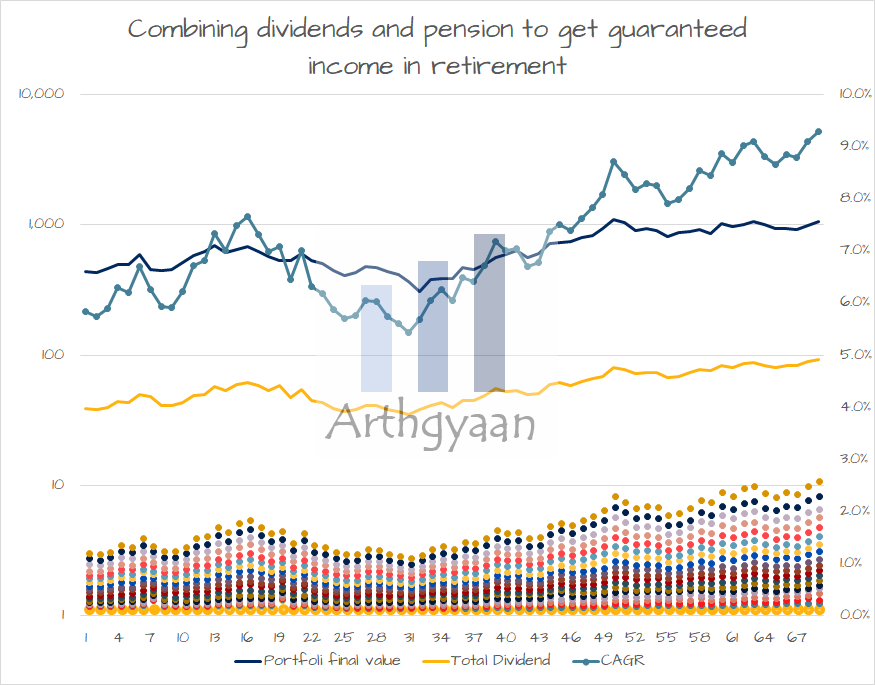

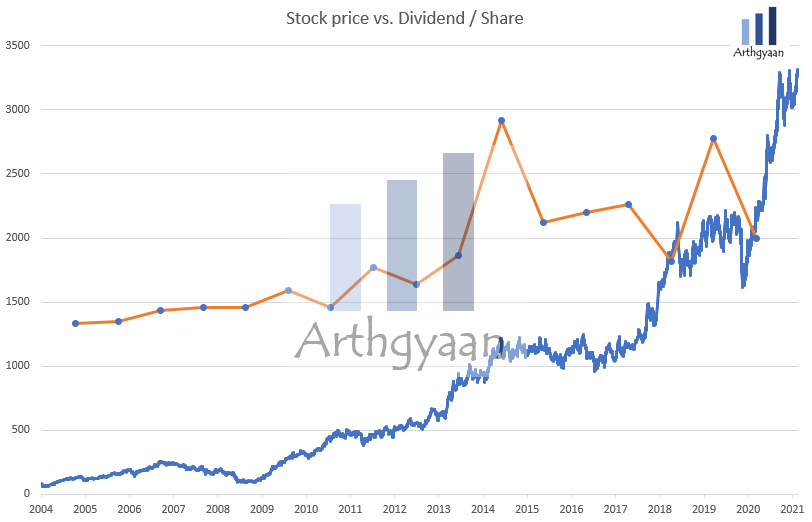

Stock dividends (the above figure is for TCS) are generally stable due to the value and quality factors inherent in a high dividend yield stock portfolio. The NSE published the Nifty Dividend Opportunities 50 index to identify high-dividend yield stocks. This index has shown a 2.8% dividend yield since inception. The dividends of the underlying stocks have grown at a rate higher than inflation in this period. However, the dividend yield of a stock portfolio is typically lower than the safe withdrawal rate (SWR) used by retirees.

While dividends can be cut in case the company faces financial trouble, they are not as fluctuating as stock prices in times of high volatility. This is important in this case. Due to sequence of return risk, there is a loss to the equity portfolio at the beginning of the retirement period.

Due to this reason, dividends cannot be the only source of income during retirement. Instead, they must be supplemented via other sources of income (rent and interest payments) and growth stocks to offer income and growth, respectively.

Currently, dividends in India are taxable at slab rates. This means that as per the RRTTLLU suitability framework, dividend-paying stocks are unsuitable for the accumulation stage, i.e. pre-retirement portfolio. In post-retirement, there is a possibility of taxes being lower, making dividends more tax-friendly. Even at the highest slab rates, the chance of stable income from dividends must be balanced against the lower taxation from stock and mutual fund capital gains.

High dividend-paying stocks are

Sources of finding high dividend yield stocks using index constituents:

These are common pitfalls that should be avoided.

Evaluating all of the selection factors together is essential to find suitable stocks for inclusion in the portfolio. For example, sometimes companies can temporarily have high dividend yields but may have systematic issues that make maintaining the dividend difficult.

A portfolio of dividend-paying stocks will have a higher total return if held in mutual fund form than held in the hand of an individual investor. This is because a mutual fund does not pay taxes on selling the stocks from their portfolio or when a stock declares dividends. However, an individual investor will pay capital gains and income taxes respectively in the same two cases.

Suppose your retirement (or early retirement) is still some time away. In that case, you will be losing much of the returns due to taxation today. Once retired, you can consider rebalancing from equity mutual funds to dividend-paying stocks.

We have covered the topic of choosing stocks vs mutual funds for dividend income here: Understanding dividend investing: should you invest in stocks or mutual funds for dividend income?.

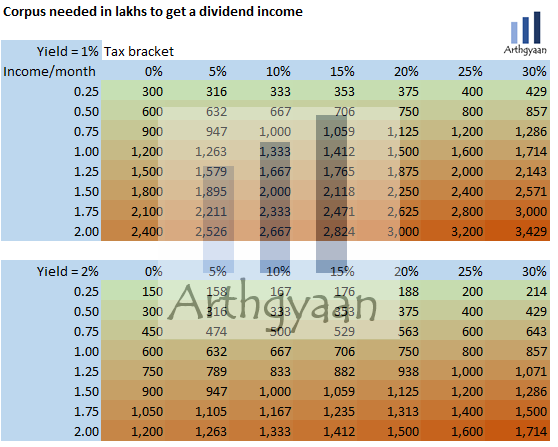

An investors’ typical question is, “how much should I invest to get ₹1 lakh/month from dividends”.

Since this income is post-tax, we assume a 15% marginal tax rate to calculate. Yearly desired income, pre-tax is ₹ 1 * 12/(1-15%) = ₹ 14.18 lakhs. If the dividend yield is 2% when purchasing the stocks, the corpus needed is ₹ 14.18 / 2% = ₹ 706 lakhs or ₹ 7 crores. Please note that just investing ₹ 7 crores does not guarantee the desired ₹ 1 lakh/month (it will fluctuate based on company performance). There is also no surety that this income will beat inflation. It is recommended that investors build a diversified portfolio of stocks and bonds (via mutual funds) and other assets to build their retirement corpus. The following links will be helpful:

A question that came from a Twitter user on this topic is this:

If I have 7 crores, then why will I invest in stock to get 14lakh dividends yearly? That too post-retirement.FD will give 26 lakh safe and secure post-tax.

While this is correct, the major problem with this FD-only portfolio is that it does not beat inflation. Assuming 7% inflation, the rule of 72 shows that purchasing power of 26 lakhs will be 13 lakhs in 10 years and 6.5 lakhs in 20 years, drastically cutting down the quality of life of the investor. This, of course, assumes that the interest rates remain high enough to get the same level of income throughout retirement. Thus, at the end of retirement, the balance in the FD account will be close to zero since there will be withdrawals from the principal to maintain the quality of life of ₹ 12 lakhs adjusted by inflation.

The dividend portfolio is

There are two assumptions regarding inflation and capital growth in the points above, and if both premises are valid, this is one portfolio that

We show some sensitivities of retiring without any equity exposure in the retirement portfolio in this post.

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to plan for retirement/FIRE using dividend income? first appeared on 23 Jun 2021 at https://arthgyaan.com