Is real-estate a large part of your portfolio - how to value income-generating investments?

This article provides thumb-rules for adding the value of income-generating investments for your long-term portfolio based on how much returns they give.

This article provides thumb-rules for adding the value of income-generating investments for your long-term portfolio based on how much returns they give.

This article is in response to a query from a reader:

I have my second flat which gives a rent value of 10K and the worth of the property is currently 50Lacs. So how to handle this property for our goal planning sheet for calculations?

There can be multiple variations of this question:

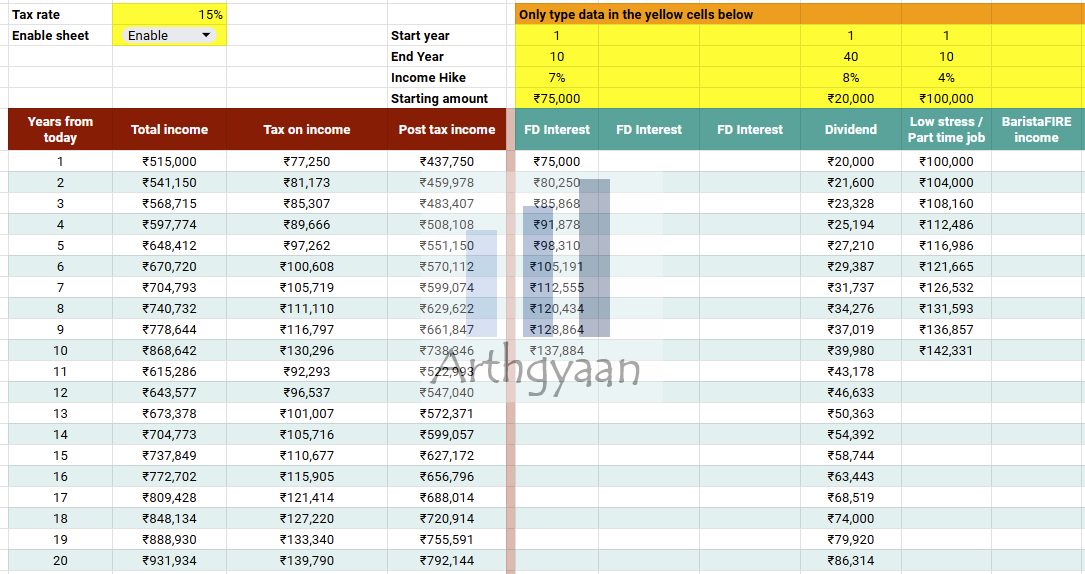

The Arthgyaan goal-based investing tool supports incomes from rent, interest, pension, royalty, commission, or any other source, with or without an inflation adjustment, to your portfolio.

Here’s a list of income sources that you can enter in the sheet:

You can read more on using this tool here: How can you add multiple income streams to your portfolio for retirement?

The asset and portfolio tracking features of the sheet are free for all users.

We will use this sheet to capture the rental income (in this example) and then adjust the assets of the investor for the value of the house.

But before that, we need to understand the concept of total return of any asset.

Total return of an asset = Regular Income + Price Increase

Total return of a house = Rent + Price Appreciation

Total return of a stock = Dividends + Price Appreciation

etc

The above concept holds for every asset except gold (which does not give interest) and stocks of companies that do not give dividends. In such cases, you can only hope to get a return from your investment if you sell it at a higher price in the future.

Therefore, when adding income-generating assets to our portfolio, we will add the income part to the “income section” tab and adjust for the price appreciation in the “assets” tab. We need to do this in such a way that there is no double counting.

A good example of this category of assets is stocks that may or may not give dividends. There are two ways to handle this:

A caveat here is that there will be a fluctuation in the dividend income stream due to market movements of the stocks and some retirees might find that difficult to manage. In such a case, the better option will be to add the stock portfolio value in the assets tab, nothing from dividends in the income tab and manage the movements in the stock portfolio (and associated dividends via rebalancing)

Here the best example is real estate beyond the primary residence. We will obviously add the current rental income to the income stream. The question arises about the market value of the house.

We believe that the market value of the house should be added to the portfolio assets tab if:

In such a case, you can enter the house as a 100% debt asset.

For both bonds and FDs, there will be:

In both cases, there will be an amount to be received on maturity which must be added as a lump sum income under income sources like this:

The interest/coupon income should be added to the income section in the usual way.

NPS, and by extension UPS, is an interesting case because before you withdraw from it, the portfolio behaves like a hybrid mutual fund with both equity and debt allocation. Once you reach 60 (or earlier/later), you must allocate a large portion to purchase an annuity and the rest is given to you.

You can simply add the NPS market value to the assets tab and set the equity/debt allocation as per the current NPS fund portfolio you have invested in.

Once you retire, and the pension starts, you need to remove the part that went into the annuity from the portfolio and add the income stream to the income source section.

Published: 18 December 2025

7 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled Is real-estate a large part of your portfolio - how to value income-generating investments? first appeared on 06 Nov 2024 at https://arthgyaan.com