How to Track Your NPS Portfolio for Free with the Arthgyaan Goal-Based Investing Tool?

This article walks you through setting up and tracking your NPS portfolio for free using this user-friendly and free tool.

This article walks you through setting up and tracking your NPS portfolio for free using this user-friendly and free tool.

There are three kinds of investors who invest in NPS:

In any of these cases, it is essential to integrate your NPS investments with your remaining portfolios with shares, mutual funds and other assets like real estate, provident fund and bank deposits to get the holistic view. We show how to track your NPS portfolio in a way:

![]()

The easiest solution for getting the latest value of your NPS portfolio is to use the portfolio tracker function of the Arthgyaan goal-based investing tool. There is no charge for using the portfolio tracking feature. All you have to do is enter the NPS fund ID in column E and the number of units you hold in column G in the assets tab of the sheet.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

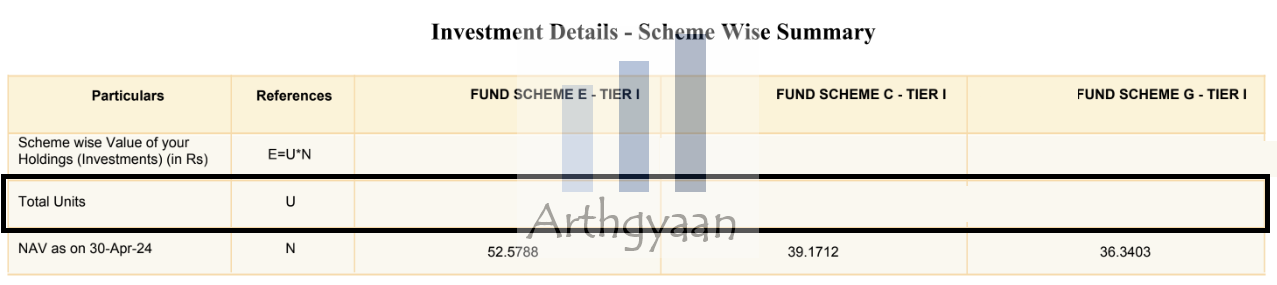

Please refer to the “assets” tab of the sheet once you open it. You will get your NPS fund balance in your statements that come on your email from where you can get the unit counts:

You can refer to this article for the IDs of your NPS funds and, for reference, the latest NPS NAVs: Latest NAVs - National Pension System (NPS).

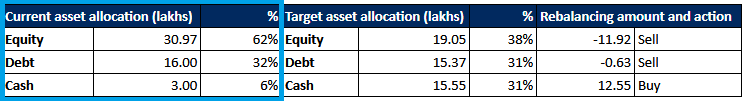

If you are using the tool as described above, you will get a view like this in the “goals” tab:

Setting up your current portfolio and knowing the asset allocation is the first step towards creating your financial plan like this: Case study: how this double income single kid family can perform DIY goal-based investment planning

You can see what the Arthgyaan goal-based investing tool can do via these YouTube tutorials: Click to watch

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to Track Your NPS Portfolio for Free with the Arthgyaan Goal-Based Investing Tool? first appeared on 22 May 2024 at https://arthgyaan.com