How to use Arthgyaan API to get NPS NAV to calculate your NPS corpus value?

This article helps you get NPS NAV data via an easy to use API so that you can easily calculate, using Excel or Google Sheets, how much money you have in NPS.

This article helps you get NPS NAV data via an easy to use API so that you can easily calculate, using Excel or Google Sheets, how much money you have in NPS.

Disclaimer: The data provided by this API is not guaranteed to be complete, accurate, or delivered in a timely manner. No warranties are made regarding the reliability or suitability of the data for any purpose. This API is subject to rate limitations and is not intended for use in production environments. Commercial usage of the API is not permitted.

NPS NAV is available for download from the NSDL site but that is not easy to use in case you wish to track your NPS portfolio via Excel or Google Sheets. This API allows you to get the latest NPS NAV for the NPS funds where you have invested.

In the examples below, we will use the example of the fund

SBI PENSION FUND SCHEME E - TIER I which has the ID sm001003.

The NAV for this fund as available by hitting this endpoint: https://arthgyaan.com/api/nps/

If you use the example id, then the query https://arthgyaan.com/api/nps/sm001003/nav.json will give you the NAV 57.5494.

You can then setup a table like this to track your NPS portfolio in Excel or Google Sheets:

| Fund | Units (a) | Fund ID | NAV (b) from API | Value(a x b) |

|---|---|---|---|---|

| Tier 1 E | 10000 | sm001003 | ₹57.5494 | ₹575494.0 |

| Tier 1 G | 5000 | sm001005 | ₹40.7253 | ₹203626.5 |

| Tier 1 C | 2000 | sm001004 | ₹45.1456 | ₹90291.2 |

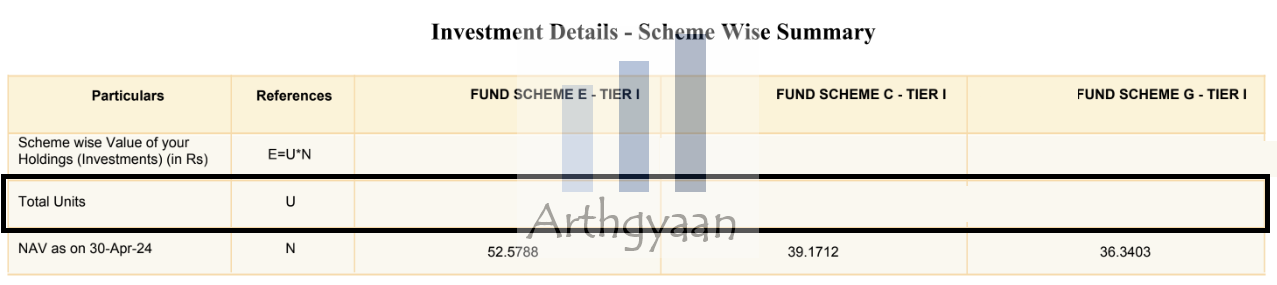

The units figure comes from your NPS statement that you will get periodically via email.

If you are an Excel user, the you can use the WEBSERVICE function (Excel 2013 or later in Windows) like this in a cell to get the NAV:

=CHOOSECOLS ( TEXTSPLIT ( WEBSERVICE( "https://arthgyaan.com/api/nps/sm001003/nav.json") ,"""") ,4 ) +0

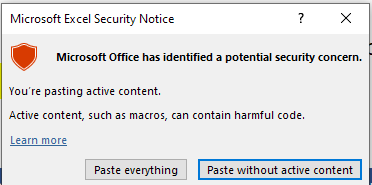

Excel will pop-up a warning about using the WEBSERVICE function to fetch live data from the Internet for the first time.

If you get this pop-up, especially if you paste the formula above, please click “Paste everything” to continue.

For the name of the fund, use this:

=CHOOSECOLS ( TEXTSPLIT ( WEBSERVICE( "https://arthgyaan.com/api/nps/sm001003/name.json") ,"""") ,4 )

If you are a Google Sheets user, the you can use the IMPORTDATA function like this in a cell to get the NAV:

=CHOOSECOLS (SPLIT ( IMPORTDATA( "https://arthgyaan.com/api/nps/sm001003/nav.json") ,"""") ,4 )+0

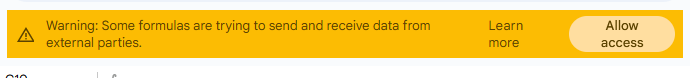

Here, Google Sheets will give an error pop-up on the top of the screen the first time you use this function. Please click “Allow Access” to continue.

For the name of the fund, use this:

=CHOOSECOLS (SPLIT ( IMPORTDATA( "https://arthgyaan.com/api/nps/sm001003/name.json") ,"""") ,4 )

To understand how to use this API for tracking your NPS corpus:

![]()

The easiest solution for getting the latest value of your NPS portfolio is to use the portfolio tracker function of the the Arthgyaan goal-based investing tool. There is no charge for using the portfolio tracking feature. All you have to do is enter the NPS fund ID in column E and the number of units you hold in column G in the assets tab of the sheet.

We will use Google sheets to create a simple calculator for this calculation. There is a link to download a pre-filled copy of the Google sheet via the button below.

Important: You must be logged into your Google Account on a laptop/desktop (and not on a phone) to access the sheet.

Please refer to the “assets” tab of the sheet once you open it. You will get your NPS fund balance in your statements that come on your email from where you can get the unit counts:

You can refer to this article for the IDs of your NPS funds and, for reference, the latest NPS NAVs: Latest NAVs - National Pension System (NPS).

Of the three options, Excel, Google Sheets and the Arthgyaan Goal-based investing calculator, the Arthgyaan tool is easiest to setup and use. Apart from NPS, you can track your Indian mutual funds as well as any stock whose price comes from the Google Finance API.

The API needs the NPS fund ID to get the NAV.

Please refer to this article for the IDs of your NPS funds and, for reference, the latest NPS NAVs: Latest NAVs - National Pension System (NPS)

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How to use Arthgyaan API to get NPS NAV to calculate your NPS corpus value? first appeared on 05 May 2024 at https://arthgyaan.com