What happens to your mutual fund portfolio final value if you choose to buy a house?

This article shows how to understand the impact on your portfolio if you stop investing for a few years between today and retirement to buy a house.

This article shows how to understand the impact on your portfolio if you stop investing for a few years between today and retirement to buy a house.

This is a common advice you’ll hear often on social media platforms like YouTube, Twitter/X, Facebook, and Instagram. Your friends and colleagues might suggest the same. Many advocate that investing in mutual funds rather than real estate is better for wealth accumulation. They might be promoting the best mutual funds or teaching investment strategies. Conversely, real estate advocates favor property investment.

It’s well-known that pausing or reducing your mutual fund contributions during your career can impact your final savings. The critical question is:

How significant is this impact if you interrupt your investments to purchase a home?

This article explores the answers to that question.

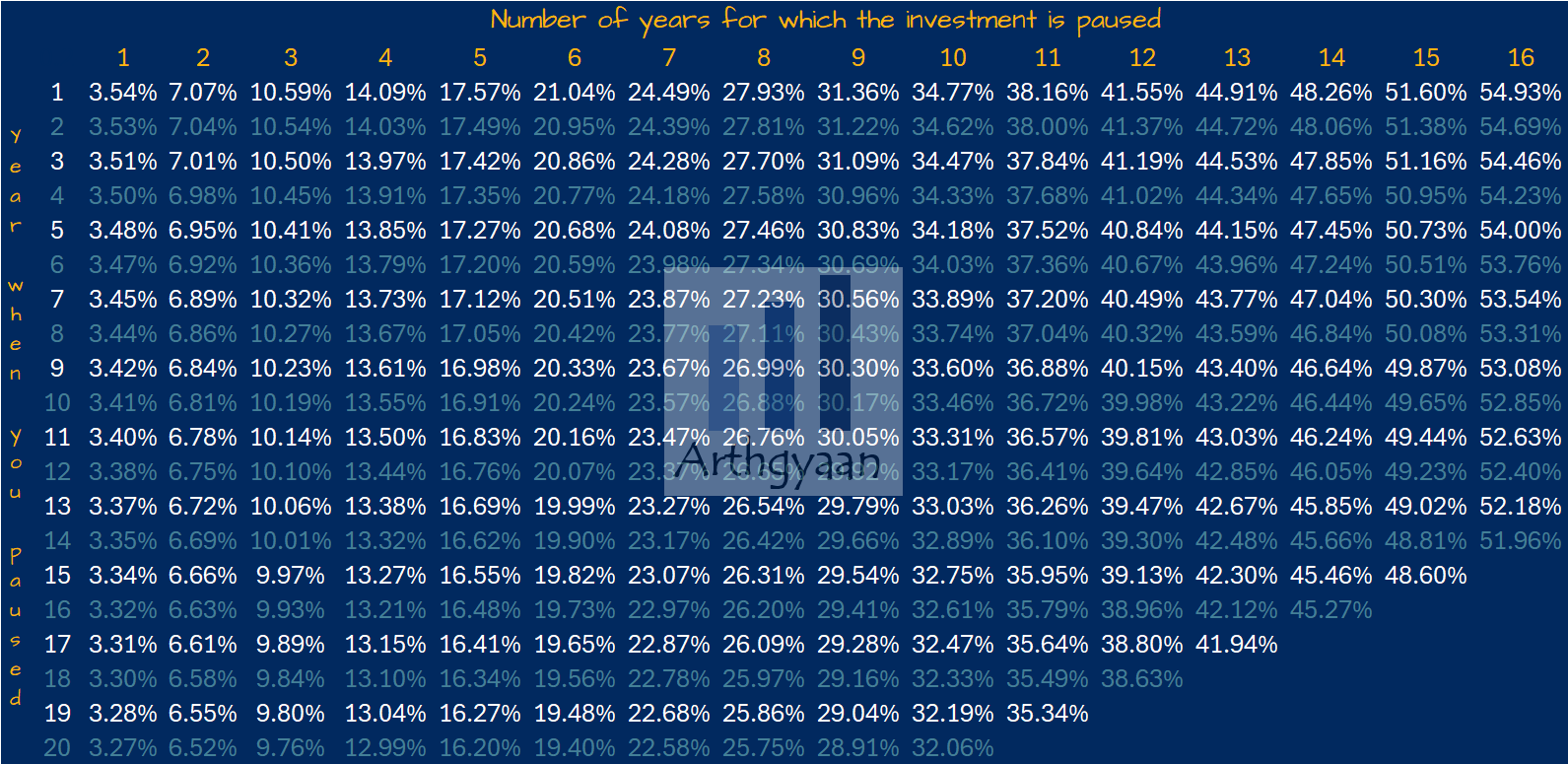

We’ll apply the framework described here: How much lower is your portfolio value if you pause investments for a few years?

| Year | Yearly Investment (without break) | Yearly Investment (with break) |

|---|---|---|

| 1 | 5.00 | 5.00 |

| 2 | 5.50 | 5.50 |

| 3 | 6.05 | 6.05 |

| 4 | 6.66 | 6.66 |

| 5 | 7.32 | 7.32 |

| 6 | 8.05 | House EMI |

| 7-14 | 8.86-17.26 | House EMI |

| 15 | 18.99 | House EMI |

| 16 | 20.89 | 20.89 |

| 17-20 | 22.97-30.58 | 22.97-30.58 |

| 21 | and | so on |

By the end of a 30-year period, marked as ‘House EMI’ years in the table, we’ll examine the impact on your portfolio.

We assume an investor:

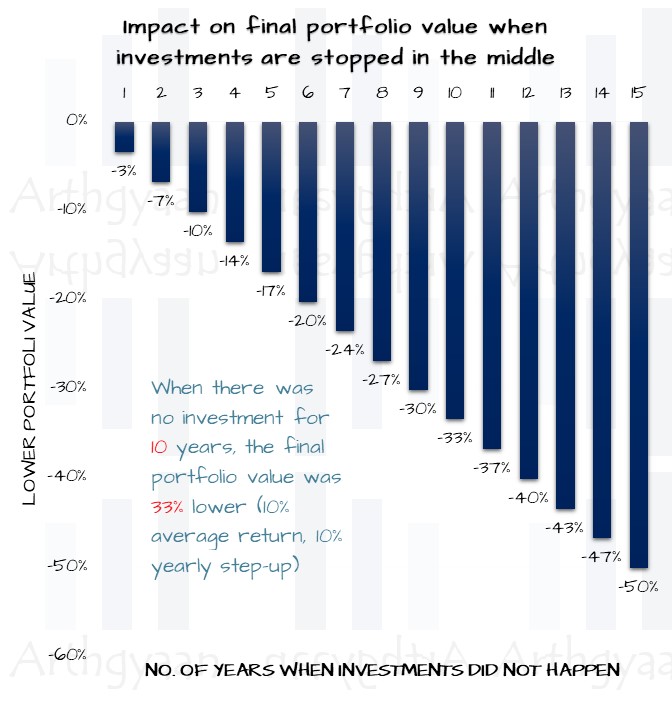

The differences in portfolio values are shown in the table, highlighting the effects of investment pauses.

The final portfolio value varies little with the timing of the house purchase. Regardless of when you buy during your earning years, the impact remains relatively consistent. However, the longer the investment pause, the smaller your final portfolio. It’s advisable to repay the loan quickly to minimize this effect.

To understand what is the right time to buy your first house:

Questions often arise about the best time to buy a house:

The timing of your house purchase surprisingly has minimal impact on your final portfolio, as income tends to increase over time. Thus, you could afford a more valuable home later in your career. An argument could be made for purchasing at retirement, but consider:

In conclusion, buy a house when it suits you best:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled What happens to your mutual fund portfolio final value if you choose to buy a house? first appeared on 08 May 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.