How much lower portfolio value do you end up with if you do not invest for a few years in between?

This article shows how to understand the impact on your portfolio if you stop investing for a few years between today and retirement.

This article shows how to understand the impact on your portfolio if you stop investing for a few years between today and retirement.

In an ideal world, we will all be investing from the day we start our first job, increase the SIP amount year on year by 10%, get 15% returns like clock-work and then retire with crores in our portfolio.

However, we do not live in the ideal world.

Credit: http://thedoghousediaries.com/5468

As the excellent comic above clearly shows, plans and situations change that affect your goal-based investing journey:

There are good things that can happen as well like:

We will assume that the salary growth (or by proxy the investment growth) is uninterrupted. For example, at a 10% yearly step-up, and a 5-year break starting at Year 3, the investments done per year (starting at ₹5 lakhs/year at year 1) look like this:

| Year | Yearly Investment (without break) | Yearly Investment (with break) |

|---|---|---|

| 1 | 5.00 | 5.00 |

| 2 | 5.50 | 5.50 |

| 3 | 6.05 | Stopped |

| 4 | 6.66 | Stopped |

| 5 | 7.32 | Stopped |

| 6 | 8.05 | Stopped |

| 7 | 8.86 | Stopped |

| 8 | 9.74 | 9.74 |

| 9 | 10.72 | 10.72 |

| 10 | 11.79 | 11.79 |

We will have to see what happens to your portfolio at the end, at the 30-year point when you retire, due to investments not happening in the years marked “Stopped” in the table above.

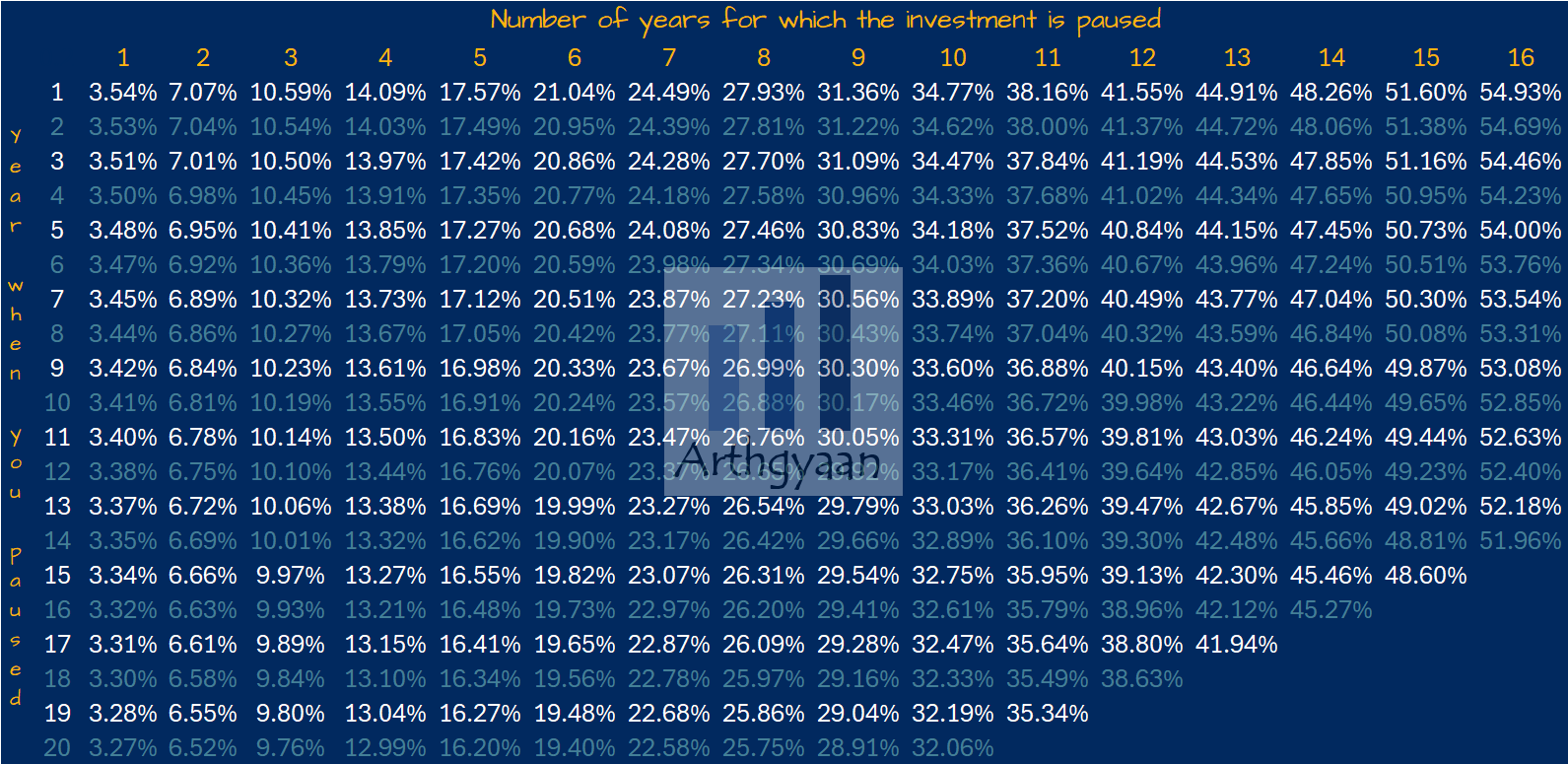

In the table below, we assume what happens to an investor who:

The figure in the table shows the difference in the portfolio value in the two cases. For example:

To understand the impact of pausing your investments for some time:

One interesting observation in the table above is that the final portfolio value does not depend a lot on the time when you paused investing. You can see this trend very well by taking any column in the table above and moving from top to bottom. There is of course a larger impact of increasing the duration of the pause since, obviously, the longer you do not invest, the smaller will be the portfolio value.

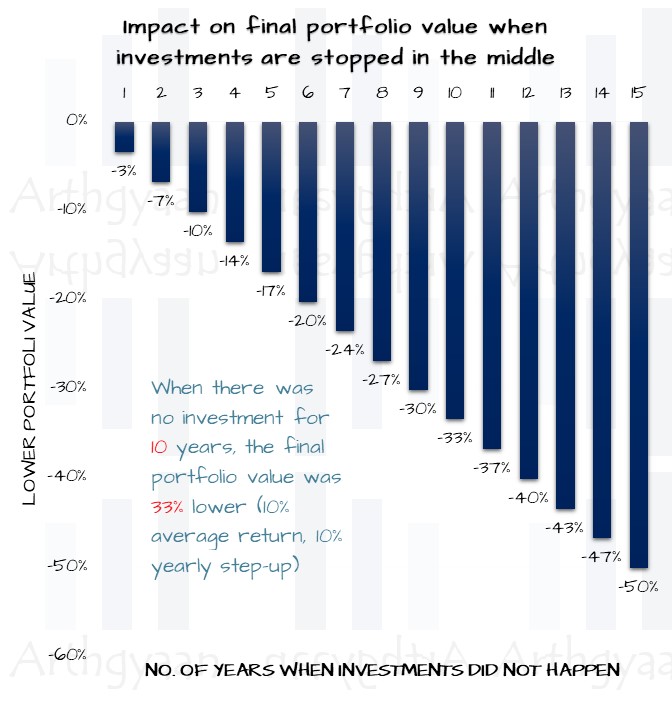

The chart above summarises the observation and tells you the average lower portfolio value whenever you stop investing irrespective of when you stop investing:

We have covered this point on purchasing a house and the impact on your portfolio in detail here:

Published: 23 December 2025

6 MIN READ

Published: 18 December 2025

8 MIN READ

1. Email me with any questions.

2. Use our goal-based investing template to prepare a financial plan for yourself.Don't forget to share this article on WhatsApp or Twitter or post this to Facebook.

Discuss this post with us via Facebook or get regular bite-sized updates on Twitter.

More posts...Disclaimer: Content on this site is for educational purpose only and is not financial advice. Nothing on this site should be construed as an offer or recommendation to buy/sell any financial product or service. Please consult a registered investment advisor before making any investments.

This post titled How much lower portfolio value do you end up with if you do not invest for a few years in between? first appeared on 24 Apr 2024 at https://arthgyaan.com

Copyright © 2021-2025 Arthgyaan.com. All rights reserved.